You’ve seen the ads. The podcast sponsorships. The YouTube pre-rolls promising market-crushing returns. And now you’re here, wondering if The Motley Fool is actually legit—or just brilliant marketing.

Here’s the short answer: The Motley Fool is a legitimate investment research company with 30+ years of history and verified track records that have beaten the market. Their flagship Stock Advisor service has returned +883.8% since 2002, compared to the S&P 500’s +195.8%—with 42 ten-baggers, 182 doublers, and a 92% win rate for positions held 10+ years. That’s real, and it’s independently verifiable.

Why this matters right now (February 2026): The S&P 500 at ~6,883 is up +0.68% YTD and within 1.4% of its all-time high — but getting here required navigating the VIX spike to ~21.77 on AI capex panic, followed by a 4.3% VIX decline to 20.29 as tech rebounded on Feb 18. The AI panic is subsiding, but the bifurcation underneath hasn’t changed. CPI confirmed at 2.4% YoY (lowest since May 2025), financials remain the worst sector at -5.7% (worse than tech’s -3.1%), and gold above $5,000/oz with the Fed holding at 3.50-3.75% confirm this is a stock-picker’s market, not a passive investor’s market.

The old economy vs. new economy divide:

| Sector | YTD Performance |

|---|---|

| Energy | +22.5% |

| Materials | +17.6% |

| Consumer Staples | +15.2% |

| Financials | -5.7% (worst sector — PYPL, COIN, HOOD in freefall) |

| Tech | -3.1% (bifurcated — memory surging, software collapsing) |

Memory and storage stocks are up ~+83% on average (SNDK +155%, WDC +75%, MU +48%) while enterprise software averages ~-33% (CRM -29%, NOW -29%, WDAY -34%, INTU -41%). That’s a 116-point intra-sector gap within technology alone — the starkest proof that stock selection matters more than sector allocation. Consumer confidence has hit a 12-year low even as manufacturing PMI expanded to 52.6, and credit spreads at 2.94% remain tight enough to signal no systemic stress. The market is not broken — it is deeply bifurcated.

This bifurcation reveals why different Motley Fool services exist — and why both Stock Advisor and Rule Breakers are improving:

- Stock Advisor captures the quality rotation — its GARP methodology thrives when financials collapse (-5.7%) and AI capex fatigue punishes undisciplined growth. The service’s 883.8% total return, 42 ten-baggers, 182 doublers, and 504 positions prove this quality-first approach works across every cycle — including the fear-and-recovery pattern playing out right now.

- Rule Breakers positions for the tech recovery that’s already underway. With 60 ten-baggers over 21 years and a 71% win rate, the declining VIX (down 4.3%) and tech rebound on Feb 18 signal improving conditions for high-growth innovators — memory stocks at +83% prove innovation returns are alive and accelerating.

- Hidden Gems rides the small-cap wave and benefits from the manufacturing expansion (PMI 52.6) that favors smaller domestic companies.

With 83-point dispersion between top performers (+51.8%) and bottom performers (-30.7%) — a new 2026 high — CAPE near ~40, the Fed holding at 3.50-3.75%, CPI confirmed at 2.4% (Core CPI 2.5%), and the VIX declining to 20.29 as AI panic subsides, each Motley Fool service captures a different piece of this bifurcated opportunity. The full ecosystem — from Stock Advisor at $99 to Epic’s multi-strategy bundle — serves investors across this entire market where consumer confidence sits at a 12-year low yet credit spreads at 2.94% show no systemic stress.

But here’s what the ads don’t emphasize: The Motley Fool runs six different service tiers ranging from $99 to $13,999 per year. The upselling is relentless. And those headline returns required holding through multiple 40-50% drawdowns—which most subscribers didn’t do.

This review will help you answer two questions: Should you trust The Motley Fool at all? And if so, which of their services actually fits your situation?

The Motley Fool at a Glance

| Dimension | Details |

|---|---|

| Founded | 1993 by Tom and David Gardner |

| Headquarters | Alexandria, Virginia |

| Track Record | 30+ years, verified performance since 2002 |

| Price Range | $99 – $13,999/year |

| Flagship Return | +883.8% (Stock Advisor) vs +195.8% S&P 500 |

| Refund Policy | 30-day full refund (entry tiers); credit swap only (premium tiers) |

| Best For | Long-term investors with 5+ year horizons |

Who Are the Gardner Brothers?

Tom and David Gardner founded The Motley Fool in 1993 from a backyard shed in Alexandria, Virginia. The name comes from Shakespeare—the court jester who could speak truth to power when others couldn’t.

Their core philosophy hasn’t changed in three decades:

- Buy 25+ companies over time — Diversification isn’t optional

- Hold for 5+ years minimum — Anything shorter is “gambling with investment money”

- Let winners run — Don’t trim positions just because they’ve appreciated

- Expect volatility — 10% drops annually, 20% every four years, 30% every decade

Important note about David Gardner: He stepped back from active stock picking in May 2021. He now focuses on education through his Rule Breaker Investing podcast, but he does NOT make stock recommendations for any current service—including Rule Breakers, which now carries his philosophy but is managed by analyst teams.

Tom Gardner remains actively involved, personally leading picks for Hidden Gems, the Moneyball Portfolio, and his real-money Everlasting Portfolio.

The Complete Motley Fool Service Lineup

Here’s what you’re actually choosing between:

| Service | Price | Monthly Picks | Target Portfolio | Best For |

|---|---|---|---|---|

| Stock Advisor | $99/yr (promo) | 2 | $25K+ | Entry point for most investors |

| Epic | $299/yr (promo) | 5 | $50K+ | Diversified strategy exposure |

| Epic Plus | $1,999/yr | 8+ | $100K+ | Daily ideas + AI insights |

| Fool Portfolios | $3,999/yr | 10+ | $250K+ | Tom’s real-money portfolios |

| Fool One | $13,999/yr | 30+ | $500K+ | Complete all-access |

Note on Rule Breakers: Rule Breakers is no longer sold standalone. It’s bundled into Epic membership alongside Stock Advisor, Hidden Gems, and Dividend Investor.

Stock Advisor: The Flagship Service

If you’re new to The Motley Fool, Stock Advisor is where you start. It’s their most affordable service, has their longest track record, and delivers everything most investors actually need.

Motley Fool Stock Advisor Performance

The Motley Fool · 504 picks · 24 years · Updated Feb 18, 2026

| SA Return | S&P 500 | Alpha | Win Rate |

|---|---|---|---|

| +888% | +193% | +695% | 65% |

S&P 500 shows what you'd have earned buying the index on each pick date instead. Same timing, fair comparison.

| SA Multi-Baggers | 10x+ | 5x+ | 3x+ | 2x+ |

|---|---|---|---|---|

| Count | 42 | 86 | 126 | 181 |

| SA Asymmetry | Avg Winner | Avg Loser | Ratio |

|---|---|---|---|

| Return | +1.5K% | -45% | ~34:1 |

Best Performers (All-Time)

| SA Pick | Return |

|---|---|

NFLX Netflix | +41K% |

AAPL Apple | +5.4K% |

NVDA NVIDIA | +113K% |

AMZN Amazon | +26K% |

BKNG Booking Holdings | +18K% |

TSLA Tesla | +19K% |

MME.DL MME.DL | +4.3K% |

DIS Disney | +5.9K% |

COST Costco | +3.5K% |

CTAS CTAS | +4.4K% |

42 ten-baggers. These 1,000%+ winners—NVDA, NFLX, AMZN—are what drive the portfolio. You don't need to pick all winners; you need a few massive ones.

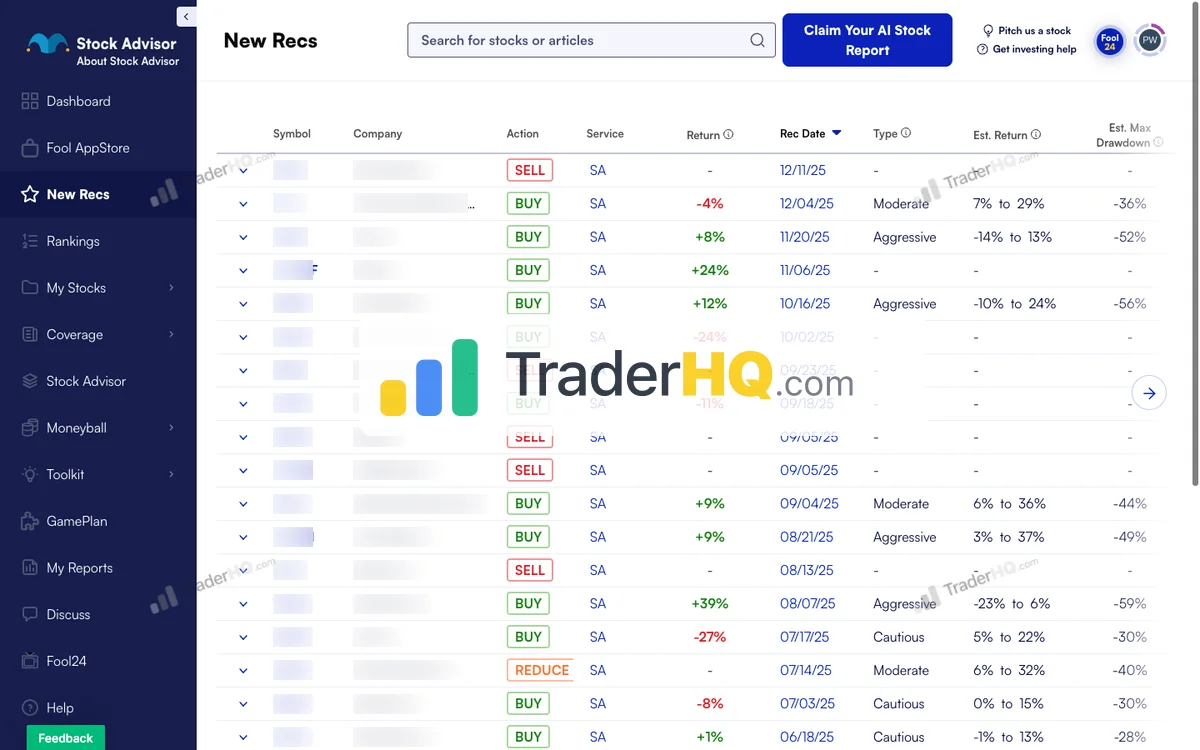

See All Stock Advisor Recommendations →Latest Stock Advisor Picks

Tickers masked to protect subscriber value. Recent picks need 3-5+ years to demonstrate thesis.

| SA Pick | Return |

|---|---|

**** Chip Equipment | +95% |

**** Mobile App Platform | +70% |

**** Space Launch | +58% |

**** Infrastructure Construction | +46% |

**** Growth Company | +35% |

**** Growth Company | +33% |

**** Growth Company | +24% |

**** Athletic Apparel | +16% |

**** Growth Company | +12% |

**** Athletic Footwear | +5% |

Lessons from 2005. 16 picks that year averaged +7.2K%. Best performers often come from buying during uncertainty—when conviction feels hardest.

Stock Advisor Win Rate by Holding Period

| Hold Time | SA Win Rate | Avg Return |

|---|---|---|

| < 1 Year | 54.3% | +10% |

| 1-3 Years | 58.2% | +13% |

| 3-5 Years | 37.2% | -2% |

| 5-10 Years | 62.8% | +181% |

| 10+ Years | 92.9% | +3.7K% |

504 data points over 24 years. The pattern repeats: early volatility, mid-term clarity, long-term outperformance. The data is the strategy.

Stock Advisor Performance by Year

| Year | SA Picks | Avg Return | Win Rate | |

|---|---|---|---|---|

| 2026 | 2 | 0% | 50% | CASY+4% |

| 2025 | 25 | +6% | 52% | HWM+106% |

| 2024 | 25 | +6% | 58% | SHOP+85% |

| 2023 | 25 | +44% | 75% | CRWD+235% |

| 2022 | 23 | +22% | 43% | NET+285% |

| 2021 | 23 | -33% | 17% | LRCX+360% |

| 2020 | 24 | +82% | 29% | TSLA+1.3K% |

| 2019 | 24 | +36% | 67% | SNPS+243% |

| 2018 | 22 | +155% | 64% | SHOP+795% |

| 2017 | 23 | +568% | 87% | NVDA+7.1K% |

| 2016 | 21 | +367% | 81% | SHOP+3.4K% |

| 2015 | 24 | +195% | 71% | CASY+721% |

| 2014 | 21 | +215% | 81% | IBKR+995% |

| 2013 | 19 | +324% | 68% | NFLX+2.4K% |

| 2012 | 23 | +1.3K% | 74% | TSLA+19K% |

| 2011 | 19 | +492% | 63% | AAPL+2.6K% |

| 2010 | 18 | +418% | 83% | AMZN+2.2K% |

| 2009 | 20 | +2.8K% | 90% | NVDA+48K% |

| 2008 | 18 | +1.0K% | 94% | AAPL+5.4K% |

| 2007 | 19 | +1.5K% | 37% | NFLX+27K% |

| 2006 | 20 | +2.3K% | 65% | NFLX+24K% |

| 2005 | 16 | +7.2K% | 63% | NVDA+113K% |

| 2004 | 17 | +5.4K% | 59% | NFLX+41K% |

| 2003 | 17 | +230% | 65% | BWA+1.4K% |

| 2002 | 16 | +2.6K% | 81% | AMZN+26K% |

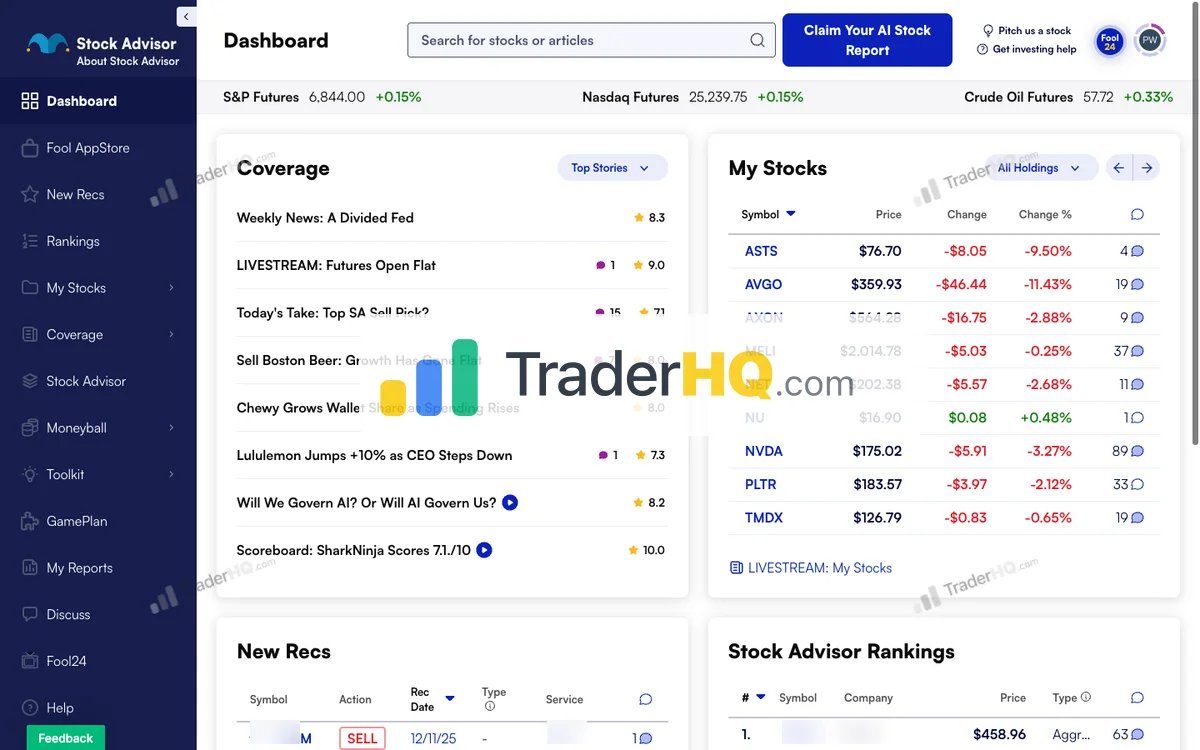

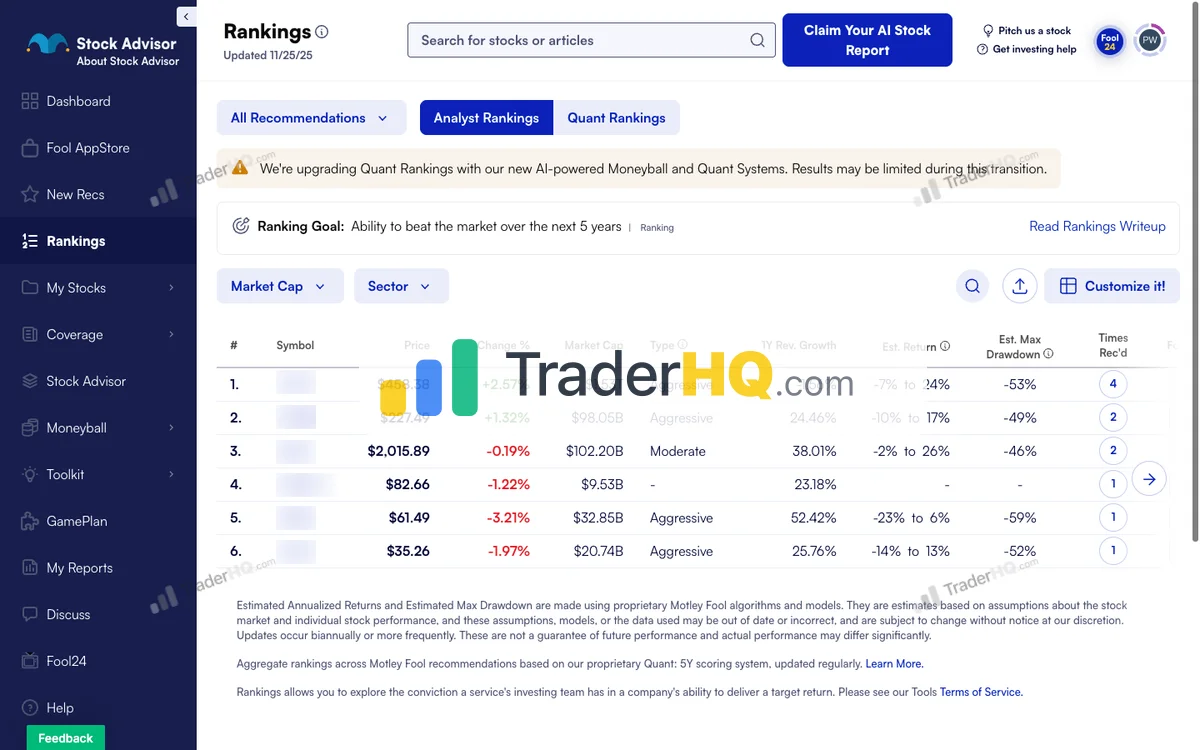

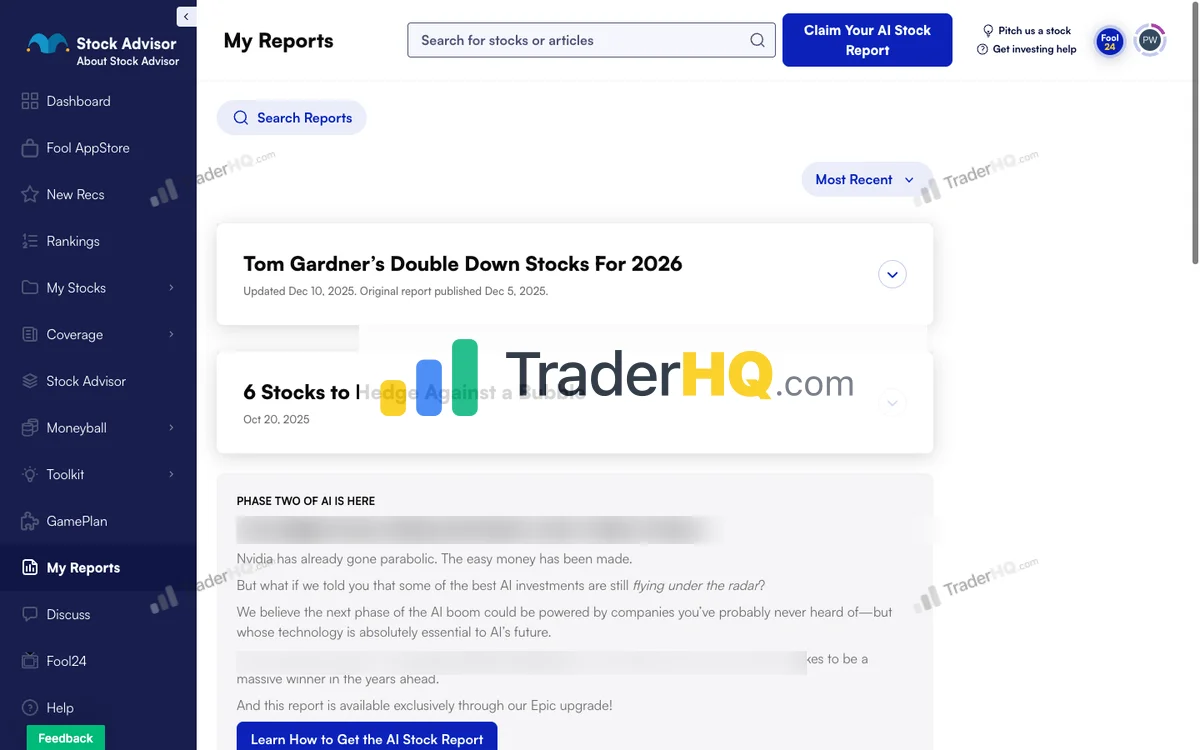

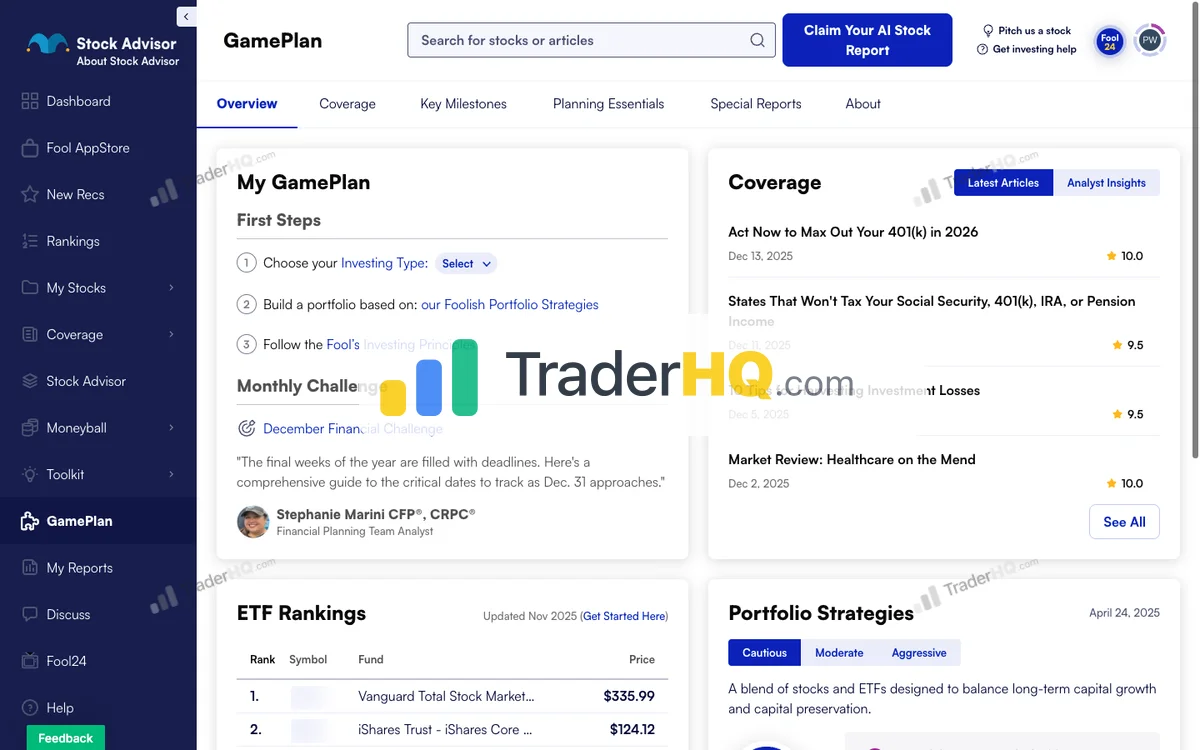

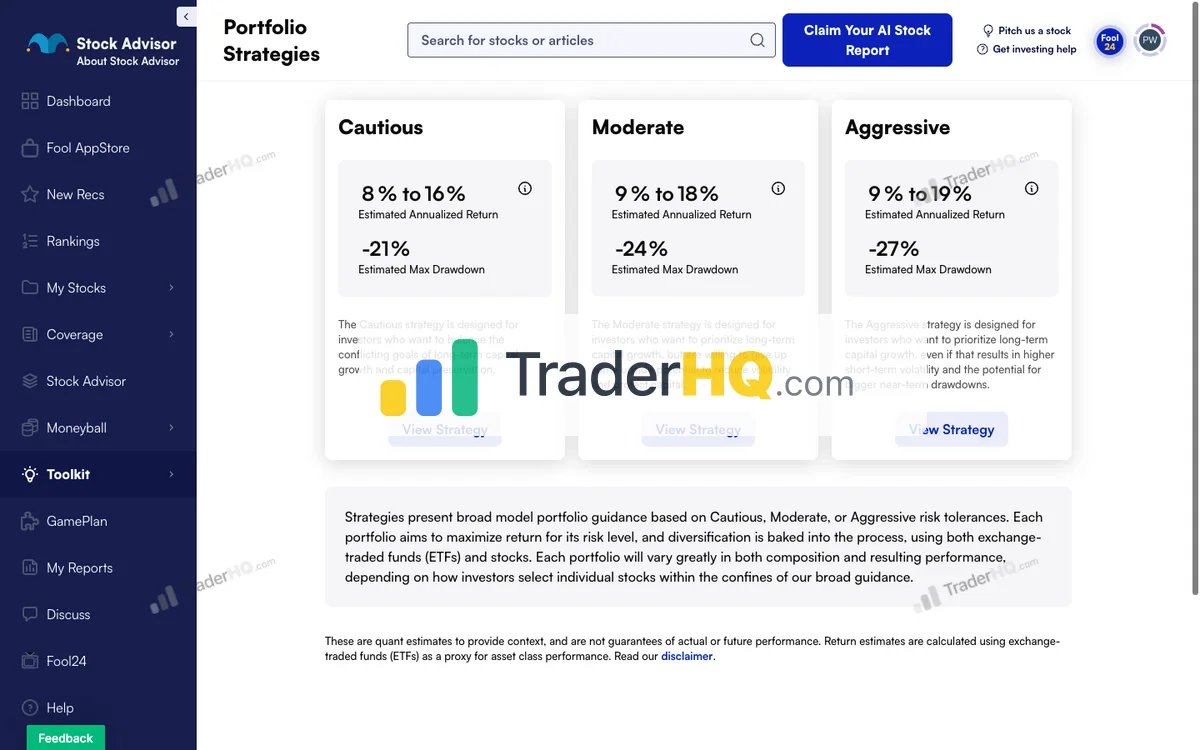

Inside Stock Advisor

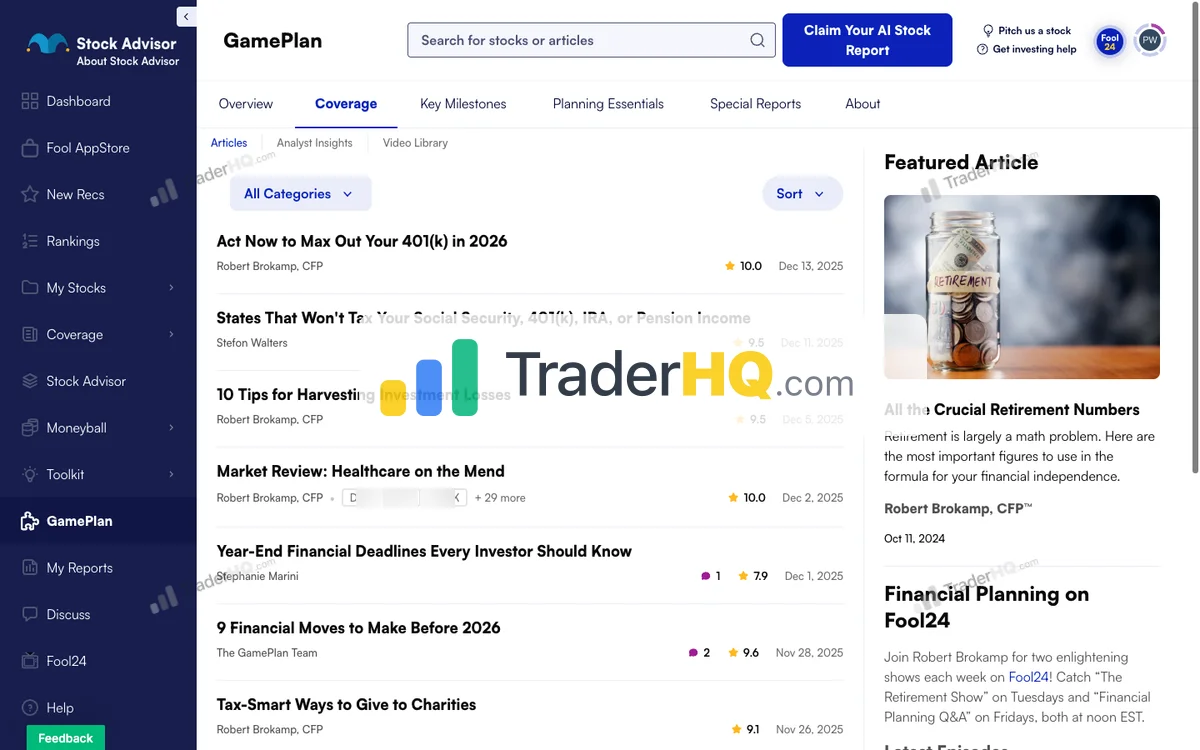

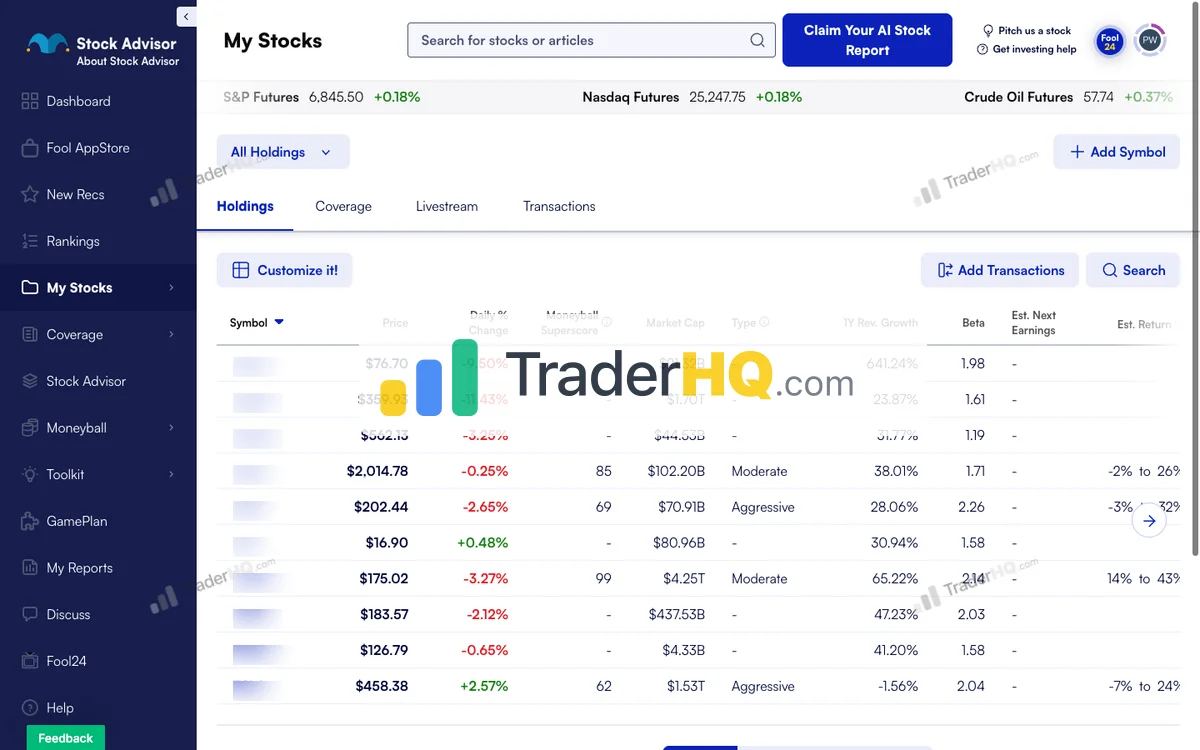

9 screenshots · Click to expand

The Track Record

$10,000 invested in Stock Advisor’s picks in 2002 would be worth roughly $98,380 today. The same $10,000 in an S&P 500 index fund? About $29,000.

| Metric | Stock Advisor | S&P 500 |

|---|---|---|

| Cumulative Return (since 2002) | +883.8% | +195.8% |

| 2022 Drawdown | ~40% | ~18% |

| Win Rate (10+ year holds) | 92% | — |

| Win Rate (under 1 year) | 57% | — |

The pattern is clear: time is the strategy. Hold for a decade and you’re winning 92% of the time with average returns of 3,803.9%. Bail in the first year and you’re barely better than a coin flip. The service has produced 42 ten-baggers and 182 doublers over its 23+ year history.

What You Get

- 2 stock picks per month — One from Tom Gardner’s team, one from the Stock Advisor team

- Foundational Stocks — 10 highest-conviction core holdings to build your portfolio around

- Moneyball Database — 340+ companies with 12+ scoring dimensions

- Portfolio Strategies — Cautious, Moderate, and Aggressive frameworks based on your risk tolerance

- Fool IQ Access — Financial data and quant projections

The Pricing

- New Member Price: $99/year (50% off)

- Regular Price: $199/year

- Refund Policy: 30-day money-back guarantee, no questions asked

At $99/year, you’re paying roughly $1.90 per week. If just ONE pick outperforms the S&P 500 by 4% on a $5,000 position, that’s $200 in excess returns—you’ve paid for the service for two years.

Try Stock Advisor — 30-Day Guarantee

Epic: The Bundle Tier

Motley Fool Epic is where things get interesting—and where the upselling begins in earnest. It bundles four services that would cost significantly more separately.

No screenshots available for motley-fool-epic

What’s Included

- Stock Advisor — 2 picks/month (the flagship)

- Rule Breakers — 1 pick/month (high-growth disruptors)

- Hidden Gems — 1 pick/month (Tom Gardner’s small-cap hunting ground)

- Dividend Investor — 1 pick/month (income focus)

- Full Fool IQ Access — Financial data, quant projections

- GamePlan+ — Retirement planning, tax strategies

The Track Record by Scorecard

| Service | Total Return | vs S&P 500 |

|---|---|---|

| Stock Advisor | +883.8% | +688% |

| Rule Breakers | +318.1% | +149.1% |

| Hidden Gems | +46.74% | -17% |

| Dividend Investor | +16.83% | -40% |

The honest take: Stock Advisor and Rule Breakers carry the performance. Hidden Gems adds genuinely differentiated small-cap exposure. Dividend Investor has significantly underperformed the market—if income is your goal, you might be better served elsewhere.

The Pricing

- New Member Price: $299/year ($200 off — auto-applied)

- Regular Price: $499/year

- Refund Policy: 30-day money-back guarantee

Who Should Choose Epic Over Stock Advisor?

Epic makes sense if you:

- Have $50,000+ to invest

- Want exposure to small-caps (Hidden Gems)

- Like having more picks to choose from (5/month vs 2)

- Value the diversified strategy approach

Stock Advisor is enough if you:

- Have under $50K to invest

- Prefer simplicity (2 picks/month)

- Don’t need income-focused recommendations

Try Epic — Save $200 (Auto-Applied)

The Premium Tiers: Epic Plus, Fool Portfolios, and Fool One

This is where The Motley Fool’s pricing—and refund policies—change dramatically.

Epic Plus ($1,999/year)

What it adds over Epic:

- Daily Moneyball recommendations (up to 250/year)

- AI Playbook Portfolio

- 5 Moneymakers Portfolios backed by Motley Fool capital

- Options trading strategies

- Expanded Moneyball database (3,500+ vs 340+ companies)

Target portfolio: $100,000+

Critical difference: No cash refund. You get a credit swap to Epic ($499 value) if you want out. That’s a $1,500 loss.

Fool Portfolios ($3,999/year)

What it adds over Epic Plus:

- Tom Gardner’s Everlasting Portfolio (the only stocks he personally owns)

- 35 total real-money portfolios

- Cryptoball database (800+ cryptocurrencies)

- White-glove support with Investor Solutions

Target portfolio: $250,000+

Critical difference: Credit swap to Epic Plus means you lose $2,000.

Fool One ($13,999/year)

What it adds:

- Complete all-access to every Motley Fool service

- One Portfolio with quarterly rebalancing

- Microball database (2,500+ microcap companies)

- Exclusive events and early access to new tools

Target portfolio: $500,000+

Critical difference: Credit swap to Fool Portfolios means you lose $10,000.

Warning: The premium tiers have no cash refunds. Before committing $2,000+, make sure you’ve used Stock Advisor or Epic long enough to know the Foolish philosophy works for your temperament.

The Upselling Reality

Let’s address the elephant in the room: The Motley Fool will try to upsell you constantly.

Once you subscribe to Stock Advisor, you’ll receive emails promoting Epic. Subscribe to Epic, and you’ll hear about Epic Plus. This is relentless and, frankly, annoying.

How to handle it:

- Start with Stock Advisor ($99). Use it for at least a year.

- If you’re following the picks and building conviction, consider Epic.

- Only upgrade to premium tiers when your portfolio actually justifies it.

- Ignore the urgency tactics. The deals come back.

The services themselves are good. The marketing pressure is not. Separate the two in your mind.

Which Motley Fool Service Is Right for You?

Start with Stock Advisor if:

- You’re new to stock picking services

- Your portfolio is under $50,000

- You want the simplest possible approach (2 picks/month)

- You’re not sure if you can hold through volatility (test yourself first)

Upgrade to Epic if:

- You’ve used Stock Advisor for 6+ months and want more

- Your portfolio is $50,000+

- You want small-cap exposure (Hidden Gems)

- You value having diversified strategies in one place

Consider Premium Tiers if:

- Your portfolio is $100,000+ (Epic Plus), $250,000+ (Portfolios), or $500,000+ (One)

- You want daily recommendations and AI-driven insights

- You specifically want access to Tom Gardner’s real-money portfolios

- You understand and accept the credit-swap-only refund policy

Who Should NOT Use The Motley Fool

The Motley Fool’s philosophy requires specific behaviors. If you can’t commit to these, the services won’t work for you—regardless of their track record.

Don’t subscribe if:

-

You can’t hold through a 40% drawdown. Not “you think you can”—you’ve actually done it. Stock Advisor’s best performers have all crashed at some point.

-

You want to trade actively. These services recommend buying and holding for years. If you get bored without action, you’ll overtrade and destroy your returns.

-

You need the money in 3 years. This is a 5+ year strategy. Volatility can hurt you in shorter timeframes.

-

You’re income-focused. Dividend Investor has underperformed. If income is your primary goal, look at dedicated dividend services or dividend ETFs.

-

You have under $10,000 to invest. The diversification required (25+ positions) doesn’t work with small portfolios.

If any of these describe you: Consider Morningstar Investor for research without picks, or explore our guide to best stock research websites for alternatives. There’s no shame in indexing—it beats most active investors anyway. See our Morningstar Investor review for details.

The Motley Fool vs. Alternatives

| Service | Price | Track Record | Best For |

|---|---|---|---|

| Stock Advisor | $99-199/yr | +883.8% (23 yrs) | Long-term growth investors |

| Alpha Picks | $449/yr | +308.3% (3.6 yrs) | Data-driven investors |

| Morningstar Investor | $249/yr | N/A (research) | Self-directed researchers |

| Index Fund (VOO) | ~0.03% ER | +195.8% (23 yrs) | Passive investors |

Stock Advisor vs. Alpha Picks: Stock Advisor has a 23.9-year track record with 883.8% total returns and 42 ten-baggers; Alpha Picks has 3.6 years but an impressive 308.3% total return and 73% win rate. Stock Advisor focuses on quality growth (GARP); Alpha Picks uses quantitative scoring. If you want proven longevity and through-cycle resilience, Stock Advisor wins. If you prefer quant-driven value investing with shorter holding periods, Alpha Picks is worth considering. See our Stock Advisor vs Alpha Picks comparison for the full breakdown.

Stock Advisor vs. Indexing: The honest answer is that most investors should probably just index. Stock Advisor has beaten the market, but only for those who actually held through the volatility. If you’ll panic-sell during crashes, indexing will serve you better.

The Bottom Line

The Motley Fool is legitimate. The track records are real. The philosophy—buy great companies, hold for years, let winners run—is sound.

But the experience includes relentless upselling, and the returns only materialize for investors who can actually follow the process through brutal drawdowns.

My recommendation:

-

Start with Stock Advisor at $99/year. It’s low-risk with a 30-day guarantee, and it gives you everything you need to test the Foolish philosophy. Read our Stock Advisor review for the complete analysis.

-

Use it for at least a year before upgrading. See if you can actually hold when positions drop 30-40%.

-

Only upgrade when your portfolio justifies it. Epic at $50K+, Epic Plus at $100K+, and so on.

-

Ignore the marketing pressure. The services are good. The sales tactics are not. Separate them.

If you can commit to the philosophy—5+ year holds, adding regularly, holding through volatility—The Motley Fool’s track record suggests you’ll do well. If you can’t, save your money and buy an index fund.

Explore all your options in our best stock advisors guide.

Frequently Asked Questions

Is Motley Fool worth the money?

Yes, for long-term investors who can hold 5+ years. Stock Advisor has returned +883.8% since 2002 compared to the S&P 500’s +195.8%—with 42 ten-baggers, 182 doublers, and a 92% win rate for 10+ year holds. At $99/year for new members, the math works if you follow the strategy. The catch: 35% of picks lose money, and the winners require holding through significant volatility. If you’ll panic-sell during drawdowns, the service won’t work for you regardless of its track record.

What is the best Motley Fool service?

Stock Advisor is the best starting point for most investors. It has the longest track record (23 years), the lowest price ($99/year for new members), and delivers everything most investors need: 2 picks per month, foundational stock recommendations, and portfolio construction guidance. Only upgrade to Epic or premium tiers when your portfolio size justifies it ($50K+ for Epic, $100K+ for Epic Plus).

Is Motley Fool legit or a scam?

The Motley Fool is a legitimate 30-year-old investment research company founded by Tom and David Gardner in 1993. Their performance is verified and publicly displayed on their scorecards—including both winners and losers. The company is not a scam. However, the marketing is aggressive, the upselling is relentless, and the advertised returns required holding through drawdowns that most subscribers didn’t survive. The returns are real; capturing them requires discipline.

How do I cancel Motley Fool?

For Stock Advisor and Epic: You can cancel within 30 days for a full refund, no questions asked. Contact member services at 1-888-665-3665 or through your account dashboard. For Epic Plus, Fool Portfolios, and Fool One: There are no cash refunds. You can only swap your membership credit to a lower tier—which means losing significant value ($1,500 to $10,000 depending on your tier). Understand this before subscribing to premium services.

Should I get Stock Advisor or Epic?

Start with Stock Advisor unless you have $50,000+ to invest. Stock Advisor at $99/year gives you 2 picks per month and the complete portfolio-building framework. Epic at $299/year adds 3 more picks (from Rule Breakers, Hidden Gems, and Dividend Investor) but requires a larger portfolio to properly diversify across all recommendations. Use Stock Advisor for at least 6 months before considering an upgrade.

Does David Gardner still pick stocks?

No. David Gardner stepped back from active stock picking in May 2021. He now focuses on education through his Rule Breaker Investing podcast (Wednesdays at 4pm ET) and chairs The Motley Fool Foundation. The services that carry his philosophy—including Rule Breakers—are now managed by analyst teams using his criteria. Tom Gardner remains actively involved in stock selection for Hidden Gems, Moneyball Portfolio, and his personal Everlasting Portfolio.

How do Motley Fool services perform in today’s sector rotation?

The sector bifurcation is exactly why the Motley Fool has multiple services — each one serves a different piece of this divided market.

The numbers tell the story: Energy +22.5% (with BKR +36%, SLB +35%) and Materials +17.6% lead, while Financials have collapsed to worst sector at -5.7% — worse than tech’s -3.1%. Technology is bifurcated — memory/storage stocks averaging ~+83% (SNDK +155%, WDC +75%, MU +48%) while enterprise software averages ~-33% (CRM -29%, NOW -29%, WDAY -34%, INTU -41%). But the AI panic is subsiding: the VIX dropped 4.3% to 20.29 as tech rebounded on Feb 18. With 83-point dispersion between the top 20 stocks (+51.8% average) and the bottom 20 (-30.7% average) — a new 2026 high — being in the right stocks matters more than being in the market.

Here’s how each service maps to the rotation:

- Stock Advisor (EXCEPTIONAL fit): Quality GARP methodology avoids the financials wreckage and AI capex blowups. Its 883.8% total return, 42 ten-baggers, and 182 doublers across 504 positions prove the approach works — thriving through both the fear spike AND the recovery

- Rule Breakers (IMPROVING): The declining VIX (down 4.3%) and Feb 18 tech rebound signal improving conditions for growth innovators. The 60 ten-baggers and 98.3% win rate for 10+ year holds were built by buying during exactly these transitional moments — memory stocks thriving at +83% prove innovation returns are accelerating

- Epic (GOOD fit): Multi-strategy diversification captures defensive sector strength (Staples +15.2% via Dividend Investor) alongside growth exposure, while Hidden Gems benefits from manufacturing expansion (PMI 52.6)

The Fed holding at 3.50-3.75%, CAPE near ~40, CPI confirmed at 2.4% (lowest since May 2025), and gold above $5,000/oz all point to an environment where the ecosystem approach (quality + growth + small-cap + income) is more valuable than any single strategy.

Is The Motley Fool worth it at all-time market highs?

The S&P 500 at ~6,883 is up +0.68% YTD and within 1.4% of its all-time high — but the headline number hides extreme stock-level bifurcation. The underlying reality is deeply divided:

- Winners: Energy +22.5%, Materials +17.6%, Consumer Staples +15.2%

- Losers: Financials -5.7% (worst sector), Tech -3.1%, enterprise software averaging -33%

- 83-point dispersion between top 20 (+51.8%) and bottom 20 (-30.7%) — a new 2026 high

CAPE near ~40 compresses forward index returns to an estimated 6-9% CAGR. But disciplined stock pickers are capturing the rotation — top 20 performers averaged +51.8% while the index barely moved. Stock Advisor’s 883.8% total return and 42 ten-baggers were built across multiple cycles, including periods with similarly elevated valuations. With CPI at 2.4%, the inflation picture supports quality businesses with pricing power.

Is The Motley Fool worth it in 2026’s volatile market?

Yes — the current market validates their multi-service ecosystem from both sides. The VIX spiked to ~21.77 on AI capex panic, then dropped 4.3% to 20.29 as tech rebounded and AI concerns faded. Consumer confidence sits at a 12-year low — yet manufacturing PMI at 52.6 and credit spreads at 2.94% confirm no systemic stress. This transitional environment is where multiple analytical frameworks pay off:

- Stock Advisor’s GARP methodology captures quality stocks insulated from AI capex fatigue. Its 883.8% total return was built by holding through exactly these fear-and-recovery cycles

- Rule Breakers’ growth thesis is improving as the VIX declines and tech rebounds. Its 60 ten-baggers were built by buying during moments of fear that turned out to be temporary — memory stocks at +83% prove innovation returns are accelerating

- Hidden Gems benefits from manufacturing expansion (PMI 52.6) and defensive sector strength (Staples +15.2%)

Services with 20+ year track records have navigated worse — the 2008 crisis, 2020 COVID crash, and 2022 bear market. Current conditions are transitional, not catastrophic.