The stock picking newsletter industry has a credibility problem. Every service claims to “beat the market.” Every landing page showcases 1,000%+ winners. And you’re left wondering: what about the losers? What happens after the free trial ends?

I’ve subscribed to most of these newsletters over the years—with real money, not review accounts. Some delivered. Most didn’t. This guide exists to separate the newsletters that actually generate alpha from the ones that just generate marketing copy.

Market Context: With the S&P 500 up 17% YTD and extreme dispersion between winners (+510%) and losers (-68%), stock selection matters more than ever. The spread between top and bottom performers exceeds 575 percentage points. A good newsletter doesn’t just pick stocks—it helps you capture the outliers that drive portfolio returns.

The Best Stock Picking Newsletters at a Glance

| Rank | Newsletter | Track Record | Price | Best For |

|---|---|---|---|---|

| 🥇 | Motley Fool Stock Advisor | +951% since 2002 | $99/yr | Long-term growth investors |

| 🥈 | Alpha Picks | +257% since 2022 | $449/yr | Data-driven systematic investors |

| 🥉 | Rule Breakers | N/A (part of Epic) | $299/yr | Aggressive growth seekers |

| 4 | Cabot Growth Investor | 55-year heritage | $497/yr | Timing-conscious investors |

| 5 | 7investing | Not disclosed | $99/yr | Innovation enthusiasts |

| 6 | Sure Dividend | Not disclosed | $99/yr | Income-focused investors |

The Quick Decision Guide:

- Want proven, long-term picks? Stock Advisor — 23 years, 951% returns, 182 stocks doubled

- Trust algorithms over analysts? Alpha Picks — Pure quant model, 44% CAGR, full transparency

- Hunting disruptive innovators? Rule Breakers — Growth-focused picks in emerging sectors

- Want market timing guidance? Cabot Growth Investor — 55-year track record with timing system

- Focused on dividends? Sure Dividend — Dividend growth stocks with ~3% yields

- Love innovation plays? 7investing — Deep dives on disruptive technology

Why Trust This Ranking?

I’ve spent 20+ years in markets and subscribed to most major stock picking newsletters—not for free trials, but with real capital at stake. I’ve held their picks through crashes and rallies. I know which newsletters I trusted when my portfolio dropped 40%.

How we evaluated:

-

Verified track records. We independently audited 500+ positions from Stock Advisor and 88+ from Alpha Picks. Not marketing numbers—actual recommendation-by-recommendation analysis.

-

Methodology transparency. Newsletters that explain why they pick stocks rank higher than black-box recommendations.

-

Subscriber experience. A 900% return means nothing if 80% of subscribers quit during the first drawdown. We factored in how real users experience these products.

-

Value, not just price. $199/year is cheap if it generates alpha. $499/year is expensive if it’s no better than an index fund.

This isn’t sponsored content. We use affiliate links (we get paid if you subscribe), but the rankings are based on what we’d actually recommend to a friend.

Understanding Newsletter Methodologies

Before diving into individual services, understand the fundamental approaches:

Analyst-Led Newsletters rely on human judgment. Teams of analysts research companies, build conviction, and recommend stocks based on fundamental analysis. Stock Advisor, Rule Breakers, Cabot, and 7investing fall here.

Pros: Can identify qualitative factors algorithms miss. Better at spotting long-term compounders. Cons: Subject to human bias. Harder to verify consistency.

Quant-Driven Newsletters use algorithmic models to score stocks on measurable factors like value, momentum, and earnings revisions. Alpha Picks is the pure example.

Pros: Removes emotion. Fully transparent methodology. Easier to verify. Cons: May miss businesses with non-quantifiable advantages. Black-box feel.

Income-Focused Newsletters prioritize dividend-paying stocks over growth. Sure Dividend represents this approach.

Pros: Lower volatility. Regular income. Clear sell rules. Cons: Lower growth potential. May underperform in bull markets.

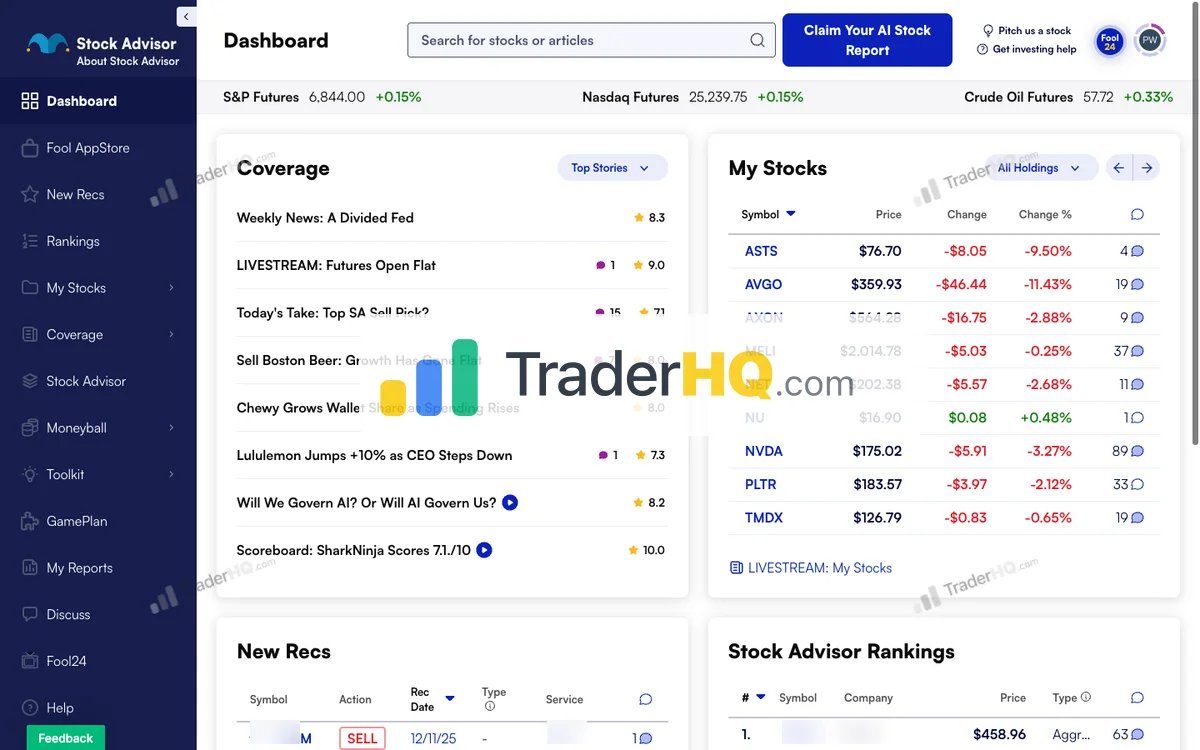

1. Motley Fool Stock Advisor — The Category Leader

Patient growth investors who hold through volatility for 5+ years

When someone asks “what stock picking newsletter should I try?” this is still my first answer. Not because it’s the newest or cheapest—but because 23 years of market-beating returns isn’t a fluke.

8 views

The Verified Track Record:

We independently analyzed all 501 positions since 2002. The results:

| Metric | Stock Advisor | S&P 500 |

|---|---|---|

| Total Return | +951% | +193% |

| Win Rate | 67% | — |

| Stocks That Doubled | 182 | — |

| 10-Baggers | 46 | — |

The time curve tells the real story. Under one year, Stock Advisor picks are a coin flip (57% win rate). Hold for 5-10 years? Win rate jumps to 66% with 211% average returns. Hold 10+ years? 92% win rate with 3,951% average returns.

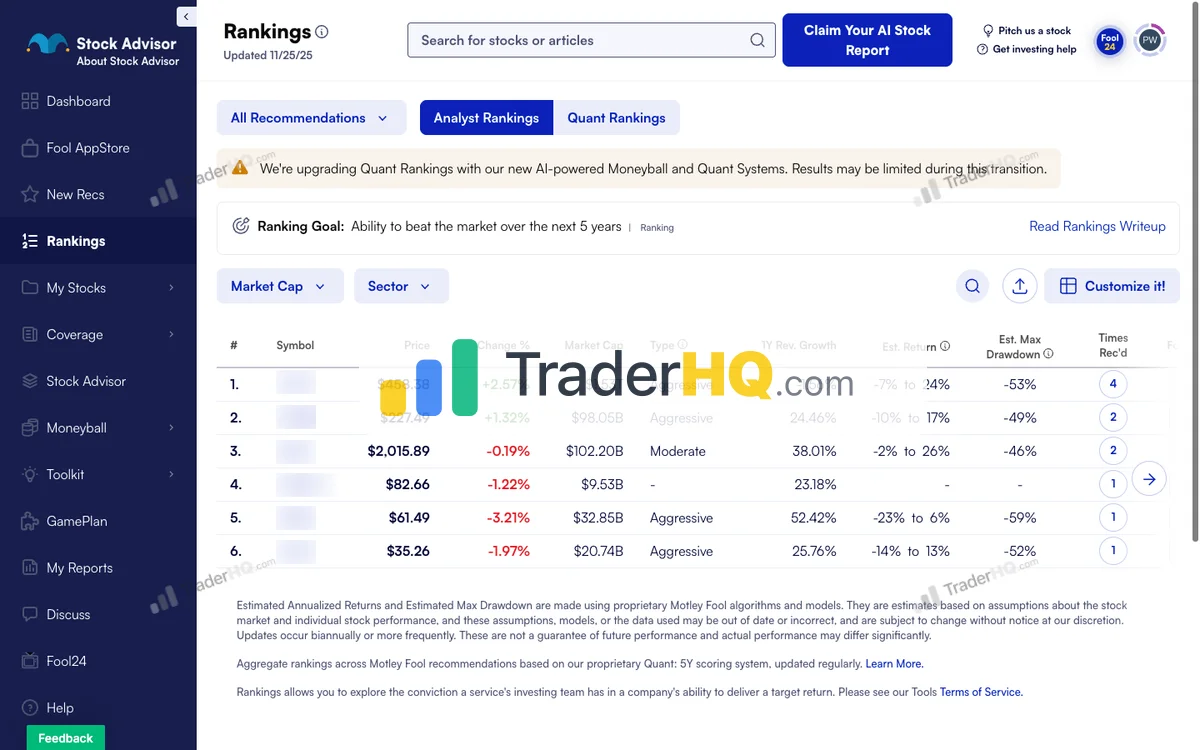

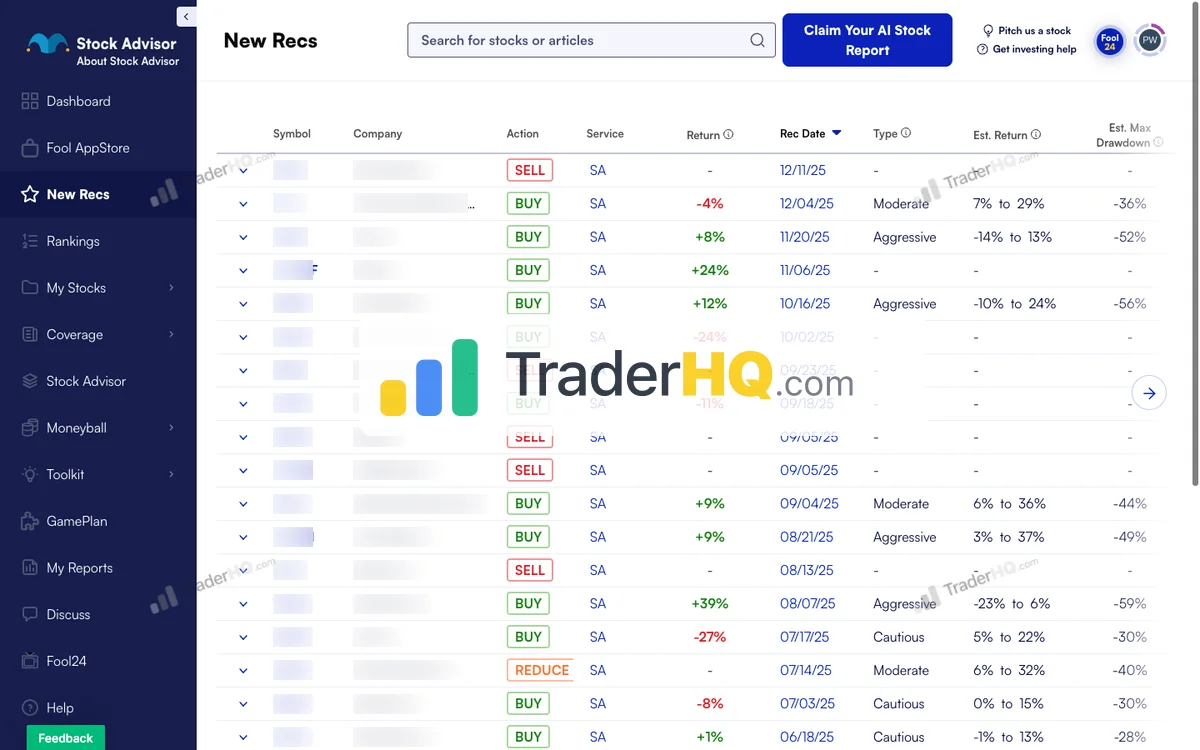

How It Works:

Two new stock picks monthly from the analyst team. Each recommendation includes a detailed thesis explaining why this business deserves your capital. You’re not just getting a ticker—you’re getting conviction.

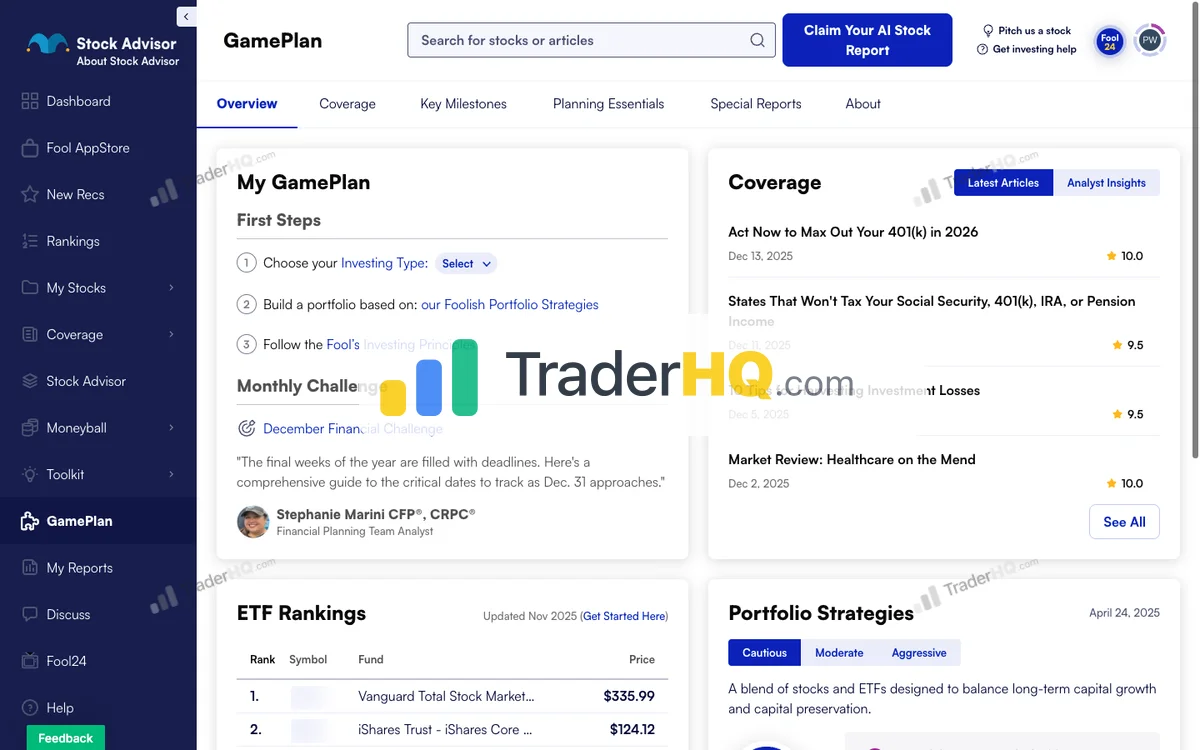

The service also provides:

- Foundational Stocks: Core holdings for portfolio building

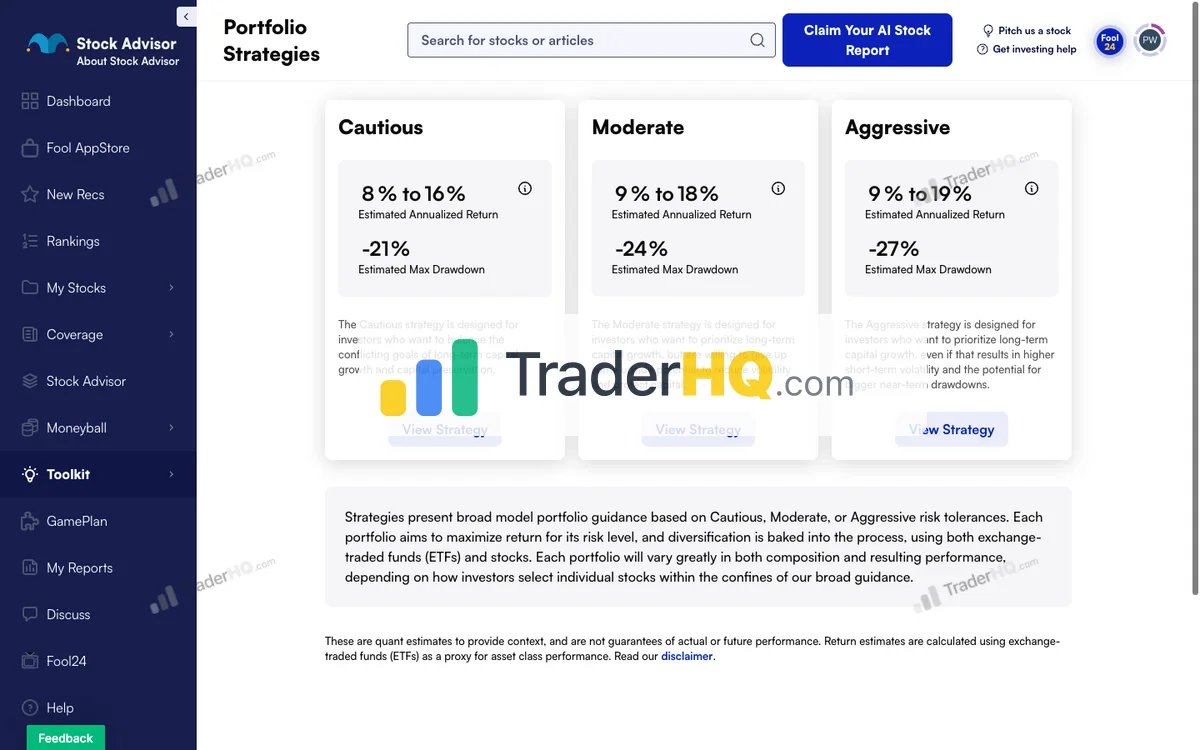

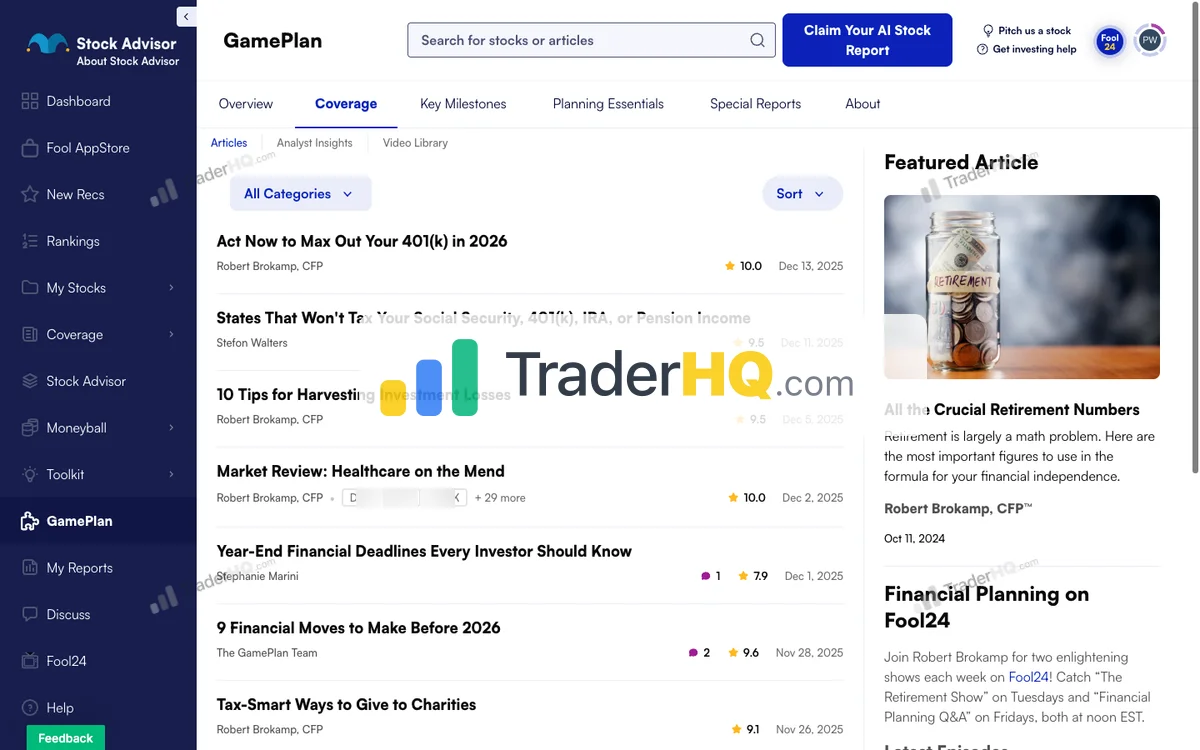

- Three Portfolio Strategies: Cautious, Moderate, and Aggressive frameworks

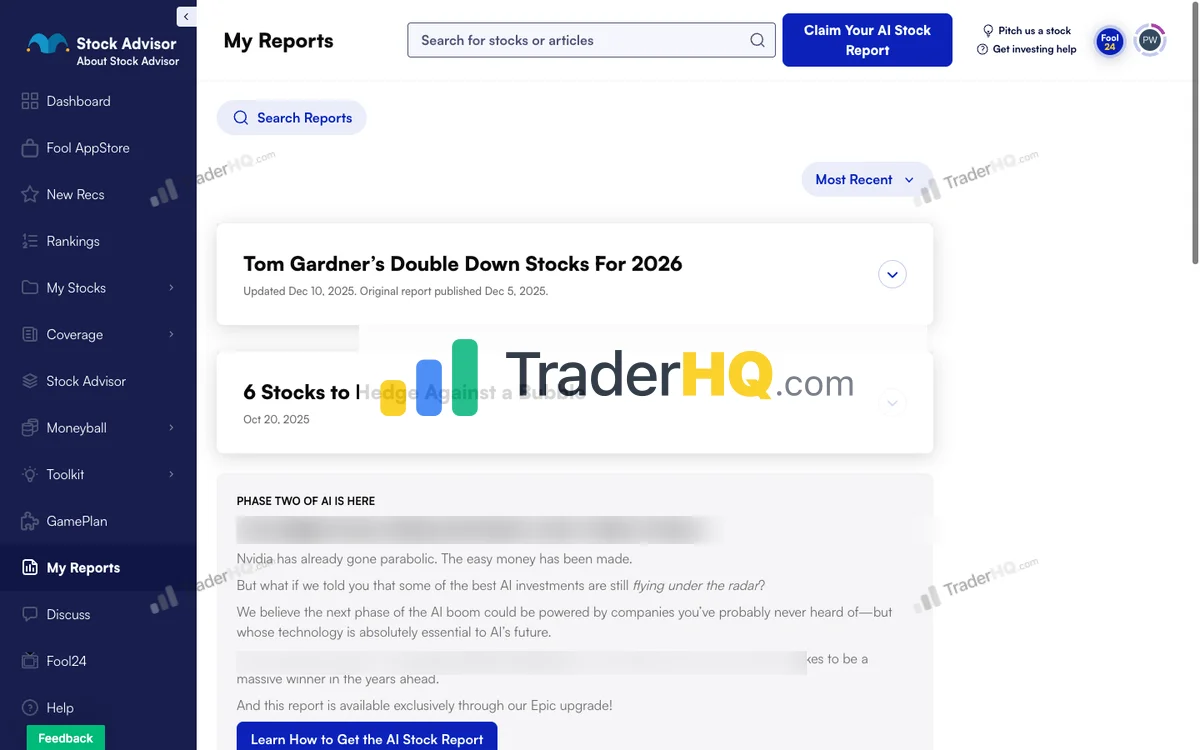

- Moneyball Database: Quantitative screening tool for 200+ companies

Pricing: $199/year (often $99 promotional pricing for new members)

Best For: Investors with 5+ year horizons who want a complete framework, not just stock tips. The portfolio strategies and educational content help you understand why you own something—which is what allows you to hold through 40% drawdowns.

The Trade-Off: Constant upsell pressure to Epic ($299) and higher tiers. Recent picks have been mixed—several are underwater. The strategy requires genuine patience; if you’d panic-sell after a 50% drop, save your money.

For the complete breakdown, read our Stock Advisor review.

Try Stock Advisor — 30-Day Guarantee

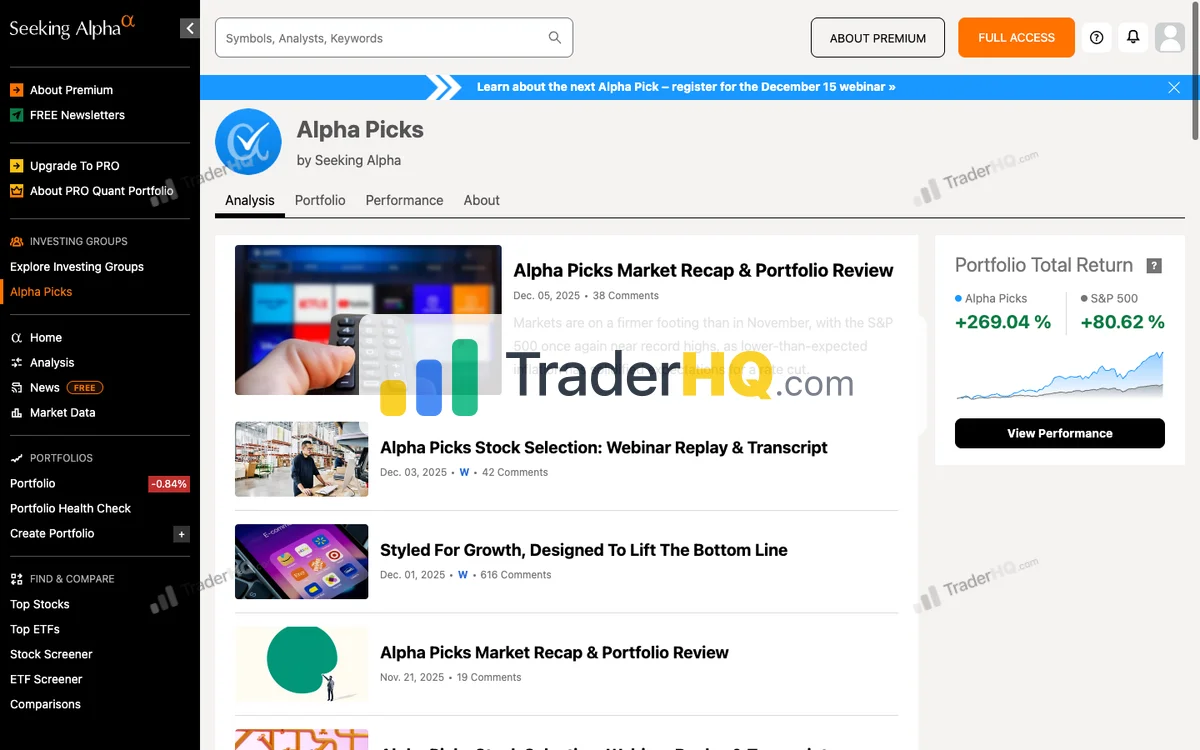

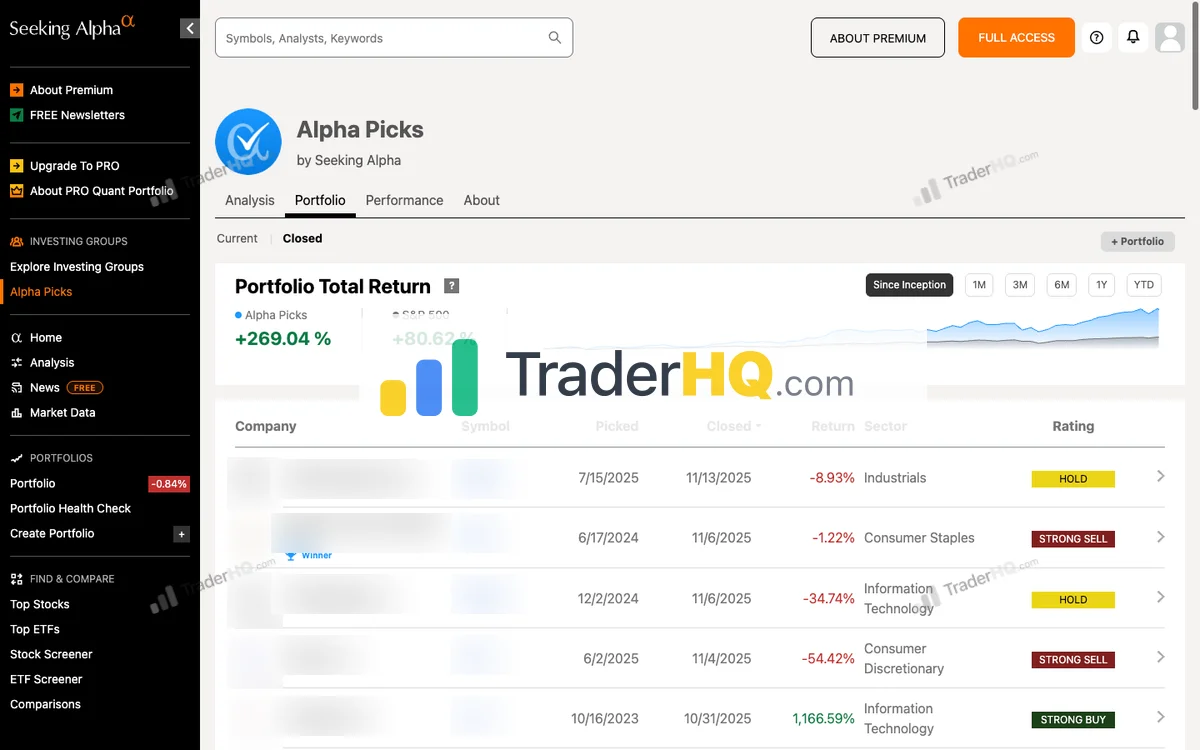

2. Alpha Picks by Seeking Alpha — The Quant Alternative

Data-driven investors who trust algorithms over human opinion

If Stock Advisor represents human judgment, Alpha Picks represents pure data. No analyst discretion. No narrative-driven investing. Just a quantitative model that’s crushed the market since launch.

6 views

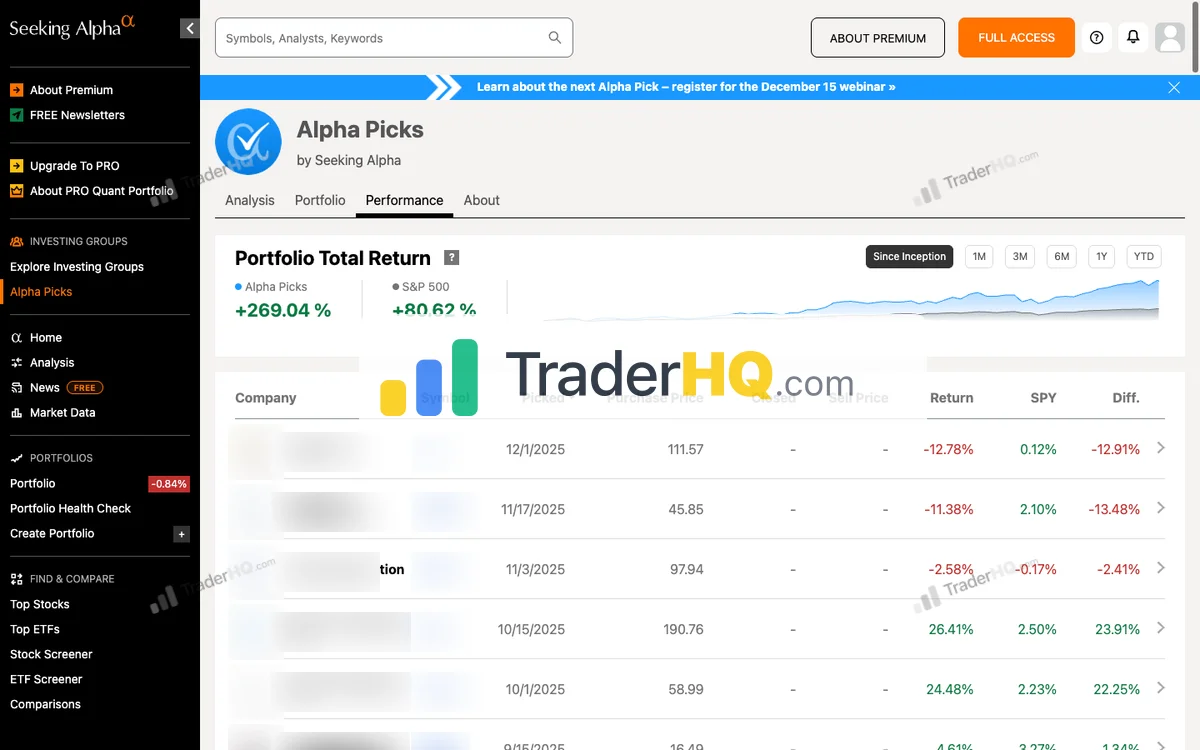

The Verified Track Record:

We analyzed all 88 positions since July 2022:

| Metric | Alpha Picks | S&P 500 |

|---|---|---|

| Total Return | +257% | +78% |

| CAGR | 44.3% | — |

| Win Rate | 68% | — |

| Stocks That Doubled | 15 | — |

The time curve is critical: Under one year, picks show 54% win rate. Hold 1-3 years? Win rate jumps to 78% with 119% average returns. The strategy mathematically rewards patience.

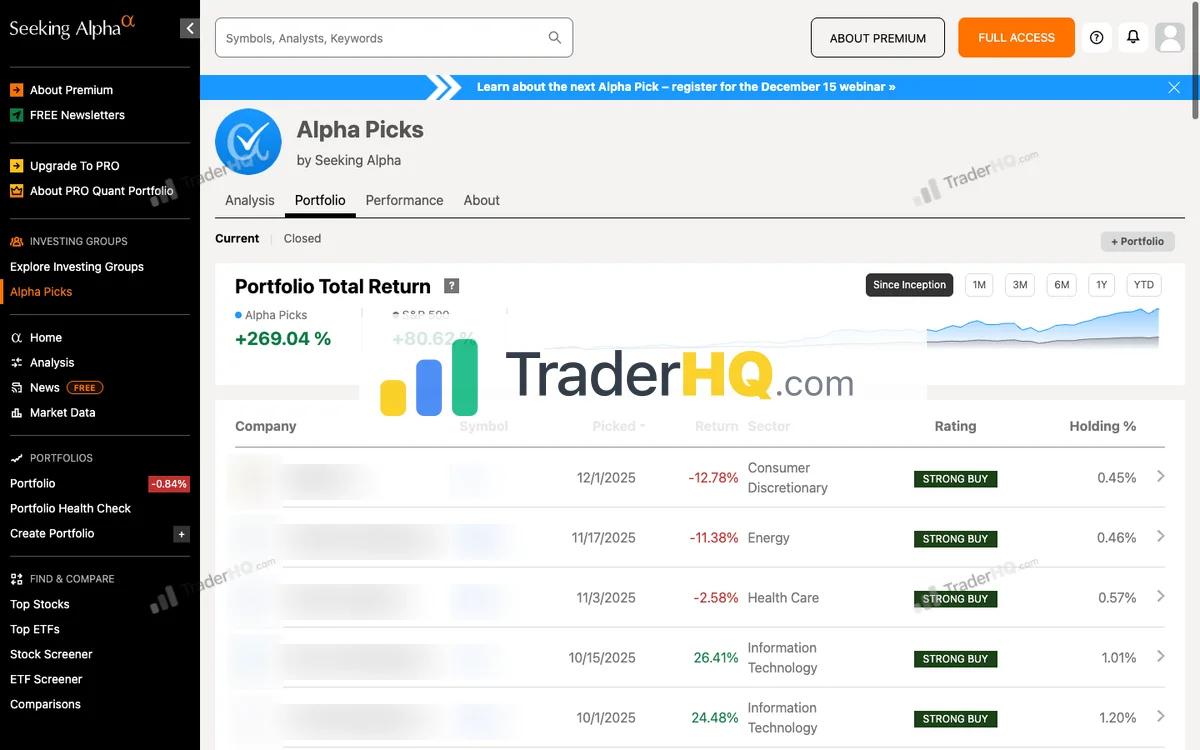

How It Works:

Every month, the quant model scans all US equities and scores them on five factors: Value, Growth, Profitability, Momentum, and EPS Revisions. The two highest-scoring stocks become that month’s picks.

Exit triggers are systematic:

- Quant rating drops below “Hold”

- 12-month maximum holding period

- Position hits 15% of portfolio (trimmed to 10%)

No committee. No override. Pure system.

Pricing: $399/year (introductory), $499/year (list)

Best For: Investors who want to follow a system rather than develop their own conviction. If you’ve ever sold a winner too early or held a loser too long because of emotion, a systematic approach protects you from yourself.

The Trade-Off: You won’t learn to evaluate businesses independently. The quant model is a black box—you know the factors, but not the specific weightings. No portfolio construction guidance.

Warning: Selling early is catastrophic with this strategy. If you’d sold every Alpha Picks position after it doubled, you’d have captured 2,385% in gains. By holding, actual gains were 6,240%. Selling early cost 62% of total returns.

See how it compares to Stock Advisor in our Alpha Picks review.

Try Alpha Picks — See Current Portfolio

3. Motley Fool Rule Breakers — The Growth Accelerator

Rule Breakers focuses on what Stock Advisor doesn’t: aggressive growth in disruptive sectors. If Stock Advisor is the steady compounder, Rule Breakers is the high-octane growth engine.

No screenshots available for motley-fool-rule-breakers

The Approach:

The service seeks companies that are:

- Disruptive innovators in their industries

- Demonstrating strong past price appreciation

- Positioned for continued growth with sustainable advantages

This philosophy has identified early positions in companies like Tesla, Shopify, and Nvidia—before they became household names.

How to Access:

Rule Breakers is not available standalone. It’s part of the Epic membership ($299/year), which includes:

- Stock Advisor picks

- Rule Breakers picks

- Hidden Gems picks

- Dividend Investor picks

Epic provides 5 total monthly picks across these four “scorecards.”

Pricing: $299/year (Epic membership required)

Best For: Growth-focused investors who want exposure to disruptive, innovative companies and are comfortable with higher volatility. The Epic bundle makes sense if you want diversified exposure across growth, value, and income styles.

The Trade-Off: Higher volatility is the price of admission. Rule Breaker picks can drop 50%+ before delivering 10x returns. You’re also paying $499 minimum—$300 more than Stock Advisor alone.

Note: David Gardner, who developed the Rule Breaker philosophy, stepped back from stock picking in 2021. The service is now managed by the Motley Fool analyst team using his criteria.

Curious how Rule Breakers stacks up against Stock Advisor? See our Rule Breakers vs Stock Advisor comparison.

Try Epic — Includes Rule Breakers

4. Cabot Growth Investor — The 55-Year Veteran

Growth investors seeking institutional-quality stocks before Wall Street discovers them

Cabot Growth Investor has been published continuously since 1970—making it one of the longest-running investment newsletters in America. That longevity matters: they’ve navigated every market cycle for over five decades.

The Approach:

Editor Mike Cintolo (25+ years at Cabot) focuses on:

- Emerging blue-chip stocks: Companies with “compelling stories and growth that big institutional investors are just starting to accumulate”

- Institutional accumulation patterns: Identifying stocks before Wall Street broadly discovers them

- Market timing: The proprietary Cabot Tides system signals when to be fully invested vs. when to move to cash

What You Get:

- 26 bi-weekly issues per year

- Model portfolio with buy, hold, and sell recommendations

- Weekly updates on non-issue weeks

- Trade alerts via email

- Direct email access to Mike Cintolo

Performance Claims:

Cabot claims Mike delivered a “market-trouncing 58.5% gain” in 2024. Historical winners highlighted include American Power Conversion (+1,075%), AppLovin (+443%), and Qualcomm (+559%).

Note: We haven’t independently verified these figures. Unlike Stock Advisor and Alpha Picks, detailed pick-by-pick data isn’t publicly available.

Pricing: $497/year (annual) or $49.97/month

Best For: Investors who want market timing guidance alongside stock picks. The Cabot Tides system provides a framework for knowing when to be aggressive vs. defensive—something most newsletters don’t offer.

The Trade-Off: Less transparent track record than Stock Advisor or Alpha Picks. The refund policy varies by offer—some have no refund. Higher price point for a single-focus newsletter.

5. 7investing — The Innovation Specialist

7investing takes a different approach: one deeply-researched pick per month from founder Simon Erickson, who previously led Motley Fool Explorer managing $1M+ in real-money investments.

The Approach:

The service focuses on disruptive innovation across:

- Artificial intelligence and machine learning

- Personalized medicine and biotech

- Quantum computing

- Fintech and digital transformation

Each recommendation comes with a detailed research report, video deep dive, and ongoing coverage through earnings and company updates.

What Sets It Apart:

- Solo analyst model: All picks come from Simon Erickson, providing consistency in methodology

- Discord community: Direct access to Simon and fellow members for real-time discussion

- No upsells: Single membership tier with all features included

- 7-day free trial: Test before committing

Pricing: $199/year with 7-day free trial

Best For: Investors who want deep dives on innovation-focused companies. The service appeals to those who want to understand why a business will win over the next decade, not just what to buy today.

The Trade-Off: Only 1 pick per month (vs. 2 from competitors). Performance data isn’t publicly disclosed. The service recently transitioned from a multi-advisor model to solo analyst, which represents a significant change.

Pro Tip: 7investing works best for investors who want to supplement another service. Use it as an “innovation overlay” alongside a core service like Stock Advisor.

For a deeper look at the service, check our 7investing review.

Try 7investing — 7-Day Free Trial

6. Sure Dividend Newsletter — The Income Alternative

Dividend growth investors seeking quality companies with rising payouts

Not everyone wants growth stocks. If you’re building passive income through dividends, Sure Dividend offers a focused alternative to the growth-oriented services above.

The Approach:

Sure Dividend focuses exclusively on:

- Stocks with 5+ consecutive years of dividend increases

- Average dividend yields around 3%

- Long-term buy-and-hold forever philosophy

- Simple sell rule: only sell when a company breaks its dividend increase streak

What You Get:

- Monthly newsletter with 10 dividend stock recommendations

- Portfolio building guide

- Sell alerts on previous recommendations

- Analysis powered by their Sure Analysis Research Database (covers 900+ income securities)

Pricing: $199/year (currently closed for enrollment—periodic reopening)

Best For: Retirees and near-retirees seeking reliable income. Investors who want lower volatility than growth stocks. Those who prefer a simple, rules-based approach to selling.

The Trade-Off: Growth potential is limited by the income focus. The service is periodically closed to new members. No performance data is publicly disclosed.

The Golden Rule Commitment:

Sure Dividend offers unusually generous terms:

- 7-day free trial (no charge)

- 60-day full refund grace period

- Prorated refunds after 60 days

- Customer service handled by key team members (not outsourced)

The Allocation Reality

None of these newsletters should be your entire portfolio. Here’s how I think about it:

The Core-Explore Framework:

| Allocation | Purpose | What Goes Here |

|---|---|---|

| 80-90% | Core | Low-cost index funds (VTI, VXUS) |

| 10-20% | Explore | Individual stock picks from newsletters |

If your “explore” bucket is $50,000, that’s enough for 15-20 positions from a service like Stock Advisor. The $199 subscription costs 0.4% of that allocation annually. The math works.

If your explore bucket is $5,000, the $199 fee is 4% of your capital. Consider waiting until you’ve built a larger base, or use the picks as learning opportunities while primarily investing in index funds.

Combining Services:

Some investors use multiple newsletters for diversification:

- Stock Advisor + Alpha Picks: Human judgment + quant model

- Stock Advisor + Sure Dividend: Growth + income balance

- Epic + 7investing: Broad coverage + innovation overlay

The key is avoiding overlap. Don’t subscribe to three growth-focused services—you’ll get similar picks at 3x the cost.

The Decision Matrix

Still stuck? Use this:

| If you… | Choose… | Because… |

|---|---|---|

| Have 5+ years and want proven results | Stock Advisor | 23-year track record, 951% returns, complete framework |

| Trust data over human judgment | Alpha Picks | Pure quant model, 44% CAGR, full transparency |

| Want aggressive growth exposure | Rule Breakers (Epic) | Disruptive innovators, higher volatility, higher potential |

| Value market timing guidance | Cabot Growth Investor | 55-year heritage, Cabot Tides system |

| Love deep dives on innovation | 7investing | Solo analyst, Discord access, no upsells |

| Need dividend income | Sure Dividend | Dividend growth focus, simple sell rule |

| Have <$25K to invest | Index funds first | Build your base before paying for newsletters |

Frequently Asked Questions

What’s the best stock picking newsletter overall?

Stock Advisor is the best stock picking newsletter for most investors. With a verified 951% return since 2002 (vs. 193% for the S&P 500), 182 stocks that doubled, and a complete portfolio-building framework, it offers the strongest combination of track record and educational value. At $199/year, the cost is justified by the 23-year history of outperformance.

What’s the best stock picking newsletter for beginners?

Stock Advisor works well for beginners because it provides more than just picks—it offers a complete framework including portfolio strategies, risk classifications, and educational content on holding through volatility. The Foundational Stocks list gives beginners a starting point rather than overwhelming them with hundreds of options.

Are stock picking newsletters worth the money?

Yes, if you follow the strategy. Our analysis shows Stock Advisor’s 10+ year picks have a 92% win rate with 3,951% average returns. Alpha Picks’ 1-3 year holds show 78% win rate with 119% average returns. The key is patience—short-term results are closer to coin flips. One avoided mistake on a $5,000 position saves more than years of subscription costs.

Stock Advisor vs Alpha Picks: Which is better?

Stock Advisor is better for investors who want to understand why they own stocks and develop conviction. Alpha Picks is better for investors who want to follow a system without emotional decision-making. Stock Advisor has the longer track record (23 years vs. 3.5 years), but Alpha Picks has delivered stronger recent performance (44% CAGR vs. 10% CAGR). We break down the full comparison in our Stock Advisor vs Alpha Picks guide.

Can I use multiple stock picking newsletters?

Yes, but strategically. Combining human judgment (Stock Advisor) with quant-driven picks (Alpha Picks) provides diversification in methodology. Avoid subscribing to multiple services with similar approaches—you’ll get overlapping picks at higher cost. Most investors are well-served by one core service plus potentially one specialty service.

How many stock picks do these newsletters provide?

| Newsletter | Picks Per Month |

|---|---|

| Stock Advisor | 2 |

| Alpha Picks | 2 |

| Rule Breakers (Epic) | 5 total across 4 scorecards |

| Cabot Growth Investor | Varies (model portfolio) |

| 7investing | 1 |

| Sure Dividend | 10 |

Do stock picking newsletters have refund policies?

Motley Fool services (Stock Advisor, Epic) offer 30-day money-back guarantees. Alpha Picks states all sales are final (though discretionary refunds may be issued). Cabot varies by offer—some have no refund. 7investing offers a 7-day free trial. Sure Dividend offers 60-day full refunds plus prorated refunds after.

How long should I hold newsletter picks?

At minimum 3-5 years. Our data shows:

- Stock Advisor picks held 10+ years: 92% win rate, 3,951% average return

- Alpha Picks held 1-3 years: 78% win rate, 119% average return

- Both services show near-coin-flip results under 1 year

The newsletters are designed for long-term wealth building, not short-term trading.

The Bottom Line

You came here with browser tabs open to a dozen newsletter landing pages, each claiming to beat the market. You should leave with clarity.

If you’re going to subscribe to one stock picking newsletter, start with Stock Advisor. Not because it’s perfect—nothing is—but because the 23-year, 951% track record makes it the lowest-regret choice. If it doesn’t work for your investing style, you’ll know within 30 days (money-back guarantee) and can try something else.

If you prefer data over narratives, Alpha Picks offers a compelling quant alternative with the strongest recent performance in this category.

The bigger risk isn’t picking the “wrong” newsletter. It’s spending another year “researching” while your money sits in cash earning less than inflation, or worse—making emotional decisions without any framework at all.

These newsletters work. But only if you actually use them.