February 2026: Two different time horizons, one elevated-volatility market — and each systematic approach faces a different test.

The market isn’t rewarding complacency. VIX at ~21.77 has climbed well above the sub-17 levels of early February, creating a fundamentally different environment for both quant investing and swing trading.

What the quant long-term investor sees:

- A structural rotation into defensive sectors — Energy (+21.6%), Consumer Staples (+15.2%) — while Tech drops -3.1% and the S&P 500 sits flat at 6,832.76

- Memory stocks averaging +82% while enterprise software averages -33% — an intra-sector gap the quant factors captured early

- 81-point dispersion (top 20 at +50.2%, bottom 20 at -31.2%) — the strongest stock-picker’s signal of 2026

- CPI at 2.4% (lowest since May 2025) confirming the disinflation trend that supports quality and profitability factors

- Consumer confidence at a 12-year low and credit spreads at 2.92% — historically, this kind of consumer softening creates contrarian opportunities for patient quant investors

What the technical short-term trader sees:

- VIX at ~21.77 — elevated volatility expands option premiums and creates wider swing ranges, exactly the environment where technical pattern recognition should generate opportunities

- The Fed at 3.50-3.75% despite CPI cooling to 2.4% — the policy lag creates rate-sensitive dislocations that swing traders can exploit

- 81-point dispersion (2026’s highest) creating intraday spreads between sector leaders and laggards

Alpha Picks captures the structural rotation. Mindful Trader captures the tactical swings. Different tools for different time horizons — and elevated VIX tests them differently. For Alpha Picks, VIX at ~21.77 creates friction for momentum-driven positions but doesn’t impair value, profitability, or EPS revision factors. The ★★★★☆ fit rating reflects this split: CPI relief supports fundamentals while volatility compresses short-term edge. For Mindful Trader, elevated VIX should theoretically expand opportunities — wider price swings mean more setups — but the whipsaw risk increases too. CAPE at ~40 compresses forward index returns, making both active approaches more compelling than passive indexing. APP’s crash from +1,571% to -45.6% reminds us that even well-positioned strategies face concentration risk the models haven’t fully stress-tested against.

Alpha Picks wins for most investors. The +308.3% verified return since July 2022 (vs S&P 500’s +83%) isn’t marketing—it’s documented and verified by S&P Global using GIPS standards. The service has a 73% win rate (77.8% for 1-3 year holds). Mindful Trader’s 141% median annual return sounds impressive, but it’s back-tested data, not live trading results. One caveat: APP crashed from +1,571% to -45.6%, showing concentration risk in action. CLS remains an emerging ten-bagger at +983%.

Important Caveat: Alpha Picks is only 3.6 years old (launched July 2022) and has only been tested in one bear market. Consider pairing with a recession-tested service like Stock Advisor for comprehensive coverage.

But here’s the real question: Do you want to be an investor or a trader?

Alpha Picks gives you 2 stock picks per month and asks you to hold for 1-3 years. Mindful Trader sends 1-3 trade alerts per day and expects you to act near market open. Same “quant” label, completely different lifestyles.

If you have the patience for long-term investing and want a verified track record, Alpha Picks is the clear choice. If you enjoy active trading and want monthly billing flexibility, Mindful Trader might suit your style—just understand you’re betting on hypothetical returns.

Quick Comparison: Alpha Picks vs Mindful Trader

| Dimension | Alpha Picks | Mindful Trader | Edge |

|---|---|---|---|

| Track Record | +308.3% since July 2022 (live, verified) | 141% median annual (back-tested) | Alpha Picks |

| CAGR | 46.9% | N/A (back-tested) | Alpha Picks |

| Verification | S&P Global (GIPS standards) | Self-reported | Alpha Picks |

| Annual Cost | $449-499/year | $564/year ($47/mo) | Alpha Picks |

| Billing Flexibility | Annual only, no refunds | Monthly, cancel anytime | Mindful Trader |

| Holding Period | 1-3 years optimal | ~1 week average | Depends on style |

| Time Commitment | 2 picks/month (set-and-forget) | 1-3 picks/day (active) | Alpha Picks |

| Asset Types | Stocks only | Stocks + Options | Mindful Trader |

| Win Rate | 73% (77.8% at 1-3 years) | Not disclosed (live) | Alpha Picks |

| Ten-Baggers | 3 emerging (CLS +983%, POWL +984%, APP +976%); APP crashed from peak to -45.6% | N/A | Alpha Picks |

| Track Record Length | 3.6 years | 4+ years | Mindful Trader |

| Overall Winner | — | — | Alpha Picks |

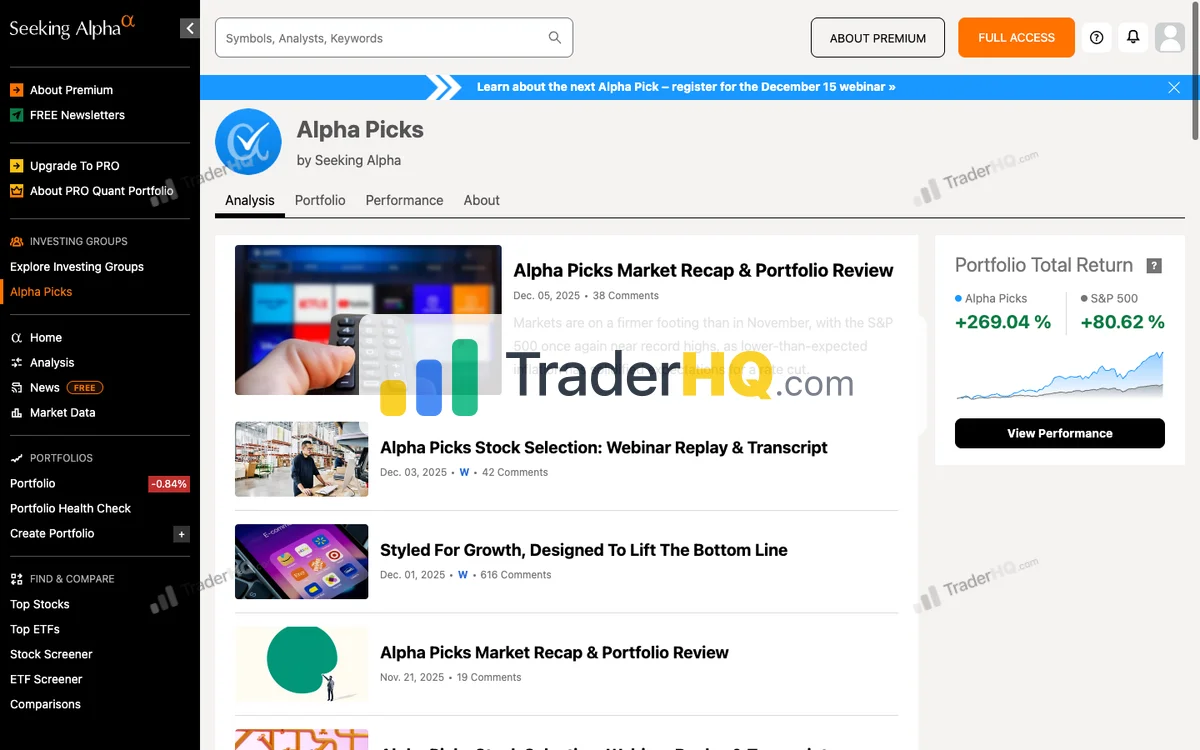

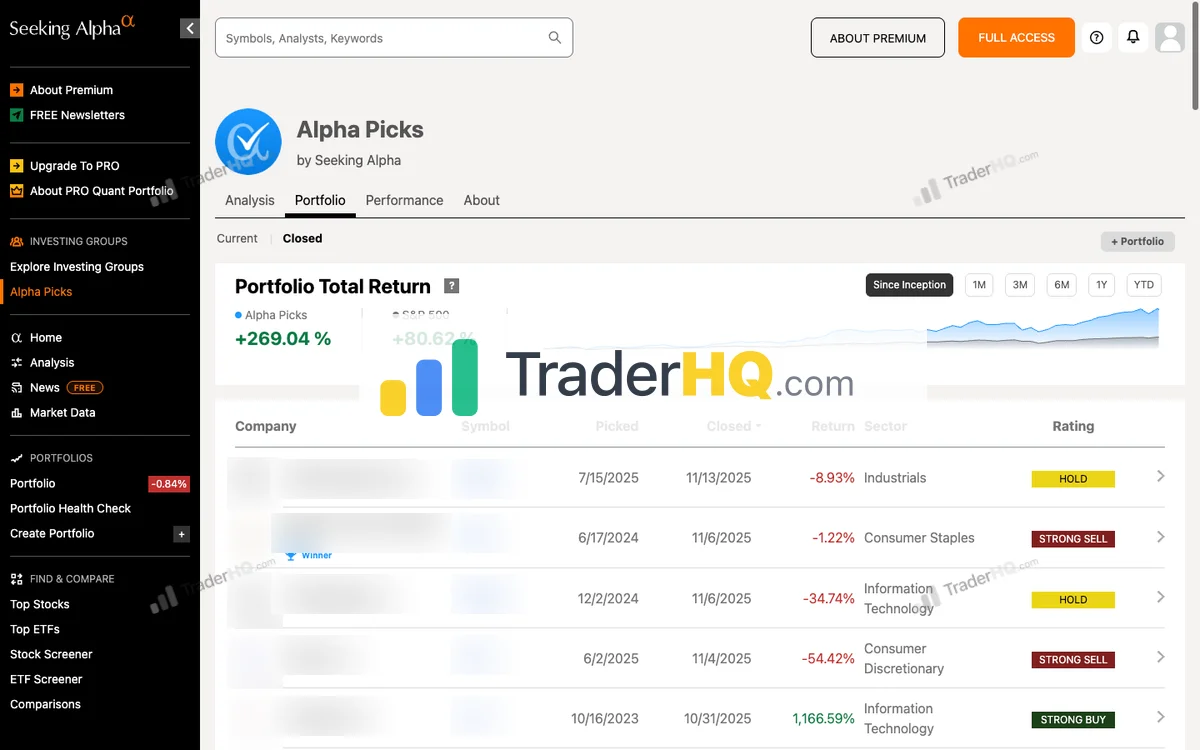

Alpha Picks: The Verified Quant System

Alpha Picks is Seeking Alpha’s flagship stock-picking service—a pure quantitative system with no human discretion. The algorithm evaluates stocks across five factors: Value, Growth, Profitability, Momentum, and EPS Revisions. When a stock scores high enough, it gets recommended. When the score drops, it gets sold.

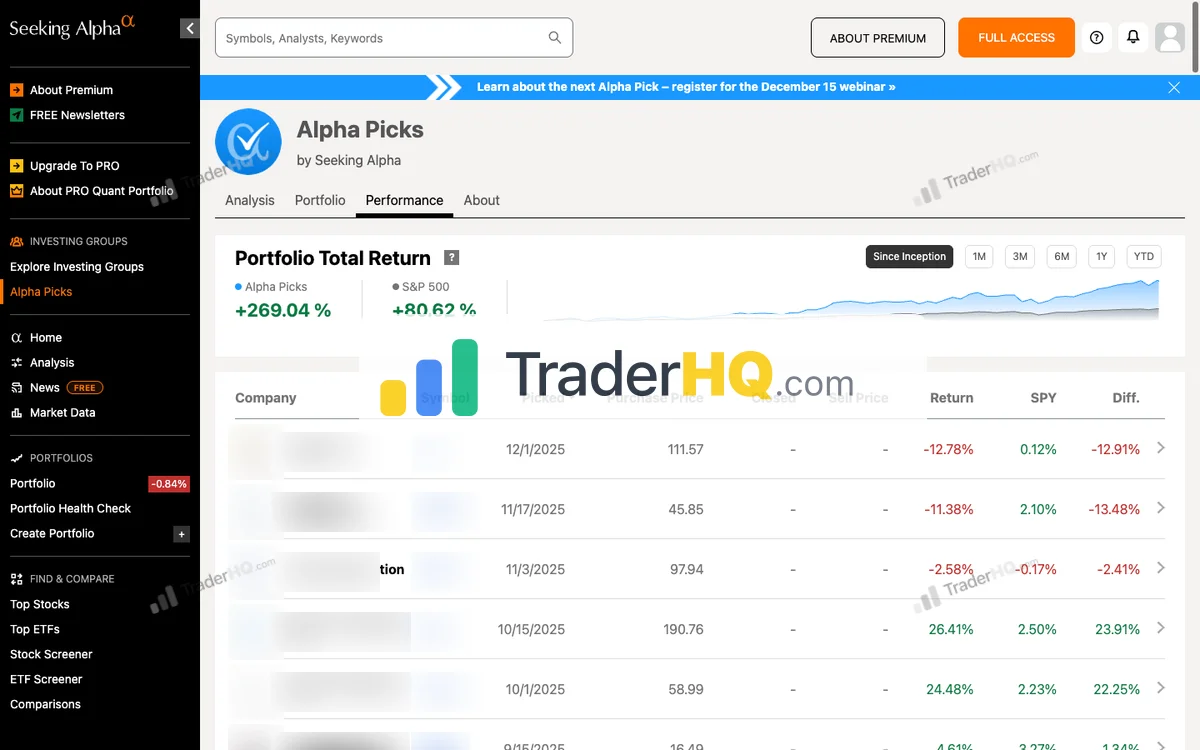

Alpha Picks by Seeking Alpha Performance

Seeking Alpha · 92 picks · 4 years · Updated 2026-02-19

| AP Return | S&P 500 | Alpha | Win Rate |

|---|---|---|---|

| +297% | +81% | +216% | 73% |

S&P 500 shows what you'd have earned buying the index on each pick date instead. Same timing, fair comparison.

| AP Multi-Baggers | 10x+ | 5x+ | 3x+ | 2x+ |

|---|---|---|---|---|

| Count | 1 | 4 | 10 | 14 |

| AP Asymmetry | Avg Winner | Avg Loser | Ratio |

|---|---|---|---|

| Return | +110% | -22% | ~5:1 |

Best Performers (All-Time)

| AP Pick | Return |

|---|---|

**** Casual Dining | +209% |

**** Growth Company | +153% |

**** Thermal Management | +348% |

STRL Sterling Construction | +558% |

**** Power Plant Construction | +249% |

APP AppLovin | +1.6K% |

POWL Powell Industries | +894% |

CLS Celestica | +1.2K% |

**** Homebuilder | +228% |

SMCI Super Micro Computer | +969% |

Latest Alpha Picks Picks

Tickers masked to protect subscriber value. Recent picks need 3-5+ years to demonstrate thesis.

| AP Pick | Return |

|---|---|

**** Memory Chips | +121% |

**** Precious Metals Mining | +106% |

**** Engineering Services | +77% |

**** Pawn & Financial Services | +63% |

**** Gold Mining | +62% |

**** Dermatology Biotech | +62% |

**** Circuit Board Manufacturing | +59% |

**** Infrastructure Construction | +58% |

**** Growth Company | +37% |

**** Growth Company | +30% |

Alpha Picks Win Rate by Holding Period

| Hold Time | AP Win Rate | Avg Return |

|---|---|---|

| < 1 Year | 65.8% | +14% |

| 1-3 Years | 77.8% | +117% |

| 3-5 Years | N/A% | N/A |

| 5-10 Years | N/A% | N/A |

| 10+ Years | N/A% | N/A |

Alpha Picks Performance by Year

| Year | AP Picks | Avg Return | Win Rate | |

|---|---|---|---|---|

| 2026 | 4 | +8% | 100% | B+11% |

| 2025 | 24 | +30% | 75% | MU+121% |

| 2024 | 24 | +49% | 67% | CLS+259% |

| 2023 | 24 | +161% | 71% | CLS+967% |

| 2022 | 16 | +65% | 75% | MOD+348% |

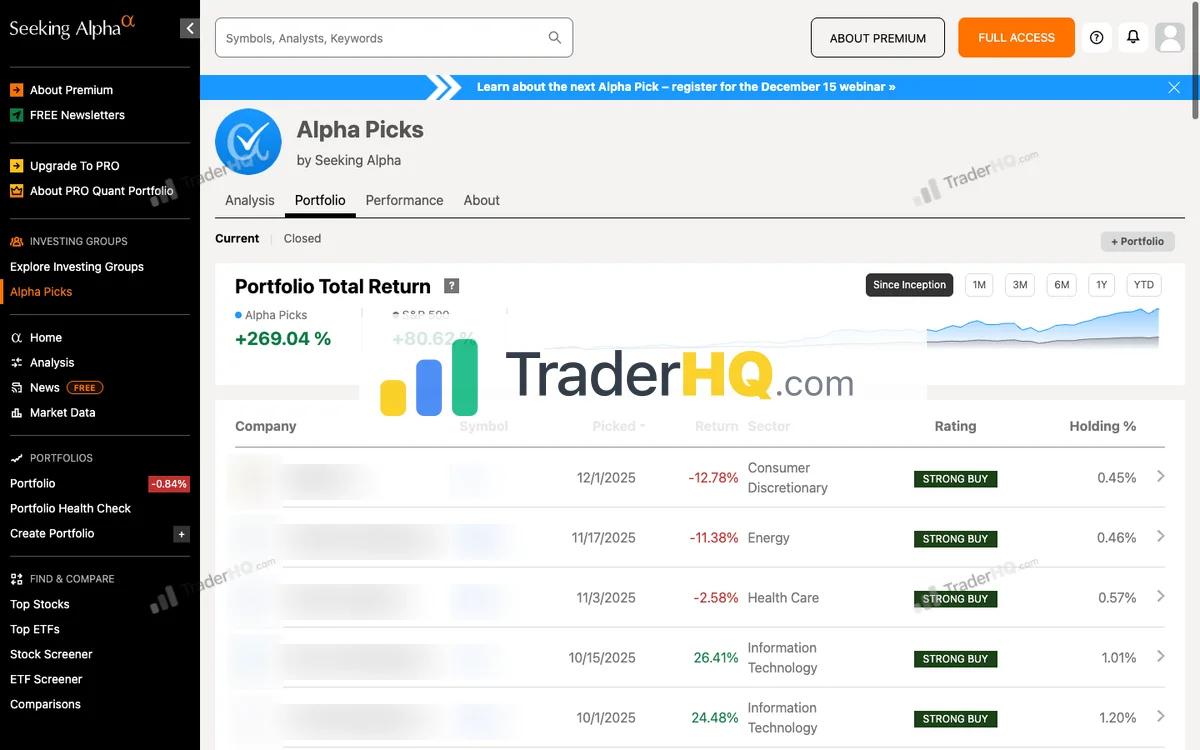

Inside Alpha Picks

6 screenshots · Click to expand

The philosophy is simple: trust the data, not the narratives.

The Numbers That Matter (February 2026)

Since launching in July 2022, Alpha Picks has delivered:

- +308.3% total return vs S&P 500’s +83%

- 46.9% CAGR

- 73% overall win rate

- 77.8% win rate for positions held 1-3 years (+123% avg return)

- 3 emerging ten-baggers including CLS +983%

- The APP cautionary tale: peaked at +1,571%, now -45.6%—concentration risk in action

- 2025 Vintage: 75% win rate, +29% avg return

The performance isn’t self-reported—it’s calculated by S&P Global using GIPS (Global Investment Performance Standards). Every position is visible: entry date, exit date, and return. Winners and losers.

The Time Curve Is Everything

Here’s what separates Alpha Picks from day-trading services:

| Holding Period | Win Rate | Avg Return |

|---|---|---|

| Under 1 year | 64.9% | +14.6% |

| 1-3 years | 77.8% | +123% |

The system is designed for patience. If you’re checking your portfolio daily and panicking at drawdowns, you’ll underperform the strategy.

Why Quant Long-Term Positioning Is Working Now

The distinction between structural and tactical matters here. Alpha Picks doesn’t try to time the Dow’s +1,207 point single-session move. It positions in the factors that caused the move — and holds through the noise.

The structural case for quant positioning:

- Defensive rotation with earnings power: Energy +21.6%, Consumer Staples +15.2% — these aren’t just flight-to-safety trades. They’re driven by real earnings acceleration in sectors where the quant model’s profitability and EPS revision factors generate strong signals.

- CPI confirms the quality thesis: At 2.4% (lowest since May 2025, core 2.5%), cooling inflation supports the profitability factor — companies with pricing power see margin expansion when input costs fall. The quant model captures this automatically.

- 81-point dispersion validated: S&P 500 flat at 6,832.76 (~0% YTD) while top 20 stocks average +50.2% and bottom 20 average -31.2% — this widening gap (strongest of 2026) rewards Alpha Picks’ stock selection, not intraday traders.

The challenge is VIX at ~21.77 — elevated volatility compresses the momentum factor’s short-term edge. The Fed at 3.50-3.75% despite cooling CPI creates policy uncertainty the model hasn’t navigated. Consumer confidence at a 12-year low and credit spreads at 2.92% are early deceleration signals. CAPE at ~40 compresses forward index returns, making the quant model’s alpha generation more valuable — but the alpha must come from value, profitability, and EPS revisions rather than momentum alone. This environment earns Alpha Picks a ★★★★☆ fit rating — CPI relief supports fundamentals while VIX headwinds temper the momentum edge. APP’s crash from +1,571% to -45.6% illustrates concentration risk — consider position sizing carefully and potentially pairing with a diversified service like Stock Advisor.

Strengths

- Verified track record — Not claims, not back-tests, actual live trading results verified by a third party

- Complete transparency — Every position visible with full details

- Minimal time commitment — 2 picks per month, review quarterly

- Small-cap rotation positioning — Methodology benefits from 2026’s market environment

- Lower annual cost — $449-499/year vs Mindful Trader’s $564

Limitations

- Shorter track record — Only 3.6 years old (launched July 2022)

- Limited bear market testing — Only tested in one bear market (2022), no recession data

- No refunds — Annual billing only, no trial period

- Black-box methodology — You know the five factors but not the weightings

- No position sizing guidance — Equal-weight recommendations only

Best For

Investors with 1-3+ year horizons who trust algorithms over opinions. Ideal portfolio size: $25,000+ to deploy across 44 positions meaningfully. You want verified results, not promises.

For the complete breakdown of Alpha Picks’ methodology, performance, and user experience, see our Alpha Picks review.

Mindful Trader: The Swing Trading Algorithm

Mindful Trader takes a completely different approach. Founded in November 2020 by Eric Ferguson (Stanford graduate, perfect math SAT), the service provides real-time swing trade alerts based on algorithmic pattern recognition.

Eric spent over $200,000 and four years developing these strategies. When he makes a trade in his personal account, subscribers get an alert. Trades typically last about one week.

The Back-Tested Numbers

Mindful Trader’s website prominently features:

- 141% median annual return (Main Account)

- 24% average annual drawdown

- 40% maximum drawdown

Critical caveat: These are back-tested results from 20 years of historical data. They’re hypothetical—not actual live trading performance. The website extensively disclaims this, but the distinction matters.

The service has been live since November 2020 (4+ years), but live trading performance isn’t disclosed with the same specificity as the back-test data.

How It Works

Every trade includes:

- Entry price

- Profit target

- Stop-loss level

Trades focus on large-cap stocks ($10B+ market cap) and sometimes options. Alerts typically come near market open (6:30am Pacific), and you’re expected to act quickly.

The methodology is pure technical analysis—no fundamental or news-based analysis. The algorithm identifies specific price patterns and trends.

Strengths

- Monthly billing flexibility — $47/month, cancel anytime

- Skin in the game — Founder trades his own picks

- Defined risk parameters — Every trade has a stop-loss

- Educational content — Tutorials to learn the strategies

- No Pattern Day Trader requirement — Trades average 1 week

Limitations

- Back-tested results only — Live trading performance not disclosed

- Active time commitment — 1-3 alerts per day, trade at market open

- Expects significant drawdowns — 20-40% is normal

- Requires options capability — Full strategy needs both stocks and options

- U.S. residents only — Geographic restriction

- Not a registered investment advisor — Founder is an educator, not a fiduciary

Best For

Active traders who enjoy the process of swing trading. You can trade near market open (6:30am Pacific), you’re comfortable with 20-40% drawdowns, and you want the flexibility to cancel monthly.

For the full analysis of Mindful Trader’s strategy, track record, and user experience, see our Mindful Trader review.

The Real Difference: Investor vs Trader

These services aren’t competing for the same person. They represent fundamentally different approaches to the market.

Time Horizon

| Alpha Picks | Mindful Trader |

|---|---|

| 1-3 years optimal | ~1 week average |

| 2 picks per month | 1-3 picks per day |

| Patience is the edge | Speed is the edge |

Alpha Picks asks you to buy and hold. Mindful Trader asks you to buy, set a stop-loss, and exit when the target hits—or when the stop triggers.

Daily Commitment

| Alpha Picks | Mindful Trader |

|---|---|

| Review portfolio quarterly | Check alerts daily |

| No action required most days | Trade near market open |

| 30 minutes per month | 30+ minutes per day |

If you have a full-time job and can’t monitor markets at 6:30am Pacific, Mindful Trader will frustrate you. Alpha Picks works for people who want to set and forget.

Track Record Verification

This is the biggest difference:

| Alpha Picks | Mindful Trader |

|---|---|

| Live trading since July 2022 (3.6 years) | Live trading since November 2020 (4+ years) |

| Verified by S&P Global (GIPS) | Self-reported |

| Every position documented | Back-test data emphasized |

| +308.3% documented | 141% annual (hypothetical) |

| Only tested in one bear market | Unknown live performance |

Alpha Picks shows you the receipts. Mindful Trader shows you what the algorithm would have done over 20 years of historical data. Both are valid approaches, but one has proof and the other has projections.

Important Note: Neither service has been tested through a full recession. Alpha Picks has only 3.6 years of data. For recession-tested performance, consider pairing with Stock Advisor (23-year track record).

Risk Management

| Alpha Picks | Mindful Trader |

|---|---|

| Let winners run | Preset profit targets |

| No stop-losses | Stop-loss on every trade |

| Accept 30-50% drawdowns | Expect 20-40% drawdowns |

| Systematic exits based on model | Discipline-based exits |

Alpha Picks trusts the model to identify when to sell. Mindful Trader trusts you to follow the stop-losses. Both require discipline—just different kinds.

How to Decide

Choose Alpha Picks if:

- You’re investing for 1-3+ years and won’t need the money

- You want a verified track record, not back-tested projections

- You prefer set-and-forget over active trading

- You trust algorithms and don’t need to understand the “why”

- You can commit $449-499 annually without a refund option

Choose Mindful Trader if:

- You enjoy active trading and the daily engagement

- You want monthly billing flexibility ($47/month, cancel anytime)

- You can trade near market open (6:30am Pacific)

- You’re comfortable with 20-40% account drawdowns

- You want to trade both stocks and options

- You prefer defined stop-losses over open-ended positions

Either Works if:

- You’ll actually follow the recommendations (the biggest variable is you)

- You understand that drawdowns are normal in any strategy

- You’re adding this as one input, not your entire strategy

The Tiebreaker

Ask yourself: “Do I want to be an investor or a trader?”

If you want to build wealth over years with minimal daily involvement, choose Alpha Picks. If you want to actively trade, learn technical patterns, and engage with the market daily, choose Mindful Trader.

There’s no wrong answer—just the wrong fit for your lifestyle.

The Bottom Line

Alpha Picks wins for most investors. The verified track record (+308.3% vs S&P 500’s +83%), the 46.9% CAGR, the minimal time commitment (2 picks per month), and the lower annual cost ($449-499 vs $564) make it the better choice for anyone who wants quant-driven stock selection without becoming a full-time trader.

The time-horizon test: If you’re drawn to the structural rotation — Energy +21.6%, the intra-sector gap (memory +82% vs software -33%), CPI at 2.4% confirming disinflation, and consumer confidence at a 12-year low creating contrarian opportunity — that’s a quant long-term thesis (Alpha Picks, ★★★★☆ fit). If you’re drawn to VIX at ~21.77 expanding swing ranges, the Fed at 3.50-3.75% creating rate-sensitive dislocations, and 81-point dispersion generating intraday sector spreads — that’s a technical short-term thesis (Mindful Trader). CAPE at ~40 compresses forward passive returns, making both active approaches compelling.

Important Caveats for Alpha Picks:

- Only 3.6 years old (launched July 2022)

- Only tested in one bear market (2022)—no recession data

- Consider pairing with a recession-tested service like Stock Advisor for comprehensive coverage

Mindful Trader wins for active traders. If you enjoy the process of swing trading, want monthly billing flexibility, and can commit to daily engagement, it offers a structured approach with defined risk parameters. Just understand that the impressive return numbers are back-tested hypotheticals, not verified live results.

The real question isn’t which service is “better.” It’s which approach matches who you are.

If I had to recommend one for a friend who’s never used a quant service? Alpha Picks. The verified track record removes the guesswork, and the set-and-forget approach means you’ll actually use it. Most people don’t have the time or temperament for daily swing trading—and there’s nothing wrong with that.

Looking to evaluate more options? Explore all top services in our guide to the best stock advisors.

Frequently Asked Questions

Alpha Picks vs Mindful Trader: which is better?

Alpha Picks earns a ★★★★☆ fit rating for most investors. It has a verified track record (+308.3% since July 2022 vs S&P 500’s +83%), a 46.9% CAGR, requires minimal time commitment (2 picks per month), and costs less annually ($449-499 vs $564). February 2026’s environment features 81-point dispersion (top 20 at +50.2%, bottom 20 at -31.2%) — the strongest case for stock picking this year. CPI at 2.4% (lowest since May 2025) supports quality factors, but VIX at ~21.77 creates momentum headwinds. The Fed at 3.50-3.75%, consumer confidence at a 12-year low, and credit spreads at 2.92% add macro caution. Mindful Trader is better for active traders who enjoy daily engagement — elevated VIX should expand swing opportunities — but its 141% annual return is back-tested, not live trading performance. Important caveat: Alpha Picks is only 3.6 years old.

Is Alpha Picks worth it?

Yes, for patient investors who can hold 1-3 years. At $449-499/year, Alpha Picks has returned +308.3% since July 2022 with a 73% overall win rate (77.8% for 1-3 year holds). The performance is verified by S&P Global using GIPS standards. 3 emerging ten-baggers including CLS +983%. Important caveat: the service is only 3.6 years old and has only been tested in one bear market (2022). Consumer confidence at a 12-year low and credit spreads at 2.92% introduce macro risk the model hasn’t fully navigated.

Is Mindful Trader worth it?

It depends on your trading style. At $47/month with cancel-anytime flexibility, Mindful Trader offers low-risk entry for active traders. The founder trades his own picks and provides clear entry/exit parameters. However, the 141% median annual return is back-tested—not verified live trading performance. If you enjoy swing trading and can commit to daily engagement, it’s worth trying. If you want verified results, look elsewhere.

Can I use both Alpha Picks and Mindful Trader?

Technically yes, but they serve completely different purposes. Alpha Picks is for long-term investing (1-3 year holds), while Mindful Trader is for short-term swing trading (~1 week holds). Running both would require separate capital allocations and different mindsets. Most investors are better served picking the approach that matches their lifestyle rather than trying to do both.

Which service has a better track record?

Alpha Picks has the better verified track record. Its +308.3% return since July 2022 (46.9% CAGR, 73% win rate, 77.8% for 1-3Y holds) is documented and verified by S&P Global using GIPS standards. 3 emerging ten-baggers including CLS +983%. Mindful Trader’s 141% median annual return comes from 20 years of back-tested data—hypothetical results, not actual live trading. Both services have been running live since 2020/2022, but only Alpha Picks publishes verified performance data. Important caveat: Alpha Picks is only 3.6 years old and has only been tested in one bear market.

Do I need to trade options for either service?

Alpha Picks: No. It recommends stocks only. Mindful Trader: Partially. The full strategy includes both stock and options trades. You can follow stock trades only, but you’ll miss part of the strategy. If you’re not comfortable with options, Alpha Picks is the simpler choice.