2025 Motley Fool Stock Advisor Review: Worth It?

Seeking a trusted partner to grow your wealth? Discover if The Motley Fool's Stock Advisor can help you invest with confidence and achieve your financial dreams, without the stress or guesswork.

Upfront Bottom Line

Is Motley Fool Stock Advisor worth it for you? In short, yes, if you’re focused on long-term wealth building and value expert guidance, educational resources, and a supportive community. Here’s why this service stands out and whether it aligns with your investment goals:

- Exceptional Long-Term Focus: If your aim is to beat the market over years or decades, Motley Fool Stock Advisor delivers with well-researched stock picks designed for sustained growth. Their track record, with standout returns like NVIDIA (+69,974%) and Netflix (+50,888%), shows they can identify winners for patient investors like you.

- Educational Empowerment: Beyond just stock picks, you’ll gain access to a wealth of articles, videos, and tools that break down complex financial concepts. This is perfect if you’re looking to grow your financial acumen while building your portfolio.

- Community and Tools for Success: The interactive community and planning tools like the Returns Simulator help you strategize and mitigate risks, addressing your need for support and control over your financial future.

- Value for the Price: At $99/year for new members (50% off the regular $199/year), the subscription offers significant value compared to the potential returns and educational benefits you receive.

However, it’s not perfect for everyone. If you’re seeking real-time trading opportunities or a heavy focus on international markets, you might find the U.S.-centric approach and monthly recommendation timing a bit limiting. Still, for most long-term investors who crave trustworthy recommendations and a holistic approach to portfolio management, the benefits far outweigh these drawbacks.

Bottom Line: Motley Fool Stock Advisor is a worthwhile investment for you if your goal is to build wealth over time with a trusted partner. It’s not just about picks—it’s about equipping you with the knowledge, tools, and community to navigate the market confidently.

Motley Fool Stock Advisor Review

If you’re on the hunt for a reliable investment service that goes beyond just stock picks, Motley Fool Stock Advisor might just be the partner you’ve been looking for. This service stands out with its comprehensive approach to long-term wealth building, offering a unique blend of well-researched recommendations, educational resources, and community interaction. Let’s dive into what makes it exceptional and how it delivers real value to you as an investor, while also aligning with your desire for learning and connection.

Key Benefits and Features That Stand Out

-

In-Depth Stock Recommendations: At the core of Motley Fool Stock Advisor are two monthly stock picks curated by top analysts, including David and Tom Gardner. Each recommendation comes with detailed research reports that break down the company’s business model, growth drivers, risk factors, and more. You get the “Foolish Thesis”—the reasoning behind why they believe in a stock’s potential—helping you understand the ‘why’ behind every pick. This transparency empowers you to make informed decisions tailored to your portfolio.

-

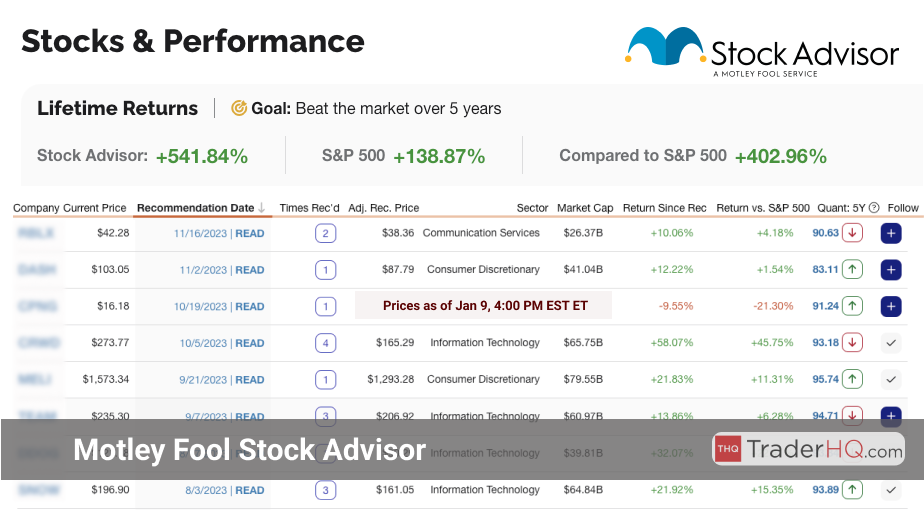

Powerful Performance Track Record: The service has a proven history of beating the market, boasting a total return of +817.63% since its inception in March 2002, compared to the S&P 500’s +156.11% over the same period. That’s an outperformance of +661.52%! Standout picks like NVIDIA (+68,668% since April 2005) and Netflix (+52,550% since December 2004) highlight the potential for life-changing returns. This track record shows you’re not just getting guesses—you’re getting insights grounded in decades of success.

-

Robust Financial Planning Tools: Beyond stock picks, you gain access to tools like the GamePlan feature for retirement and estate planning, as well as Returns Simulators and calculators to visualize potential outcomes. These resources help you manage risk and reward, ensuring you’re building a portfolio that aligns with your long-term goals.

-

Rich Educational Content: Whether you’re just starting out or looking to refine your strategy, the service offers a wealth of learning materials. From articles and special reports to the Video Library with content like “Investing 101,” you’ll find complex financial concepts broken down into digestible insights. This focus on education ensures you’re not just following picks but growing as an investor.

-

Engaging Community and Live Interaction: One of the unique aspects is the interactive community where you can discuss strategies and ideas with fellow investors. Add to that Fool Live, a daily livestream (Monday to Friday, 9-11 am ET) featuring real-time market updates, earnings analyses, and expert interviews, and you’ve got a dynamic environment to stay informed and connected.

Overall Value for You

The value of Motley Fool Stock Advisor lies in its holistic approach. It’s not just about handing you a list of stocks—it’s about equipping you with the knowledge, tools, and support to build wealth over time. The detailed research behind each recommendation saves you hours of analysis, while the performance data proves its ability to outperform benchmarks like the S&P 500. Whether your goal is to beat the market or secure your financial future, this service provides a roadmap to get there. Plus, with a subscription price of just $99/year for new sign-ups (50% off the regular $199/year), you’re getting premium insights at a reasonable cost.

Alignment with Educational Needs and Community Desires

If you’re someone who craves understanding over blind following, the educational resources here are a goldmine. The articles, videos, and special reports demystify the stock market, helping you grasp why certain companies are poised for growth or how to navigate volatility. This aligns perfectly with your need to learn and make informed choices.

As for community engagement, the interactive platform lets you exchange ideas and perspectives with others who share your passion for investing. It’s not a cutthroat space but a collaborative one, where you can refine your approach through diverse viewpoints. Combined with Fool Live, you’re never investing in isolation—you’ve got a network and real-time insights at your fingertips.

In short, Motley Fool Stock Advisor delivers exceptional value through its blend of expert recommendations, stellar performance, educational depth, and community support. It’s designed to help you grow not just your portfolio, but your confidence as an investor.

Performance Analysis

When it comes to evaluating the effectiveness of an investment advisory service, nothing speaks louder than the numbers. If you’re looking to gauge whether Motley Fool Stock Advisor can truly help you achieve your financial goals, let’s dive into the performance history of their recommendations. With detailed data and a track record spanning over two decades, you’ll get a clear picture of how this service measures up against benchmarks and what it could mean for your portfolio.

Since its launch in March 2002, Motley Fool Stock Advisor has posted an impressive total return of over 817%, absolutely dwarfing the S&P 500’s return of approximately 156% over the same period. That’s an outperformance of more than 661% compared to the broader market. What does this mean for you? It shows a consistent ability to pinpoint stocks that have the potential to significantly beat market averages, across various sectors and through different economic climates. This isn’t just a fluke; it’s a testament to their research and long-term focus, which could align perfectly with your ambition to build wealth over time.

Looking at their all-time best performers, the service has identified some truly transformative opportunities. Imagine being guided toward investments that have yielded returns upwards of 68,000% or 52,000% compared to their initial recommendation dates. These exceptional gains came from early picks in technology and entertainment sectors, showcasing their knack for spotting companies with exponential growth potential well before they become household names. Even against the S&P 500, these picks have outperformed by staggering margins, often exceeding 50,000% above the index. For you, this highlights the possibility of catching the next big winner that could multiply your investment many times over.

More recently, over the last five years, their recommendations continue to impress. Top picks from this period have delivered returns ranging from over 780% down to around 100%, with many outperforming the S&P 500 by hundreds of percentage points. These selections span innovative fields like electric vehicles, cybersecurity, and streaming services, proving that their analysts are still adept at finding high-growth opportunities in today’s market. For your portfolio, this suggests that even in a shorter timeframe, their guidance could lead to substantial gains.

If you’re more focused on the immediate landscape, their performance over the last 12 months also holds up. Returns on recent picks have ranged from a solid 37% down to a modest 2%, with many still beating the market by a notable margin. This shows that even in the near term, their recommendations can provide an edge, which could be critical if you’re looking to capitalize on current trends or bolster your returns quickly.

One of the standout tools in assessing ongoing potential is their Monthly Rankings, powered by the proprietary Quant 5-Year Scoring System. This system evaluates stocks based on a multitude of factors like historical returns, projected gains, volatility, and financial metrics. It gives you a clear view of which stocks are poised to outperform over a five-year horizon, categorized by risk levels—whether you’re cautious or aggressive in your approach. With data points like estimated returns and maximum drawdowns, you can make informed decisions about balancing risk and reward in your investments. This isn’t just a list; it’s a strategic tool to help you align your portfolio with your personal risk tolerance and growth goals.

How does this track record stack up against other investment services? While direct comparisons depend on specific timeframes and methodologies, the outperformance of over 661% against the S&P 500 is a benchmark few can match consistently over such a long period. Many services might promise quick wins or focus on short-term trades, but Motley Fool Stock Advisor’s emphasis on long-term growth—evidenced by returns that compound over decades—sets it apart. If beating the market is your aim, their historical performance suggests they have a proven edge, often surpassing competitors who may not have the same depth of historical success or focus on sustained wealth building.

Of course, past performance isn’t a guarantee of future results, and market conditions can shift. However, the consistency across different timeframes—from decades to the last year—offers a strong case that their methodology resonates with the kind of growth you might be seeking. Whether it’s through transformative long-term picks or more recent market outperformers, the numbers indicate that this service could be a powerful ally in your journey to financial success.

The Good

When it comes to the standout strengths of Motley Fool Stock Advisor, there are several aspects that truly make it a valuable resource for your investment journey. This service isn’t just about handing you stock picks; it’s about empowering you with the tools, knowledge, and community to build long-term wealth. Let’s break down the key positives that can help you succeed in the market.

-

In-Depth Stock Recommendations: One of the most impressive features is the comprehensive research behind each of the two monthly stock picks. You get detailed reports that dive into the company’s business model, growth drivers, and potential risks through sections like the Foolish Thesis and Risk Factors. This level of transparency helps you understand the ‘why’ behind each recommendation, making it easier to decide if a stock fits your portfolio. For example, knowing the growth drivers behind a tech company can give you confidence to hold through market dips, aligning perfectly with a long-term strategy.

-

Educational Resources: If you’re looking to grow your financial know-how, this service has you covered. The educational content—through articles, special reports, and videos—breaks down complex concepts into digestible insights. Whether it’s learning how to assess a stock’s valuation or understanding macroeconomic trends, you’ll find resources that build your skills over time. This focus on education means you’re not just following advice blindly; you’re learning to make smarter decisions for your future.

-

Community Engagement: The interactive community aspect is a game-changer. You can discuss strategies and share ideas with fellow investors, gaining diverse perspectives that refine your own approach. This collaborative environment helps you feel supported, especially during volatile market periods, and ensures you’re not navigating your investment path alone. It’s a unique feature that fosters confidence and connection.

-

Financial Planning Tools: Tools like GamePlan and the Returns Simulator are incredibly useful for visualizing your financial future. Whether you’re planning for retirement or assessing potential portfolio outcomes, these resources help you balance risk and reward. For instance, using the Returns Simulator, you can see the likelihood of achieving specific returns based on historical data, giving you a clearer picture of what to expect over the long haul.

-

Real-Time Insights with Fool Live and Video Library: If staying updated on market movements is a priority for you, Fool Live and the Video Library are fantastic additions. Fool Live offers daily streams (Monday to Friday, 9 am to 11 am ET) where analysts break down earnings reports, review portfolios, and answer your questions in real time. Missed a session? No problem—the Video Library archives past shows, covering everything from beginner basics to deep dives into specific stocks. These features ensure you’re always in the loop with actionable insights, helping you react to market shifts with greater confidence.

Ultimately, what makes Motley Fool Stock Advisor so valuable is its holistic approach. You’re not just getting stock tips; you’re gaining a partner in your wealth-building journey. From detailed analyses and educational content to real-time updates and a supportive community, this service equips you with everything you need to pursue your long-term financial goals.

The Hype

When it comes to Motley Fool Stock Advisor, there’s a lot of buzz about its ability to deliver market-beating returns and transform your portfolio. While the service has a strong track record, there are areas where the hype might not fully align with reality. Let’s break it down so you can set realistic expectations for what this service can—and can’t—do for your investment journey.

-

Performance Claims Can Be Misleading: You’ve likely seen the jaw-dropping numbers touted in their marketing, like NVIDIA’s +69,974% return since 2005 or Tesla’s +12,724% since 2012. While these figures are accurate and impressive, they can create the illusion that every pick will be a home run. The reality is that past performance doesn’t guarantee future results. Market conditions shift, and not every recommendation will skyrocket. So, while the service has had incredible wins, you should approach these claims with a healthy dose of skepticism and understand that losses or underperformance are also part of the game.

-

U.S.-Centric Focus May Overpromise Global Reach: Much of the hype around Motley Fool Stock Advisor positions it as a comprehensive solution for building wealth through stock picks. However, if you’re an investor with a global perspective, you might find the service’s predominantly U.S.-centric approach a bit disappointing. The marketing doesn’t always highlight this limitation, which can mislead you into thinking it covers a broader international scope. If you’re looking to diversify beyond U.S. markets, you’ll likely need to supplement this service with other resources. This isn’t a deal-breaker, but it’s something to keep in mind if your strategy includes significant international exposure.

-

Timing of Recommendations Isn’t Always Spot-On: The service often promotes its monthly stock picks as your ticket to timely opportunities. While the research behind each recommendation is thorough, the timing might not always align with real-time market movements. By the time you act on a pick, the stock could have already moved significantly. If you’re expecting split-second, day-trading-style advice, you’ll need to temper those expectations. This service is built for long-term growth, not short-term market timing.

In short, while Motley Fool Stock Advisor offers incredible value, the hype around guaranteed massive returns, global coverage, and perfect timing doesn’t always match the reality. You’ll benefit most by viewing it as a tool for long-term investing rather than a magic bullet for instant wealth. Adjust your expectations accordingly, and you’ll be better positioned to make the most of what it offers.

Room for Improvement

While Motley Fool Stock Advisor offers a robust set of tools and insights for long-term investing, there are a few areas where it could enhance its offerings to better meet your needs and elevate your investment journey. Here are some key improvements that could take the service to the next level, addressing specific gaps and aligning with your aspirations for wealth building and market-beating returns.

-

Broader International Exposure: One of the most significant limitations you might encounter is the service’s heavy U.S.-centric focus. If you’re looking to diversify your portfolio beyond American markets, this can feel restrictive. To better serve global investors like you, Motley Fool could expand its coverage by including more stock picks and in-depth analysis of international markets. Imagine having access to detailed research reports on emerging markets in Asia, Europe, or Latin America, or insights into global trends that impact your investments. This would empower you to build a truly diversified portfolio without needing to seek external resources.

-

Real-Time Market Updates: While the monthly stock recommendations and live shows like Fool Live are valuable, they don’t always align with the fast-paced nature of the market. If you’re eager to capitalize on immediate opportunities, the timing of these insights might leave you wanting more. Introducing real-time updates or alerts for significant market movements or breaking news related to recommended stocks could make a big difference. A dynamic system that notifies you of urgent developments would help you act swiftly and stay ahead of the curve.

-

Enhanced Performance Metrics: The Monthly Rankings and Quant 5-Year Scoring System provide a good overview of stock performance, but you might crave deeper, more personalized data. Motley Fool could improve by offering segmented performance analytics based on different investment styles or risk tolerances—whether you’re cautious, moderate, or aggressive in your approach. Picture having access to detailed reports showing how recommendations perform for someone with your specific goals or risk profile. This would give you a clearer understanding of how the service aligns with your unique strategy.

-

Expanded Educational Resources for Global Investing: Beyond its excellent educational content like Investing 101, the service could further cater to your needs by adding resources focused on international investing. Tutorials or special reports on navigating foreign markets, understanding currency risks, or assessing geopolitical factors would be incredibly useful. These additions would equip you with the knowledge to confidently explore opportunities worldwide, complementing any expanded stock picks in those regions.

By addressing these areas, Motley Fool Stock Advisor could become an even more comprehensive partner in your investment journey. Expanding into international markets, offering real-time insights, refining performance data, and bolstering global education would ensure the service meets your desire for diversification and informed decision-making on a broader scale.

Closing

If you’re ready to take your investing journey to the next level, Motley Fool Stock Advisor offers a powerful partnership to help you build long-term wealth. With its in-depth stock recommendations, comprehensive research, and a supportive community, this service aligns perfectly with your goals of beating the market and achieving financial security. Whether you’re just starting out or looking to refine your portfolio, the tools and insights provided can empower you to make smarter, more confident decisions.

Don’t miss out on the chance to leverage their proven track record of identifying high-growth opportunities—some of which have delivered astonishing returns over decades. Plus, for those new to investing, resources like Investing 101 from the Video Library break down the basics in an easy-to-understand way, setting you up for success from day one.

Take the next step today and see how Motley Fool Stock Advisor can transform your approach to building wealth. Your financial future is worth the investment, and this service is here to guide you every step of the way.

FAQ - Motley Fool Stock Advisor

Got questions about Motley Fool Stock Advisor? We’ve got answers! Below, you’ll find clear and concise responses to some of the most common queries about this investment service. Whether you’re curious about pricing, how to make the most of the resources, or how it stacks up against alternatives, we’re here to help you navigate your decision.

-

What is the cost of Motley Fool Stock Advisor, and is there a discount for new users? You can join Motley Fool Stock Advisor for just $99 per year as a new member, which is a 50% discount off the regular price of $199 per year. This makes it an affordable option for gaining access to expert stock recommendations and a wealth of educational tools to support your investing journey.

-

Does Motley Fool Stock Advisor offer a refund policy? Yes, they do! If you’re not satisfied with the service, Motley Fool offers a 30-day money-back guarantee. This gives you the chance to explore the platform, check out the stock picks, and utilize the resources risk-free. If it’s not the right fit for you, you can request a full refund within that window.

-

How does Motley Fool Stock Advisor compare to other services like Morningstar Premium? Motley Fool Stock Advisor shines with its focus on long-term stock picks, detailed research reports, and a strong community aspect that encourages interaction and learning. It’s particularly geared toward individual stock selection with a goal of beating the market over time. On the other hand, Morningstar (in-depth 2025 review) Premium offers a broader approach with in-depth analysis on mutual funds, ETFs, and a heavy emphasis on portfolio analytics, which might suit you if you prefer diversified investments over individual stocks. Both services have their strengths, so your choice depends on whether you’re looking for specific stock recommendations or a wider investment perspective.

-

What are the best practices for using Motley Fool Stock Advisor’s recommendations and resources? To get the most out of your subscription, start by diving into the two monthly stock recommendations and their detailed research reports. Understand the ‘Foolish Thesis’ and ‘Growth Drivers’ to grasp why a stock is picked. Don’t just act on picks blindly—use tools like the Returns Simulator to assess potential outcomes for your portfolio. Engage with the community to discuss strategies and gain diverse insights. Finally, regularly tune into Fool Live for real-time market updates and revisit the Video Library for educational content to keep sharpening your skills. Consistency and patience are key since the focus is on long-term growth.

-

How does Motley Fool Stock Advisor fit into an overall investment strategy? This service is a fantastic fit if your goal is long-term wealth building through individual stock investments. It complements a broader strategy by providing expert guidance on stocks with high growth potential, helping you diversify within the equity portion of your portfolio. You can pair its recommendations with other asset classes like ETFs (using their ETF Rankings) or bonds for balance. The educational resources and planning tools, like GamePlan, also support bigger financial goals such as retirement or estate planning, ensuring you’re not just picking stocks but building a holistic financial future.

-

Where can I explore other investment services for comparison? If you’re looking to weigh your options, check out our comprehensive reviews of alternative services. For a broader market analysis platform, take a look at Investing.com. These resources can help you find the service that best aligns with your investment style and goals.

Have more questions or need deeper insights? Don’t hesitate to explore further or reach out. Motley Fool Stock Advisor could be a powerful tool in your investment arsenal, and we’re here to help you decide if it’s the right step for you.

Best Alternative Services

If you’re exploring options beyond Motley Fool Stock Advisor to guide your investment journey, you’re in the right place. Let’s compare it with two other prominent stock advisory services—Zacks Premium and Seeking Alpha Premium—to help you decide which aligns best with your goals for long-term wealth building and market-beating returns. Each service has its unique strengths and drawbacks, and I’ll break them down for you while weaving in insights from our broader content on investment strategies. Plus, I’ll encourage you to dive deeper into these alternatives through our detailed reviews and related blog posts.

Motley Fool Stock Advisor stands out with its focus on long-term investing and a proven track record of market-beating stock picks like NVIDIA (+69,974%) and Netflix (+50,888%). Its holistic approach, combining detailed research reports, educational content, and community engagement, makes it a fantastic choice if you’re looking for a supportive partnership in your investment journey. However, its U.S.-centric focus might leave you wanting more international exposure, and the monthly recommendation timing may not suit those seeking real-time advice. If these aspects are a concern for you, the alternatives below might offer a better fit.

Zacks Premium (see our review) (read our in-depth review here) offers a different angle with its emphasis on quantitative analysis through the proprietary Zacks Rank system. This service excels in providing data-driven stock picks based on earnings revisions and other metrics, which can be a powerful tool if you’re focused on short- to medium-term gains rather than the long-term horizon of Motley Fool. A key advantage is its broader market coverage, potentially addressing some of the international exposure gaps you might feel with Motley Fool. However, Zacks Premium may not offer the same depth of educational content or community interaction, so if you’re seeking a learning-focused environment, it might not fully meet your needs. As highlighted in our blog on how to beat the market, data-driven approaches like Zacks can be a game-changer for tactical investors.

Seeking Alpha Premium (read the 2025 review) (check out our full analysis here) brings a unique value proposition with its crowd-sourced content and diverse range of opinions from independent analysts and contributors. This service shines if you crave a variety of perspectives on stocks and market trends, offering a robust platform for in-depth articles and community discussions. It’s particularly useful for portfolio management and staying updated on market sentiments, aligning well with insights from our post on best long-term investment services. On the downside, the sheer volume of content can be overwhelming, potentially leading to the information overload you might fear. Unlike Motley Fool’s curated stock picks, Seeking Alpha requires more effort on your part to filter through the noise and find actionable advice.

Each of these services caters to different aspects of your investment ambitions. If you’re just starting out, Motley Fool’s educational resources might be your best bet, as supported by tips in our guide on investing for beginners. If you’re more analytically inclined and want to dive into data, Zacks Premium could be the tool to refine your strategy. And if you thrive on community insights and diverse viewpoints, Seeking Alpha Premium might resonate with you.

Ready to explore which service truly fits your financial goals? I encourage you to delve into our comprehensive reviews of Zacks Premium and Seeking Alpha (see our review) Premium to get a deeper understanding of their offerings. Pair that with insights from our blog posts on best long-term investment services, investing for beginners, and how to beat the market to build a well-rounded perspective. Take the next step today—your path to financial success is just a click away!

Related Motley Fool Resources:

- •Discover the Best Stock Advisor Sites & Services.

- •See our recommendations for the Best Investment Subscriptions.

- •Read our detailed Motley Fool review.

- •Get Motley Fool discounts and deals.

🧠 Thinking Deeper

- ☑️ Think in terms of building lasting wealth, not just making quick profits.

- ☑️ Be highly selective in your investments. Waiting for the perfect pitch often yields better results than swinging at everything.

- ☑️ Seek to buy assets for less than they're worth. That's the essence of value investing.

- ☑️ Don't diversify just for the sake of it. Concentrate on your highest conviction ideas.

📚 Wealthy Wisdom

- ✨ The stock market is filled with individuals who know the price of everything, but the value of nothing. - Philip Fisher

- ✔️ Successful investing is about managing risk, not avoiding it. - Benjamin Graham

- 🌟 Price is what you pay. Value is what you get. - Warren Buffett

- 🚀 You get recessions, you have stock market declines. If you don't understand that's going to happen, then you're not ready, you won't do well in the markets. - Peter Lynch

📘 Table of Contents

- • Upfront Bottom Line

- • Motley Fool Stock Advisor Review

- • Key Benefits and Features That Stand Out

- • Overall Value for You

- • Alignment with Educational Needs and Community Desires

- • Performance Analysis

- • The Good

- • The Hype

- • Room for Improvement

- • Closing

- • FAQ - Motley Fool Stock Advisor

- • Best Alternative Services