7 Best Stock Market Research Websites & Service Subscriptions in 2025

Elevate your stock research with stock analysis sites and Seeking Alpha review to uncover key insights.

We aim for insightful coverage of products and services, including some from compensating partners, which may influence our topics and presentation. Our opinions and conclusions remain unbiased. See our Advertiser Disclosure.

Navigating today’s unpredictable markets—where trade policies shift, technology races ahead, and global tensions linger—can feel like a daunting task as you work to build a portfolio that secures your family’s future, whether it’s funding your children’s education or creating a retirement you can truly rely on. But with the right resources, like the best stock picking services 2025 has to offer, you can find clarity and confidence to make decisions that fit your life and protect what matters most. Picture the peace of mind that comes from knowing you’re on a path toward lasting security—hope is within reach, and this guide is here to show you the way.

Find out how these seven top stock research websites and subscriptions can give you tools and guidance you can trust to shape a future you’re proud of.

1. Alpha Picks by Seeking Alpha

-

Best for: Value investors chasing high returns, growth-focused individuals hunting for market outperformers, and strategic planners aiming to diversify with confidence.

-

Cost: $449/year for new members (10% OFF $499/year)

Aggregate Overall Performance:

- Total Return: +163.81%

- S&P 500 Return: +57.41%

- Outperformance vs. S&P 500: +106.40%

Alpha Picks by Seeking Alpha shines as a trusted guide for investors tackling the unpredictable stock market of 2025. With trade tensions, interest rate shifts, and geopolitical risks shaping today’s landscape as of May 17, 2025, this service cuts through the noise using advanced quantitative analysis and unique data to uncover top-tier investment opportunities. If you’re looking to outpace the market and secure your financial future, Alpha Picks delivers a proven, data-driven edge.

Methodology and Approach

Alpha Picks (see our 2025 review) relies on a rigorous, systematic process to select stocks, a critical advantage in today’s volatile environment. Here’s how they stand out:

- Quantitative Precision: Advanced algorithms analyze massive datasets to pinpoint stocks with the strongest potential to outperform, ensuring you’re not guessing in uncertain times.

- Fundamental Depth: Every pick is supported by thorough research, focusing on companies with solid foundations—key when market swings are driven by policy shifts like recent U.S. trade tariffs.

- Risk-Aware Strategy: With inflation pressures and global uncertainties in play, their focus on risk-adjusted returns helps you navigate choppy waters with greater confidence.

Key Features and Benefits

Alpha Picks equips you with powerful tools and insights tailored for success in 2025’s complex market:

- Expert Quantitative Team: Tap into the expertise of seasoned strategists like Steve Cress, who decode market trends to spotlight high-potential opportunities.

- In-Depth Stock Analysis: Each recommendation includes detailed breakdowns, so you understand the reasoning behind picks—a must when adapting to rapid shifts like AI-driven tech volatility.

- Bi-Monthly Recommendations: Stay current with fresh stock picks every two weeks, ensuring your portfolio aligns with evolving conditions like interest rate cuts or tariff impacts.

- Continuous Portfolio Guidance: As inflation risks loom and small-cap opportunities emerge, Alpha Picks offers ongoing advice to fine-tune your strategy and safeguard gains.

Performance in 2025

As of May 16, 2025, Alpha Picks has proven its ability to deliver exceptional results:

- Overall Performance: Since inception, Alpha Picks boasts a total return of +163.81%, crushing the S&P 500’s +57.41% over the same period. That’s an outperformance of +106.40%, demonstrating their knack for navigating economic twists and delivering real value.

- Notable Picks:

- A Mobile App Monetization Platform picked in November 2023 soared +753.77%, turning a $1,000 investment into $8,537. This showcases their ability to spot explosive growth even in concentrated tech markets.

- A Server & Storage Solutions Provider from November 2022 rocketed +968.59%, transforming $1,000 into over $10,685 by March 2024. It’s proof of their foresight in high-demand sectors.

- A Casual Dining Chain recommended in April 2024 gained +195.82%, growing $1,000 to nearly $2,958. This highlights their skill in identifying value across diverse industries.

Tools and Resources

Alpha Picks arms you with cutting-edge resources to sharpen your investment game:

- Proprietary Quantitative Ratings: Get clear insights into stock potential with their unique system, invaluable for gauging performance amidst 2025’s trade policy uncertainties.

- Portfolio Management Tools: Adjust your holdings in real-time with user-friendly dashboards, essential for reacting to market moves like the Fed’s rate adjustments.

- Timely Alerts & Analytics: Stay informed with email updates and deep analysis, keeping you ahead of trends like gold’s 21% surge this year as a safe-haven asset.

The Team Behind Alpha Picks

Alpha Picks’ success stems from a powerhouse team of financial experts:

- Steve Cress, Head of Quantitative Strategies: Spearheads the analytical framework, ensuring picks are rooted in data—a lifeline in volatile times.

- Zachary Marx, CFA, Senior Quantitative Strategist: Leverages deep market knowledge to uncover high-potential stocks, enhancing your odds of success.

- Joel Hancock, Senior Director of Product: Drives innovation in tools and resources, making sure you have everything needed to make smart, timely decisions.

Why Alpha Picks in 2025?

With economic uncertainty, geopolitical tensions, and inflation pressures defining 2025, Alpha Picks by Seeking Alpha (read the 2025 review) (read the 2025 review) offers a standout solution. Their data-driven methodology, paired with expert insights and a focus on long-term growth, positions you to not just weather the storm but thrive. Whether it’s capitalizing on small-cap resilience or dodging risks from global trade disputes, this service has your back.

Picture this: turning today’s market challenges into tomorrow’s big wins. With Alpha Picks, you’re not just investing—you’re strategically building wealth, outpacing inflation, and securing your goals in a year full of unknowns.

By joining Alpha Picks, you’re stepping into a community of savvy investors armed with the strategies, tools, and insights to excel in 2025 and beyond. Don’t just react to the market—lead it.

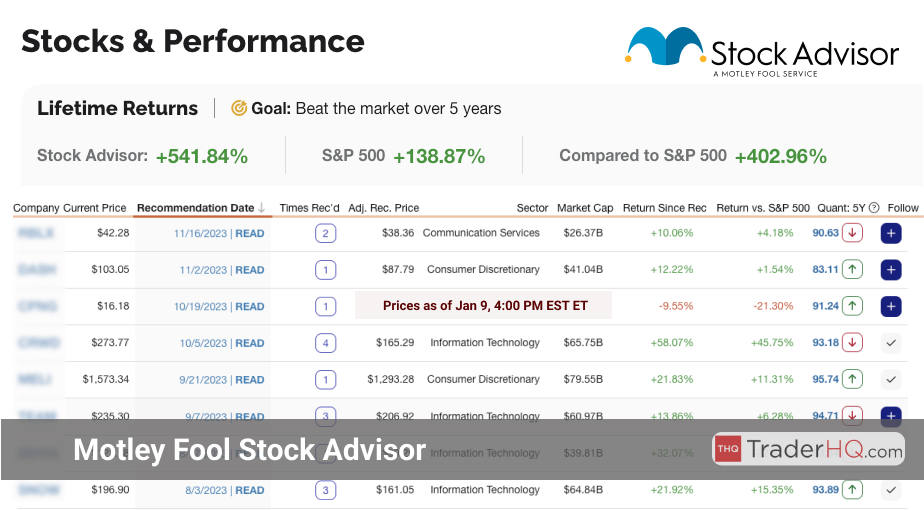

2. Motley Fool Stock Advisor

-

Best for: Long-term investors chasing market-beating returns, beginners needing clear expert guidance, and busy professionals seeking streamlined stock picks.

-

Cost: $99/year for new members (50% OFF $199/year)

Aggregate Overall Performance:

- Total Return: +975.44%

- S&P 500 Return: +171.82%

- Outperformance vs. S&P 500: +803.62%

Motley Fool Stock Advisor, launched in 2002, stands as a trusted name among the best stock advisor services for 2025. With a proven focus on long-term, buy-and-hold strategies, it’s designed to help you outpace the market, especially critical in today’s landscape where trade policy uncertainties and inflation pressures—such as the proposed 10% universal tariff in April 2025—add layers of risk. If you’re looking to build wealth while navigating volatility, this service offers the clarity and conviction you need.

The platform delivers monthly stock picks, a curated list of foundational investments, and transparent performance tracking. Its philosophy centers on identifying high-quality businesses with enduring growth potential, a strategy that aligns perfectly with the current need to counter inflation (still above the Fed’s 2% target as of May 2025) and geopolitical tensions. Stock Advisor isn’t just about picks; it’s about empowering you to stay the course for compounding returns.

As of May 16, 2025, Stock Advisor’s average return since inception is a staggering +975.44%, compared to the S&P 500’s +171.82% over the same period. That’s an outperformance of +803.62%, a clear signal of its edge in spotting winners—even amidst 2025’s market swings driven by AI concentration risks and interest rate volatility. This track record proves you can achieve life-changing growth with the right guidance.

Stock Advisor’s success reflects the power of patience, echoing Warren Buffett’s wisdom: “The stock market is a device for transferring money from the impatient to the patient.” In a year where gold prices surged 21% as a safe haven (per May 2025 data), their focus on resilient, long-term picks helps you avoid emotional traps and build a portfolio that thrives through uncertainty.

Imagine turning a modest investment into a fortune. Their historical wins speak volumes:

- A semiconductor giant, picked in 2005, delivered +82,888%, transforming $1,000 into over $829,880.

- A streaming pioneer, recommended in 2004, returned up to +64,158%, turning $1,000 into $642,580.

- An e-commerce titan, flagged in 2002, soared +26,757%, growing $1,000 to $268,570.

Beyond numbers, Stock Advisor (read our review) tackles the mental game of investing. Their research-backed insights help you sidestep panic during market dips—like the small-cap declines of 18% in the Russell 2000 this year—and focus on fundamentals. Whether it’s trade disputes or Fed rate cuts (targeting 3.25% by year-end), their guidance keeps your goals in sight.

The Motley Fool ecosystem equips you with tools like stock screeners, performance dashboards, and a robust learning hub. For beginners, this demystifies investing; for pros, it saves time. In 2025’s fast-moving market—where AI investments hit $315 billion from tech giants—these resources ensure you’re not left behind.

Whether you’re just starting or refining a portfolio, Stock Advisor offers a roadmap to a diversified, high-performing portfolio. With inflation and global tensions as real threats, their long-term focus helps secure your financial future against today’s economic headwinds.

Key Features of Motley Fool Stock Advisor (read our review)

- Monthly Stock Recommendations: Get two deeply researched picks each month with detailed reports, targeting companies poised for growth—vital for beating inflation in 2025.

- Curated Foundational Stocks: Access a list of 10 core stocks with lasting potential, updated regularly to reflect opportunities amid shifting policies like tariff hikes.

- Monthly Rankings: See the top 10 investment ideas from their picks, keeping you aligned with the strongest opportunities in a volatile market.

- Detailed Performance Tracking: Track every recommendation against the S&P 500, offering transparency to gauge your success during uncertain times.

- Extensive Educational Resources: Dive into articles, videos, live Q&As, and a community forum to sharpen your skills—key for navigating 2025’s complex landscape.

Motley Fool Stock Advisor’s legacy of market-beating returns builds unshakable trust. By prioritizing quality investments and ongoing education, it empowers you to achieve lasting wealth, even as challenges like geopolitical risks and sector-specific volatility loom large in 2025.

Investment Philosophy and Methodology

Long-Term, Buy-and-Hold Investing

At its core, Stock Advisor champions long-term investing. You’re encouraged to ignore short-term noise—like weekly volatility spikes from trade policy fears—and focus on a company’s enduring potential. This compounding strategy maximizes wealth over decades, a proven shield against 2025’s inflation and rate uncertainties.

This approach fosters discipline, helping you avoid knee-jerk reactions to market swings. Holding quality stocks through cycles ensures you capture growth from solid businesses, especially when small-caps offer attractive valuations as they do now.

Focus on High-Quality Companies

Stock Advisor zeroes in on firms with robust fundamentals: strong balance sheets, steady earnings growth, and high returns on equity. These are businesses built to endure economic turbulence—think tariff-driven cost hikes or geopolitical flare-ups—and grow over time, a must-have in today’s market.

The Role of Team Everlasting

Led by Tom Gardner, Team Everlasting seeks companies with:

- Strong Competitive Advantages: Unique edges like proprietary tech or brand power, critical for staying ahead in competitive sectors.

- Excellent Management: Leaders who innovate and execute, steering firms through policy shifts and economic challenges.

- Consistent Growth: Steady gains in revenue and market share, ensuring long-term value in uncertain 2025 markets.

The Role of Team Rule Breakers

Team Rule Breakers targets disruptive innovators with:

- Innovation: Firms redefining industries with cutting-edge solutions, aligning with 2025’s AI and tech boom.

- Disruption: Companies upending norms, offering exposure to emerging trends.

- Market Potential: Massive growth opportunities in evolving sectors, key for outsized returns.

Rigorous Analysis and Strict Criteria

Every pick undergoes intense scrutiny, including:

- Fundamental Research: Deep dives into financials and business models to uncover true value amid market noise.

- Management Assessment: Evaluating leadership’s ability to navigate challenges like inflation or trade tensions.

- Competitive Advantage Analysis: Spotlighting unique strengths that sustain growth during downturns.

- Growth Potential: Assessing expansion prospects in light of 2025 trends like M&A surges (up 17% in 2024).

- Valuation Metrics: Using P/E ratios and cash flow analysis to find fairly priced gems in a turbulent market.

This meticulous process ensures recommendations balance growth and stability, helping you build a portfolio that outperforms even in 2025’s complex environment.

Stock Picking Performance and Examples of Successful Picks

Motley Fool Stock Advisor’s knack for picking winners is unmatched. Their long-term outperformance—+803.62% over the S&P 500—shows their ability to spot top stock picks for 2025 across market cycles.

Recent successes highlight their relevance. A 2024 e-commerce pick from June soared +80%, beating the S&P 500 by +67%. A ride-hailing and delivery firm picked in April 2024 gained +50%, outpacing the index by +29%, despite trade policy headwinds.

Over five years, their foresight shines. A 2020 electric vehicle leader returned +1,120%, crushing the S&P 500 by +1,021%. A cybersecurity firm from 2023 delivered +255%, outperforming by +201%. Picture turning $1,000 into thousands with picks like these—Stock Advisor makes it possible.

These wins underscore why it’s a standout among the best stock market research websites in 2025. With their guidance, you can confidently tackle market ups and downs, turning insights into real gains.

Best Stock Research Websites Reviewed

Here are the best stock research sites and best investment research websites we’ve reviewed in 2025.

| Best Stock Research Services | Best For | Key Feature |

|---|---|---|

| 📊 Alpha Picks by Seeking Alpha | Community Insights | Analyst Wisdom |

| 💼 Motley Fool Stock Advisor | Long-term Growth | Stock Picking |

| 📈 Koyfin | Data Visualization | Advanced Charting |

| 📅 Seeking Alpha Premium | Data Evaluation | Detailed Analysis |

| 🔍 Zacks Premium | Stock Ratings | In-depth Analysis |

| 💡 Trade Ideas | Strategic Trading | Real-time Data |

| 🔍 Morningstar Investor | Fundamentals | Comprehensive Data |

3. Koyfin

-

Best for: Active traders seeking comprehensive data, fundamental analysts needing detailed financials, and visual learners benefiting from robust charting tools.

-

Cost: $0/month for Free Plan, $39/month for Plus Plan, $79/month for Pro Plan

Koyfin is a comprehensive financial data and analysis platform that has quickly established itself as a go-to resource for investors seeking to make informed decisions. Founded with the mission of empowering investors, Koyfin (read the 2025 review) offers a robust suite of tools and features that cater to users with varying levels of experience and needs as of January 2025.

At the heart of Koyfin’s offerings is its extensive access to financial data across multiple asset classes, including global equities, bonds, yield curves, and foreign exchange rates. This comprehensive data coverage is essential for investors looking to conduct thorough research and analysis.

Koyfin sets itself apart by providing both historical and predictive data, enabling users to assess past performance and forecast future possibilities. The platform’s data visualization tools, such as fundamental charting, make complex financial information more accessible and easier to interpret.

Beyond data access, Koyfin offers powerful customization and analysis features:

-

Screeners and watchlists allow users to filter and track their selected stocks or assets, keeping their investment strategy organized.

-

Custom formulas and financial templates enable users to tailor their analysis to their specific investing styles and methodologies.

-

Model portfolios, exclusive to the Pro plan, provide tools for hypothesis testing and simulated portfolio management.

Koyfin’s commitment to accessibility is evident in its web-based interface, which ensures users can access the platform from any internet-enabled device. The service caters to a global audience, providing access to over 100,000 global company snapshots across its plans.

Recognizing that users have different needs and preferences, Koyfin offers a tiered subscription model. The Free plan is tailored towards novice users or those seeking basic tools, while the Plus and Pro plans target more serious or professional investors requiring in-depth analysis capabilities.

Koyfin prioritizes the delivery of timely and relevant information to its users. The platform offers real-time data streams, market dashboards, and economic calendars, ensuring that investors can make decisions based on the most up-to-date information. Higher-tier plans also provide access to premium news, press releases, filings, and transcripts for more granular analysis.

The platform fosters a knowledge-sharing community, with collaborative support in the Free tier and escalating levels of one-on-one service in the Plus and Pro plans. This ecosystem allows beginners to learn from their peers while advanced users receive priority support.

Koyfin’s tools have numerous insightful applications:

-

Risk management: Unlimited custom calculations can help sophisticated traders create complex risk management plots.

-

Strategic allocation: ETF holdings data assists asset managers in assessing diversification.

-

Market timing strategies: Real-time dashboards and economic calendars provide insights for technical traders.

-

Quantitative analysis: Custom formulas allow analysts to devise and backtest algorithmic trading models.

Koyfin’s core value proposition lies in its versatility and adaptability. By offering a range of tools and features that cater to users with different levels of experience and requirements, the platform positions itself as a one-stop-shop for financial data aggregation, analysis, and portfolio management.

Whether you’re a casual investor looking to learn the ropes or a professional seeking advanced tools to refine your strategies, Koyfin has something to offer. The platform’s commitment to accessibility, real-time data, customization, and analytical rigor sets it apart in the market.

If you’re seeking a powerful yet user-friendly platform to elevate your investment research and decision-making, Koyfin is definitely worth exploring. With its comprehensive features and tiered pricing, you can select the plan that best aligns with your needs and embark on a journey towards more informed and effective investing.

4. Seeking Alpha Premium

-

Best for: Experienced traders seeking in-depth analysis, long-term investors looking for stock ratings, and value investors interested in fundamental data.

-

Cost: $189/year (Save $50 off regular $239/year)

Seeking Alpha Premium empowers investors with comprehensive tools for informed decision-making. As of January 2025, the platform continues to evolve, maintaining its status as a leading resource for in-depth stock analysis and investment ideas since its launch in 2004.

The service stands out by offering a unique blend of:

- Quantitative ratings from algorithmic models

- Insights from experienced Seeking Alpha contributors

- Wall Street analyst perspectives

This multi-faceted approach provides a holistic view of investment opportunities, catering to diverse investor needs.

Seeking Alpha Premium’s core offerings include:

- Stock Ratings and Scorecards: Comprehensive evaluations based on various factors

- Dividend Insights: Critical analysis of dividend stocks for income-focused investors

- Screening Tools: Efficient filters to identify stocks matching specific criteria

- Real-time Alerts: Timely notifications on rating changes and market shifts

These features enable users to make data-driven decisions and stay ahead of market trends.

The platform’s additional tools and resources further enhance the investment process:

- Stock Symbol Pages: Consolidate ratings and key information for quick analysis

- News Aggregation: Curated news relevant to specific stocks

- Comparative Analysis Tools: Side-by-side stock comparisons for informed decision-making

- Historical Financial Data: Access to a decade of financial information for trend analysis

Seeking Alpha Premium (see our review) also offers portfolio management tools, including:

- Portfolio grading based on various metrics

- Dividend grading system for income-focused strategies

- Customized news dashboard tailored to investor preferences

These features allow users to refine their investment strategies and maintain a balanced portfolio.

The service’s real-time updates and unlimited access to premium content ensure users can react promptly to market developments. Data visualizations and downloadable financial statements further support in-depth analysis and presentation needs.

Seeking Alpha Premium’s comprehensive toolkit empowers investors to navigate complex financial markets with confidence. By leveraging its diverse features, users can develop robust investment strategies aligned with their goals and risk tolerance.

5. Zacks Premium

-

Best for: Value investors seeking expert stock analysis, long-term investors looking for growth opportunities, and proactive investors aiming to optimize their portfolio.

-

Cost: $249/year after free 30-day trial

Since 1978, Zacks Premium has been a trusted name in investment research, providing investors with a comprehensive suite of tools and insights to confidently navigate the stock market.

At the core of Zacks Premium’s offerings is the proprietary Zacks Rank system, which harnesses the power of earnings estimate revisions to identify stocks with the greatest potential for outperformance. This proven methodology has consistently doubled the returns of the S&P 500, making it an invaluable resource for investors seeking to optimize their portfolios.

Beyond the Zacks Rank, the service offers a wealth of additional features designed to cater to each user’s unique investment style and goals:

-

Style Scores and VGM Score allow users to align their stock selections with their preferred investment approach, whether it be value, growth, or momentum-focused.

-

The Focus List Portfolio provides a curated selection of 50 stocks poised for long-term growth, complete with in-depth research reports and expert analysis.

-

Industry Rank helps users identify the most promising sectors to invest in, based on historical data and current market trends.

-

The Earnings ESP Filter employs predictive analytics to pinpoint stocks most likely to deliver positive or negative earnings surprises, giving users an edge during earnings season.

In addition to these powerful tools, Zacks Premium (see our review) members gain access to a vast library of detailed Equity Research Reports, covering over 1,000 widely-followed companies. These reports offer an unparalleled level of insight into each company’s financial health, competitive positioning, and growth prospects, empowering users to make more informed investment decisions.

For investors who prefer a more hands-on approach, the Zacks Premium Screener allows for custom stock screening based on a wide array of criteria, from market cap to broker rating upgrades. This flexibility ensures that users can tailor their research to their specific needs and goals, whether they’re seeking income, value, growth, or momentum opportunities.

With its commitment to data-driven analysis, user-friendly tools, and expert insights, Zacks Premium is an indispensable resource for investors looking to elevate their stock research and achieve market-beating returns.

Try Zacks Premium today with a free 30-day trial and experience the difference that comprehensive, professional-grade investment research can make in your portfolio.

6. Trade Ideas

-

Best for: Active traders, swing traders, and tech-savvy investors. Each group will benefit from advanced AI-driven stock picks and real-time data analysis.

-

Cost: $84/month for Standard Plan (billed annually at $999), $167/month for Premium Plan (billed annually at $1999), $17/month for TI Swing Picks subscription

Trade Ideas, a pioneering market analysis platform, has been empowering traders and investors since 2003. With its cutting-edge technology and comprehensive suite of tools, Trade Ideas (see our review) has firmly established itself as a leader in stock research and investment analysis.

At the heart of Trade Ideas’ offerings is its powerful AI-driven analytics engine, which processes vast amounts of market data in real-time to identify potential trading opportunities. This advanced technology allows users to stay ahead of the curve and make informed decisions based on up-to-the-minute insights.

What sets Trade Ideas apart is its commitment to providing a holistic trading experience. Beyond its core stock scanning and alerting capabilities, the platform offers a wealth of additional tools and resources designed to support traders at every stage of their journey:

-

Backtesting: Users can test and refine their strategies against historical market data, helping to optimize their approach before risking real capital.

-

Risk Assessment: Integrated risk management tools enable traders to evaluate potential trades and manage their positions effectively.

-

Education: Trade Ideas offers a robust library of educational content, including webinars, tutorials, and a vibrant trading community, fostering continuous learning and growth.

One of the standout features of Trade Ideas is its AI-powered virtual trading analyst, Holly. By leveraging machine learning algorithms, Holly generates data-driven trade ideas and strategies that adapt to changing market conditions, providing users with an unparalleled level of insights and guidance.

Moreover, Trade Ideas understands that every trader is unique. The platform’s highly customizable interface and flexible alerts system allow users to tailor their experience to their specific needs and preferences, ensuring a personalized and efficient workflow.

For traders seeking a comprehensive, data-driven approach to stock research and analysis, Trade Ideas is an indispensable tool. Its powerful AI analytics, extensive feature set, and commitment to user education make it a top choice for traders of all levels.

Whether you’re a seasoned professional or just starting your trading journey, Trade Ideas can provide the insights, tools, and support you need to navigate the markets with confidence. Discover the power of AI-driven analysis and take your trading to the next level with Trade Ideas.

7. Morningstar Investor

- Best for: Value seekers, long-term planners, and retirement-focused individuals who need in-depth analysis and comprehensive data tailored to their unique goals.

- Cost: $199/year for new members (20% OFF $249/year)

Morningstar Investor stands as a trusted cornerstone in financial research, empowering self-directed investors like you to make confident, informed decisions. With decades of delivering independent, unbiased analysis, this platform equips you to take charge of your financial future—whether you’re building wealth for retirement or seeking value-driven opportunities in today’s complex market.

Why Morningstar Investor Shines in 2025

In a landscape shaped by trade policy uncertainties, interest rate fluctuations, and sector-specific volatility (like AI-driven tech growth as of May 17, 2025), Morningstar’s commitment to rigorous, objective research is more vital than ever. Their team of over 150 specialized analysts spans diverse sectors, ensuring you get deep, actionable insights—no matter the market’s twists and turns. This fiduciary-first approach prioritizes your interests, aligning with the highest standards in the industry.

Morningstar’s standout feature is its transparent ratings system, which goes beyond mere securities to evaluate fund managers and ESG factors. This gives you a clear, holistic view of potential investments, helping you navigate risks like inflation pressures or geopolitical tensions impacting markets right now.

Key Features for Smarter Investing

The platform’s tools blend cutting-edge data analytics with expert insights, empowering you to filter through noise and pinpoint opportunities that match your goals. Here’s how Morningstar Investor (see our 2025 review) adds value to your strategy:

- Portfolio X-Ray: Dive deep into your holdings with multi-dimensional analysis, spotting hidden risks, redundancies, or over-concentrations—crucial in a market where small-cap resilience and tech volatility coexist in 2025.

- Fee Evaluator: Uncover the true impact of expenses on your returns, ensuring you maximize every dollar in an era of potential tariff-driven cost increases.

- Account Aggregation: Simplify your financial oversight by tracking all holdings in one place, enabling a unified strategy across diverse assets.

- Personalized Insights: Get tailored recommendations based on your specific portfolio and preferences, making research relevant and actionable.

Why It’s Worth Your Time and Money

Morningstar Investor’s pricing—$199/year with a 20% discount for new members—reflects a focus on long-term value, encouraging commitment while offering a trial period for risk-free exploration. Imagine the time saved: instead of sifting through endless reports, their pre-filtered lists and screening tools align opportunities with industry benchmarks, letting you focus on strategy. Whether you’re a beginner craving simplicity or a seasoned investor balancing a busy life, this efficiency is a game-changer.

Built for Today’s Challenges

With markets facing unique pressures in 2025—like gold’s 21% surge as a safe-haven asset or M&A activity spiking 17% in targeted sectors—Morningstar’s unbiased research helps you stay ahead. From managing risks tied to global trade disputes to spotting undervalued small-cap opportunities (as the Russell 2000 suggests attractive valuations), their platform serves as both a tactical tool and an educational hub. Picture this: a retiree using Morningstar (see our 2025 review) to grow a modest $5,000 nest egg by identifying low-fee, high-value funds suited to a risk-averse strategy.

Empower Your Financial Future

For investors aiming to refine stock picking or optimize portfolio management, Morningstar Investor is your professional-grade ally. It’s not just about data—it’s about uncovering profitable paths, fine-tuning strategies, and achieving your goals with less stress. Ready to elevate your investing game?

A Resource for Every Investor

Whether you’re tracking performance, managing risk, or discovering new opportunities, Morningstar’s consistent, trustworthy analysis democratizes investment knowledge. It’s a must-have for anyone serious about navigating the 2025 market landscape, from long-term planners to value-focused individuals. Take the first step toward smarter investing today.

Ready to Transform Your Portfolio?

Don’t let market uncertainties hold you back. With Morningstar Investor, you have the tools and insights to make informed decisions and build lasting wealth. Join thousands of investors who trust this platform to guide their financial journey.

What is a Stock Research Website?

A stock research website is an online platform that provides investors with the tools and insights needed to make informed investment decisions. These websites offer a wealth of financial data, analysis, and expert opinions to help you thoroughly evaluate potential stock investments. By leveraging the resources available on these platforms, you can gain a deeper understanding of market trends, company fundamentals, and key metrics that impact stock performance.

The best stock research websites combine real-time data, advanced charting tools, and comprehensive company profiles to give you a holistic view of investment opportunities. They also often feature expert analysis, news updates, and educational resources to keep you informed and empowered as an investor. Whether you’re a beginner or an experienced investor, these websites can be invaluable in guiding your investment strategy and helping you uncover profitable opportunities in the stock market.

When choosing a stock research website, it’s important to consider factors such as the depth and quality of data provided, the user-friendliness of the platform, and the credibility of the analysis offered. The right website should align with your individual investing style and goals, providing the specific tools and insights you need to make confident, well-informed decisions. With the power of these research platforms at your fingertips, you can elevate your investing skills and work towards achieving your financial objectives more effectively.

What is the Best Stock Research Website?

The best stock research website is one that offers a comprehensive suite of tools, data, and insights to empower your investment decisions. It should provide real-time, accurate market data and advanced charting capabilities to help you analyze price movements and identify key trends. Look for a website that offers in-depth company profiles, financial statements, and key metrics to give you a clear picture of a stock’s underlying fundamentals.

Expert analysis and commentary from experienced investors can also be incredibly valuable in guiding your research process. The best stock research websites feature insights from trusted industry professionals who can provide unique perspectives on market events, sector trends, and individual stocks. Additionally, these top platforms often include powerful screening tools that allow you to quickly filter through thousands of stocks based on your specific criteria, saving you time and effort in identifying potential investments.

Ultimately, the best stock research website for you will depend on your individual needs, preferences, and investing style. Some investors prioritize technical analysis tools, while others focus more on fundamental data or expert opinions. Consider factors such as ease of use, mobile accessibility, and cost when evaluating different options. By choosing a research platform that aligns with your goals and provides the specific resources you need, you can gain a significant edge in your investing journey and make more informed, confident decisions in the stock market.

How We Evaluated the Best Stock Research Websites?

To determine the best stock research websites, we conducted a thorough evaluation process that considered a wide range of factors. Our goal was to identify the platforms that offer the most comprehensive, reliable, and user-friendly tools for investors of all levels. Here are some of the key criteria we used in our assessment:

-

Depth and quality of data: We looked for websites that provide accurate, real-time market data, extensive company profiles, and key financial metrics.

-

Advanced charting and analysis tools: The best platforms offer sophisticated charting capabilities and technical analysis indicators to help users identify trends and patterns.

-

Expert insights and commentary: We evaluated the quality and credibility of expert analysis provided by each website, looking for unique and actionable insights.

-

Screening and comparison tools: Powerful stock screening and comparison features were a top priority, allowing users to quickly filter and evaluate potential investments.

In addition to these core features, we also considered factors such as user experience, mobile accessibility, and educational resources. The best stock research websites strike a balance between powerful functionality and intuitive design, making it easy for investors to navigate the platform and find the information they need.

We also took into account the cost and value proposition of each website, evaluating whether the features and insights provided justify the price of subscription or membership. By weighing all of these factors, we were able to identify the top stock research websites that offer the most comprehensive and effective tools for investors seeking to elevate their skills and make better-informed decisions in the stock market.

🧠 Thinking Deeper

- ☑️ Understand that the market oscillates between extremes. Neither optimism nor pessimism lasts forever.

- ☑️ Learn to embrace calculated risks. They're necessary for achieving above-average returns.

- ☑️ Continuously educate yourself. The market is always evolving, and so should your knowledge.

- ☑️ Understand that risk and reward are inextricably linked. Higher potential returns come with higher risk.

📚 Wealthy Wisdom

- ✨ You get recessions, you have stock market declines. If you don't understand that's going to happen, then you're not ready, you won't do well in the markets. - Peter Lynch

- ✔️ The secret to investing is to figure out the value of something and then pay a lot less. - Joel Greenblatt

- 🌟 If you have trouble imagining a 20% loss in the stock market, you shouldn't be in stocks. - John Bogle

- 🚀 Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas. - Paul Samuelson

📘 Table of Contents

- • Alpha Picks by Seeking Alpha

- • Methodology and Approach

- • Key Features and Benefits

- • Performance in 2025

- • Tools and Resources

- • The Team Behind Alpha Picks

- • Why Alpha Picks in 2025?

- • Motley Fool Stock Advisor

- • Best Stock Research Websites Reviewed

- • Koyfin

- • Seeking Alpha Premium

- • Zacks Premium

- • Trade Ideas

- • Morningstar Investor

- • Why Morningstar Investor Shines in 2025

- • Key Features for Smarter Investing

- • Why It’s Worth Your Time and Money

- • Built for Today’s Challenges

- • Empower Your Financial Future

- • A Resource for Every Investor

- • Ready to Transform Your Portfolio?

- • What is a Stock Research Website?

- • What is the Best Stock Research Website?

- • How We Evaluated the Best Stock Research Websites?