You’re staring at two Motley Fool options and doing the math in your head: $99 for 2 picks a month, or $299 for 5 picks a month. Triple the price for 2.5x the picks. Is that worth it?

Here’s the straight answer: Stock Advisor is the better choice for most investors. Epic only makes sense if you have $50,000+ to deploy and specifically want access to Hidden Gems’ small-cap picks. Otherwise, you’re paying $200 more for complexity you don’t need.

Why This Decision Matters Now (February 2026): This comes down to experience vs. volume — Stock Advisor’s proven 24-year track record (883.8% total returns) versus Epic’s broader approach with more frequent picks across four strategies.

The S&P 500 has pushed to ~6,883 (+0.68% YTD, within 1.4% of ATH) — but the surface calm disguises violent rotation beneath. 83-point dispersion (a new 2026 high) between winners and losers (top 20 averaging +51.8%, bottom 20 at -30.7%) makes this a stock-picker’s market. The sector story is stark: Energy +22.5%, Materials +16.9% are leading, while Tech lags at -2.1% with SNDK surging +155% and WDC +75% as enterprise software drops (CRM -29%, WDAY -34%, INTU -41%). The VIX has dropped to 20.29 (down 4.3%, AI panic subsiding), consumer confidence remains at a 12-year low, and the Fed holds at 3.50-3.75% with CPI at 2.4% YoY. CAPE at ~40 compresses forward index returns and makes alpha essential.

Stock Advisor rates EXCEPTIONAL — its 42 ten-baggers, 65% win rate, and 24-year track record shine when 83-point dispersion makes quality GARP the dominant strategy. Epic rates GOOD — Hidden Gems’ small-cap tilt adds diversification across market caps, and the declining VIX signals improving conditions for growth exposure. The key question: does Epic’s multi-strategy diversification justify the $200 premium, or does Stock Advisor’s proven foundation provide enough exposure to capture this opportunity?

Let me show you exactly why—and when Epic actually becomes the smarter move.

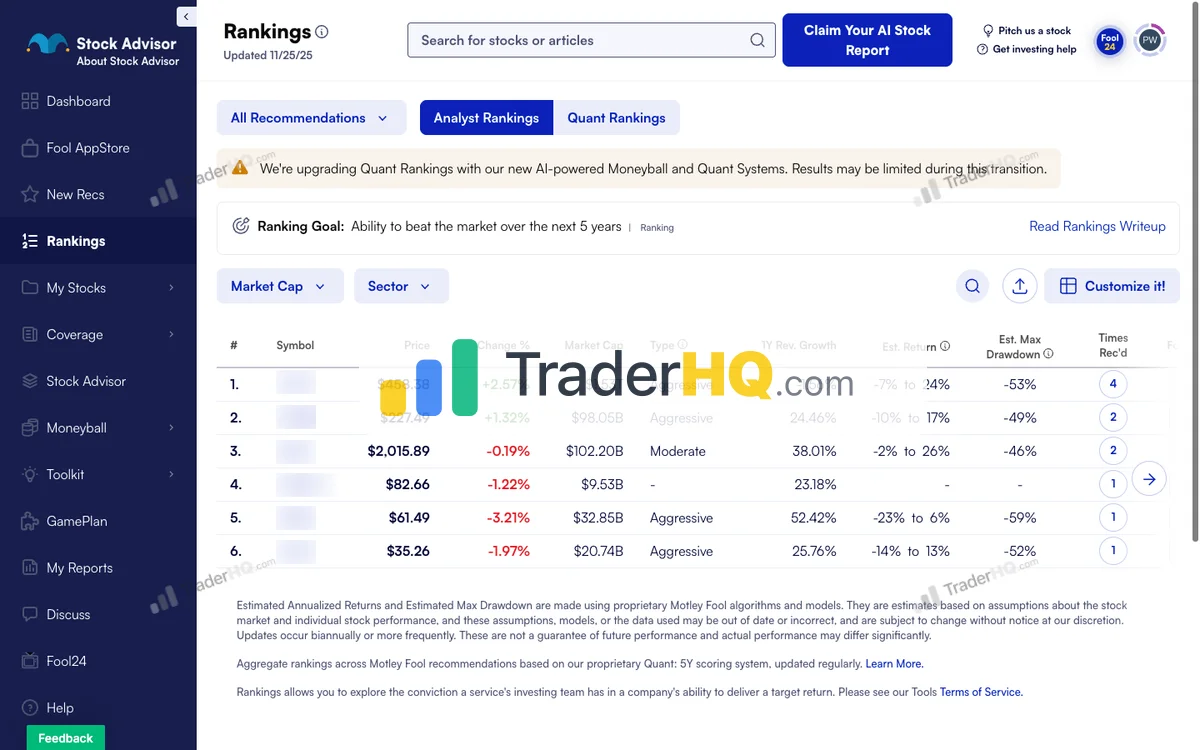

Quick Comparison: Motley Fool Stock Advisor vs Epic

| Dimension | Stock Advisor | Epic | Edge |

|---|---|---|---|

| Price (New Member) | $99/year | $299/year | Stock Advisor |

| Regular Price | $199/year | $499/year (currently $299) | Stock Advisor |

| Monthly Picks | 2 | 5 | Epic |

| Core Track Record | +883.8% since 2002 | Same (includes Stock Advisor) | Tie |

| Small-Cap Access | No | Yes (Hidden Gems) | Epic |

| Moneyball Database | 190+ companies | 340+ companies | Epic |

| Simplicity | Very simple | More to manage | Stock Advisor |

| Target Portfolio | $25,000+ | $50,000+ | Depends on you |

| Overall Winner | — | — | Stock Advisor (for most) |

The table tells the story: Epic includes everything in Stock Advisor plus three additional services. But “more” isn’t automatically “better”—especially when the flagship track record is identical.

For the complete breakdown, see our Stock Advisor review.

Motley Fool Stock Advisor: The Foundation That Actually Matters

Motley Fool Stock Advisor is the original Motley Fool subscription—the one that built their reputation and the one that still drives most of the returns.

Motley Fool Stock Advisor Performance

The Motley Fool · 504 picks · 24 years · Updated Feb 18, 2026

| SA Return | S&P 500 | Alpha | Win Rate |

|---|---|---|---|

| +888% | +193% | +695% | 65% |

S&P 500 shows what you'd have earned buying the index on each pick date instead. Same timing, fair comparison.

| SA Multi-Baggers | 10x+ | 5x+ | 3x+ | 2x+ |

|---|---|---|---|---|

| Count | 42 | 86 | 126 | 181 |

| SA Asymmetry | Avg Winner | Avg Loser | Ratio |

|---|---|---|---|

| Return | +1.5K% | -45% | ~34:1 |

Best Performers (All-Time)

| SA Pick | Return |

|---|---|

AMZN Amazon | +26K% |

TSLA Tesla | +19K% |

DIS Disney | +5.9K% |

AAPL Apple | +5.4K% |

MME.DL MME.DL | +4.3K% |

NFLX Netflix | +41K% |

BKNG Booking Holdings | +18K% |

COST Costco | +3.5K% |

NVDA NVIDIA | +113K% |

CTAS CTAS | +4.4K% |

The multi-bagger pipeline. 181 doublers → 86 5-baggers → 42 10-baggers. About 23% of doublers become 10-baggers with enough time.

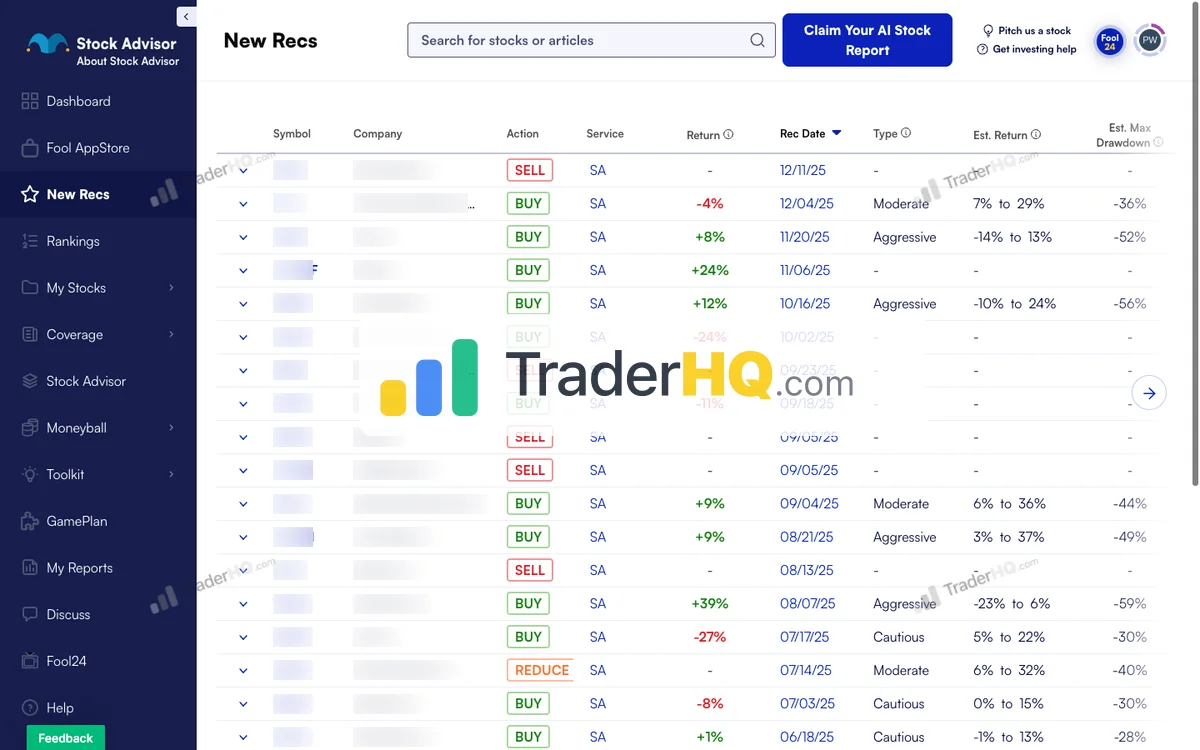

See All Stock Advisor Recommendations →Latest Stock Advisor Picks

Tickers masked to protect subscriber value. Recent picks need 3-5+ years to demonstrate thesis.

| SA Pick | Return |

|---|---|

**** Chip Equipment | +95% |

**** Mobile App Platform | +70% |

**** Space Launch | +58% |

**** Infrastructure Construction | +46% |

**** Growth Company | +35% |

**** Growth Company | +33% |

**** Growth Company | +24% |

**** Athletic Apparel | +16% |

**** Growth Company | +12% |

**** Athletic Footwear | +5% |

$10K → $99K. Following every recommendation since inception would yield a 9.9x return. Recent picks look small now, but compounding hasn't had time to work.

Stock Advisor Win Rate by Holding Period

| Hold Time | SA Win Rate | Avg Return |

|---|---|---|

| < 1 Year | 54.3% | +10% |

| 1-3 Years | 58.2% | +13% |

| 3-5 Years | 37.2% | -2% |

| 5-10 Years | 62.8% | +181% |

| 10+ Years | 92.9% | +3.7K% |

Time is the strategy. 10+ year picks show 92.9% win rate with +3.7K% average returns. Same methodology, same picks—time transforms the results.

Stock Advisor Performance by Year

| Year | SA Picks | Avg Return | Win Rate | |

|---|---|---|---|---|

| 2026 | 2 | 0% | 50% | CASY+4% |

| 2025 | 25 | +6% | 52% | HWM+106% |

| 2024 | 25 | +6% | 58% | SHOP+85% |

| 2023 | 25 | +44% | 75% | CRWD+235% |

| 2022 | 23 | +22% | 43% | NET+285% |

| 2021 | 23 | -33% | 17% | LRCX+360% |

| 2020 | 24 | +82% | 29% | TSLA+1.3K% |

| 2019 | 24 | +36% | 67% | SNPS+243% |

| 2018 | 22 | +155% | 64% | SHOP+795% |

| 2017 | 23 | +568% | 87% | NVDA+7.1K% |

| 2016 | 21 | +367% | 81% | SHOP+3.4K% |

| 2015 | 24 | +195% | 71% | CASY+721% |

| 2014 | 21 | +215% | 81% | IBKR+995% |

| 2013 | 19 | +324% | 68% | NFLX+2.4K% |

| 2012 | 23 | +1.3K% | 74% | TSLA+19K% |

| 2011 | 19 | +492% | 63% | AAPL+2.6K% |

| 2010 | 18 | +418% | 83% | AMZN+2.2K% |

| 2009 | 20 | +2.8K% | 90% | NVDA+48K% |

| 2008 | 18 | +1.0K% | 94% | AAPL+5.4K% |

| 2007 | 19 | +1.5K% | 37% | NFLX+27K% |

| 2006 | 20 | +2.3K% | 65% | NFLX+24K% |

| 2005 | 16 | +7.2K% | 63% | NVDA+113K% |

| 2004 | 17 | +5.4K% | 59% | NFLX+41K% |

| 2003 | 17 | +230% | 65% | BWA+1.4K% |

| 2002 | 16 | +2.6K% | 81% | AMZN+26K% |

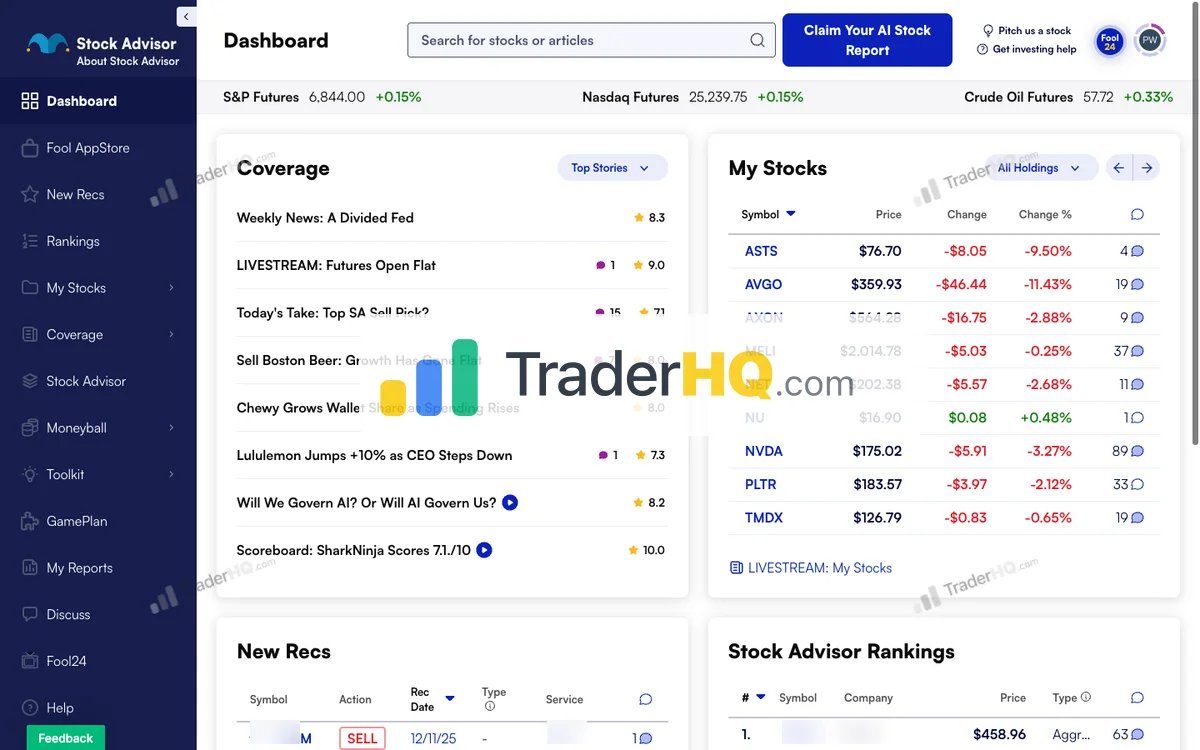

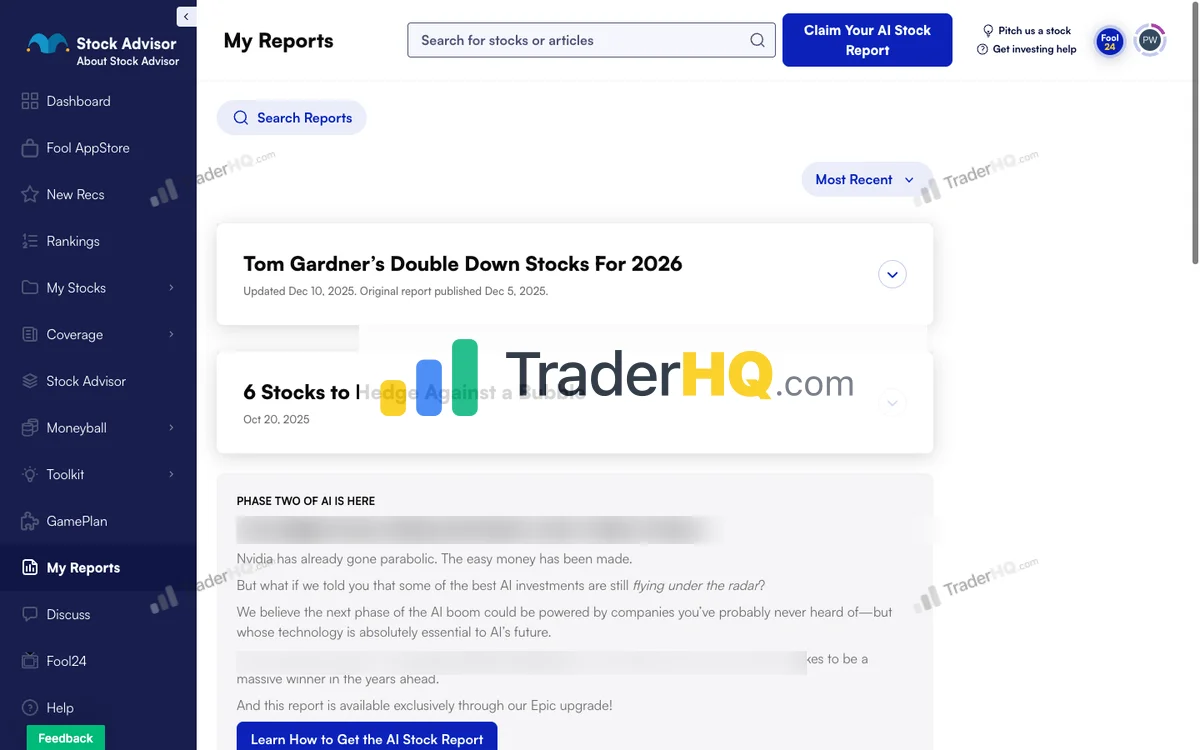

Inside Stock Advisor

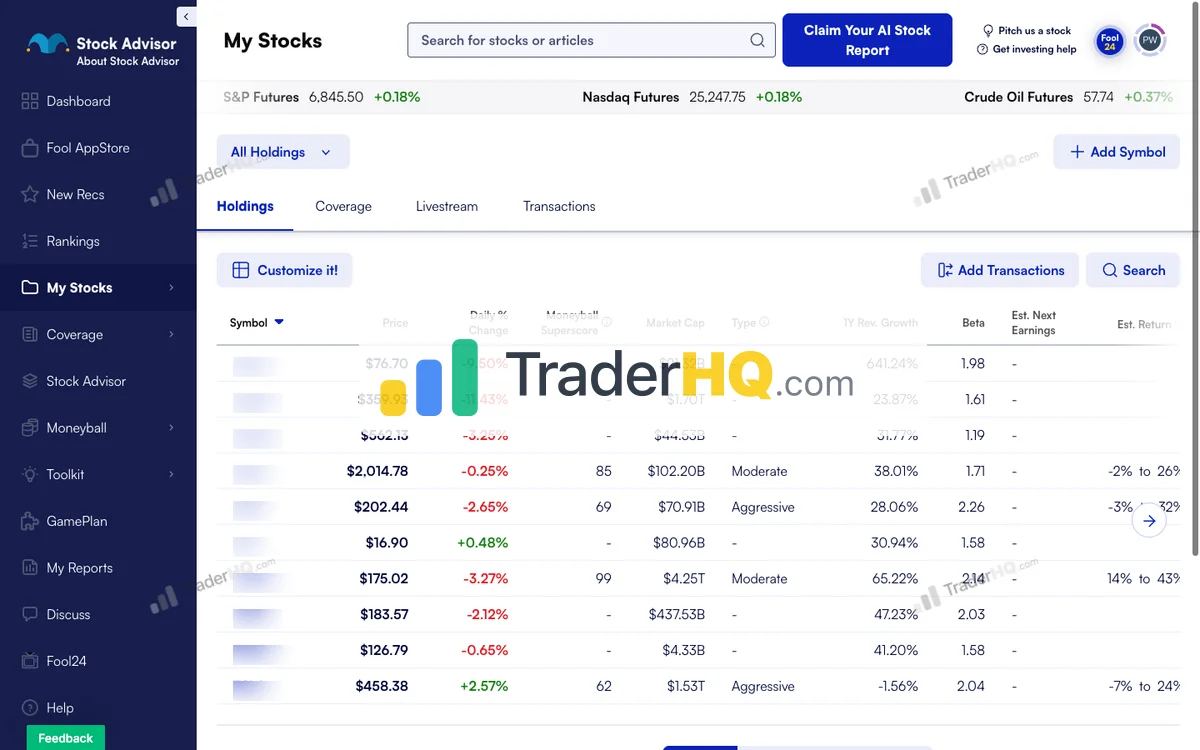

9 screenshots · Click to expand

The Philosophy: Find companies with durable competitive advantages, buy them, and hold for 5+ years while the market catches up to their value. Two picks per month. No noise, no complexity.

The Numbers: Since 2002, Stock Advisor picks have returned +883.8% compared to the S&P 500’s +196%. That’s not a typo. $10,000 invested following their methodology would be worth roughly $98,380 today. The same amount in an index fund? About $29,600.

February 2026 Context: Stock Advisor’s 24-year track record is proving its worth in a market that punishes passivity. The S&P 500 has pushed to ~6,883 (+0.68% YTD, within 1.4% of ATH), but 83-point dispersion (a new 2026 high) means disciplined stock selection is everything — top 20 stocks average +51.8% while bottom 20 average -30.7%. The quality rotation continues: Energy +22.5%, Materials +16.9% are leading, while Tech sits at -2.1% with violent internal splits (SNDK +155%, WDC +75%, MU +48% vs CRM -29%, NOW -29%, WDAY -34%, INTU -41%). The VIX has dropped to 20.29 (down 4.3%, AI panic subsiding), but consumer confidence remains at a 12-year low despite credit spreads holding at 2.94% and manufacturing PMI at 52.6 signaling expansion. The Fed holds at 3.50-3.75%, CPI at 2.4% (core 2.5%) confirms disinflation, and CAPE sits near ~40. Stock Advisor’s 65% overall win rate improves dramatically with patience — 92% for positions held 10+ years. They’ve generated 42 ten-baggers and 182 doublers across 504 positions through every crisis. That through-cycle proof matters most when the macro picture sends mixed signals.

But those numbers come with volatility. Stock Advisor’s portfolio dropped 40%+ in 2022 while the S&P fell 18%. Their biggest winners—Netflix, Amazon, Nvidia—have all seen 50%+ drawdowns at various points. The strategy works if you can hold through the pain.

What You Get:

- 2 new stock picks per month

- Foundational Stocks list (10 highest-conviction core holdings)

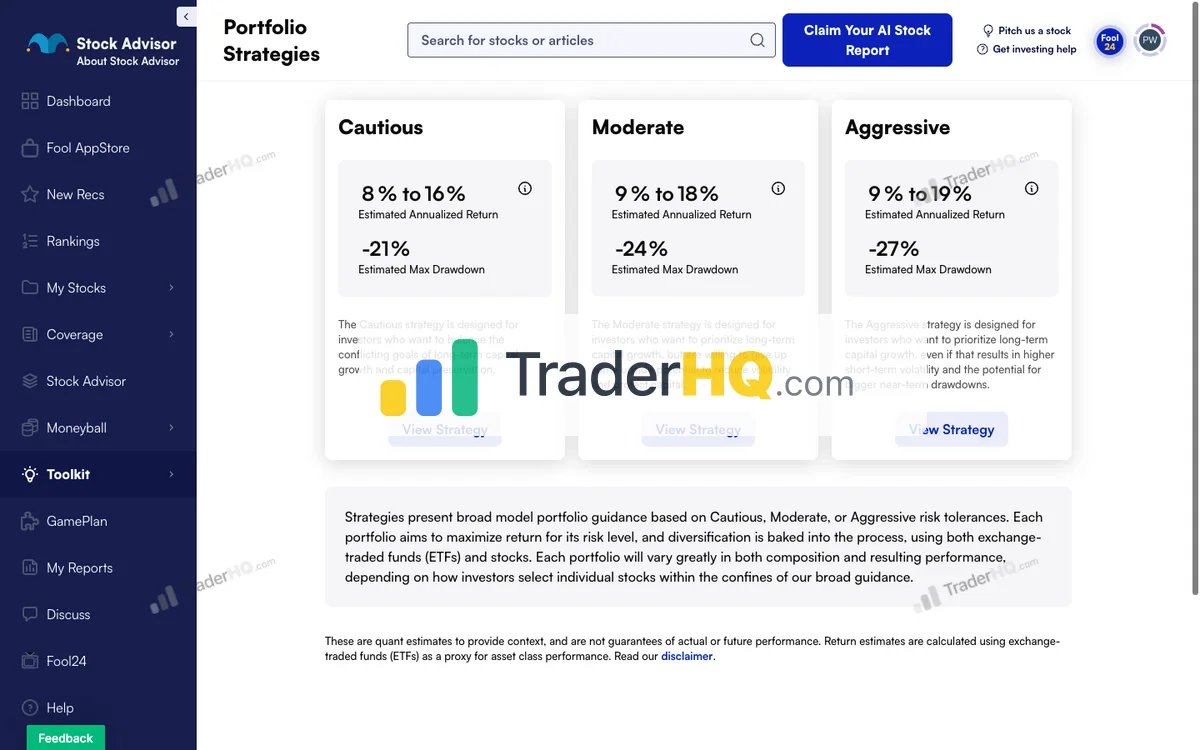

- Three portfolio strategies (Cautious, Moderate, Aggressive)

- Moneyball database with 190+ companies

- Quantitative projections for every recommendation

Best For: Investors with 5+ year horizons, portfolios of $25,000+, and the stomach for volatility. If you need hand-holding during crashes or want constant activity, this will frustrate you.

The Reality Check: About 65% of Stock Advisor picks are winners overall—improving to 92% for 10+ year holds. The strategy works because the winners dramatically outperform the losers—but only if you hold long enough to let them compound.

Epic: The Bundle That Adds Three Services

Motley Fool Epic is the next tier up—a bundle that includes Stock Advisor plus three additional services: Rule Breakers, Hidden Gems, and Dividend Investor.

No screenshots available for motley-fool-epic

The Philosophy: Same long-term holding approach as Stock Advisor, but with diversified exposure across growth, small-cap, and income strategies. Five picks per month instead of two.

What’s Actually Inside:

| Service | Focus | Track Record |

|---|---|---|

| Stock Advisor | Large-cap growth | +883.8% since 2002 |

| Rule Breakers | Aggressive growth | +313.8% since 2004 |

| Hidden Gems | Small/mid-cap | +46.7% (7.4 years) |

| Dividend Investor | Income focus | +16.8% (6.1 years) |

The Honest Assessment: Stock Advisor and Rule Breakers have significant overlap—both target growth companies, and many picks appear in both services. If you’re curious about Rule Breakers specifically, we break down the comparison in our Stock Advisor vs Rule Breakers analysis. The real differentiation in Epic is Hidden Gems, led by co-founder Tom Gardner, which focuses on under-the-radar small and mid-caps that larger services overlook.

Dividend Investor has returned +16.8% over 6.1 years with a 72% win rate across 85 positions. It underperforms the S&P 500 by about 40 percentage points, but provides income stability and defensive positioning.

What You Get Beyond Stock Advisor:

- 3 additional picks per month (5 total)

- Hidden Gems small-cap access

- Full Fool IQ with Quant projections

- Expanded Moneyball database (340+ companies)

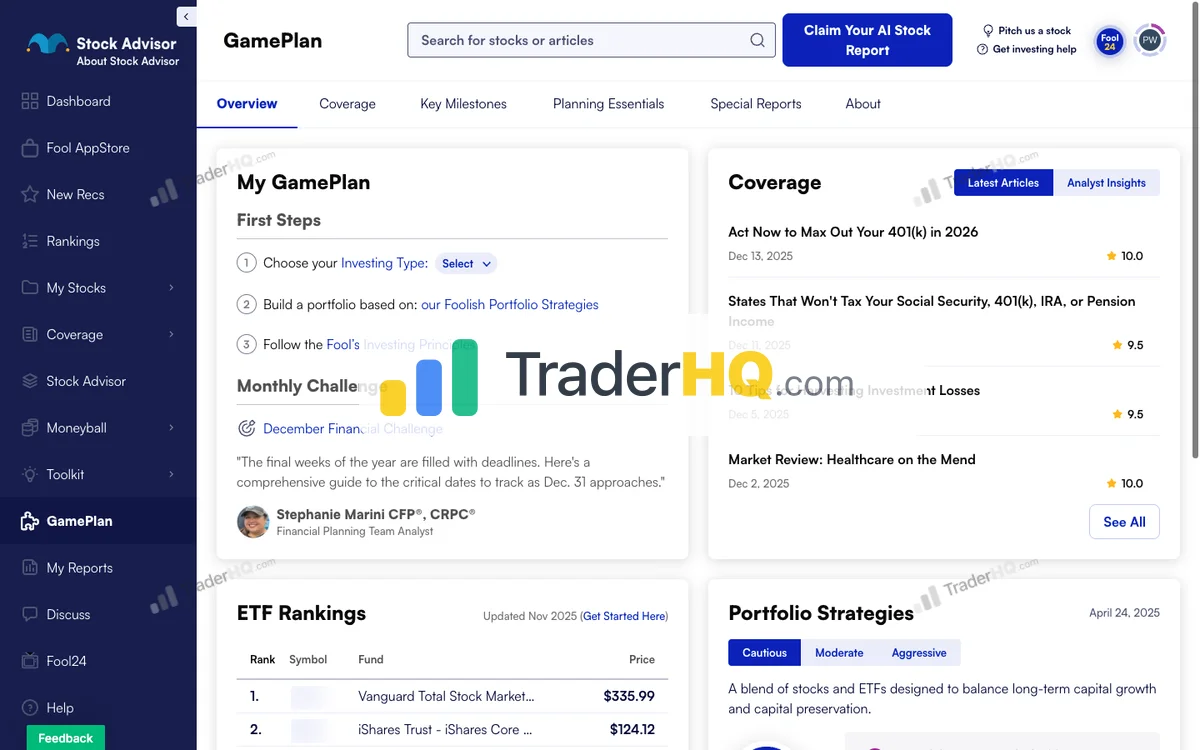

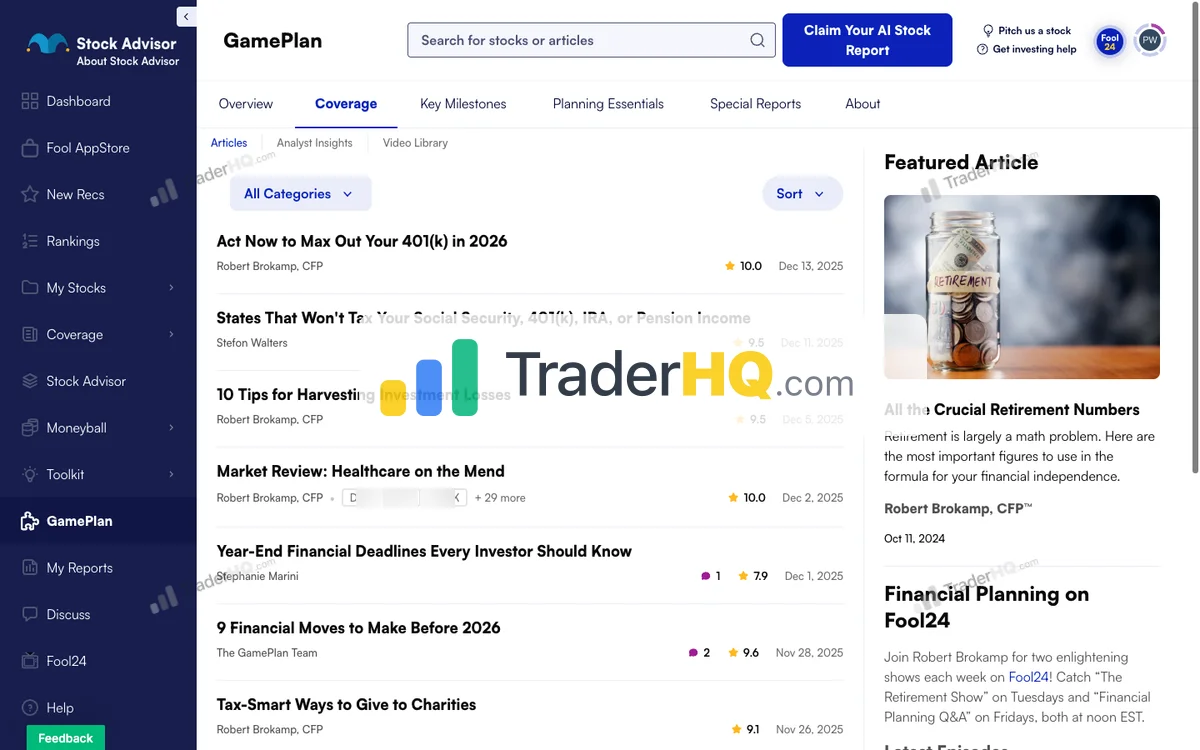

- GamePlan+ financial planning content

Best For: Investors with $50,000+ portfolios who want diversified exposure across multiple strategies and have the capital to deploy 5 picks per month without overconcentrating.

For the full analysis, see our Epic bundle review.

Head-to-Head: The Three Differences That Actually Matter

Forget the feature checklists. Here’s what really separates these services:

1. Capital Deployment Capacity

This is the crux of the decision.

With Stock Advisor’s 2 picks per month, you’re adding 24 positions per year. If you’re investing $1,000 per pick, that’s $24,000 deployed annually. For a $25,000 portfolio, that’s nearly your entire capital in year one.

Epic’s 5 picks per month means 60 positions per year. Same $1,000 per pick equals $60,000 deployed. For a $50,000 portfolio, you’d be fully deployed in 10 months.

The Math: If your portfolio is under $50,000, you likely can’t deploy 5 picks per month without overconcentrating in newer, unproven positions. Stock Advisor’s 2 picks give you room to build positions gradually.

If you have $100,000+, Stock Advisor’s 2 picks might feel limiting. You have capital sitting idle while waiting for the next recommendation.

2. Hidden Gems Access

This is Epic’s genuine differentiation.

Hidden Gems targets small and mid-cap companies that fly under Wall Street’s radar. These are the stocks with higher growth potential—and higher risk—that Stock Advisor’s large-cap focus doesn’t cover.

Hidden Gems has returned +46.7% over 7.4 years with a 70% win rate, 59 doublers, and 18 ten-baggers across 150 positions. The philosophy is sound: find quality companies before they become household names.

The Question: Do you want small-cap exposure? If yes, Epic is the only way to get it within the Motley Fool ecosystem. If you’re comfortable with large-cap growth stocks, Stock Advisor covers that territory.

3. Complexity vs. Simplicity

Stock Advisor is clean. Two picks per month. One portfolio strategy. Simple decisions.

Epic is busier. Five picks across four services. More decisions about what to buy, how much to allocate, and how to balance across strategies.

For some investors, more picks means more opportunities. For others, it means more noise, more second-guessing, and more chances to make mistakes.

The Self-Assessment: Are you the type who thrives with more options, or do you perform better with constraints? Your answer matters more than the feature comparison.

How to Decide: Stock Advisor vs Epic

Choose Stock Advisor if:

- Your portfolio is under $50,000

- You want simplicity over variety

- You’re new to stock-picking services

- You prioritize the proven flagship track record at the lowest cost

- You find 2 picks per month sufficient for your capital deployment

Choose Epic if:

- You have $50,000+ to deploy

- You specifically want Hidden Gems’ small-cap exposure

- You find yourself wanting more picks than Stock Advisor provides

- You can manage 5 positions per month without overcomplicating your portfolio

- The $200 price difference is trivial relative to your portfolio size

Either Works if:

- You’ll actually follow the recommendations (the biggest variable is you, not the service)

- You understand that 30-35% of picks from any service will lose money

- You can hold through 40-50% drawdowns without panic-selling

- You’re adding this as one input to your process, not your entire strategy

The Tiebreaker: If you’re still stuck, ask yourself: “Do I have capital sitting idle because Stock Advisor only gives me 2 picks per month?” If yes, Epic. If you’re still building positions from existing recommendations, Stock Advisor.

The Upgrade Path: When Stock Advisor Members Should Consider Epic

Here’s the scenario where Epic makes sense as an upgrade:

You’ve been a Stock Advisor member for 2+ years. You’ve built positions in most of the Foundational Stocks. You’re following the new picks each month. And you have fresh capital you want to deploy—but you’re waiting weeks for the next recommendation.

That’s when Epic’s additional 3 picks per month becomes valuable. Not because the picks are “better,” but because you have capital that needs a home.

The Wrong Reason to Upgrade: “I want better returns.” Epic won’t deliver better returns than Stock Advisor—it delivers more picks. The flagship Stock Advisor track record is identical in both packages. If you’re upgrading hoping for superior performance, you’ll be disappointed.

The Right Reason to Upgrade: “I have more capital to deploy than Stock Advisor can absorb.” That’s the legitimate use case for Epic.

The Bottom Line

Stock Advisor wins for most investors. The 24-year track record (+883.8%), the 65% win rate improving to 92% for decade-long holds, 42 ten-baggers, the simplicity of 2 picks per month, and the $99 price point make it the obvious starting point. You get the methodology that built Motley Fool’s reputation without the complexity of managing multiple services.

Epic earns a GOOD fit rating for investors with $50K+ portfolios who want broader exposure across market caps. With 83-point dispersion (a new 2026 high) — the strongest stock-picker’s signal of 2026 — Hidden Gems’ small-cap focus adds genuine diversification. The sector rotation continues: Energy +22.5%, Materials +16.9% are leading while Tech lags at -2.1% with violent internal splits (SNDK +155%, WDC +75% vs CRM -29%, INTU -41%). The VIX has dropped to 20.29 (down 4.3%, AI panic subsiding), consumer confidence remains at a 12-year low, and the S&P 500 at ~6,883 (+0.68% YTD) confirms this is a market that rewards selectivity. The $200 premium is justified if you have the capital to deploy five picks monthly and specifically want small-cap exposure — otherwise, Stock Advisor’s EXCEPTIONAL fit rating, 883.8% total return, and 24-year track record may better serve investors who value proven methodology over breadth.

The real question isn’t which service is “better.” It’s whether you have the capital and appetite for more picks. Stock Advisor is the foundation. Epic is the expansion. Start with the foundation unless you have a specific reason to expand.

If I had to pick one for a friend who’s never subscribed? Stock Advisor, because the training wheels of simplicity make it easier to follow the process that actually generates returns.

Want to compare these with other options? Explore our guide to the best stock advisors. See also: Stock Advisor vs Motley Fool One for the all-access tier, or Stock Advisor vs Alpha Picks for an outside-the-Fool-ecosystem alternative.

Frequently Asked Questions

Stock Advisor vs Epic: which is better?

Stock Advisor earns an EXCEPTIONAL fit rating for most investors — both include the same flagship picks with the +883.8% track record since 2002 (65% win rate, 92% for 10+ year holds, 42 ten-baggers, 182 doublers across 504 positions). Epic earns a GOOD fit rating — Hidden Gems’ small-cap tilt adds market-cap diversification and 83-point dispersion (a new 2026 high) creates selective opportunities across caps, with the declining VIX (20.29, down 4.3%) improving conditions for growth exposure. Epic adds Rule Breakers, Hidden Gems, and Dividend Investor for $200 more per year, but only adds value if you have $50,000+ to deploy. For portfolios under $50K, Stock Advisor’s 2 picks per month is sufficient.

Is Motley Fool Stock Advisor worth it?

Yes, for long-term investors who can hold 5+ years. At $99/year (new member price), Stock Advisor has returned +883.8% since 2002 vs the S&P 500’s +196%. The 65% overall win rate improves to 92% for 10+ year holds, with 42 ten-baggers generated across 504 positions. The math works if you follow the strategy—patience lets the winners compound. The 30-day money-back guarantee lets you test the service risk-free.

Is Motley Fool Epic worth it?

Yes, but only for investors with $50,000+ portfolios. Epic costs $299/year (new member price) and provides 5 picks per month across four services. The genuine value is Hidden Gems’ small-cap access—Stock Advisor and Rule Breakers have significant overlap. If you have the capital to deploy 5 picks monthly and want diversified exposure, Epic delivers. For smaller portfolios, Stock Advisor at $99 is the better starting point.

Can I use both Stock Advisor and Epic?

No—Epic includes Stock Advisor. Epic is a bundle that contains Stock Advisor plus Rule Breakers, Hidden Gems, and Dividend Investor. If you subscribe to Epic, you get all Stock Advisor picks automatically. There’s no reason to pay for both. The decision is whether to start with Stock Advisor alone or upgrade to the full Epic bundle.

What’s included in Epic that’s not in Stock Advisor?

Epic adds three services beyond Stock Advisor: Rule Breakers (aggressive growth, +313.8% since 2004), Hidden Gems (small/mid-cap, +46.7% over 7.4 years), and Dividend Investor (income focus, +16.8% over 6.1 years). You also get an expanded Moneyball database (340+ vs 190+ companies), full Fool IQ access, and GamePlan+ financial planning content. The most valuable addition is Hidden Gems’ small-cap picks.

Should I start with Stock Advisor or Epic?

Start with Stock Advisor unless you have $50K+ to deploy. Stock Advisor’s 2 picks per month is sufficient for portfolios under $50,000. You can always upgrade to Epic later when your portfolio grows and you need more picks to deploy. Starting with Epic when you can’t fully utilize 5 picks per month means paying for features you won’t use.

Is Stock Advisor worth it in 2026?

Yes — the case for Stock Advisor is as strong as it’s ever been. With 883.8% total returns since 2002, 42 ten-baggers, and 182 doublers across 504 positions, the track record speaks for itself. February 2026’s 83-point dispersion (a new 2026 high) between winners (+51.8%) and losers (-30.7%) means stock selection dramatically outperforms passive indexing (S&P 500 at ~6,883, +0.68% YTD). The sector rotation tells the story: Energy +22.5%, Materials +16.9% are leading while Tech lags at -2.1% — Stock Advisor’s quality GARP methodology naturally gravitates toward durable, profitable companies that benefit from this rotation. The VIX at 20.29 (down 4.3%) signals calming conditions, but consumer confidence at a 12-year low and CAPE near ~40 mean company-level fundamentals remain the only reliable anchor. At $99/year for new members, the cost is trivial relative to the alpha opportunity.

Which Motley Fool service is best for the current market rotation?

Stock Advisor for proven methodology; Epic for broader coverage. The 2026 rotation continues: Energy +22.5%, Materials +16.9% are leading while Tech sits at -2.1% (internally bifurcated: SNDK +155%, WDC +75% vs CRM -29%, INTU -41%). The Fed holding at 3.50-3.75% with CPI at 2.4% (core 2.5%) favors quality GARP approaches. Stock Advisor’s methodology naturally gravitates toward durable companies. Epic adds Hidden Gems (small-cap exposure across market caps), Rule Breakers (contrarian entries into beaten-down growth as the VIX declines to 20.29), and Dividend Investor (defensive income when consumer confidence is at a 12-year low). 83-point dispersion (a new 2026 high) and manufacturing PMI at 52.6 reward selectivity at every cap level. Choose based on your capital: Stock Advisor for portfolios under $50K, Epic for $50K+.