Best Investment Subscription & Stock Picking Services in 2024

Published

Published

| Best Stock Advisor Services | Best for |

|---|---|

| 1. Motley Fool Stock Advisor | Consistent Market Outperformance |

| 2. Motley Fool Rule Breakers | High-Growth Potential |

| 3. Alpha Picks by Seeking Alpha | Actionable Stock Selections |

| 4. Seeking Alpha Premium | Data-Driven Investment Insight |

| 5. Zacks Premium | Earnings-Based Stock Forecasts |

| 6. Morningstar Investor | Intrinsic Stock Values Analysis |

| 7. TipRanks Premium | Comprehensive Analyst Ratings |

Welcome to your definitive guide on stock advisor services for strategic portfolio growth.

Dive into our detailed reviews of top stock advisory providers in 2024.

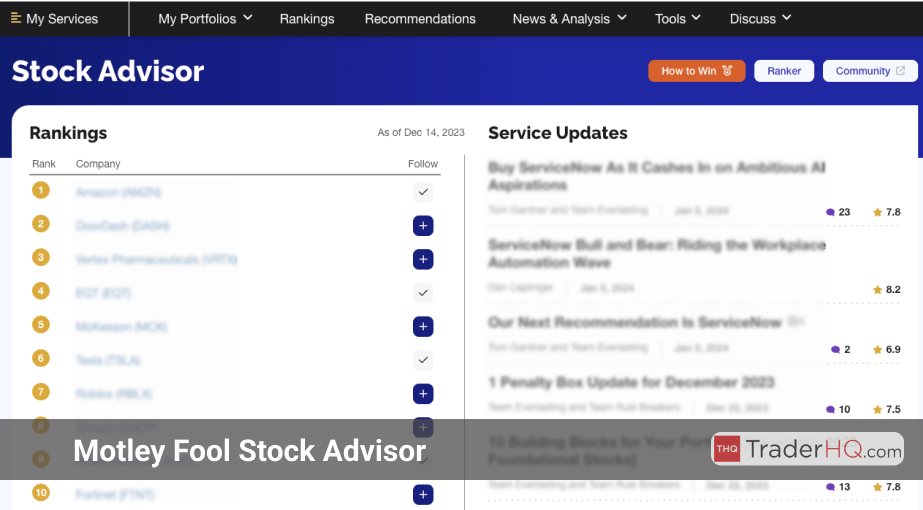

Motley Fool Stock Advisor, renowned for its impressive history of spotting high-growth stocks, has earned the trust of countless investors.

The service's expert analysis and well-timed recommendations have consistently beaten the market over the long term.

Catering to investors of all experience levels, Stock Advisor aims to refine their strategies and uncover the most promising growth opportunities.

Let's delve deeper into what sets this service apart from the rest.

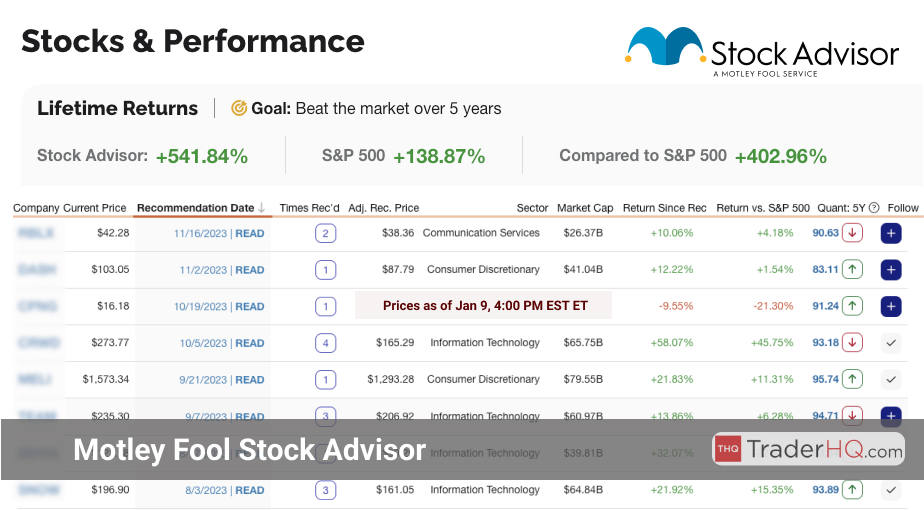

Stock Advisor Performance

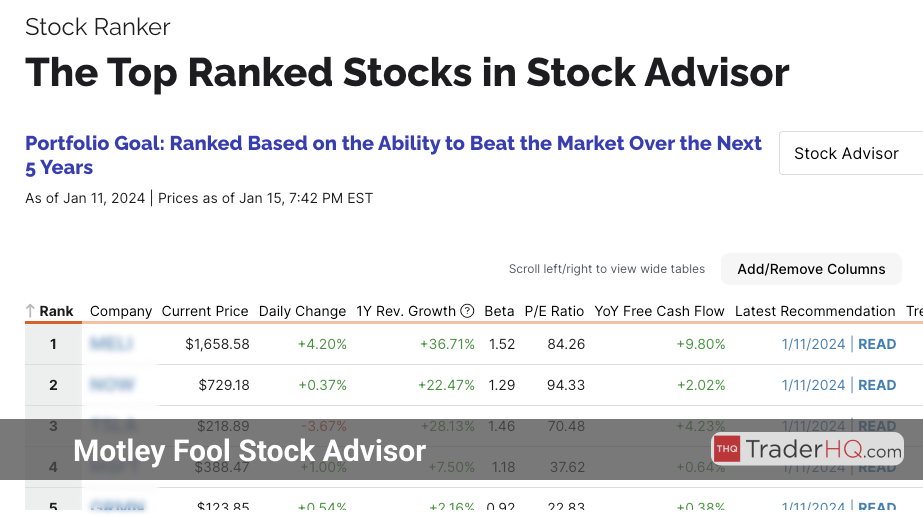

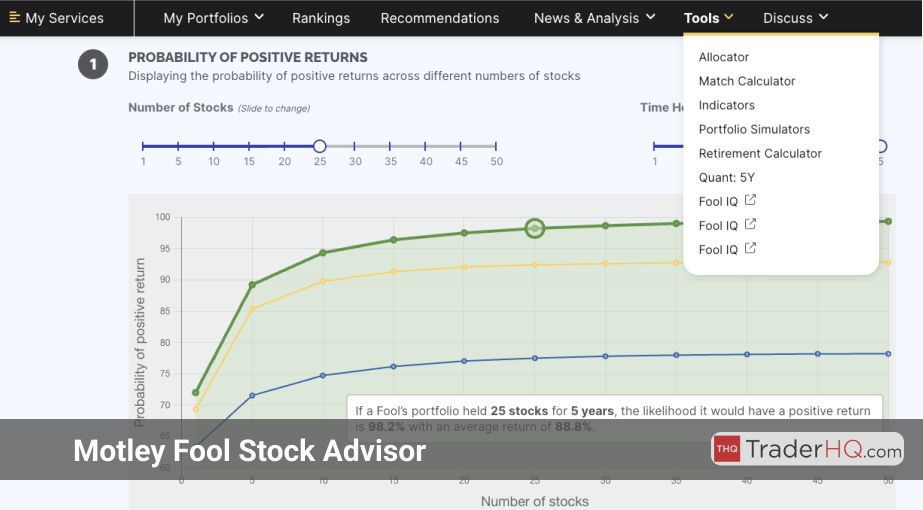

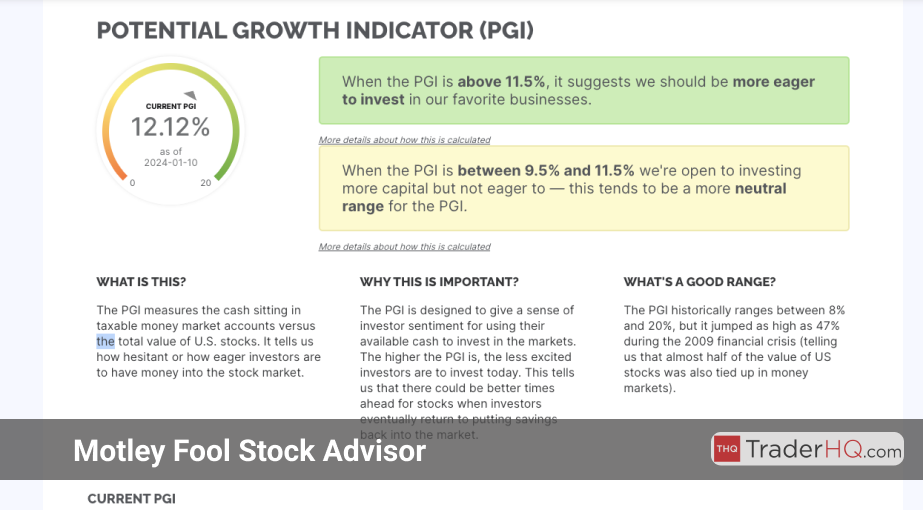

The Motley Fool's Stock Advisor service has a history of delivering market-beating returns. By focusing on companies with strong growth potential, the service aims to help subscribers build wealth over the long term.

Let's take a closer look at the performance of some of Stock Advisor's top picks:

| Best Stock Advisor Picks (2002 to 2024) | Return* | Annualized Return |

|---|---|---|

| Computer Graphics Company | 53,287% | 63% |

| Streaming Company | 33,790% | 38% |

| Online Retail Company | 24,092% | 62% |

| Travel Company | 15,127% | 29% |

| Electric Car Company | 8,049% | 52% |

These Stock Advisor stock picks have produced an average return of 26,869% or 49% annualized.. (As of Apr 08, 2024)

While these are the best performers the average Stock Advisor pick has returned 668.28% compared to 152.44% for the S&P 500.

Click here to See the Latest Stock Advisor Picks (Apr 10th, 2024)

Stock Advisor's ability to identify winning stocks spans across various time frames. The service's recommendations have not only outperformed over the long term but have also delivered impressive returns in more recent years.

| Best Stock Picks (2011 to 2024) | Return | Annualized Return |

|---|---|---|

| Electric Car Company | 8,049% | 52% |

| Gaming Company | 5,927% | 55% |

| Computer Graphics Company | 3,300% | 63% |

| E-commerce Company | 2,201% | 50% |

| Streaming Company | 1,928% | 32% |

Q4-2019 Stock Advisor Stock Picks

The Q4-2019 Stock Advisor picks have produced an average return of 180%. (As of Apr 08, 2024)

| Stock Picks from Q4-2019 | Return | Annualized Return |

|---|---|---|

| Advertising Tech Company | 350% | 40% |

| Cloud Software Company | 336% | 40% |

| Streaming Company | 102% | 17% |

| Consulting Firm Company | 69% | 13% |

| Biotech Company | 44% | 8% |

This closer look at the individual year of 2019 demonstrates that even within a shorter to medium-term timeframe, selected stocks can yield impressive results..

Click here to See the Latest Stock Advisor Picks (Apr 10th, 2024)

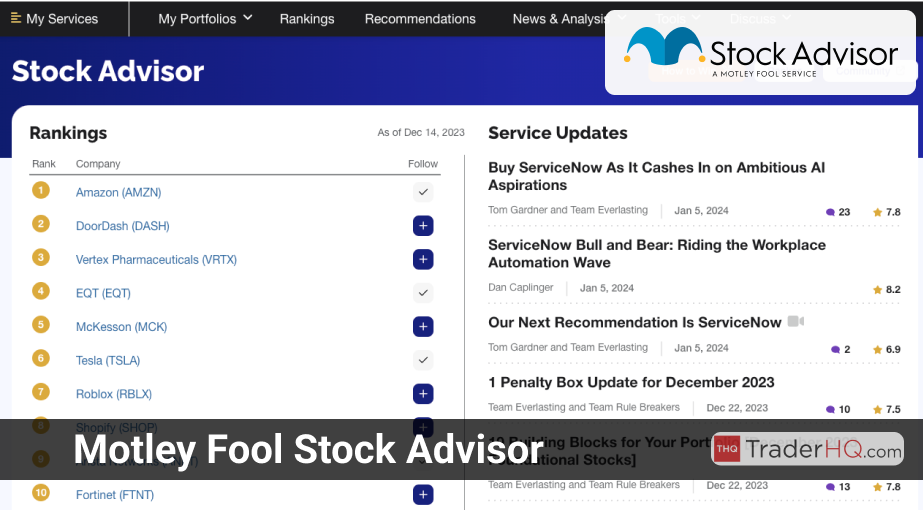

The Motley Fool Stock Advisor service delivers long-term investment recommendations to subscribers.

While short-term performance may vary, the service focuses on solid fundamentals and growth potential.

The table below presents the five most recent stock picks and their returns.

| Latest Stock Advisor Stock Picks | Return | Rec Date |

|---|---|---|

| Payment Network Company | 1% | Apr 4, 2024 |

| Software Company | -6% | Mar 21, 2024 |

| E-commerce Company | -1% | Mar 7, 2024 |

| Beauty Products Company | -5% | Feb 15, 2024 |

| Digital Payments Company | 7% | Feb 1, 2024 |

Although these recent Stock Advisor picks are relatively new, it's crucial to consider the service's long-term investing focus.

The returns shown provide an early performance snapshot, but true potential is realized over a longer horizon.

As with any investment, thorough research and consideration of individual financial goals and risk tolerance are essential.

Stock Advisor's recommendations serve as a valuable starting point for analysis within a broader, diversified investment strategy designed for sustained, long-term returns.

The next Stock Advisor pick will be released on Apr 11, 2024.

You can access the next couple picks and all past picks with their 30 day membership back fee guarantee.

| Stock Advisor Release Schedule | Release Date |

|---|---|

| New Stock Pick | Apr 4, 2024 |

| 5 Best Buys Now | Apr 11, 2024 |

| New Stock Pick | Apr 18, 2024 |

| 5 Best Buys Now | Apr 25, 2024 |

The Stock Advisor Release Schedule outlines upcoming releases for new individual stock picks and their curated list of the 5 best stocks to buy at the moment, providing investors with regular influxes of expert analysis and recommendations.

Click here to See the Latest Stock Advisor Picks (Apr 10th, 2024)

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Motley Fool Stock Advisor stands as a beacon for both novice and seasoned investors aiming for market outperformance. Its blend of educational components, detailed analyses, and community engagement fosters a comprehensive approach to investing.

This service is not just about stock recommendations but about cultivating a deeper understanding of investment philosophy. It's an invaluable resource for anyone committed to building a prosperous financial future through thoughtful, informed investing strategies.

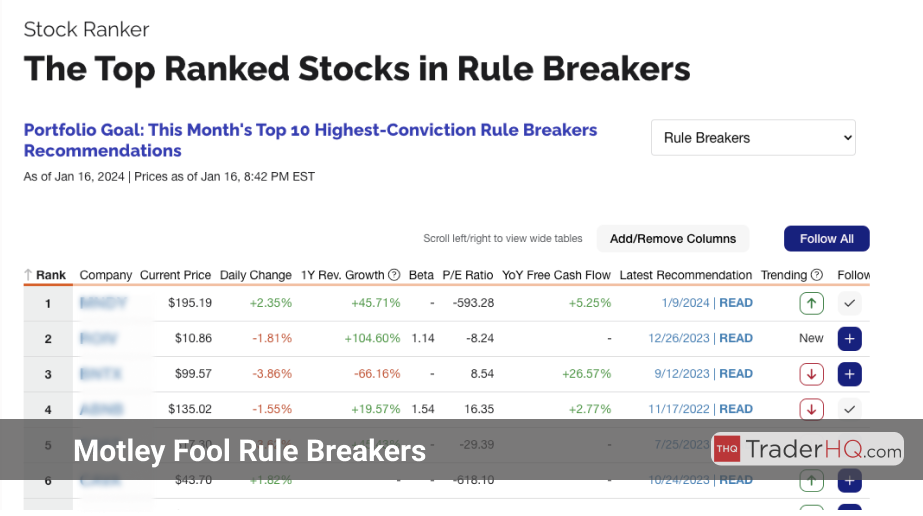

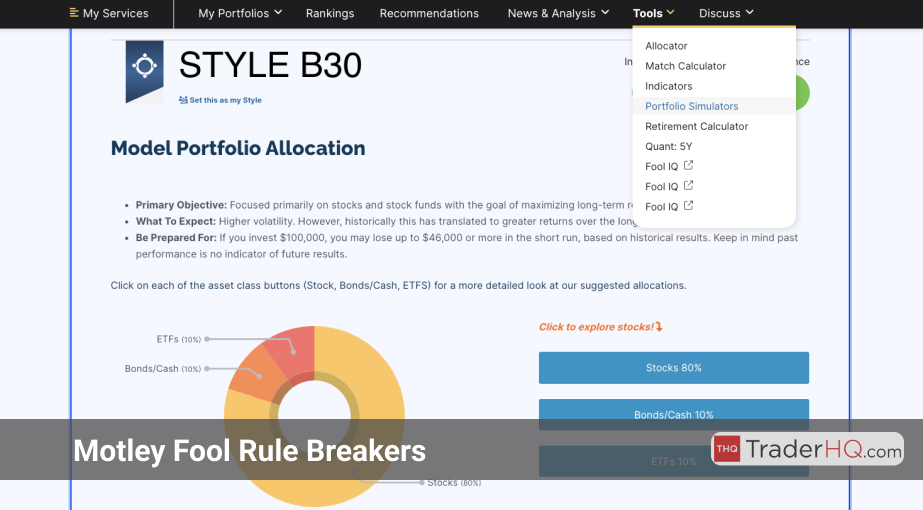

Motley Fool Rule Breakers focuses sharply on high-growth stocks. It's tailored for those eyeing future market leaders. The service zeros in on innovative companies with the potential to disrupt industries and yield substantial returns. This approach requires patience and a stomach for volatility but can be immensely rewarding for those who adhere to its principles.

I've found that leveraging in-depth analyses of such companies offers a unique advantage. Rule Breakers stands out by not only identifying these opportunities but also providing actionable insights that align with my own investment strategies—a blend of risk management and long-term growth potential analysis.

Let's dive into what makes this service truly invaluable for your investment journey. From detailed stock recommendations to community engagement, it serves as a comprehensive platform for growth-focused investors.

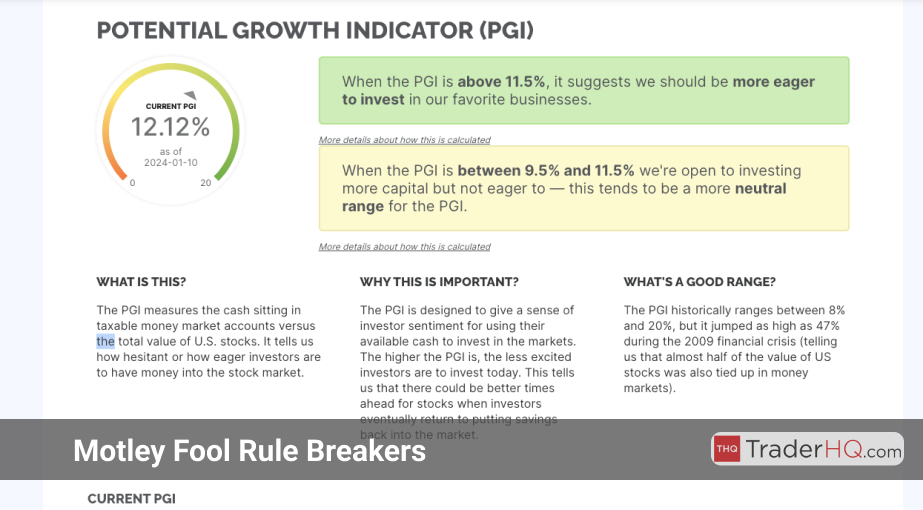

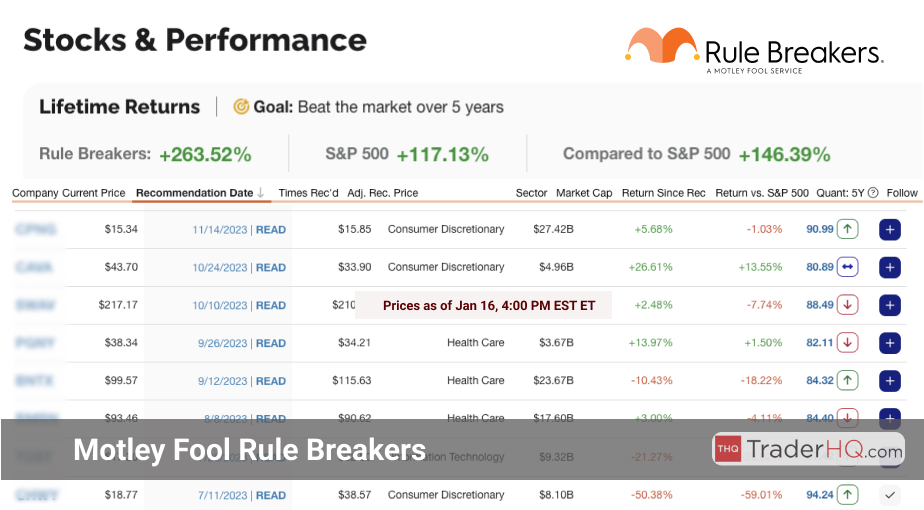

Rule Breakers Performance

An effective investment strategy is supported by clear performance data, reflecting both past achievements and future potential.

Reviewing the Motley Fool Rule Breakers performance data, we highlight the service's track record for investors targeting long-term growth.

The performance figures of these selected stocks demonstrate the potential for significant returns.

| Best Rule Breakers Picks (2012 to 2024) | Return* | Annualized Return |

|---|---|---|

| Electric Car Company | 8,049% | 52% |

| Gaming Company | 5,927% | 55% |

| Computer Graphics Company | 3,300% | 63% |

| E-commerce Company | 2,201% | 50% |

| Streaming Company | 1,928% | 32% |

The average return of these stocks is 4,281%, with an annualized return of 51%. (As of Apr 08, 2024).

Average performance across all picks from Stock Advisor has resulted in 668.28%, outperforming 152.44% of the S&P 500.

Click here to See the Latest Stock Advisor Picks (Apr 10th, 2024)

Below, we showcase the top-performing picks from 2011 to 2024, reflecting their growth potential and the effectiveness of their investment approach.

| Best Rule Breakers Picks (2011 to 2024) | Return* | Annualized Return |

|---|---|---|

| Electric Car Company | 8,150% | 43% |

| E-commerce Company | 3,439% | 55% |

| Composite Decking Company | 2,777% | 33% |

| Advertising Tech Company | 2,427% | 57% |

| Tech Company | 2,138% | 139% |

Q4-2019 Rule Breakers Stock Picks

The Q4-2019 Rule Breakers picks have produced an average return of 71%. (As of Apr 08, 2024)

| Stock Picks from Q4-2019 | Return* | Annualized Return |

|---|---|---|

| Cloud Monitoring Company | 287% | 35% |

| Fitness Equipment Company. | 101% | 18% |

| Online Marketplace Company | 58% | 11% |

| Medical Device Company | -8% | -2% |

| Fitness Company | -81% | -32% |

The data from 2019 shows that careful selection of stocks can lead to significant returns over short to medium terms.

This underscores the value of rigorous analysis behind each selection, highlighting the expertise Stock Advisor offers to investors.

Click Here to See the Latest Rule Breakers Picks (Apr 10th, 2024)

| Latest Rule Breakers Stock Picks | Return | Rec Date |

|---|---|---|

| Ad tech company | 9% | Mar 12, 2024 |

| Swiss Footwear Company | -4% | Feb 27, 2024 |

| Education Company | -17% | Feb 13, 2024 |

The next Rule Breakers pick will be released on Apr 4, 2024.

Access upcoming picks and all historical selections with a 30-day money-back guarantee on membership.

| Rule Breakers Release Schedule | Release Date |

|---|---|

| New Stock Pick | Mar 28, 2024 |

| 5 Best Buys Now | Apr 4, 2024 |

| New Stock Pick | Apr 11, 2024 |

| 5 Best Buys Now | Apr 18, 2024 |

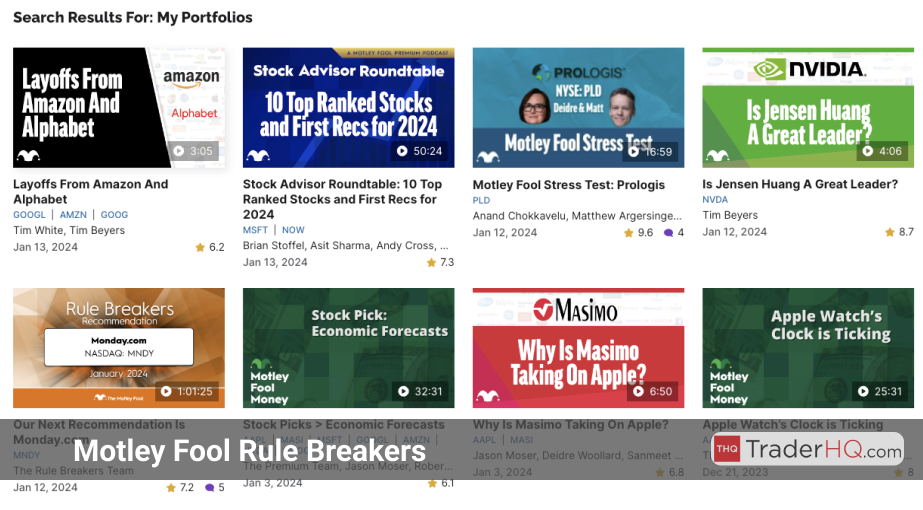

Rule Breakers recommendations are based on continuous investment research and identifying growth opportunities. This is essential for a portfolio growth.

Investors should not only consider past performance but also focus on new picks.

Data is significant, but practical experience and insight are also necessary for investing.

Rule Breakers provides detailed research aimed at uncovering future market leaders, supporting a proactive, growth-oriented investment strategy.

Click Here to See the Latest Rule Breakers Picks (Apr 10th, 2024)

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Motley Fool Rule Breakers is adept at demystifying high-growth investing through meticulously researched stock picks. Its focus on disruptive innovation offers a clear path to potentially outsized returns for those willing to accept higher risks associated with such investments.

Anchored in a philosophy that champion long-term vision over short-term gains, it's an instrumental resource for growth-focused investors ready to capitalize on the next generation of market leaders before they hit the mainstream investor radar.

In the landscape of investment services, Alpha Picks by Seeking Alpha stands prominently, offering a rich suite of selection tools and insights. Its strength lies in combining rigorous quantitative analysis with actionable stock picks, a methodology I've found invaluable in my own investment journey. This approach, blending empirical rigor with investment acumen, underpins why it occupies the third spot in our list.

At its core, Alpha Picks caters to those who appreciate the depth and precision of data-driven decisions. The service excels in cutting through the noise of market speculation, providing focused recommendations that resonate with disciplined investors looking for long-term growth. It seamlessly integrates into the due diligence process, enhancing traditional analysis with quantitative insights.

The transition to detailing what makes Alpha Picks particularly commendable is as smooth as the evolution of investing has been over decades. With technology and analytics becoming cornerstone elements of successful strategies, services like Alpha Picks are indispensable. This guide will now explore its signature features and how they can amplify your investment outcomes.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

In sum, Alpha Picks by Seeking Alpha offers an advanced 'quantamental' framework that harmoniously blends data analytics with fundamental investing principles. Its array of features facilitates a comprehensive approach to stock selection, catering especially to those dedicated to long-term wealth building.

The service adeptly meets the needs of investors seeking credible, data-backed insights to inform their stock picks. With Alpha Picks, your investment strategy is not just supported but substantially enhanced by the richness of quantitative analysis and the expertise of seasoned analysts. A prudent choice for those committed to cultivating a robust, growth-oriented portfolio.

Seeking Alpha Premium is a cornerstone for discerning investors. It unlocks unparalleled depth in stock research and analysis.

This service equips you with tools to navigate market complexities confidently. It's indispensable for data-driven decision making.

The platform's comprehensive access to financial insights propels your investment strategies forward. Let's dive deeper into its offerings.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

In my experience, Seeking Alpha Premium is an invaluable resource for investors aiming at diligent, thorough market analysis. It supports nuanced investment decisions.

The assortment of tools and insights provided facilitates both broad market understanding and focused research—a compelling combination for sustained success in the dynamic world of investing.

Zacks Premium aims to empower subscribers through its data-driven analysis and research tools. This service is designed for investors who prize the importance of earnings estimate revisions and seek to outperform the market leveraging this strategy. As someone who values deep, analytical approaches to investing, let me share why I think Zacks Premium could be a game-changer for your portfolio.

The cornerstone of Zacks Premium is undoubtedly the Zacks Rank and #1 Rank List. This proprietary ranking system has historically been proven to double the S&P 500’s performance. It's not just about access to ranked lists; it's about gaining insight into which stocks are poised for significant growth, based on sophisticated analysis of earnings estimates and revisions.

Moving on, let's delve into what makes Zacks Premium stand out and how it can serve as a pivotal tool in your arsenal for generating wealth through investing.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Zacks Premium represents an advanced toolkit for investors prioritizing detailed analysis and strategic stock selection. Not just another investment service, it leverages proprietary algorithms and analysis to provide actionable insights that could significantly contribute to outperforming the market.'

'While no service guarantees success, the extensive research resources and tools offered by Zacks Premium make it an attractive option for those committed to a disciplined, informed investment approach. Bearing in mind its cost, its depth of offerings presents it as a valuable asset for serious investors.'

Morningstar Investor champions the importance of independent, comprehensive analysis for lasting investment success. From leveraging its robust suite of tools to tapping into its vast reservoir of expertise, it underscores the significance of informed decision-making. As we unpack the essence of Morningstar Investor, you'll discover how it serves as a cornerstone for those committed to crafting a strategy centered around genuine understanding and long-term vision.

The service brims with features specifically designed to aid self-directed investors and financial professionals alike in making more nuanced, well-rounded investment decisions. It’s not merely about access to data but about understanding the narrative behind numbers – a philosophy deeply ingrained in my own approach to investing.

With this in mind, let's delve into why Morningstar Investor stands as an indispensable resource, particularly if your commitment leans heavily on analytical rigor, objective insights, and strategic portfolio diversification. Its offerings could very well be the lynchpin in elevating your investment journey from conventional to exceptional.

What I Like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Morningstar Investor impeccably aligns with the ethos of investors committed to long-term wealth creation through informed choices. It enables discerning selection backed by rigorous analysis and well-defined logic.

It stands as a beacon for those who value autonomy in their investing journey, providing the necessary tools, insights, and resources to navigate the complexities of the market confidently. While its depth can be daunting, the rewards in clarity, strategy formulation, and execution are unparalleled—making it an invaluable ally in achieving investing success.

In the constellation of investment tools, TipRanks Premium radiates as a beacon for those who navigate the tumultuous seas of the stock market with a compass oriented towards data and expert consensus. Empowering users with a rich tapestry of analytical features, it caters to individual investors and financial advisors alike, ushering them towards informed decision-making shores.

The platform's heart beats with the promise of democratizing financial analytics, offering access to the same caliber of data once reserved for the vaults of towering institutions. This alignment with my investment philosophy underscores the pivotal role of thorough research and balanced viewpoints in sculpting a resilient portfolio.

As we delve deeper into what makes TipRanks Premium an indispensable tool in an investor's arsenal, remember: prudence dictates the marriage of tools like these to one's own research and strategy. Now, let’s explore the uniqueness of its features and how they can be leveraged effectively.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

TipRanks Premium crystallizes as a linchpin in the armory of investors who prioritize a comprehensive analysis backed by expert consensus. With features tailoring to diversified needs - from foundational analysis to trend-spotting - it caters adeptly to those committed to building robust portfolios over meticulous research and strategic insights.

In sum, for those who view investing not just as a transaction but as an academic discipline requiring deep exploration and constant learning, TipRanks Premium offers not only a substantial resource pool but also acts as a guiding light towards informed decision-making in the intricate world of investing.

In the realm of stock picking newsletters and financial advice websites, there are several services that stand out for their unique value propositions and proven performance. From long-term investment strategies to cutting-edge stock recommendations, these services cater to a range of investor needs. Here's a concise summary of the seven best stock picking newsletter services and websites for savvy investors:

Stock picking newsletter services are specialized offerings that provide subscribers with curated and often exclusive investment guidance meant to inform their stock selection decisions. These services usually come in the form of recurring publications that contain a mix of market analysis, individual stock recommendations, and broader investing strategies. They cater to various investor profiles—from those starting their investing journey to the seasoned market participants looking for additional perspectives or lesser-known opportunities.

A key factor that sets premium stock picking newsletters apart is the depth of research and expertise provided. Subscribers receive more than just bare recommendations; they also gain access to comprehensive explanations on why certain stocks are chosen, including detailed analyses of the companies' business models, growth potential, and their fit within current economic contexts. This insightful guidance aims to help investors build and maintain portfolios aligned with their long-term financial goals.

Identifying the best stock picking newsletter subscription can be subjective as it largely depends on an individual investor’s goals, risk tolerance, and investment style. However, what distinguishes a leading service is its consistent track record of outperforming the market, transparency, quality of analysis, and the ability to present actionable investment ideas in an accessible manner—offering not just guidance but educating investors in the process.

For instance, Motley Fool Stock Advisor, sitting at the top with its monthly stock picks from renowned experts, has been commended for its exceptional performance history and clear investment rationale. Its accessibility makes it stand out for investors at all levels. On the other hand, services like Motley Fool Rule Breakers cater to those with a taste for aggressive growth opportunities by spotlighting disruptive industry players. Meanwhile, platforms like Seeking Alpha Premium and Zacks Premium focus on delivering a wealth of data-driven insights and proprietary analytical tools designed to empower investors to make informed decisions amidst market noise. Elaborate star rating systems from Morningstar Investor and comprehensive analyst performance data from TipRanks Premium further exemplify how nuanced investment guidance can drive success in portfolio management.

The efficacy of these subscriptions often comes down to how well they resonate with an investor’s personalized strategy—whether one values long-term, sizable growth or prefers playing aggressive bets on future market leaders. Nevertheless, a combination of empirical success and educational prowess constitutes a strong argument when selecting among the best newsletter services for insightful stock recommendations.

More Stock Market Resources:

Did you know that...

Quotes of the Day:

*Disclaimer: Unless noted otherwise all returns are as of Apr 8, 2024. Past performance is no guarantee of future results. Individual investment results may vary. All investing involves risk of loss.

We provide general information, not investment advice. Some of the links on this page are affiliate links in which we receive a commission when a purchase is made.

$89 promotional price for new members only. $110 discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then current list price.

$99 promotional price for new Rule Breakers members. $200 discount based on current list price for Rule Breakers of $299. Membership will renew annually at the then current list price.