7 Best Stock Analysis Websites & Technical Analysis Subscription Service in 2024

Elevate your trading game with the top seven stock analysis websites and technical analysis services. For more expert insights, explore these best stock advisor websites and investment subscriptions.

We aim for insightful coverage of products and services, including some from compensating partners, which may influence our topics and presentation. Our opinions and conclusions remain unbiased. See our Advertiser Disclosure.

What separates the exceptional traders from the average ones in today’s data-driven markets? You recognize that accessing high-quality, actionable research is key to refining your edge and achieving consistent outperformance. Let’s explore the top stock analysis websites and technical analysis services that can elevate your trading strategy in 2024.

1. Morningstar Investor

-

Best for: Fundamental analysts, passive investors. Comprehensive research for long-term portfolio building.

-

Cost: $199/year with $50 discount (7-day free trial available)

Morningstar Investor is a comprehensive investment research and analysis platform that empowers self-directed investors to make informed decisions. With a history of providing independent and objective research, Morningstar has established itself as a trusted name in the investment industry.

The core offerings of Morningstar Investor (in-depth review) include a comprehensive ratings system, investment screening tools, and the Portfolio X-Ray feature. These tools are designed to help investors understand the fundamentals of their investments and make decisions aligned with their goals.

The ratings system covers a wide range of securities, fund managers, and even ESG considerations. The transparency in the methodology allows investors to understand the basis of the evaluations.

The investment screening tools integrate data analytics with expert insights, enabling investors to filter options effectively. Pre-filtered lists provide a curated starting point, saving time and aligning selections with industry benchmarks.

The Portfolio X-Ray feature offers a multi-dimensional analysis of portfolio composition, identifying concentrations, redundancies, and hidden risks. It also evaluates fees, which can have a significant impact on investment returns.

Morningstar Investor also offers account aggregation, consolidating all investment holdings for streamlined monitoring and real-time data. Personalized insights enhance relevance by focusing on subscriber-specific assets, while watchlists and customization features ensure pertinent information is readily accessible.

With Morningstar Investor, you can:

-

Manage risk by understanding diversification levels

-

Track performance against benchmarks

-

Discover new opportunities through data-driven screening

-

Enhance your financial literacy through continuous interaction with research material

-

Gain efficiency by streamlining portfolio analysis and automating monitoring tasks

Whether you’re a beginner or an experienced investor, Morningstar Investor provides the tools and insights you need to navigate the investment landscape with confidence. With a commitment to unbiased research and a focus on empowering investors, Morningstar Investor is an essential resource for anyone seeking to take control of their financial future.

Try Morningstar Investor today with a 7-day free trial and experience the difference that independent, objective research can make in your investment decisions. With a yearly subscription of $199 (discounted from $249), you’ll have access to a wealth of tools and insights designed to help you achieve your financial goals.

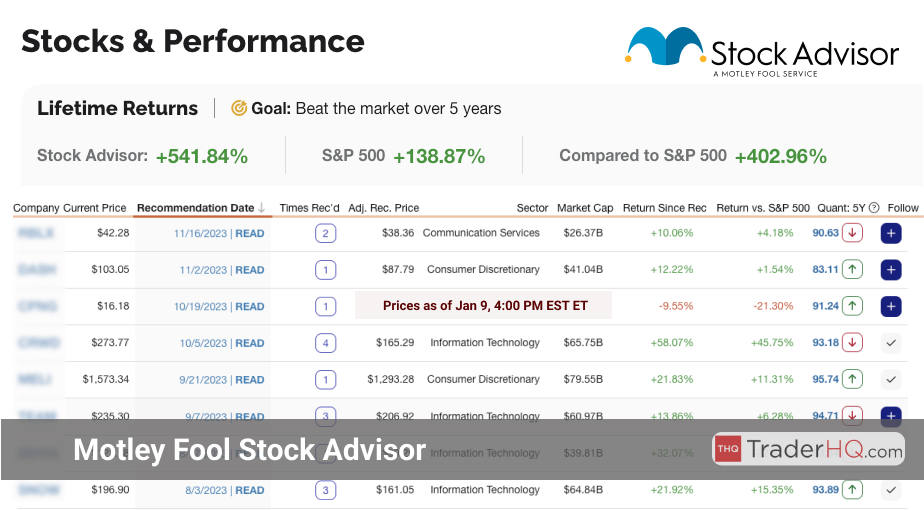

2. Motley Fool Stock Advisor

-

Best for: Long-term investors seeking consistent gains, growth-focused investors looking for high-potential stocks, and beginners wanting expert guidance for starting out.

-

Cost: $99/year for new members (50% OFF $199/year)

Founded in 2002 by brothers David and Tom Gardner, Motley Fool Stock Advisor has become one of the most respected and successful investment advisory services in the market. With a focus on long-term, buy-and-hold investing in high-quality companies, Stock Advisor has consistently outperformed the S&P 500.

The average return of a Stock Advisor pick since inception is +789.67%, while the average return of the S&P 500 over the same period is +170.96%. This means Stock Advisor (in-depth review) has outperformed the S&P 500 by an impressive 4.6x times.

Some of Stock Advisor’s most remarkable picks include:

-

DIS, recommended in June 2002, with a return of 5,285% and turning a $1000 investment into $53,850

-

AAPL, recommended in January 2008, with a return of 4,670% and turning a $1000 investment into $47,700

-

NVDA, recommended in January 2017, with a staggering return of 5,244% and turning a $1000 investment into $53,440

But the real stars are picks like NFLX, first recommended in October 2004, which has returned an astonishing 29,377%, turning a $1000 investment into $294,770, and AMZN, picked in September 2002, with a return of 24,398%, turning $1000 into $244,980.

These returns illustrate the power of Stock Advisor’s investment philosophy, which is built on the principles of asymmetrical risk, compounding returns, and long-term investing. As legendary investor Peter Lynch once said, “In this business, if you’re good, you’re right six times out of ten.” Stock Advisor’s track record proves the wisdom of this approach.

Warren Buffett, another investing icon, famously stated, “The stock market is a device for transferring money from the impatient to the patient.” Stock Advisor’s focus on high-quality, long-term investments embodies this patient, disciplined approach to wealth-building.

In addition to its outstanding stock recommendations, Stock Advisor provides members with a wealth of tools and resources, including:

-

In-depth research reports on each recommended stock

-

Ongoing coverage and updates on recommended companies

-

A vibrant member community for sharing ideas and insights

-

Educational resources to help you become a smarter, more confident investor

Whether you’re a seasoned investor or just starting to build your portfolio, Motley Fool Stock Advisor (read our review) offers the guidance, tools, and proven track record to help you achieve your financial goals. With its commitment to long-term, patient investing in high-quality companies, Stock Advisor can help you navigate the market’s ups and downs and build lasting wealth.

Best Stock Analysis Websites for Investors

Here are the best stock analysis websites and seeking alpha services we’ve reviewed in 2024.

| Best Analysis Service | Key Features |

|---|---|

| 📈 Morningstar Investor | Research Reports |

| 🎯 Motley Fool Stock Advisor | Stock Picks |

| 🌟 Alpha Picks | Community Insight |

| 📊 Koyfin | Data Visualization |

| 🔍 SA Premium | Detailed Analysis |

| 🚀 Trade Ideas | Real-time Alerts |

| 📉 TipRanks | Analyst Research |

3. Alpha Picks by Seeking Alpha

-

Best for: Long-term investors seeking stability, growth-focused investors aiming for high returns, and value seekers looking for undervalued opportunities.

-

Cost: $449/year for new members (10% OFF $499/year)

Alpha Picks by Seeking Alpha is a specialized service that leverages a systematic stock selection process to identify top investment opportunities. Seeking Alpha, a renowned financial services company, offers Alpha Picks to provide subscribers with well-researched stock recommendations derived from advanced quantitative analysis and unique data.

Since its inception in July 2022, Alpha Picks has delivered impressive results. The average return of an Alpha Picks (see our review) stock pick is 128%, outperforming the S&P 500’s 48% return over the same period by 2.6x. With 51 total recommendations, Alpha Picks has consistently identified high-potential investment opportunities.

Join Alpha Picks for 10% off at $449/year for new members. Introductory offer for the first year only. Renews at then current list price (currently $499).

Some of Alpha Picks’ top-performing recommendations include:

-

A Server Solutions Company recommended on 2022-11-15 has returned 969% to date, turning a $1,000 investment into $$10,686.

-

A Thermal Solutions Company pick from 2022-12-15 has gained 425%, growing $1,000 to $$5,251.

-

An Energy Solutions Company selected on 2023-05-15 has delivered a 217% return, increasing a $1,000 investment to $$3,174.

Alpha Picks offers a range of tools and resources to support subscribers, including:

-

Quantitative Ratings: Access proprietary ratings to identify strong buy opportunities.

-

Portfolio Management: Tools to track and manage the recommended stock portfolio.

-

Email Alerts: Notifications for any changes or updates in the portfolio.

-

Analytical Tools: Best-in-class data and tools to support informed investment decisions.

-

Expert Team: Insights from seasoned professionals with extensive experience in equity research and quantitative strategies.

The Alpha Picks team, led by Steve Cress, Zachary Marx, CFA, and Joel Hancock, brings decades of experience in quantitative modeling, equity research, and product management to deliver data-driven stock recommendations and expert analysis to long-term investors seeking to enhance their portfolios.

With its proven track record and comprehensive suite of tools and resources, Alpha Picks is an invaluable service for investors looking to make informed, data-backed investment decisions. Join now to access the latest stock picks and take your portfolio to the next level.

4. Koyfin

-

Best for: Data-driven investors seeking comprehensive insights, technical traders needing advanced charting, and value investors looking for detailed financial analysis.

-

Cost: $39/month for Plus Plan

Koyfin emerged as a powerful financial data platform, revolutionizing how investors access and analyze market information. Its comprehensive approach to data aggregation and visualization sets it apart in the crowded financial technology space.

At its core, Koyfin offers global financial data across multiple asset classes. This includes equities, bonds, yield curves, and foreign exchange rates. The platform’s strength lies in its ability to present complex data in easily digestible formats.

Koyfin’s tiered subscription model caters to a wide range of users:

- Free Plan: Basic tools for novice investors

- Plus Plan: Enhanced features for intermediate users

- Pro Plan: Advanced tools for professional investors

The platform’s customization options are particularly noteworthy. Users can create:

- Custom screeners

- Personalized watchlists

- Tailored financial templates

These tools allow investors to adapt the platform to their unique strategies and analytical approaches.

Koyfin’s data visualization capabilities stand out as a key differentiator. Even the free plan offers fundamental charting tools, making complex data more accessible and understandable.

For more advanced users, Koyfin provides:

- Access to historical financials (up to 10 years in higher-tier plans)

- Future estimates and predictive data

- Custom formula creation for in-depth analysis

The platform’s global reach is impressive, offering data on over 100,000 companies worldwide. This breadth of information makes Koyfin valuable for investors looking beyond their local markets.

Koyfin’s web-based interface ensures accessibility from any internet-enabled device, catering to the modern investor’s need for mobility and convenience.

Real-time data streams and market dashboards keep users informed of market movements as they happen. This feature is crucial for making timely investment decisions in volatile markets.

The platform also offers valuable research tools, including:

- Earnings calendars

- Economic event tracking

- Access to filings and transcripts (in higher-tier plans)

These resources enable users to align their strategies with macroeconomic developments and corporate performance indicators.

Koyfin’s community support system fosters a collaborative learning environment, particularly beneficial for users on the free plan. As users upgrade, they gain access to more personalized support options.

For quantitative analysts and advanced traders, Koyfin’s custom formula capabilities open up possibilities for creating and backtesting complex trading models directly within the platform.

Koyfin’s versatility makes it a valuable tool for various investment strategies, from risk management to strategic asset allocation. Its combination of comprehensive data, customizable analysis tools, and user-friendly interface makes it a compelling choice for investors at all levels.

5. Seeking Alpha Premium

-

Best for: Experienced investors seeking in-depth analysis, value investors looking for detailed stock insights, and active traders who need up-to-date market information.

-

Cost: $189/year + 7 day free trial ($50 OFF $239/year)

Seeking Alpha Premium has established itself as a premier destination for savvy investors looking to elevate their trading strategies. With a rich history of providing high-quality investment research and analysis, Seeking Alpha Premium has earned its place as a trusted resource in the market.

At its core, Seeking Alpha Premium offers a comprehensive suite of tools and insights designed to empower investors to make well-informed decisions. From in-depth stock analysis and ratings to dividend insights and screening tools, the platform provides a wealth of information to suit various investment styles and goals.

What sets Seeking Alpha Premium apart is its multi-faceted approach to investment analysis. Users can access a range of perspectives, including:

-

Quant Ratings: Algorithmic evaluations of stocks based on statistical models.

-

SA Authors: Insights from a vibrant community of experienced investors and analysts.

-

Wall Street Ratings: Professional opinions from financial institution analysts.

This holistic view enables investors to triangulate their research and make decisions based on a diverse set of expert opinions.

Beyond stock analysis, Seeking Alpha Premium offers a host of additional tools and resources to enhance the investing experience.

Dividend investors can leverage the platform’s Dividend Grades to assess the safety, growth, and consistency of income-generating stocks. The screening tools allow users to efficiently identify stocks that match their specific criteria, saving time and refining their investment searches.

Quick Lists provide instant access to highly-rated opportunities across various categories, further streamlining the discovery process.

Seeking Alpha Premium also excels in terms of research depth and accessibility. Users can access a vast library of articles, earnings call transcripts, and in-depth analysis of often-overlooked stocks.

The Stock Symbol Pages consolidate ratings from multiple perspectives, offering a convenient snapshot of a stock’s potential.

For those looking to stay atop market movements, Seeking Alpha Premium’s real-time alerts and customizable news dashboard ensure that users never miss a beat. The platform’s commitment to user experience is evident in its ad-lite interface, which minimizes distractions and allows for seamless navigation.

Whether you’re a long-term investor building a resilient portfolio or an active trader seeking alpha, Seeking Alpha Premium has the tools and insights to support your journey. With its unparalleled depth, expert analysis, and user-friendly design, the platform is well-equipped to help you navigate the complexities of the financial markets with confidence.

6. Trade Ideas

-

Best for: Active traders seeking advanced tools, swing traders needing precise picks, and data analysts looking for robust market insights.

-

Cost: $999/year for new members (16% OFF $1,188/year)

Trade Ideas is a cutting-edge trading analysis platform that has been revolutionizing the way investors and traders approach the market since 2003. With its advanced AI-powered tools and comprehensive market data, Trade Ideas has established itself as a leader in the industry.

At the core of Trade Ideas’ offerings is a suite of sophisticated scanning and alerting tools that help users identify profitable trading opportunities in real-time. These tools are powered by the company’s proprietary AI technology, which constantly analyzes market data to spot trends, patterns, and anomalies that might otherwise go unnoticed.

One of the key features that sets Trade Ideas apart is its AI-powered trading assistant, Holly. Holly uses machine learning algorithms to generate high-probability trade ideas based on historical data and current market conditions. By leveraging the power of AI, Holly helps traders stay ahead of the curve and make more informed decisions.

In addition to its cutting-edge technology, Trade Ideas also offers a wealth of educational resources and a vibrant community of traders. The platform’s trading room allows users to collaborate, share ideas, and learn from one another in real-time. This collaborative approach to trading is a testament to Trade Ideas’ commitment to empowering its users and helping them succeed in the markets.

Trade Ideas offers two main subscription plans to cater to the needs of different types of traders:

-

Standard Plan: At $84 per month (billed annually at $999), this plan provides access to the platform’s core features, including real-time streaming data, advanced charting tools, and the AI-powered assistant, Holly.

-

Premium Plan: For more advanced traders, the Premium Plan offers additional features such as the Oddsmaker backtesting tool, the Risk Assessment Dashboard, and priority access to customer support. This plan is priced at $167 per month (billed annually at $1,999).

Regardless of the plan chosen, Trade Ideas users can expect a high-quality, feature-rich platform that is designed to help them succeed in the markets. With its intuitive interface, advanced technology, and supportive community, Trade Ideas is an excellent choice for any trader looking to take their skills to the next level.

So if you’re a passionate investor seeking to elevate your trading game, Trade Ideas is the perfect platform for you. With its cutting-edge tools, expert insights, and vibrant community, Trade Ideas can help you unlock your full potential and achieve consistent, market-beating returns over the long run. Sign up today and start your journey towards trading success!

tradeideaspremium:last-cta

7. TipRanks Premium

-

Best for: Data-driven analysts, long-term planners, and strategic traders who want comprehensive insights.

-

Cost: $360/year for Premium Subscription

TipRanks Premium has established itself as a premier service in the investment research market. It emerged from a need to democratize access to high-quality financial data and analyst opinions. The platform is recognized for its comprehensive analytical tools and robust data aggregation capabilities.

TipRanks Premium caters to a diverse audience, including investors, financial advisors, and institutional investors. The core offerings include:

-

Advanced analytical tools, enabling users to conduct in-depth research and forecasting.

-

Data export options, facilitating offline analysis through PDF and CSV formats.

-

An expert aggregation algorithm that curates diverse analyst opinions to provide a balanced perspective.

What sets TipRanks Premium apart is its focus on data-driven insights and risk analysis, which help users navigate the complexities of the market. The platform also offers insider trading insights, enhancing the qualitative and quantitative understanding of stocks.

Additional tools and resources include:

-

Predictive analytics for future-proof investment decisions.

-

Exclusive insights from insider sentiments.

-

Comprehensive risk assessment tools to manage market volatility.

By deeply connecting users with expert opinions and sophisticated tools, TipRanks Premium transforms investment strategies. Users can bolster their investment acumen and make informed decisions. This service offers a unique blend of technological sophistication and intuitive design, making it a compelling choice for modern investors.

Embrace the power of TipRanks Premium to enhance your investment strategy with reliable data and comprehensive analysis

. Whether you’re managing a personal portfolio or conducting high-level institutional analysis, this service can provide the insights needed to succeed.What is a Trading Analysis Website?

A trading analysis website is an online platform that provides insights, research, and tools to help you make informed investment decisions. These sites offer a wealth of resources, including in-depth stock analysis, market commentary, and educational content tailored to your needs. By leveraging the expertise of experienced analysts and investors, you can gain a deeper understanding of market dynamics and identify promising trading opportunities.

The best trading analysis websites go beyond simple data and charts, offering actionable recommendations and strategic guidance. They help you cut through the noise and focus on the factors that really drive stock prices, such as company fundamentals, industry trends, and macroeconomic forces. With access to high-quality research and analysis, you can approach the markets with greater confidence and conviction.

Whether you’re a seasoned trader looking to refine your strategies or a curious investor eager to expand your knowledge, a good trading analysis website can be an invaluable resource. By tapping into the collective wisdom of a community of passionate, like-minded investors, you can continually sharpen your skills and stay ahead of the curve in a rapidly evolving market landscape.

What is the Best Trading Analysis Website?

While there are many excellent trading analysis websites available, the best one for you will depend on your specific needs, preferences, and investing style. However, some sites consistently stand out for the quality, depth, and actionability of their research and insights.

One of the top contenders for the title of best trading analysis website is Seeking Alpha. Known for its rigorous, data-driven approach to stock analysis, Seeking Alpha brings together a diverse community of investors, analysts, and industry experts to deliver comprehensive, unbiased coverage of the markets.

What sets Seeking Alpha apart is the breadth and depth of its content, which spans individual stock reports, macro analysis, and thematic research across sectors and asset classes. Whether you’re looking for granular insights on a specific company or big-picture perspective on market trends, Seeking Alpha has you covered.

Another strength of Seeking Alpha is its focus on fostering dialogue and debate among its contributors and readers. Through lively comment sections and forums, you can engage with other passionate investors, share ideas, and challenge your assumptions. This collaborative approach helps to surface unique insights and viewpoints that you might not find elsewhere.

Ultimately, the best trading analysis website is one that empowers you to make smarter, more informed investment decisions. By providing timely, relevant, and actionable research and analysis, sites like Seeking Alpha can help you cut through the market noise, identify high-conviction opportunities, and achieve your financial goals over the long term.

How We Evaluated the Best Trading Analysis Websites?

To determine the best trading analysis websites, we conducted a thorough, multi-faceted evaluation process. Our goal was to identify the platforms that offer the most comprehensive, insightful, and actionable research and tools to help you elevate your trading skills and performance.

Some of the key factors we considered in our analysis include:

-

Quality and depth of stock research and analysis

-

Breadth of coverage across sectors, asset classes, and geographies

-

Timeliness and relevance of insights and recommendations

-

Expertise and credibility of contributing analysts and investors

-

User experience and ease of navigation

-

Availability of tools and resources for portfolio management and idea generation

-

Strength of community engagement and dialogue

-

Educational content and resources for investor development

To assess these factors, we dove deep into each platform, sampling a wide range of content, testing out tools and features, and engaging with the user community. We also consulted with experienced traders and investors to get their perspectives on what separates the best trading analysis websites from the rest.

Through this rigorous evaluation process, we identified a select group of platforms that consistently deliver exceptional value to serious traders and investors. These websites stood out for their commitment to providing high-quality, unbiased research, fostering vibrant communities of like-minded investors, and empowering users to make more informed, confident trading decisions.

Whether you’re looking for in-depth stock analysis, macro insights, or tactical trading ideas, the best trading analysis websites offer a wealth of resources to help you refine your strategies, expand your knowledge, and ultimately achieve your investing goals. By leveraging the power of these platforms, you can gain a significant edge in your pursuit of market-beating returns.

🧠 Thinking Deeper

- ☑️ Think like a business owner, not a stock trader. Your perspective will shift for the better.

- ☑️ Always look beyond the stock symbol to understand the actual business you're buying into.

- ☑️ Develop the ability to tune out market noise and focus on what truly matters.

- ☑️ Consider index investing if you don't have the time or inclination for individual stock picking.

📚 Wealthy Wisdom

- ✨ Don't look for the needle in the haystack. Just buy the haystack! - John Bogle

- ✔️ Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves. - Peter Lynch

- 🌟 Wide diversification is only required when investors do not understand what they are doing. - Warren Buffett

- 🚀 Investing is the intersection of economics and psychology. - Seth Klarman

📘 Table of Contents

- • Morningstar Investor

- • Motley Fool Stock Advisor

- • Best Stock Analysis Websites for Investors

- • Alpha Picks by Seeking Alpha

- • Koyfin

- • Seeking Alpha Premium

- • Trade Ideas

- • TipRanks Premium

- • What is a Trading Analysis Website?

- • What is the Best Trading Analysis Website?

- • How We Evaluated the Best Trading Analysis Websites?