7 Best Stock Market News & Top Financial Apps in 2024

Stay informed and make smarter decisions with our curated list of trusted financial news sources, featuring reviews of best stock advisor websites and stock analysis sites.

We aim for insightful coverage of products and services, including some from compensating partners, which may influence our topics and presentation. Our opinions and conclusions remain unbiased. See our Advertiser Disclosure.

How do you sift through the noise to find the financial news that truly matters to your investments?

In a world inundated with market information, identifying trustworthy sources can be the difference between informed decisions and costly mistakes.

Let’s explore seven of the most reliable stock market news and financial apps that can help you stay ahead of market-moving events in 2024.

Best Financial and Stock Market News Sites

Here are the best financial news websites and best stock market news websites we’ve reviewed in 2024.

| Best Stock Market News Sites | Best Financial News Website |

|---|---|

| 📈 Motley Fool Stock Advisor | Long-term growth |

| 💡 Seeking Alpha Premium | Detailed analysis |

| 📊 Morningstar Investor | Disciplined investing |

| 📉 Zacks Premium | Fundamental research |

| 🔍 Trade Ideas | Real-time updates |

| 🔔 Alpha Picks by Seeking Alpha | Analyst insights |

| 📈 TipRanks Premium | Predictive analytics |

1. Motley Fool Stock Advisor

-

Best for: Long-term investors seeking market-beating returns, active traders looking for high-quality stock picks, and beginners wanting expert guidance.

-

Cost: $99/year for new members (50% OFF $199/year)

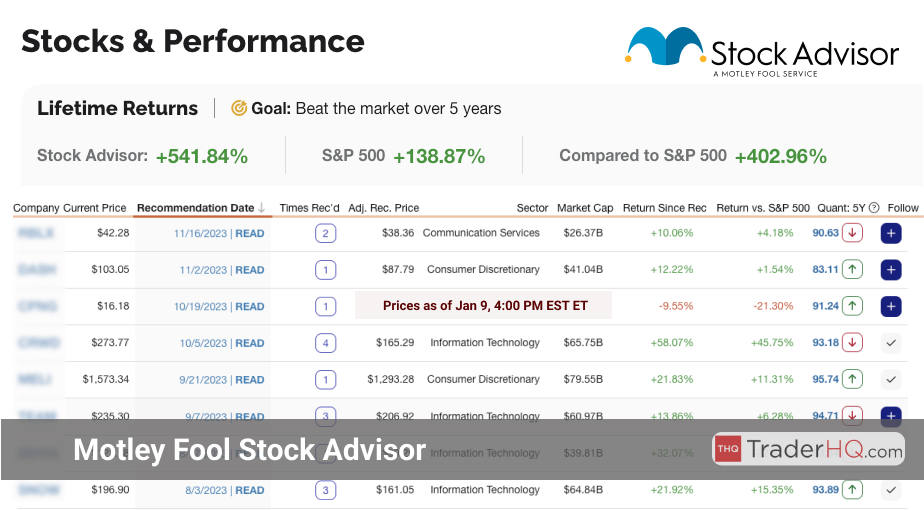

Motley Fool Stock Advisor, founded in 2002, has established itself as a premier investment guidance service. With a focus on long-term, buy-and-hold investing in high-quality companies, Stock Advisor has consistently outperformed the market.

The service’s success is built upon the principles of asymmetrical risk and compounding returns. As legendary investor Peter Lynch once said, “All you need for a lifetime of successful investing is a few big winners.” Stock Advisor’s track record exemplifies this philosophy.

Since its inception, the average return of a Stock Advisor (see our review) pick is an impressive 737%, compared to the S&P 500’s 162% over the same period. In other words, Stock Advisor has outperformed the market by an astounding 4.5x times.

Some of Stock Advisor’s most notable recommendations include:

-

NVDA, recommended in April 2005, has soared 74,099%, turning a $1,000 investment into $741,989.

-

NFLX, picked in December 2004, has skyrocketed 34,579%, transforming $1,000 into $346,786.

-

AMZN, recommended in September 2002, has surged 23,904%, turning $1,000 into $240,039.

These returns highlight the power of patient, long-term investing. As Warren Buffett wisely stated, “The stock market is a device for transferring money from the impatient to the patient.” Stock Advisor’s approach embodies this principle, helping investors navigate the market’s complexities and achieve outsized returns.

With Stock Advisor, you gain access to:

-

Monthly stock recommendations backed by rigorous research

-

Foundational stock picks for building a strong core portfolio

-

Detailed analysis and performance tracking for each recommendation

-

Educational resources and a thriving investor community

Whether you’re a seasoned investor or just starting out, Motley Fool Stock Advisor (in-depth review) provides the tools, guidance, and expertise needed to achieve your financial goals. With a proven track record and a steadfast commitment to long-term success, Stock Advisor is your trusted partner on the path to financial freedom.

2. Seeking Alpha Premium

-

Best for: Data-driven analysts, income-focused investors, and growth seekers; it offers in-depth research and unique market insights for each.

-

Cost: $189/year + 7-day free trial

Seeking Alpha Premium has established itself as a trusted resource in the world of investment research and financial news. With a rich history of providing in-depth analysis and expert insights, Seeking Alpha Premium (see our review) caters to the diverse needs of investors looking to make informed decisions in today’s dynamic market landscape.

At its core, Seeking Alpha Premium offers a comprehensive suite of tools and resources designed to empower investors at every level. From detailed stock analysis and real-time alerts to exclusive articles and interactive community features, the platform provides a holistic approach to navigating the complexities of the financial markets.

What sets Seeking Alpha Premium apart is its unwavering commitment to delivering actionable insights backed by rigorous research and analysis. The platform’s team of experienced analysts and contributors bring a wealth of knowledge and expertise to the table, ensuring that users have access to the most relevant and timely information available.

One of the standout features of Seeking Alpha Premium is its extensive library of premium articles and reports. These in-depth pieces cover a wide range of topics, from individual stock picks and sector analysis to macroeconomic trends and investment strategies.

With a focus on both fundamental and technical analysis, these articles provide users with a comprehensive understanding of the factors driving market movements and potential investment opportunities.

In addition to its wealth of written content, Seeking Alpha Premium also offers a robust set of tools and resources designed to help investors stay ahead of the curve. These include:

-

Real-time alerts and notifications to keep users informed of breaking news and market developments

-

Customizable watchlists and portfolio tracking to help users monitor their investments and identify new opportunities

-

Exclusive access to earnings call transcripts and conference presentations for a deeper understanding of company performance and management strategy

Perhaps most importantly, Seeking Alpha Premium fosters a vibrant community of investors and analysts who share their insights, experiences, and strategies with one another. Through interactive discussion forums and user-generated content, members can engage in meaningful dialogue, exchange ideas, and learn from the successes and failures of their peers.

Whether you’re a seasoned investor looking to refine your strategy or a newcomer to the world of finance seeking guidance and support, Seeking Alpha Premium has something to offer. With its unparalleled depth of analysis, cutting-edge tools, and engaging community features, this platform is an essential resource for anyone looking to take their investment game to the next level.

So why wait? Sign up for Seeking Alpha Premium today and start tapping into the power of expert insights, real-time data, and a vibrant community of like-minded investors. With its commitment to quality, transparency, and actionable analysis, Seeking Alpha Premium is the key to unlocking your full potential in the world of finance.

3. Morningstar Investor

-

Best for: Value seekers, data-driven analysts, and detail-oriented planners. Ideal for those who want in-depth research and comprehensive data.

-

Cost: $199 per year (regularly $249/year). Includes a 7-day free trial.

Founded in 1984, Morningstar has established itself as a leading provider of independent investment research. Morningstar Investor is a comprehensive service designed to empower self-directed investors with the tools and insights needed to make informed decisions.

What sets Morningstar Investor (in-depth review) apart is its commitment to objective, unbiased analysis. With a team of over 150 specialized analysts, the service delivers in-depth research across various sectors, ensuring subscribers have access to expert insights without the influence of external stakeholders.

Morningstar Investor offers a range of powerful features to support your investment journey:

-

Comprehensive Ratings System: Gain a transparent understanding of how investments are evaluated, with coverage spanning securities, fund managers, and ESG considerations.

-

Investment Screening Tools: Utilize data-driven insights to filter investment options effectively, saving time and aligning with industry benchmarks.

-

Portfolio X-Ray: Conduct multi-dimensional analysis to identify concentrations, redundancies, and hidden risks, while evaluating the impact of fees on your returns.

The service prioritizes personalization and efficiency, offering account aggregation to streamline monitoring and provide a cohesive view of your investments. Tailored insights, watchlists, and customization features ensure you have quick access to the most relevant information for your needs.

Morningstar Investor’s pricing structure encourages long-term commitment, with significant savings on annual subscriptions. The 7-day free trial allows you to explore the service risk-free and experience its value firsthand.

Whether you’re focused on risk management, performance tracking, discovering new opportunities, or enhancing your financial literacy, Morningstar Investor provides the tools and insights to support your goals. By democratizing access to high-quality research, the service helps level the playing field between individual and professional investors.

Take control of your investment decisions with confidence and clarity. Try Morningstar Investor today and experience the power of independent, data-driven insights tailored to your unique investment journey.

4. Zacks Premium

-

Best for: Value seekers, long-term planners, active traders. Each group benefits from comprehensive research and actionable insights.

-

Cost: $249/year after 30-day free trial

Zacks Premium, a trusted name in investment research, is known for its data-driven approach to stock analysis and portfolio management tools. The service empowers investors to make informed decisions with a suite of features designed to give subscribers an edge in the market.

At the core of Zacks Premium (see our review) is the Zacks Rank system, which uses earnings estimate revisions to identify stocks with the highest potential for outperformance. The #1 Rank List narrows this down to the top 5% of stocks, which have historically doubled the returns of the S&P 500.

Beyond stock rankings, Zacks Premium offers a range of tools to help investors align their portfolios with their individual investment styles and goals:

-

Style Scores allow users to find stocks that fit their preferred investing approach, whether it’s value, growth, or momentum.

-

The Focus List is a curated portfolio of 50 long-term growth stocks, complete with in-depth research reports.

-

Industry Rankings help identify the sectors and industries with the best potential for outperformance.

-

The Earnings ESP Filter uses predictive analytics to find stocks most likely to beat or miss earnings expectations.

Zacks Premium members also get access to a wealth of research and analysis, including detailed equity research reports on over 1,000 companies. These reports provide deep insights into a company’s strengths, weaknesses, opportunities, and risks, giving investors a comprehensive view of their investments.

All of these tools are integrated into the Zacks Premium Screener, a powerful stock screening platform that allows users to filter stocks based on a wide range of customizable criteria. Whether you’re looking for value stocks with strong fundamentals or growth stocks with momentum, the screener makes it easy to find investment ideas that align with your goals.

For investors seeking an edge in today’s complex and fast-moving markets, Zacks Premium offers a compelling combination of data-driven insights, expert analysis, and user-friendly tools. With a proven track record of outperformance and a commitment to empowering investors, it’s a service worth considering for anyone serious about taking control of their financial future.

5. Trade Ideas

-

Best for: Active traders seeking advanced tools, day traders looking for real-time data, swing traders benefiting from curated picks.

-

Cost: $99/year for new members (50% OFF $199/year)

Trade Ideas, a pioneering market intelligence platform, has been empowering individual traders with institutional-grade tools and insights since 2003. The company’s mission is to democratize access to advanced trading technology, making it a trusted ally for investors navigating the complex world of financial markets.

At the core of Trade Ideas (read our review)’ offerings is a powerful combination of real-time market data, AI-driven analytics, and customizable alerts. By harnessing artificial intelligence, the platform transforms raw data into actionable signals, enabling traders to identify opportunities and make informed decisions quickly and precisely.

One of Trade Ideas’ key differentiators is its AI-powered assistant, Holly. This dynamic AI companion generates and adapts strategies based on evolving market conditions, helping traders stay ahead in an ever-changing landscape.

Trade Ideas offers a suite of tools and resources designed to cater to its users’ diverse needs:

-

Backtesting capabilities allow traders to validate strategies against historical data, providing a risk-free sandbox for refining approaches.

-

Customizable filters and alerts enable users to tailor the platform to their individual trading styles and preferences.

-

The Trading Room Community fosters a collaborative learning environment, facilitating the exchange of insights among peers.

Trade Ideas’ commitment to innovation is evident in its continuous evolution, such as the introduction of features like “real-time stock racing,” demonstrating the platform’s dedication to delivering cutting-edge tools.

For traders seeking a comprehensive solution, Trade Ideas offers an end-to-end experience. Seamless integration with brokerage accounts allows for a fluid transition from analysis to execution, making the platform a practical and efficient choice for active traders.

Whether you’re a day trader seizing short-term opportunities, a swing trader riding market waves, or an investor optimizing your portfolio, Trade Ideas has the tools and insights to support your journey. With plans starting at $84 per month, access to this game-changing platform is within reach.

Join the ranks of successful traders who have harnessed the power of Trade Ideas to elevate their market knowledge and performance. Embrace the future of trading with a tool that adapts to your needs, empowering you to navigate the markets with confidence and precision.

6. Alpha Picks by Seeking Alpha

-

Best for: Growth investors seeking high-potential stocks, value investors looking for undervalued opportunities, and seasoned traders desiring in-depth analysis.

-

Cost: $449/year for new members (10% off $499/year)

Alpha Picks by Seeking Alpha is a premium service that leverages advanced quantitative analysis and unique data to identify top investment opportunities. With a systematic stock selection process, Alpha Picks aims to provide subscribers with well-researched stock recommendations.

Seeking Alpha (see our review), a renowned financial services company, offers Alpha Picks as one of its specialized services. The service’s rigorous quantitative methodology sets it apart in the market, focusing on delivering high-potential stock picks to its subscribers.

Alpha Picks (see our review) has demonstrated impressive performance since its inception in July 2022. The average return of an Alpha Picks pick is 126%, compared to the S&P 500’s return of 45% over the same period. This means Alpha Picks has outperformed the S&P 500 by 2.8x.

Some of the best-performing stock picks from Alpha Picks include:

-

A Server Solutions Company recommended on 2022-11-15, which has returned to date, turning a $1,000 investment into .

-

A Thermal Solutions Company recommended on 2022-12-15, with a return, transforming $1,000 into .

-

An Energy Solutions Company picked on 2023-05-15, delivering a return and growing $1,000 into .

Alpha Picks offers subscribers access to a team of seasoned quantitative strategists, providing in-depth analysis for each stock pick. The service follows a disciplined and data-driven approach, with bi-monthly stock recommendations and ongoing portfolio management advice.

Subscribers benefit from clear guidelines for when to sell or reduce positions, as well as a reinvestment policy to maintain portfolio balance. Alpha Picks provides access to proprietary quantitative ratings, portfolio management tools, email alerts, and best-in-class analytical tools to support informed investment decisions.

The Alpha Picks team consists of experienced professionals like Steve Cress, Head of Quantitative Strategies, Zachary Marx, CFA, Senior Quantitative Strategist, and Joel Hancock, Senior Director of Product, bringing together expertise in equity research, quantitative strategies, and customer engagement.

For long-term investors seeking to enhance their portfolios with data-driven stock recommendations and expert analysis, Alpha Picks by Seeking Alpha (see our review) is a service worth considering. Its systematic approach and track record of outperformance make it a compelling choice in the market.

alpha-picks-by-seeking-alpha:last-cta

7. TipRanks Premium

-

Best for: Fundamental analysts, growth seekers, and experienced investors looking for comprehensive data and expert insights.

-

Cost: $360/year for new members (billed annually)

TipRanks has established itself as a premier financial analytics platform, offering investors a comprehensive suite of tools and insights to navigate the complex world of stock market investing. Founded in 2012, TipRanks has quickly risen to prominence, serving as a trusted resource for investors, financial advisors, and institutional investors alike.

At the heart of TipRanks’ offerings are its Premium and Ultimate services, designed to provide users with an unparalleled level of market intelligence. These services are tailored to meet the diverse needs of investors, whether they are managing personal portfolios, advising clients, or conducting high-level institutional analysis.

What sets TipRanks apart is its commitment to delivering data-driven insights through a user-friendly interface. The platform’s advanced algorithms aggregate and analyze vast amounts of financial data, including expert opinions, analyst ratings, and insider transactions, to provide users with actionable intelligence.

TipRanks Premium and Ultimate services offer a wide array of tools and resources, empowering users to make informed investment decisions:

-

Expert Aggregation: TipRanks’ proprietary algorithms curate and analyze opinions from top financial experts, providing users with a democratically sourced perspective on stock forecasts.

-

Risk Analysis: The platform incorporates sophisticated risk assessment tools, enabling users to evaluate potential risks associated with their investments and make strategic decisions.

-

Insider Insights: TipRanks provides exclusive insights into insider trading activities, allowing users to gauge market sentiment and identify potential investment opportunities.

In addition to its robust analytical capabilities, TipRanks places a strong emphasis on data security and user support. The platform employs bank-level encryption and adheres to strict PCI DSS compliance standards, ensuring the highest level of protection for sensitive financial information.

TipRanks’ commitment to customer satisfaction is further evidenced by its tiered support structure and money-back guarantee policy, providing users with peace of mind and confidence in the platform’s value proposition.

For investors seeking to elevate their market knowledge and make data-driven investment decisions, TipRanks Premium (see our review) and Ultimate services offer an unrivaled solution. With its comprehensive tools, expert insights, and user-centric approach, TipRanks empowers users to navigate the complexities of the stock market with confidence and precision.

What is a Stock Market News Website?

A stock market news website is an online platform that provides the latest financial news, analysis, and insights to help investors make informed decisions. These sites offer a wealth of information on publicly traded companies, economic indicators, and market trends. By staying up-to-date with the latest developments through these websites, you can gain a deeper understanding of the factors driving stock prices and identify potential investment opportunities.

The best stock market news websites feature articles and commentary from experienced financial journalists and industry experts. They strive to deliver unbiased, accurate reporting on the stories that matter most to investors. Many sites also offer real-time stock quotes, charts, and other tools to help you track your portfolio and monitor the markets.

Whether you’re a seasoned investor or just starting out, a quality stock market news website can be an invaluable resource for navigating the complex world of finance. By bookmarking a few reliable sites and checking them regularly, you can stay informed and confidently manage your investments.

What is the Best Stock Market News Website?

While there are many excellent stock market news websites available, the best one for you will depend on your specific investing goals and preferences. However, some sites consistently stand out for their comprehensive coverage, expert analysis, and user-friendly design. These top contenders deliver the most relevant and reliable information to help you stay ahead of the curve.

When evaluating the best stock market news websites, look for those with a proven track record of accuracy and integrity in their reporting. The best sites maintain strict editorial standards and avoid sensationalism or bias. They provide in-depth, well-researched articles that go beyond the headlines to uncover the real factors moving the markets.

The best stock market news websites also offer a range of tools and resources to enhance your investing experience. These may include real-time stock quotes, interactive charts, personalized watchlists, and portfolio trackers. Some top sites even provide expert stock picks or access to exclusive investment research.

Ultimately, the best stock market news website is one that you can trust to keep you informed and empowered to make smart investing decisions. By finding a site that aligns with your needs and preferences, you can tap into a valuable resource for financial news and insights.

How We Evaluated the Best Stock Market News Websites?

To determine the best stock market news websites, we conducted a thorough evaluation process considering a range of key factors. Our goal was to identify the sites that offer the most comprehensive, reliable, and user-friendly experience for investors.

Some of the main criteria we assessed include:

-

Coverage and depth of reporting on financial news and market events

-

Quality and expertise of the site’s editorial team and contributors

-

Commitment to accuracy, objectivity, and journalistic integrity

-

Frequency and timeliness of updates on breaking news and developing stories

-

Availability of tools and resources such as real-time quotes, charts, and portfolio trackers

-

User experience factors like site navigation, mobile compatibility, and readability

We also considered the unique value proposition of each site and how well it caters to the needs of its target audience. The best stock market news websites offer something special that sets them apart, whether it’s exceptional analysis, exclusive content, or innovative features.

By thoroughly vetting each site using these parameters, we were able to narrow down the field to a select list of the best stock market news websites available. These top picks represent the cream of the crop in financial journalism and provide investors with an invaluable resource for staying informed and making smart decisions in the market.

Upfront Bottom Line — Best Investment Research Services

✅ Top 2 Picks: Motley Fool Stock Advisor and Seeking Alpha Premium

These platforms offer unparalleled insights, tools, and support to help you navigate the complexities of the stock market and achieve your investment goals. Whether you’re a novice investor seeking guidance or a seasoned trader looking for advanced analytics, these services can provide the actionable intelligence you need to make informed decisions and outperform the market.

Our Bottom Line Summary:

1. 🥇 Motley Fool Stock Advisor

Best for long-term investors and novices, this service is renowned for its market-beating stock picks and foundational investment principles. Key features include monthly stock recommendations, performance tracking, and educational resources. Price: $99/year for new members (50% OFF $199/year)

Try it Now Read More ↓

2. 🥈 Seeking Alpha Premium

Ideal for data-driven analysts and income-focused investors, it offers in-depth research, real-time alerts, and exclusive articles. Features include customizable watchlists and earnings call transcripts. Price: $189/year + 7-day free trial

Try it Now Read More ↓

3. Morningstar Investor

Perfect for value seekers and detailed planners, this service offers rigorous, independent research and comprehensive data. Features include a comprehensive ratings system, investment screening tools, and portfolio analysis. Price: $199/year (regularly $249/year) with a 7-day free trial

Try it Now Read More ↓

4. Zacks Premium

Best for value seekers and active traders, it offers comprehensive research and actionable insights with tools like the Zacks Rank system and Focus List. Price: $249/year after a 30-day free trial

Try it Now Read More ↓

5. Trade Ideas

Ideal for active and swing traders, offering real-time data and AI-driven analytics. Features include AI assistant Holly and customizable alerts. Price: $84 per month

Try it Now Read More ↓

6. Alpha Picks by Seeking Alpha

Best for growth and value investors, it uses a data-driven, quantitative approach for stock selection. Features include bi-weekly stock picks and detailed analysis. Price: $449/year for new members (10% off $499/year)

Try it Now Read More ↓

Ideal for fundamental analysts and growth seekers, offering comprehensive data and expert insights. Features include expert aggregation, risk analysis, and insider insights. Price: $360/year for new members (billed annually)

Try it Now Read More ↓

🧠 Thinking Deeper

- ☑️ Don't let fear of volatility keep you on the sidelines. Long-term growth requires riding out short-term fluctuations.

- ☑️ Learn to manage risk, not avoid it entirely. Some risk is necessary for growth.

- ☑️ Develop a clear, written investment philosophy. It will guide you through difficult decisions.

- ☑️ Aim to make the best possible investment choices. Wealth tends to follow those who consistently make good decisions.

📚 Wealthy Wisdom

- ✨ Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas. - Paul Samuelson

- ✔️ In investing, what is comfortable is rarely profitable. - Robert Arnott

- 🌟 The only value of stock forecasters is to make fortune tellers look good. - Warren Buffett

- 🚀 If you have trouble imagining a 20% loss in the stock market, you shouldn't be in stocks. - John Bogle

📘 Table of Contents

- • Best Financial and Stock Market News Sites

- • Motley Fool Stock Advisor

- • Seeking Alpha Premium

- • Morningstar Investor

- • Zacks Premium

- • Trade Ideas

- • Alpha Picks by Seeking Alpha

- • TipRanks Premium

- • What is a Stock Market News Website?

- • What is the Best Stock Market News Website?

- • How We Evaluated the Best Stock Market News Websites?

- • Upfront Bottom Line — Best Investment Research Services

- • Our Bottom Line Summary: