You’ve narrowed it down to two: Motley Fool Stock Advisor and Alpha Picks by Seeking Alpha. One has 24 years of documented outperformance and a philosophy built on human judgment. The other is a pure algorithm that’s crushed the market in its 3.6-year existence.

Both deliver 2 picks per month. Both have transparent track records. Both claim to beat the S&P 500.

So which one actually deserves your money?

Stock Advisor wins for most investors. The 24-year track record (+883.8% vs S&P’s +196%), the 4.5x lower price ($99 vs $449), and the 30-day money-back guarantee make it the safer, smarter choice. But Alpha Picks has a case if you trust algorithms over analysts and prefer shorter holding periods (1-3 years vs 5+ years).

Veteran conviction (24 years, 883.8%) vs quantitative momentum (3.6 years, 299.6%) — complementary strengths in an 83-point dispersion market at a NEW 2026 HIGH.

The S&P 500 has pushed to ~6,883 (+0.68% YTD, within 1.4% of ATH) — but 83-point dispersion (a new 2026 high) tells the real story underneath: top 20 stocks average +51.8%, bottom 20 average -30.7%. This is a stock-picker’s paradise and an indexer’s purgatory. The VIX has dropped to 20.29 (down 4.3% as AI panic subsides), consumer confidence remains at a 12-year low, and the Fed holds at 3.50-3.75%. CPI at 2.4% (core 2.5%) confirms disinflation. Credit spreads at 2.94% say no crisis — but the sector rotation says plenty: Energy +22.5%, Materials +16.9%, while Tech lags at -2.1% with SNDK +155%, WDC +75%, MU +48% as enterprise software collapses (CRM -29%, NOW -29%, WDAY -34%, INTU -41%).

The market’s internal bifurcation perfectly illustrates the Stock Advisor vs Alpha Picks debate: Stock Advisor’s human analysts evaluate why — through-cycle judgment that reads sector leadership shifts and identifies durable quality. Alpha Picks’ quant model reads what — factor signals regardless of narrative.

The case for human conviction (Stock Advisor):

- 42 ten-baggers and 182 doublers across 504 positions and multiple market cycles — including 2008, 2020, and 2022

- 883.8% total return with 92% win rate on 10+ year holds — quality GARP thrives when CAPE hovers near ~40 and 83-point dispersion rewards disciplined selection

- With consumer confidence at a 12-year low yet manufacturing PMI at 52.6 signaling expansion, Stock Advisor’s analyst team evaluates management quality, competitive positioning, and the disconnect between sentiment and fundamentals — the qualitative factors algorithms miss

The case for quant discipline (Alpha Picks):

- 299.6% total return and 73% win rate across 92 positions with small/mid-cap tilt capturing rotation

- 83-point dispersion (new 2026 high) is precisely the environment factor models exploit — wide winner/loser spreads create more mechanical alpha

- The algorithm doesn’t care about sentiment or consumer confidence readings — it reads Value, Growth, Profitability, Momentum, and EPS Revisions signals mechanically. SNDK surging +155% while INTU drops -41% — exactly the kind of divergence quant models are built to capture

Both services earn strong fit ratings — for different reasons. Stock Advisor thrives on through-cycle quality selection (the S&P 500 near ATH but with 83-point dispersion rewarding patience and conviction). Alpha Picks thrives on tactical rotation capture (sector leadership shifting to energy/materials, dispersion at new 2026 highs that mechanically favor factor-based approaches). The real question: which approach matches your investing philosophy?

Let me show you exactly why.

Quick Comparison: Motley Fool Stock Advisor vs Alpha Picks

| Dimension | Stock Advisor | Alpha Picks | Edge |

|---|---|---|---|

| Track Record | +883.8% since 2002 | +299.6% since July 2022 | Stock Advisor |

| vs S&P 500 | 4.5x outperformance | 3.6x outperformance | Stock Advisor |

| Price | $99/year | $449/year | Stock Advisor |

| Refund Policy | 30-day money-back | No refunds | Stock Advisor |

| Methodology | Human analysts + quant tools | Pure algorithm (5 factors) | Tie |

| Win Rate | 65% overall (92% at 10+ years) | 73% overall (79.2% at 1-3 years) | Depends on horizon |

| Ten-Baggers | 42 ten-baggers, 182 doublers | 3 ten-baggers, 16 doublers | Stock Advisor |

| Optimal Holding Period | 5+ years | 1-3 years | Depends |

| Educational Value | High (builds investor capability) | Low (just delivers picks) | Stock Advisor |

| Overall Winner | — | — | Stock Advisor |

The numbers tell a clear story. Stock Advisor costs less, has more proof, and comes with a guarantee. Alpha Picks has impressive recent performance—but 3.6 years of data isn’t the same as 24 years of market cycles.

Important caveat: Alpha Picks launched in July 2022, giving it only 3.6 years of track record. For investors with 5+ year horizons, Stock Advisor’s 92% win rate on 10+ year holds is more relevant. For those seeking 1-3 year opportunities, Alpha Picks’ 79.2% win rate in that window is compelling—but we recommend capping ratings for longer horizons until more data accumulates.

Motley Fool Stock Advisor: The 24-Year Track Record

Motley Fool Stock Advisor is the original Motley Fool subscription—the service that built their reputation. Founded in 2002, it’s survived the dot-com hangover, the 2008 financial crisis, the 2020 pandemic crash, and the 2022 growth stock massacre.

Motley Fool Stock Advisor Performance

The Motley Fool · 504 picks · 24 years · Updated Feb 18, 2026

| SA Return | S&P 500 | Alpha | Win Rate |

|---|---|---|---|

| +888% | +193% | +695% | 65% |

S&P 500 shows what you'd have earned buying the index on each pick date instead. Same timing, fair comparison.

| SA Multi-Baggers | 10x+ | 5x+ | 3x+ | 2x+ |

|---|---|---|---|---|

| Count | 42 | 86 | 126 | 181 |

| SA Asymmetry | Avg Winner | Avg Loser | Ratio |

|---|---|---|---|

| Return | +1.5K% | -45% | ~34:1 |

Best Performers (All-Time)

| SA Pick | Return |

|---|---|

NVDA NVIDIA | +113K% |

AMZN Amazon | +26K% |

DIS Disney | +5.9K% |

COST Costco | +3.5K% |

BKNG Booking Holdings | +18K% |

AAPL Apple | +5.4K% |

MME.DL MME.DL | +4.3K% |

CTAS CTAS | +4.4K% |

TSLA Tesla | +19K% |

NFLX Netflix | +41K% |

34:1 asymmetry. Winners average +1.5K%, losers average -45%. One winner offsets 34 complete losses—this is why selling winners early is costly.

See All Stock Advisor Recommendations →Latest Stock Advisor Picks

Tickers masked to protect subscriber value. Recent picks need 3-5+ years to demonstrate thesis.

| SA Pick | Return |

|---|---|

**** Chip Equipment | +95% |

**** Mobile App Platform | +70% |

**** Space Launch | +58% |

**** Infrastructure Construction | +46% |

**** Growth Company | +35% |

**** Growth Company | +33% |

**** Growth Company | +24% |

**** Athletic Apparel | +16% |

**** Growth Company | +12% |

**** Athletic Footwear | +5% |

Lessons from 2005. 16 picks that year averaged +7.2K%. Best performers often come from buying during uncertainty—when conviction feels hardest.

Stock Advisor Win Rate by Holding Period

| Hold Time | SA Win Rate | Avg Return |

|---|---|---|

| < 1 Year | 54.3% | +10% |

| 1-3 Years | 58.2% | +13% |

| 3-5 Years | 37.2% | -2% |

| 5-10 Years | 62.8% | +181% |

| 10+ Years | 92.9% | +3.7K% |

504 data points over 24 years. The pattern repeats: early volatility, mid-term clarity, long-term outperformance. The data is the strategy.

Stock Advisor Performance by Year

| Year | SA Picks | Avg Return | Win Rate | |

|---|---|---|---|---|

| 2026 | 2 | 0% | 50% | CASY+4% |

| 2025 | 25 | +6% | 52% | HWM+106% |

| 2024 | 25 | +6% | 58% | SHOP+85% |

| 2023 | 25 | +44% | 75% | CRWD+235% |

| 2022 | 23 | +22% | 43% | NET+285% |

| 2021 | 23 | -33% | 17% | LRCX+360% |

| 2020 | 24 | +82% | 29% | TSLA+1.3K% |

| 2019 | 24 | +36% | 67% | SNPS+243% |

| 2018 | 22 | +155% | 64% | SHOP+795% |

| 2017 | 23 | +568% | 87% | NVDA+7.1K% |

| 2016 | 21 | +367% | 81% | SHOP+3.4K% |

| 2015 | 24 | +195% | 71% | CASY+721% |

| 2014 | 21 | +215% | 81% | IBKR+995% |

| 2013 | 19 | +324% | 68% | NFLX+2.4K% |

| 2012 | 23 | +1.3K% | 74% | TSLA+19K% |

| 2011 | 19 | +492% | 63% | AAPL+2.6K% |

| 2010 | 18 | +418% | 83% | AMZN+2.2K% |

| 2009 | 20 | +2.8K% | 90% | NVDA+48K% |

| 2008 | 18 | +1.0K% | 94% | AAPL+5.4K% |

| 2007 | 19 | +1.5K% | 37% | NFLX+27K% |

| 2006 | 20 | +2.3K% | 65% | NFLX+24K% |

| 2005 | 16 | +7.2K% | 63% | NVDA+113K% |

| 2004 | 17 | +5.4K% | 59% | NFLX+41K% |

| 2003 | 17 | +230% | 65% | BWA+1.4K% |

| 2002 | 16 | +2.6K% | 81% | AMZN+26K% |

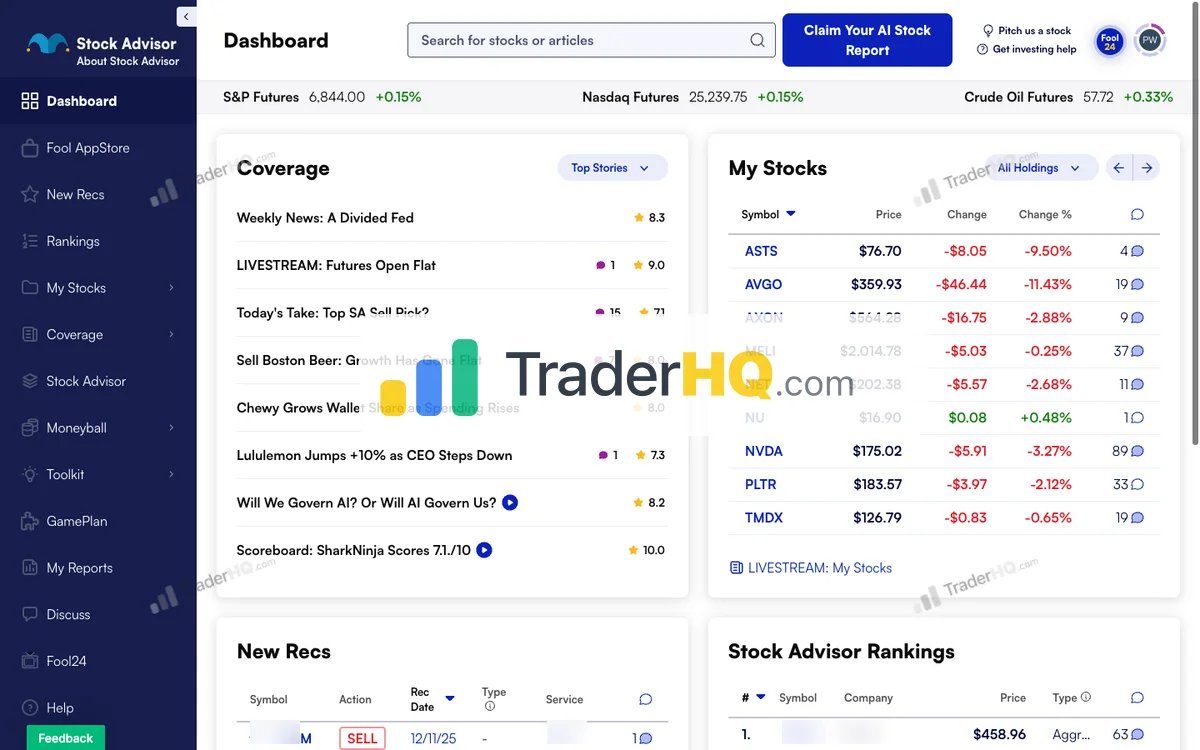

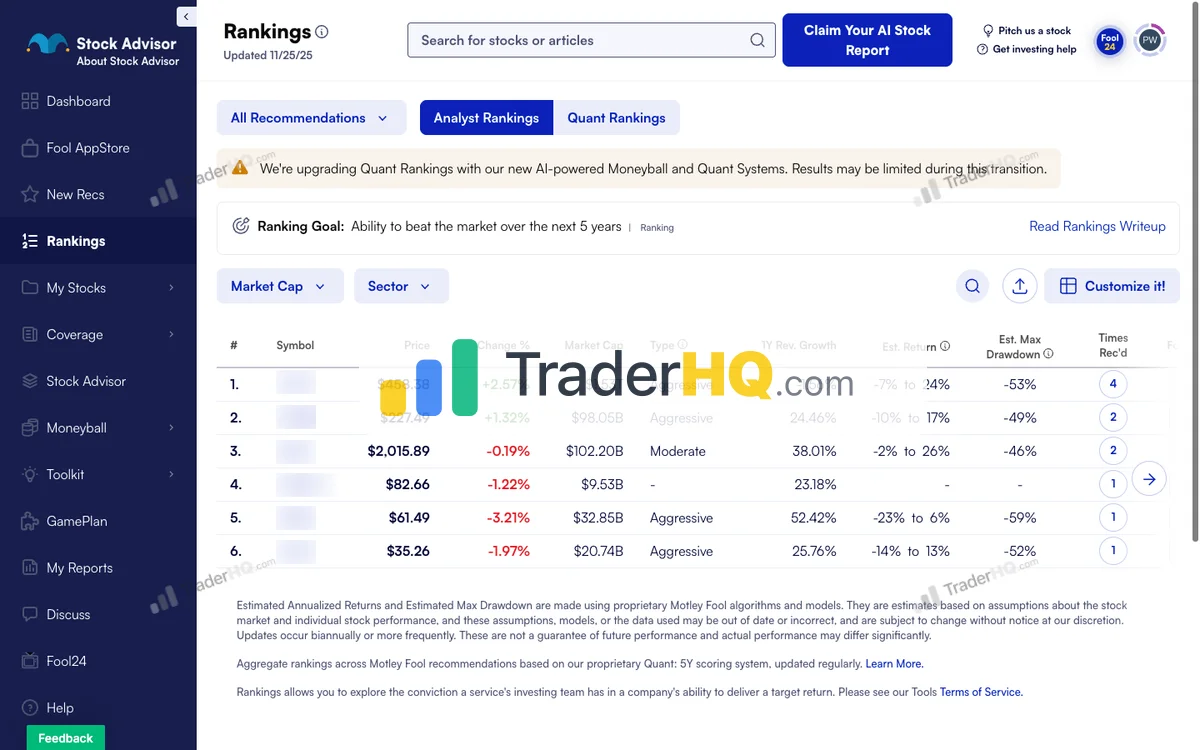

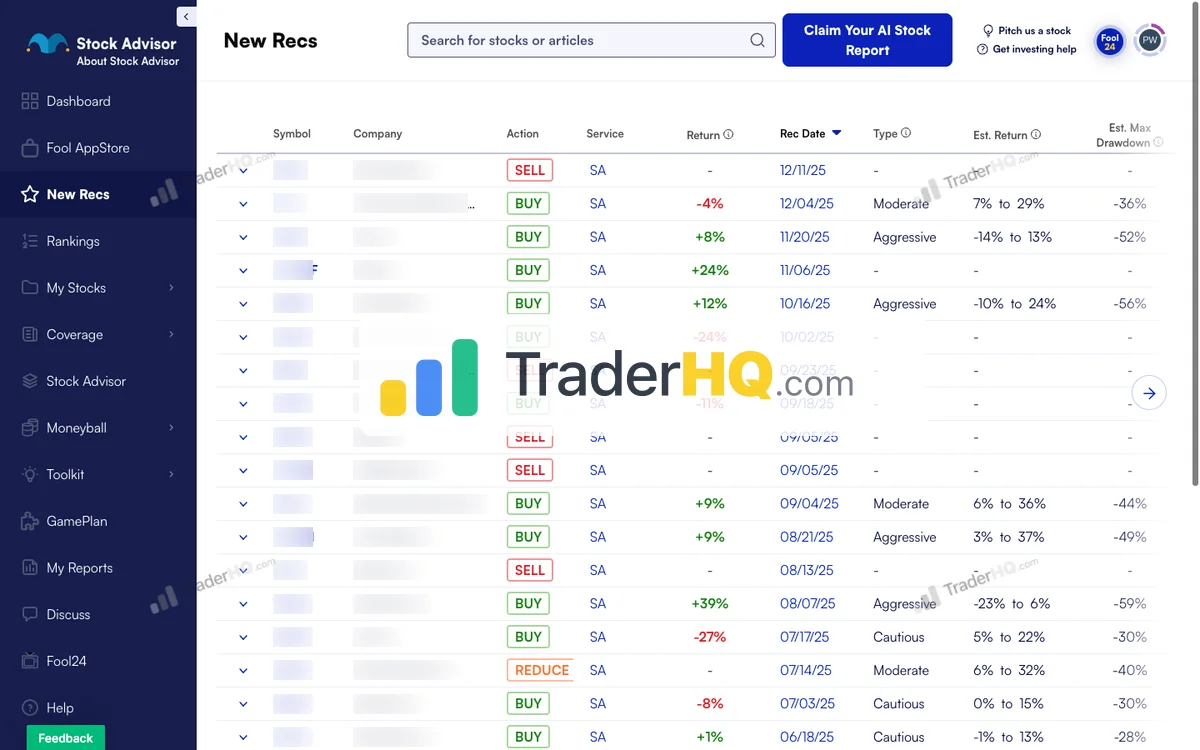

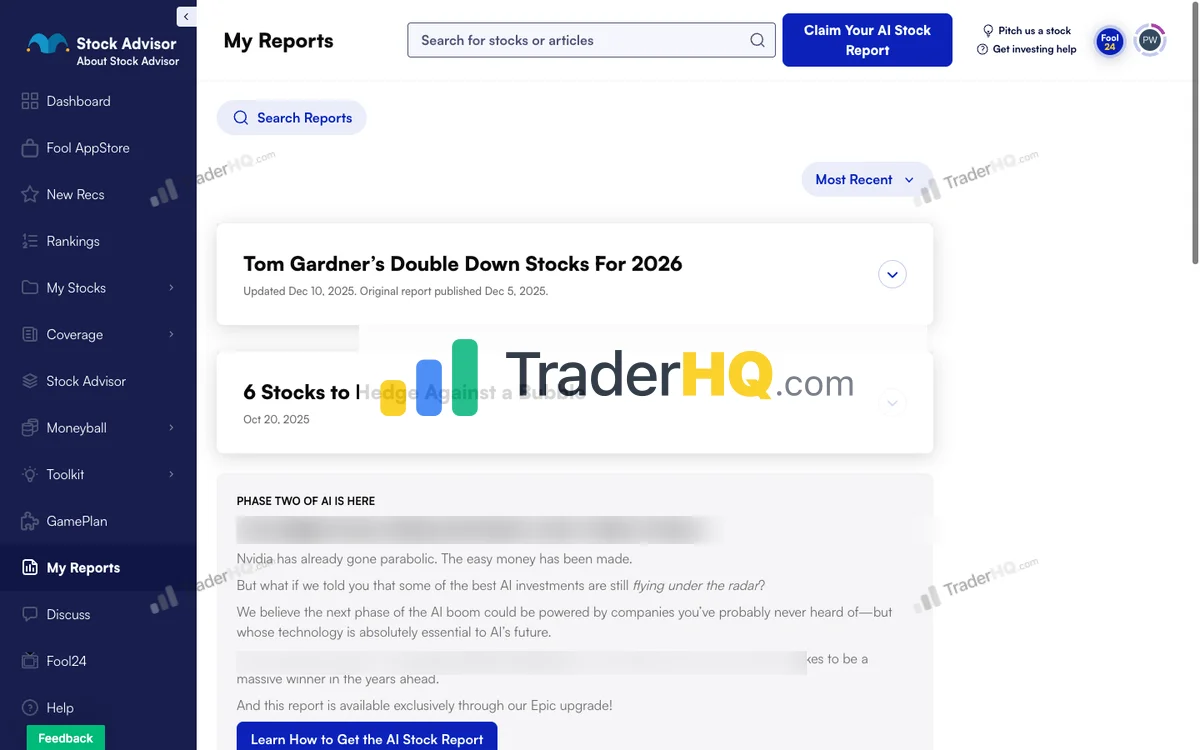

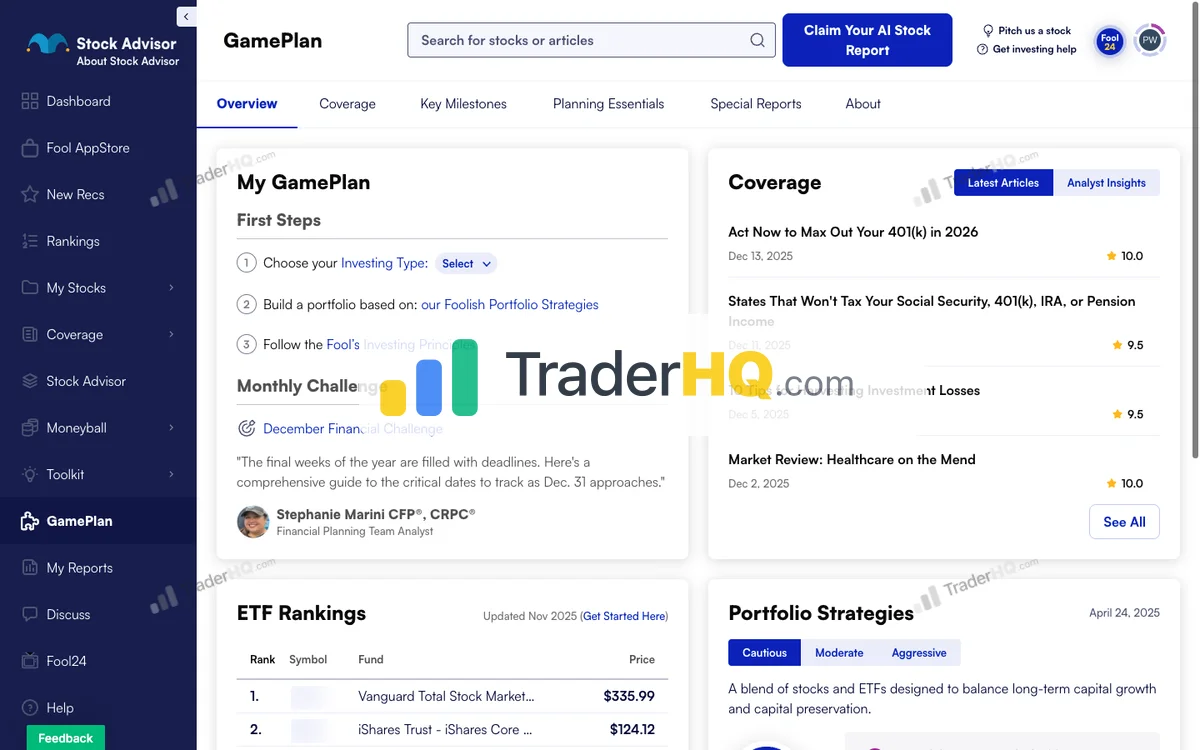

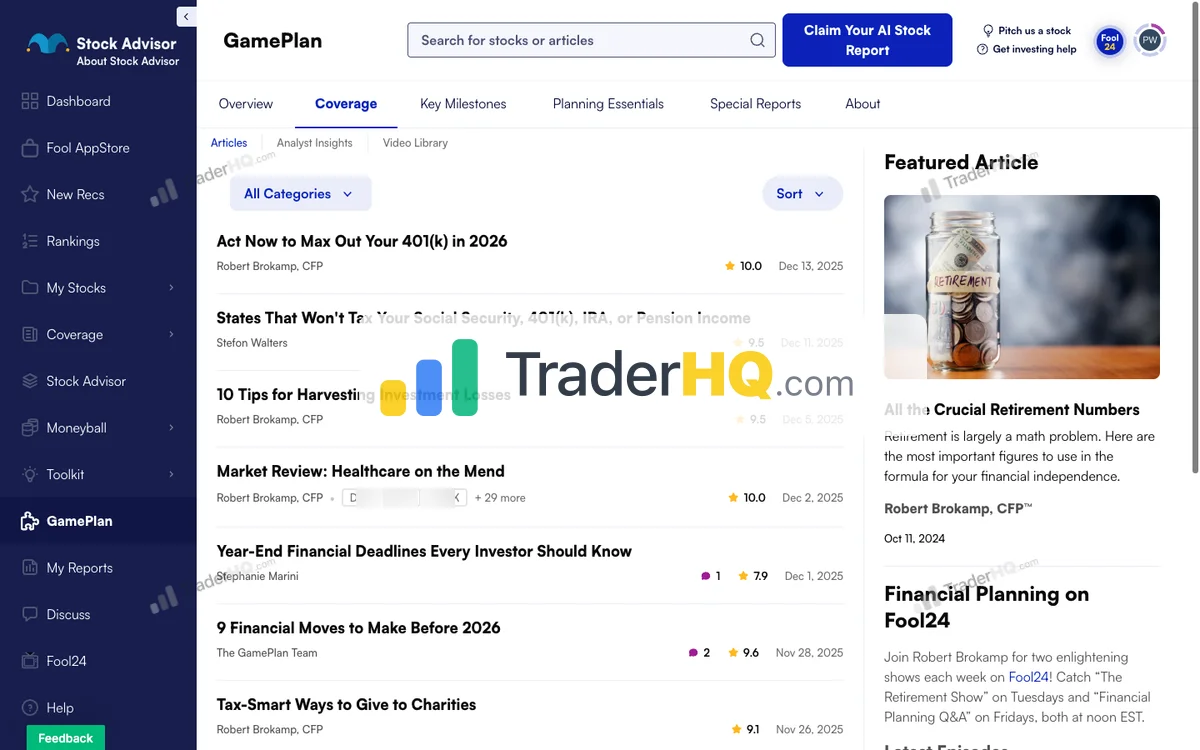

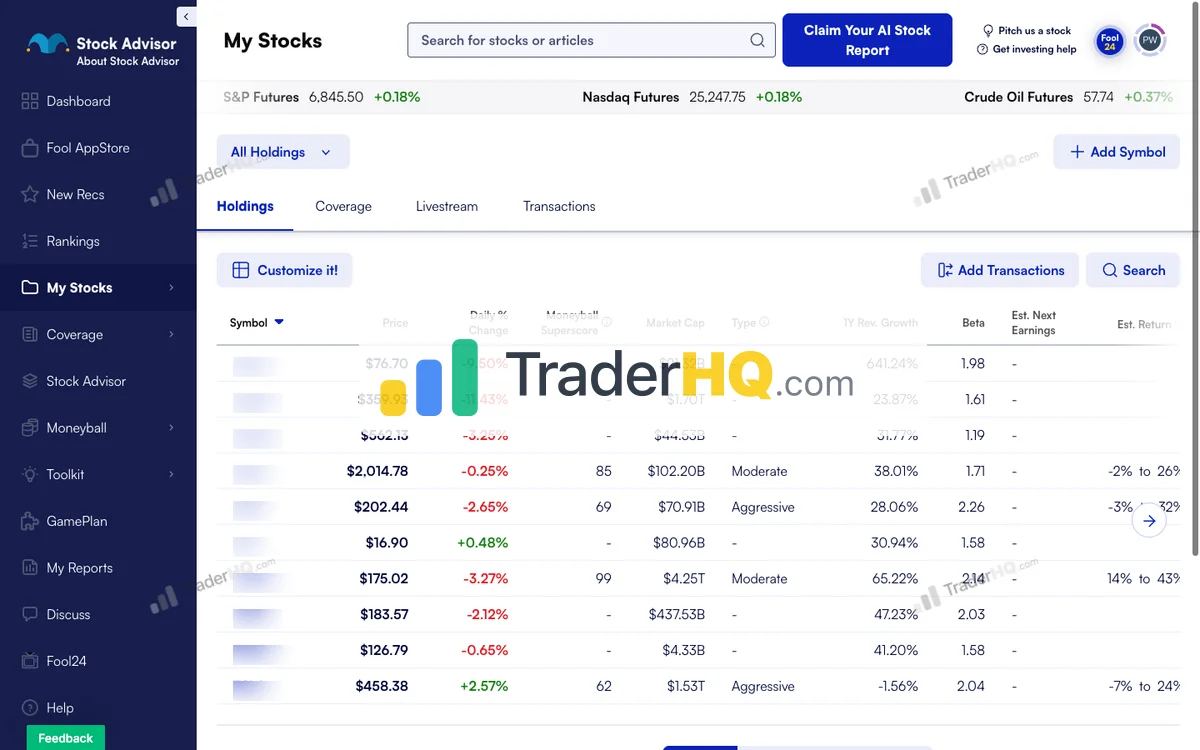

Inside Stock Advisor

9 screenshots · Click to expand

The philosophy is straightforward: find companies with durable competitive advantages, buy them, and hold for years while the market catches up to their value.

The Numbers

Since February 2002, Stock Advisor picks have returned +883.8% compared to the S&P 500’s +196%. That’s 4.5x outperformance over more than two decades.

Put another way: $10,000 invested following their picks would be worth approximately $98,380 today. The same amount in an index fund would be around $29,600.

The track record is exceptional for patient investors: 65% overall win rate, improving to 92% for positions held 10+ years. They’ve generated 42 ten-baggers and 182 doublers across 504 positions—the asymmetric wins that make long-term holding worthwhile.

But those numbers hide real volatility. Stock Advisor’s portfolio dropped 40%+ in 2022 while the S&P fell 18%. Their biggest winners—Netflix, Amazon, Nvidia—have all seen 50%+ drawdowns at various points. The strategy works if you can hold through the pain.

Why It Works

Stock Advisor is analyst-driven and narrative-heavy. Andy Cross leads the investment team (David Gardner stepped back in May 2021), and each recommendation comes with a detailed thesis explaining why this company can compound for decades.

That narrative is what gives you conviction to hold when prices drop 40%.

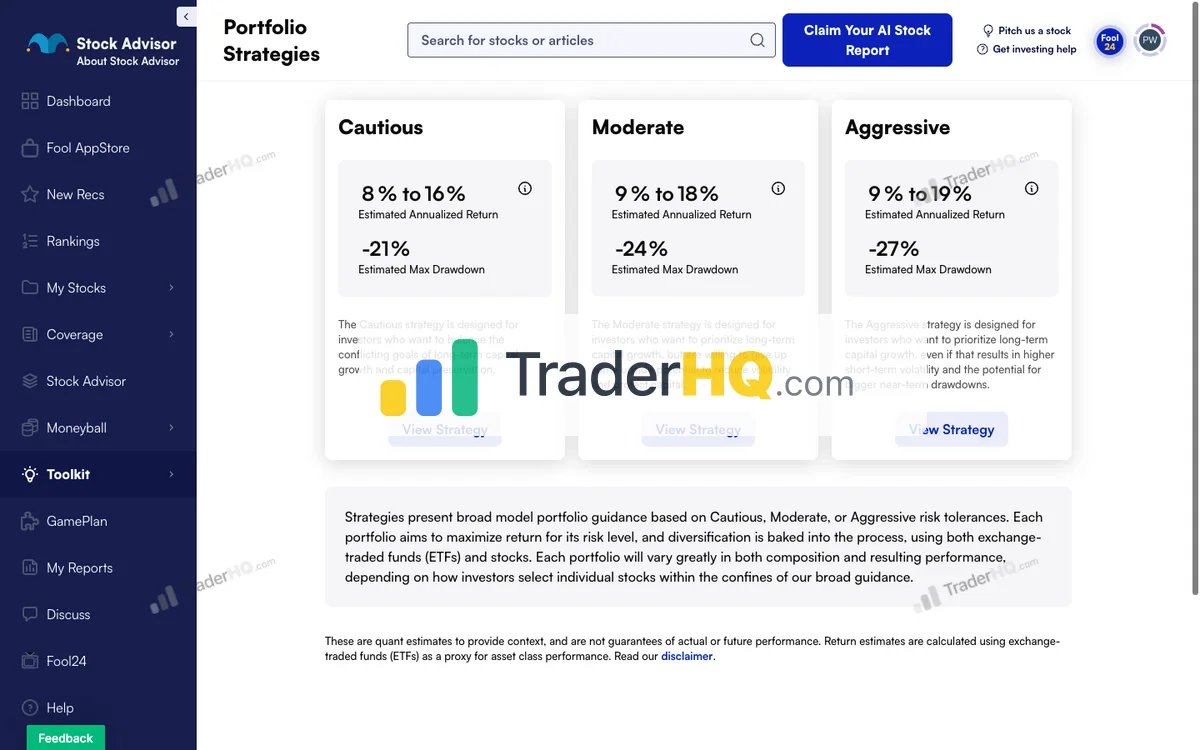

You also get three portfolio strategies calibrated to different risk tolerances (Cautious, Moderate, Aggressive), a Foundational Stocks list of their 10 highest-conviction holdings, and the Moneyball database with 344 companies scored across 12 dimensions for independent research.

This isn’t just stock tips—it’s a complete framework for building wealth.

For the complete breakdown of features, pricing, and performance, see our Stock Advisor review.

Best For

Patient investors with 5+ year horizons, $25,000+ portfolios, and the stomach for volatility. If you need hand-holding during crashes or want quick trades, this will frustrate you.

The Catch

Relentless upsell pressure. Expect emails pushing Epic, Epic Plus, and other premium tiers. The service itself is excellent—the marketing is aggressive.

Try Stock Advisor — 30-Day Guarantee

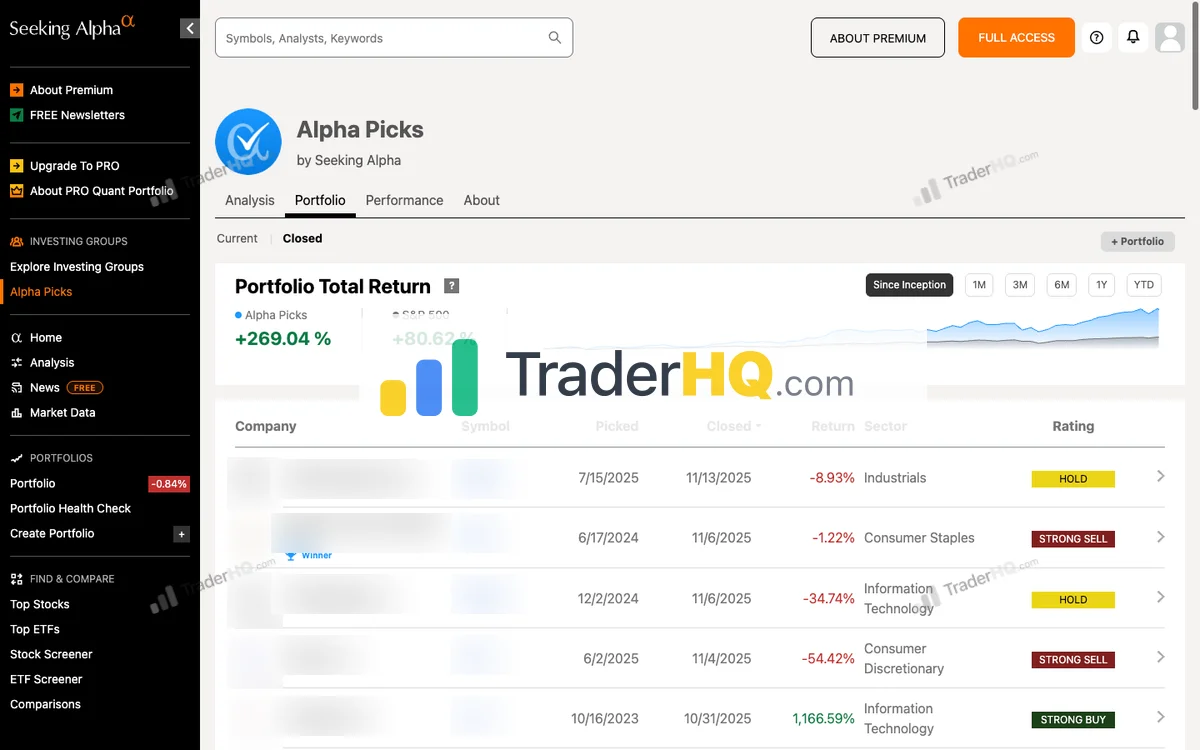

Alpha Picks: The Pure Quant Approach

Alpha Picks by Seeking Alpha represents something genuinely different: a pure quant system with no human discretion. The algorithm selects stocks based on five factors (Value, Growth, Profitability, Momentum, EPS Revisions), and analysts can’t override it.

Alpha Picks by Seeking Alpha Performance

Seeking Alpha · 92 picks · 4 years · Updated 2026-02-19

| AP Return | S&P 500 | Alpha | Win Rate |

|---|---|---|---|

| +297% | +81% | +216% | 73% |

S&P 500 shows what you'd have earned buying the index on each pick date instead. Same timing, fair comparison.

| AP Multi-Baggers | 10x+ | 5x+ | 3x+ | 2x+ |

|---|---|---|---|---|

| Count | 1 | 4 | 10 | 14 |

| AP Asymmetry | Avg Winner | Avg Loser | Ratio |

|---|---|---|---|

| Return | +110% | -22% | ~5:1 |

Best Performers (All-Time)

| AP Pick | Return |

|---|---|

**** Thermal Management | +348% |

SMCI Super Micro Computer | +969% |

**** Power Plant Construction | +249% |

**** Homebuilder | +228% |

CLS Celestica | +1.2K% |

APP AppLovin | +1.6K% |

**** Growth Company | +153% |

**** Casual Dining | +209% |

STRL Sterling Construction | +558% |

POWL Powell Industries | +894% |

Latest Alpha Picks Picks

Tickers masked to protect subscriber value. Recent picks need 3-5+ years to demonstrate thesis.

| AP Pick | Return |

|---|---|

**** Memory Chips | +121% |

**** Precious Metals Mining | +106% |

**** Engineering Services | +77% |

**** Pawn & Financial Services | +63% |

**** Gold Mining | +62% |

**** Dermatology Biotech | +62% |

**** Circuit Board Manufacturing | +59% |

**** Infrastructure Construction | +58% |

**** Growth Company | +37% |

**** Growth Company | +30% |

Alpha Picks Win Rate by Holding Period

| Hold Time | AP Win Rate | Avg Return |

|---|---|---|

| < 1 Year | 65.8% | +14% |

| 1-3 Years | 77.8% | +117% |

| 3-5 Years | N/A% | N/A |

| 5-10 Years | N/A% | N/A |

| 10+ Years | N/A% | N/A |

Alpha Picks Performance by Year

| Year | AP Picks | Avg Return | Win Rate | |

|---|---|---|---|---|

| 2026 | 4 | +8% | 100% | B+11% |

| 2025 | 24 | +30% | 75% | MU+121% |

| 2024 | 24 | +49% | 67% | CLS+259% |

| 2023 | 24 | +161% | 71% | CLS+967% |

| 2022 | 16 | +65% | 75% | MOD+348% |

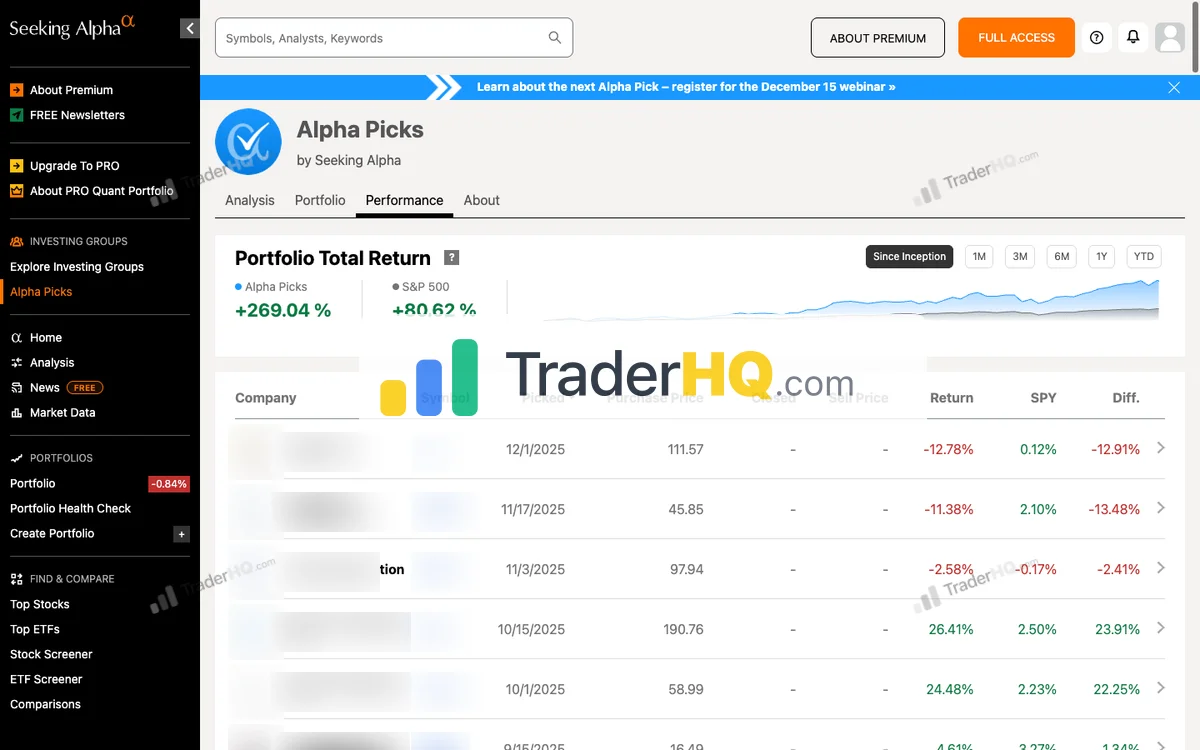

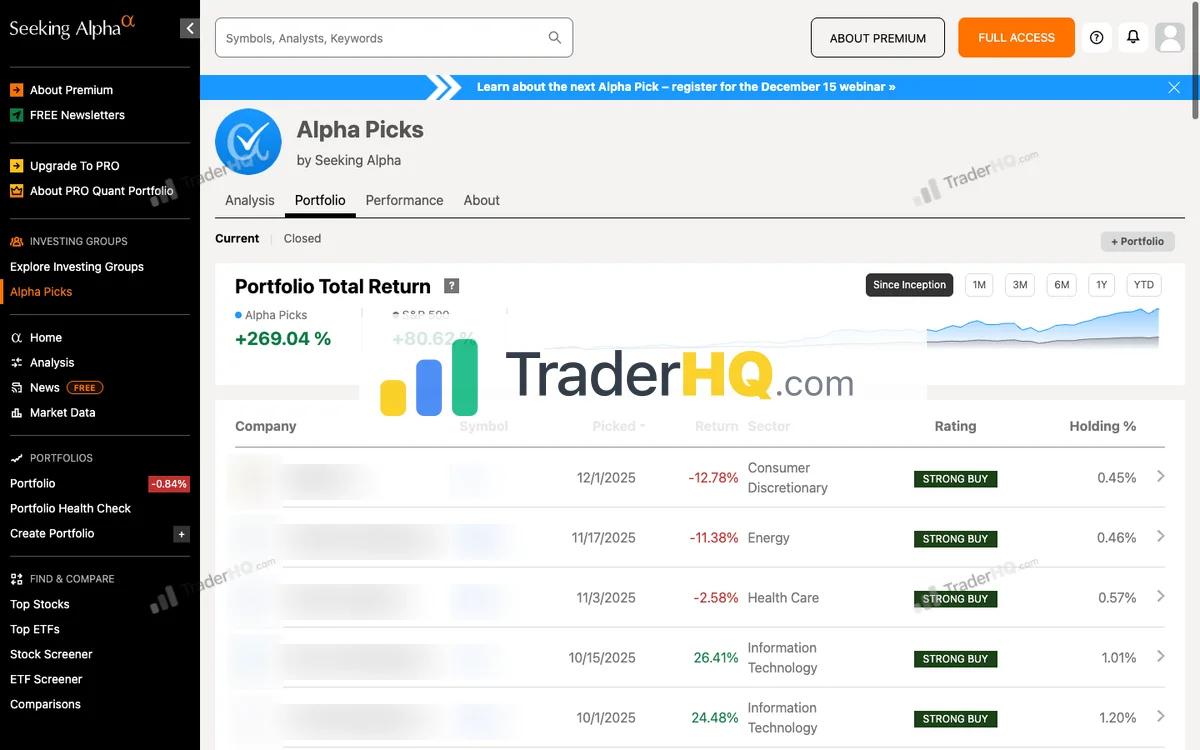

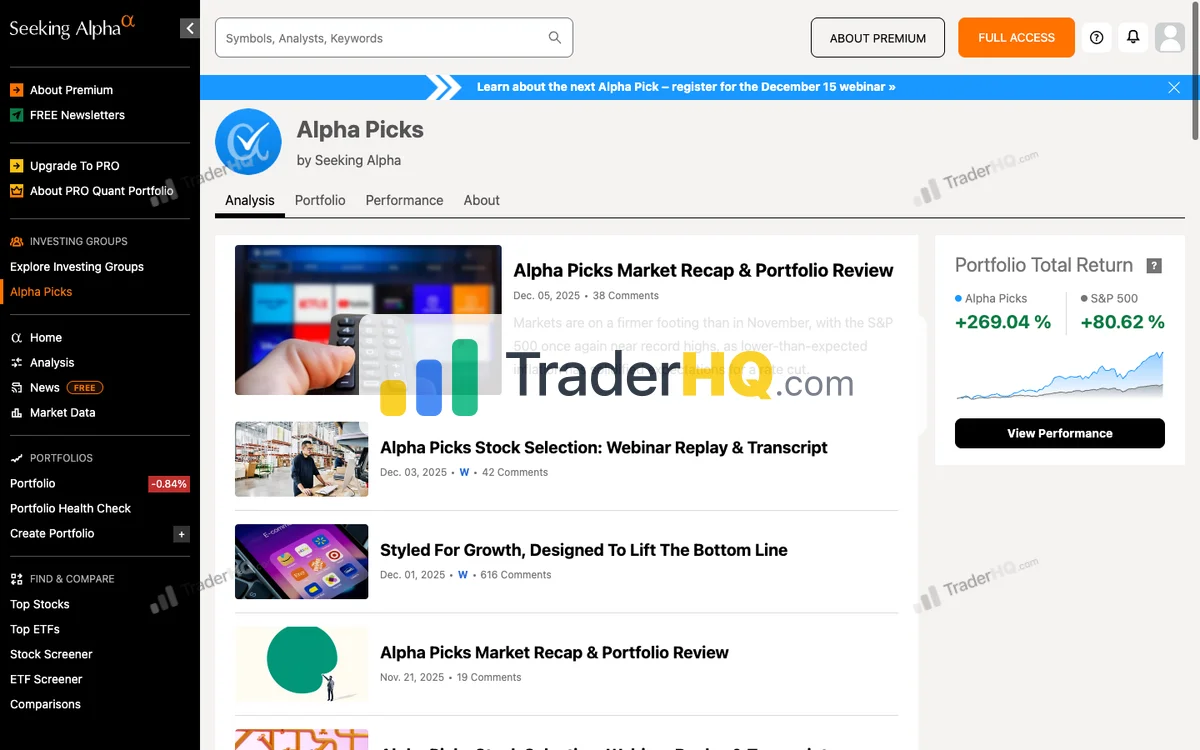

Inside Alpha Picks

6 screenshots · Click to expand

Launched in July 2022, it’s newer—but its performance is impossible to ignore.

The Numbers

Since launch, Alpha Picks has returned +299.6% compared to the S&P 500’s +83% over the same period. That’s 3.6x outperformance in 3.6 years.

The transparency is exceptional. You can see all positions with every entry date, exit date, and return. Winners and losers displayed side by side. Nothing hidden.

Win rate: 73% overall across 92 positions. But here’s what matters for time horizon: positions held 1-3 years have a 79.2% win rate. This is Alpha Picks’ sweet spot—the data-driven approach excels in medium-term holds.

The APP Cautionary Tale: APP peaked at +1,571% as Alpha Picks’ star performer—but has since crashed to -30%. This isn’t a failure of the algorithm; it’s a lesson in concentration risk. One position can make your year, then unmake it. CLS remains a genuine ten-bagger at +966%.

Time is the variable that separates mediocre from exceptional.

Why It Works

Alpha Picks removes human bias entirely. No analyst can fall in love with a stock or hold too long for emotional reasons. The algorithm buys when the numbers say buy and sells when the rating drops—systematic, unemotional, consistent.

Re-recommendations are particularly powerful. When the model picks a stock twice, returns increase significantly.

The Important Caveat

With only 3.6 years of track record, Alpha Picks hasn’t been tested through a full market cycle. It launched near the 2022 bottom and has operated primarily in recovery and bull market conditions. We recommend treating its ratings for 5+ year horizons with appropriate skepticism until more data accumulates. For 1-3 year investment horizons, the data is more robust.

Best For

Data-driven investors who trust algorithms over human opinion, can commit to 1-3+ year holds, have capital to deploy across 44 positions, and want diversification beyond mega-cap tech.

The Catch

It’s a black box. You know the five factors conceptually, but specific weightings are proprietary. If you need to understand why you own something, this will frustrate you.

No refund policy either. You’re committing to a full year at $449 with no way out.

For the full analysis of Alpha Picks’ methodology and performance, read our Alpha Picks review.

The Real Differences That Matter

Forget the feature checklists. Here are the three differences that should drive your decision:

1. Human Judgment vs Pure Algorithm

Stock Advisor’s picks come from experienced analysts who can weigh qualitative factors—management quality, competitive dynamics, industry shifts—that don’t fit neatly into quantitative models.

Alpha Picks trusts the numbers exclusively. No human can override the algorithm, for better or worse.

The question: Do you believe the best investments require human insight, or that human bias is the enemy of returns?

2. Track Record Length and Time Horizon

Stock Advisor has survived multiple market cycles. The 2008 crash. The 2020 pandemic. The 2022 growth stock massacre. We know how their picks perform when everything falls apart. For investors with 5+ year horizons, this matters enormously—Stock Advisor’s 92% win rate on 10+ year holds is built on 24 years of data.

Alpha Picks launched in July 2022—near the market bottom. Its 3.6-year track record exists primarily in recovery and bull market conditions. We don’t know how the algorithm performs in a prolonged bear market.

The question: Is 3.5 years of exceptional performance enough proof for your time horizon? For 1-3 year investments, Alpha Picks’ data is increasingly robust. For 5+ year investments, Stock Advisor’s multi-cycle track record provides more confidence.

3. Investor Development

Stock Advisor teaches you why to own companies. The detailed theses, the Moneyball database, the portfolio strategies—these build your capability as an investor. After a few years, you’re better at analyzing companies yourself.

Alpha Picks just tells you what to buy. You follow the algorithm, capture the returns, but learn nothing about investing. You’re dependent on the service forever.

The question: Do you want to become a better investor, or just get better returns?

How to Decide: Time Horizon Is Everything

Choose Stock Advisor if:

- You’re investing for 5+ years and won’t touch the money

- You want the 92% win rate that comes with 10+ year patience

- You have $25,000+ to allocate (the fee becomes trivial relative to returns)

- You want a proven track record across multiple market cycles (24 years, 504 positions)

- You value understanding why you own something (42 ten-baggers didn’t happen by accident)

- You want a money-back guarantee to test it risk-free

- You’ve seen what happened to APP (crashed after peaking at +1,571%) and want diversified risk management

Choose Alpha Picks if:

- You’re targeting 1-3 year investment horizons (where Alpha Picks’ 79.2% win rate shines)

- You trust algorithms over human judgment

- You want pure quant diversification beyond your core holdings

- You’re comfortable with a black-box methodology

- You don’t need to understand the “why” behind each pick

- You acknowledge the shorter track record (3.6 years, 92 positions) and its limitations for longer-term projections

Either works if:

- You’ll actually follow the recommendations (the biggest variable is you, not the service)

- You understand that 30-35% of picks from any service will lose money

- You’re adding this as one input to your process, not your entire strategy

The tiebreaker: Ask yourself, “Would I hold through a 40% drop?” If yes, Stock Advisor’s volatility won’t bother you. If that makes you queasy, Alpha Picks’ shorter holds and systematic exits might suit you better.

Try Stock Advisor — 30-Day Guarantee

Can You Use Both?

Yes—and they’re actually complementary.

Stock Advisor for your core long-term holdings. The analyst-driven picks with detailed theses give you conviction to hold for decades. These are the compounders you build wealth on.

Alpha Picks for quant-driven diversification. The algorithm finds opportunities human analysts might miss, and the systematic exits remove emotional decision-making.

The methodologies are different enough that you’re not just doubling up on the same stocks. Stock Advisor leans toward growth narratives; Alpha Picks follows the numbers wherever they lead.

If you have the budget for both ($548/year combined), this is a legitimate strategy. Start with Stock Advisor if you can only pick one.

The Bottom Line

Stock Advisor wins for most investors—especially those with 5+ year horizons.

With 83-point dispersion — a new 2026 high — the S&P 500 at ~6,883 (+0.68% YTD, within 1.4% of ATH) masks enormous divergence underneath. Energy +22.5%, Materials +16.9% are leading while Tech lags at -2.1%, with SNDK surging +155% while INTU drops -41%. The VIX has dropped to 20.29 (down 4.3%) as AI panic subsides, but consumer confidence remains at a 12-year low — conviction is being tested everywhere. The 24-year track record (+883.8%), the 92% win rate on 10+ year holds, the 4.5x lower price, the money-back guarantee, and the educational value justify choosing Stock Advisor over Alpha Picks for most investors. When you’re building wealth over decades, 24 years of proof across multiple market cycles provides confidence that 3.6 years of data simply cannot match — yet Alpha Picks’ 299.6% total return across 92 positions and rotation capture make it a compelling complement, not a competitor.

But Alpha Picks is the smarter choice if you’re targeting 1-3 year investment windows, want pure quant with no human bias, and don’t care about understanding the methodology. The 79.2% win rate in that holding period is compelling, and the +299.6% return with a 73% overall win rate demonstrates the algorithm works. The 83-point dispersion at new 2026 highs is precisely the environment where factor models capture mechanical alpha. Just understand you’re betting on a shorter track record with no refund if it doesn’t work for you.

The time horizon matters more than you think. Stock Advisor’s edge grows with patience (65% at any time, 92% at 10+ years). Alpha Picks’ edge is concentrated in medium-term holds (73% overall, 79.2% at 1-3 years). Match the service to your actual investment timeline.

If I had to pick one for a friend who’s never subscribed to a stock-picking service? Stock Advisor, because the training wheels of a 24-year track record make it easier to trust the process when it hurts.

Explore all your options in our guide to the best stock advisors. You can also compare Stock Advisor against Seeking Alpha Premium, IBD Leaderboard, or Rule Breakers.

Try Stock Advisor — 30-Day Guarantee

Frequently Asked Questions

Stock Advisor vs Alpha Picks: which is better?

Stock Advisor is better for most investors, especially those with 5+ year horizons. It has a 24-year track record (+883.8% vs S&P’s +196%), 65% win rate that improves to 92% for 10+ year holds, 42 ten-baggers across 504 positions, costs 4.5x less ($99/year vs $449/year), includes a 30-day money-back guarantee, and builds your capability as an investor. Alpha Picks has impressive recent returns (+299.6% since July 2022) and a 73% win rate overall across 92 positions (79.2% for 1-3 year holds), but only 3.6 years of data, no refund policy, and concentration risk — the APP crash from +1,571% illustrates the downside of pure quant approaches.

Is Stock Advisor worth it?

Yes, for long-term investors who can hold 5+ years. At $99/year, Stock Advisor has returned +883.8% since 2002 compared to the S&P 500’s +196%. The 65% overall win rate improves to 92% for positions held 10+ years, with 42 ten-baggers and 182 doublers generated across 504 positions. The math works if you follow the strategy—but expect 30-50% drawdowns on individual positions. Patience is mandatory. See our full Stock Advisor analysis for detailed performance metrics.

Is Alpha Picks worth it?

Yes, for data-driven investors targeting 1-3 year holds. At $449/year with no refund, it’s a bigger commitment—but +299.6% returns since July 2022 (vs S&P’s +83%) and a 73% overall win rate across 92 positions (79.2% for 1-3 year holds) are hard to argue with. The caveat: APP crashed from +1,571%, illustrating concentration risk. CLS remains a genuine ten-bagger. Only 3.6 years of track record—for 5+ year horizons, the data is less conclusive. Check our Alpha Picks deep dive for the complete performance breakdown.

Can I use both Stock Advisor and Alpha Picks?

Yes, and they complement each other well. Stock Advisor provides analyst-driven picks with detailed theses for core long-term holdings. Alpha Picks adds quant-driven diversification with systematic exits. The methodologies are different enough that you’re not just doubling up on the same stocks. Combined cost is $548/year.

Which service has better returns?

It depends on timeframe and time horizon. Stock Advisor has returned +883.8% since 2002 (24 years) with 42 ten-baggers across 504 positions. Alpha Picks has returned +299.6% since July 2022 (3.6 years) across 92 positions. Alpha Picks’ annualized returns are higher, but Stock Advisor’s track record spans multiple market cycles including the 2008 crash and 2022 bear market. The APP cautionary tale matters: it peaked at +1,571% and crashed, showing how quickly quant-driven concentration can reverse. For 5+ year horizons, Stock Advisor’s 92% win rate on decade-long holds is more relevant. For 1-3 year horizons, Alpha Picks’ 79.2% win rate is compelling.

Which is better in 2026’s market: Stock Advisor or Alpha Picks?

Both thrive in 2026’s 83-point dispersion market (a new 2026 high), but for different reasons. The S&P 500 has pushed to ~6,883 (+0.68% YTD, within 1.4% of ATH), but the top 20 stocks average +51.8% while the bottom 20 sit at -30.7% — stock selection is everything. Stock Advisor’s GARP quality approach benefits from sector rotation (Energy +22.5%, Materials +16.9%) and intra-sector bifurcation (SNDK +155%, WDC +75% vs CRM -29%, INTU -41% within tech). Its 883.8% total return and 42 ten-baggers prove through-cycle conviction works when consumer confidence hits a 12-year low. The VIX dropping to 20.29 (down 4.3%) signals calming conditions. Alpha Picks’ quant factors capture the rotation mechanically — its 299.6% total return and 73% win rate across 92 positions show the algorithm adapts to high-dispersion environments. The key difference: Stock Advisor has navigated elevated CAPE ratios, consumer weakness, and sector upheaval before (2008, 2020, 2022). Alpha Picks hasn’t been tested through a prolonged downturn at this scale.

Can I use both Stock Advisor and Alpha Picks together?

Yes — and they’re genuinely complementary in this market. Stock Advisor provides analyst-driven conviction picks with detailed theses for core long-term holdings (5+ years). Alpha Picks adds quant-driven diversification with systematic entries and exits for medium-term holds (1-3 years). The methodologies are different enough that you’re not doubling up on the same stocks. In 2026’s 83-point dispersion environment (a new 2026 high) — with the S&P 500 at ~6,883 near ATH but enormous divergence underneath (Energy +22.5% vs Tech -2.1%) — having both a conviction-based and a factor-based approach captures different segments of the winner/loser spread. Combined cost is $548/year — reasonable if you’re deploying $50K+ across both strategies.

What’s the main difference between Stock Advisor and Alpha Picks?

Human judgment vs pure algorithm. Stock Advisor’s picks come from experienced analysts who write detailed theses explaining why each company can compound for decades. Alpha Picks uses a quantitative model based on five factors with no human discretion—the algorithm decides everything. Choose based on whether you trust human insight or prefer removing human bias.