7 Best Stock Advisor Websites & Stock Picking Services in 2024

Published

Published

Investing in the stock market can be an effective way to grow your wealth over time, but selecting the right stocks is crucial for success. While you may be eager to take control of your financial future, the vast array of investment options and the complexity of the market can be overwhelming, especially if you lack the time or expertise to thoroughly research and analyze potential stock picks.

That's where stock advisor websites and stock picking services come in - they aim to simplify the process by providing expert guidance and actionable recommendations to help you build a profitable portfolio. However, with so many services available, it can be challenging to determine which ones are truly trustworthy and capable of delivering the results you seek.

In this blog post, we'll dive deep into the world of stock advising, exploring the key features, benefits, and drawbacks of the top stock picking services available in 2024. Our goal is to arm you with the knowledge and insights you need to make an informed decision and choose a service that aligns with your investment goals and risk tolerance.

Here are the best stock advisor and best stock picking services we've reviewed in 2024.

| 📈 Best Stock Advisor Picks | 🎯 Best For | 🔍 Investing Focus |

|---|---|---|

| 📈 Motley Fool Stock Advisor | Long-term growth | Stock Picking |

| 🎯 Alpha Picks by Seeking Alpha | Quant analysis | Analyst-Powered |

| 🚀 Motley Fool Rule Breakers | Market innovators | Growth Investing |

| 🏛 Zacks Premium | Research focused | Earnings Analysis |

| 📊 Seeking Alpha Premium | Detailed research | Comprehensive Analysis |

| 📡 Trade Ideas | Real-time traders | AI Insights |

| 📝 TipRanks Premium | Data-driven investing | Expert Consensus |

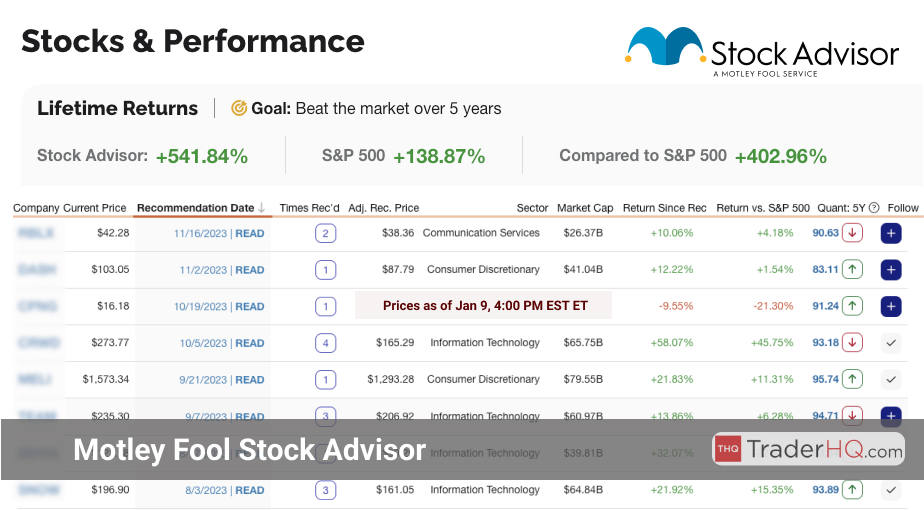

Motley Fool Stock Advisor, a market-leading stock picking service, has a proven track record of delivering exceptional returns for individual investors since its inception in 2002. With a team of experienced analysts led by Tom Gardner, Stock Advisor has consistently outperformed the S&P 500, empowering members to build long-term wealth in the stock market.

The average return of a Stock Advisor pick since inception is 665.67%, significantly higher than the S&P 500's return of 151.28% over the same period. This means that Stock Advisor has outperformed the S&P 500 by an impressive 4.4 times, showcasing the service's ability to identify high-potential stocks poised for tremendous growth.

To put these returns into perspective, consider some of Stock Advisor's most successful recommendations:

These examples showcase the power of Stock Advisor's recommendations and the potential for life-changing returns. However, it's essential to understand that investing in the stock market carries risk, and not every pick will be a winner.

As legendary investor Peter Lynch once said, "In this business, if you're good, you're right six times out of ten. You're never going to be right nine times out of ten." The key to successful investing lies in embracing this reality and focusing on the big winners that can overwhelm the occasional losses.

Moreover, Stock Advisor's investment philosophy is rooted in the concept of long-term investing, as echoed by Warren Buffett's wisdom: "The stock market is a device for transferring money from the impatient to the patient." By focusing on high-quality companies with strong competitive advantages and holding them for the long haul, investors can harness the power of compounding returns and weather short-term market fluctuations.

Stock Advisor empowers members to invest with confidence by providing:

In essence, Motley Fool Stock Advisor offers a clear path to long-term investing success. By leveraging the expertise of the Gardner brothers and their team, individual investors can access the tools, insights, and recommendations needed to navigate the stock market with confidence and achieve their financial goals.

With an unparalleled track record of outperforming the market and a commitment to empowering individual investors, Motley Fool Stock Advisor is the ultimate solution for those seeking to build lasting wealth in the stock market. Don't miss this opportunity to invest alongside the pros and unlock the potential of your portfolio.

Click Here to Try Stock Advisor (May 15th, 2024)

Top Services: You can explore the best stock picking service and stock market advisor to align with your need for robust, data-backed investment recommendations.

Alpha Picks by Seeking Alpha is a premium stock recommendation service that harnesses the power of quantitative analysis and fundamental insights to deliver market-beating returns. Launched in 2022, Alpha Picks has quickly established itself as a top-tier stock picking service, outperforming the S&P 500 by a significant margin.

At the heart of Alpha Picks' success is its rigorous, data-driven methodology that combines the expertise of Seeking Alpha's Quantitative Team, access to unique and extensive datasets, and the computational power of state-of-the-art systems. This "quantamental" approach, integrating algorithmic precision with fundamental investing principles, sets Alpha Picks apart from other stock recommendation services.

Subscribers to Alpha Picks receive two thoroughly vetted stock recommendations per month, each meeting stringent criteria for strong, sustained performance potential. The service maintains a concentrated portfolio of high-conviction stocks, focusing on letting winners run while strategically managing risk.

For investors seeking to navigate the complexities of the stock market with confidence, Alpha Picks offers a compelling solution. By leveraging advanced quantitative techniques and deep fundamental research, the service aims to demystify the stock selection process and deliver actionable, market-beating recommendations.

Whether you're a seasoned investor looking to enhance your returns or a newcomer to the world of stock investing, Alpha Picks provides the tools, insights, and expertise needed to build a robust, high-performing portfolio. With its commitment to transparency, rigor, and subscriber empowerment, Alpha Picks has quickly emerged as a trusted ally for investors seeking to grow their wealth in the stock market.

Click to Try Alpha Picks by Seeking Alpha Now

Choosing Wisely: For long-term strategies, consider best stocks for long-term which are curated by Motley Fool's experienced analysts to suit your risk-aware outlook.

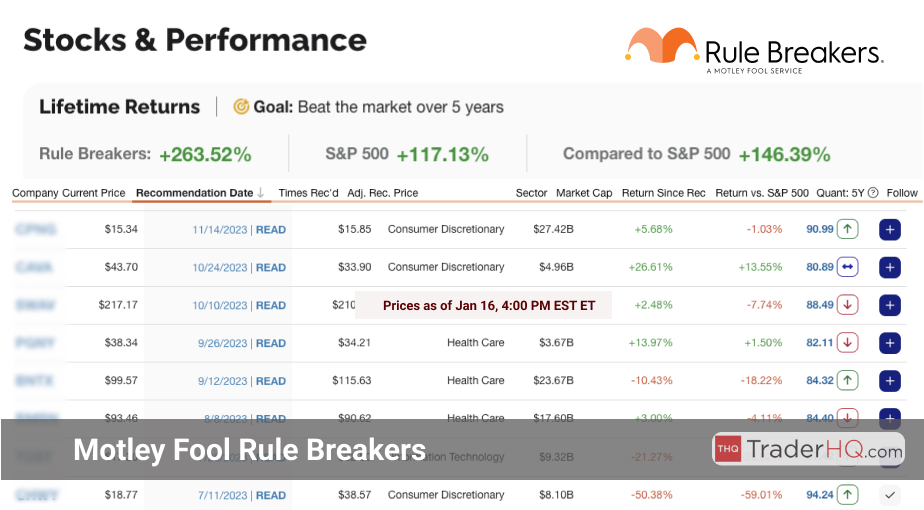

The Motley Fool's Rule Breakers service is a beacon for growth-focused investors seeking to capitalize on innovative, disruptive companies. Founded in 2004, Rule Breakers has carved out a unique niche in the investment landscape by identifying high-growth stocks that defy conventional wisdom.

This service is tailored for investors who embrace the high risk-reward dynamics of aggressive growth investing, aiming to uncover the future titans of tomorrow before they become household names.

At the heart of Rule Breakers is a dedication to finding companies with the potential to monopolize their markets, as advocated by venture capitalist Peter Thiel. The service's team of expert analysts scours the market for firms displaying sustainable competitive advantages, whether through:

By investing in these game-changers early, Rule Breakers subscribers position themselves for exponential returns.

The potency of this approach is exemplified by Rule Breakers' most notable stock picks. Since its inception:

To put this in tangible terms, a $1,000 investment in each Rule Breakers pick would have blossomed into an impressive portfolio.

Consider Shopify (SHOP), a Rule Breakers selection from February 2016. This e-commerce powerhouse has skyrocketed 3,581%, turning a humble $1,000 stake into a remarkable $36,808.

Similarly, The Trade Desk (TTD), picked in May 2017, has surged 1,674%, transforming $1,000 into $17,740. These are just two examples of how Rule Breakers' focus on disruptive innovators can yield life-changing wealth.

However, as Peter Lynch famously quipped, "In this business, if you're good, you're right six times out of ten." Rule Breakers acknowledges that not every pick will be a winner, but by embracing asymmetrical risk and letting winners run, the service aims to ensure that the gains from a few big winners overwhelm any losses.

This philosophy aligns with Warren Buffett's wisdom: "The stock market is a device for transferring money from the impatient to the patient." Rule Breakers is designed for investors who understand that true wealth creation in the stock market comes from holding great companies for the long haul, weathering short-term volatility for the promise of extraordinary long-term gains.

Beyond stock picks, Rule Breakers offers a wealth of educational resources and a vibrant community of like-minded investors. Subscribers gain access to:

This empowers them to invest with confidence. The service's commitment to transparency and member engagement fosters a continuous learning environment, allowing investors to refine their growth investing strategies.

For those ready to embrace the high-growth, high-reward world of Rule Breakers investing, now is the time to act. By joining this community of visionary investors, you position yourself at the forefront of the innovative companies shaping our future.

Don't let this opportunity to invest in the next generation of market leaders pass you by. Subscribe to Rule Breakers today and start your journey towards life-changing wealth.

Click Here to Try Rule Breakers (May 15th, 2024)

Advisor Insights: To demystify complex investments, Motley Fool Stock Advisor blends expertise with actionable guidance to boost your investing confidence.

Zacks Premium has established itself as a trusted name in the world of stock market investing, thanks to its unique blend of quantitative analysis and proprietary stock rating system. With a history dating back to 1978, Zacks has consistently delivered actionable insights to investors seeking to navigate the complexities of the market and build profitable portfolios.

At the heart of Zacks Premium lies the renowned Zacks Rank, a data-driven stock rating system that harnesses the power of earnings estimate revisions. By focusing on this key metric, Zacks is able to identify stocks with the greatest potential for outperformance, giving subscribers a significant edge in their investment decisions.

What sets Zacks Premium apart is its commitment to rigorous, quantitative analysis. The service employs a team of experienced analysts who continuously monitor earnings estimates and revisions, ensuring that subscribers receive the most up-to-date and accurate information available. This scientific approach to stock selection instills confidence in users, knowing that every recommendation is backed by solid data and research.

Beyond the Zacks Rank, Premium subscribers gain access to a wealth of additional tools and resources designed to enhance their investing experience:

One of the standout features of Zacks Premium is its flexibility. Whether you're a long-term investor seeking to build a resilient portfolio or an active trader looking to capitalize on short-term market movements, Zacks provides the tools and insights needed to succeed.

With customizable alerts and watchlists, you can tailor the service to your individual investing style and goals. For investors seeking to take control of their financial future, Zacks Premium offers a compelling solution.

With its proven track record, data-driven approach, and comprehensive suite of tools, Zacks empowers users to make informed investment decisions with confidence. If you're ready to unlock the full potential of your portfolio, Zacks Premium is an essential resource to consider.

Click to Try Zacks Premium Now

Future Planning: Enhance your retirement strategy with Motley Fool Retirement, guiding you to make informed decisions for a secure financial future.

Seeking Alpha Premium is a comprehensive stock analysis platform that harnesses the collective wisdom of a global community of investors and industry experts. With a focus on providing diverse, data-driven insights, Seeking Alpha Premium empowers users to make informed investment decisions.

The platform offers an extensive array of tools and resources, including:

What sets Seeking Alpha Premium apart is the sheer breadth and depth of its crowd-sourced content. Users can access a spectrum of opinions and analysis, from detailed fundamental research to technical assessments and contrarian views.

This diversity of perspectives, coupled with data-driven tools, allows investors to approach the market with a holistic, well-rounded understanding. Whether you're a long-term investor or an active trader, Seeking Alpha Premium provides the resources to navigate the complexities of the stock market with greater clarity and conviction.

For those seeking to take control of their financial future, Seeking Alpha Premium is an indispensable ally. Its commitment to empowering individual investors with the knowledge and tools to succeed sets it apart in a crowded field of investment services.

If you're ready to elevate your investing game and join a vibrant community of market participants, Seeking Alpha Premium is the platform to help you achieve your financial goals with confidence.

Click to Try Seeking Alpha Premium Now

Market Research: Equip yourself with insights from best investment advice websites to ensure informed, strategic market entries and exits.

Trade Ideas is a pioneering stock market analytics platform that has been empowering individual traders and investors since 2002. With its cutting-edge technology and innovative tools, Trade Ideas has carved a unique niche in the market.

At the core of Trade Ideas' offerings is a powerful combination of real-time market data, advanced analytics, and artificial intelligence. This unique blend of features sets Trade Ideas apart from other stock advisory services, providing users with actionable insights that can be immediately applied to their trading strategies.

One of the standout features of Trade Ideas is its AI-powered assistant, named Holly. Holly is designed to scan the market in real-time, identify potential trading opportunities, and provide users with clear, easy-to-follow trade ideas. By leveraging machine learning algorithms, Holly continuously adapts to changing market conditions, ensuring that the trade ideas generated are always relevant and up-to-date.

In addition to Holly, Trade Ideas offers a wealth of other tools and resources, including:

These features are designed to cater to the diverse needs of Trade Ideas' user base, whether they are day traders looking for quick profit opportunities or long-term investors seeking to build a robust portfolio.

Another key aspect of Trade Ideas is its commitment to user education and community building. The platform offers a range of educational resources, including webinars, tutorials, and a comprehensive knowledge base, to help users enhance their trading skills and knowledge.

Additionally, Trade Ideas fosters a vibrant community of traders through its trading room and forum, where users can interact, share ideas, and learn from one another.

If you're looking for a stock advisory service that can provide you with the tools, insights, and support you need to succeed in the markets, Trade Ideas is definitely worth considering. With its advanced technology, user-friendly interface, and commitment to user education, Trade Ideas has the potential to revolutionize your trading experience and help you achieve your financial goals.

TipRanks Premium is a cutting-edge stock advisor service that harnesses the power of aggregated expert opinions and predictive tools to provide investors with actionable market insights. By compiling data and forecasts from top-performing analysts, TipRanks offers a comprehensive overview of market sentiment and consensus, empowering users to make more informed investment decisions.

What sets TipRanks apart is its unique approach to transparency and user empowerment. The platform provides a wealth of features designed to give investors a clear, unbiased view of the market, including:

In addition to these powerful tools, TipRanks Premium offers a host of resources to help investors stay informed and ahead of the curve. From daily stock ideas to in-depth research reports, the platform provides a constant stream of valuable insights.

Whether you're a seasoned investor or just starting to build your portfolio, TipRanks Premium can be an invaluable ally in your investment journey. With its commitment to transparency, data-driven insights, and user empowerment, TipRanks is uniquely positioned to help you navigate the complex world of stock investing with confidence and clarity.

If you're ready to take your investment strategy to the next level, TipRanks Premium could be the solution you've been seeking. By leveraging the collective wisdom of top market experts and cutting-edge predictive tools, you'll be well on your way to building a robust, resilient portfolio designed to weather any market conditions.

Click to Try TipRanks Premium Now

A stock advisor website is an online service that provides expert guidance and recommendations to help you make informed investment decisions. These websites simplify the process of selecting stocks, offering you a curated list of promising investment opportunities.

By leveraging the knowledge and experience of professional analysts, stock advisor websites aim to empower you to build a profitable portfolio with confidence. Whether you're a beginner investor or a seasoned pro, a stock advisor website can be an invaluable resource in your investing journey.

These platforms typically offer a range of features, including:

One of the key benefits of using a stock advisor website is the potential to outperform the market. Many of these services have a proven track record of delivering market-beating returns, thanks to the expertise of their analysts and rigorous research.

Of course, not all stock advisor websites are created equal. It's important to choose a service that aligns with your investment goals, risk tolerance, and learning style. Look for a platform with:

When identifying the best stock advisor, consider services with a proven track record of delivering market-beating returns over the long term. Look for a stock advisor that has consistently outperformed benchmark indexes like the S&P 500.

Transparency is another critical component of the best stock advisor services. You want a platform that openly shares its methodology, performance metrics, and track record, so you can trust the validity of their recommendations.

The best stock advisors will also provide:

Affordability and value are also important considerations when selecting the best stock advisor. Look for a stock advisor that offers a range of subscription options and pricing tiers to fit your budget and investing goals.

To determine the best stock advisor websites, we conducted a rigorous evaluation process that considered a range of critical factors. Our goal was to identify the platforms that offer the most value, performance, and user experience for individual investors.

Some of the key criteria we assessed include:

In addition to these core factors, we also considered elements like:

By weighing each of these criteria, we identified the stock advisor websites that truly stand out. While no single service is perfect for every investor, the top-rated platforms offer a compelling combination of performance, value, and user experience.

Explore More on Stock Advisors and Investing:

```*Disclaimer: Unless noted otherwise all returns are as of Apr 19, 2024. Past performance is no guarantee of future results. Individual investment results may vary. All investing involves risk of loss.

We provide general information, not investment advice. Some of the links on this page are affiliate links in which we receive a commission when a purchase is made.

$89 promotional price for new members only. $110 discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then current list price.

$99 promotional price for new Rule Breakers members. $200 discount based on current list price for Rule Breakers of $299. Membership will renew annually at the then current list price.