7 Best Stock Market Advice & Investing Services for 2024

Discover your path to confident investing with the best stock advisor services and stock analysis sites for 2024.

We aim for insightful coverage of products and services, including some from compensating partners, which may influence our topics and presentation. Our opinions and conclusions remain unbiased. See our Advertiser Disclosure.

Are you tired of sifting through endless stock market noise, yearning for reliable guidance that could truly elevate your investment strategy?

Your quest for market-beating insights from credible sources ends here.

Let’s explore the top stock market advice and investing services poised to empower your financial decisions in 2024 and beyond.

Best Stock Advice and Picks

Here are the best stock advice and stock picks we’ve reviewed in 2024

| Best Stock Advisor Picks | Best For | Investing Focus |

|---|---|---|

| 📈Motley Fool Stock Advisor | Long-term growth | Stock Picking |

| 🎯Alpha Picks by Seeking Alpha | Community insights | Analyst Wisdom |

| 💡Trade Ideas | AI-driven strategies | Real-time Trading |

| 📊Seeking Alpha Premium | Data evaluations | Detailed Analysis |

| 🌟Morningstar Investor | Disciplined investing | Fundamentals Research |

| 🔍TipRanks Premium | Predictive analytics | Expert Consensus |

| 💼Zacks Premium | Value stocks | Quantitative Research |

1. Motley Fool Stock Advisor

-

Best for: Growth investors seeking market-beating returns, value seekers looking for thoroughly researched stock picks, and long-term investors aiming to build wealth through a proven strategy.

-

Cost: $99/year for new members (50% OFF $199/year)

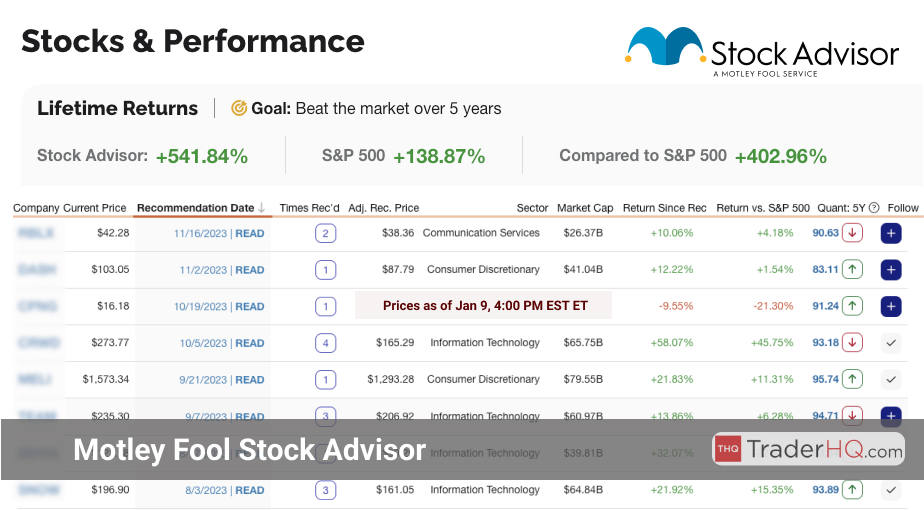

{Founded by David and Tom Gardner in 2002, Motley Fool Stock Advisor has become a premier investment guidance service, helping countless investors achieve market-beating returns. With a focus on long-term, buy-and-hold investing in high-quality companies, Stock Advisor’s philosophy is built on the principles of patience and discernment.

As legendary investor Peter Lynch once said, “In this business, if you’re good, you’re right six times out of ten.” Stock Advisor embodies this perspective, emphasizing the importance of making informed decisions and staying the course. By focusing on businesses with strong fundamentals and holding them for the long haul, investors can benefit from the power of compounding returns.

Warren Buffett, another investing icon, famously stated, “The stock market is a device for transferring money from the impatient to the patient.” Stock Advisor (in-depth review)’s approach aligns with this wisdom, encouraging investors to maintain a long-term outlook and avoid the pitfalls of emotional decision-making.

Since its inception, Stock Advisor has delivered impressive results. The average return of a Stock Advisor pick is 737%, compared to the S&P 500’s average return of 162% over the same period. In other words, Stock Advisor has outperformed the S&P 500 by an impressive 4.5x times.

Motley Fool’s commitment to transparency is evident in their performance tracking. Here are some of their most impressive stock picks:

-

NVIDIA (NVDA), recommended in April 2005, has achieved a staggering 74,099% return, turning a $1,000 investment into $741,989.

-

Netflix (NFLX), picked in December 2004, has delivered a 34,579% return, transforming a $1,000 investment into $346,786.

-

Amazon (AMZN), recommended in September 2002, has generated a 23,904% return, turning a $1,000 investment into $240,039.

Stock Advisor’s success lies not only in its stock recommendations but also in the comprehensive resources it provides. Members gain access to in-depth research reports, educational content, and a thriving investor community, all designed to support informed decision-making and continuous learning.

By combining expert guidance, a focus on long-term investing, and a wealth of educational resources, Motley Fool Stock Advisor (see our review) empowers investors to take control of their financial future. With a proven track record and a commitment to transparency, Stock Advisor is an invaluable tool for anyone seeking to build lasting wealth in the stock market.

}

2. Alpha Picks by Seeking Alpha

-

Best for: Value investors seeking high returns, growth-focused individuals looking for outperformers, and strategic planners aiming to diversify their portfolios.

-

Cost: $449/year for new members (10% OFF $499/year)

{Alpha Picks by Seeking Alpha is a specialized service that leverages a systematic stock selection process to identify top investment opportunities. Utilizing advanced quantitative analysis and unique data, Alpha Picks provides subscribers with well-researched stock recommendations.

Seeking Alpha (see our review), a renowned financial services company, offers Alpha Picks as one of its premium services. The service delivers a curated list of high-potential stocks selected through a rigorous quantitative methodology, aiming to help investors enhance their portfolios with data-driven recommendations.

Alpha Picks (see our review) has demonstrated impressive performance since its inception in July 2022. The average return of an Alpha Picks stock pick is 126%, compared to the S&P 500’s return of 45% over the same period. This means Alpha Picks has outperformed the S&P 500 by 2.8x.

Some of the best-performing stock picks from Alpha Picks include:

-

A Server Solutions Company recommended on 2022-11-15, which has returned 969%, turning a $1,000 investment into $10,686.

-

A Thermal Solutions Company recommended on 2022-12-15, with a 424% return, growing a $1,000 investment to $5,244.

-

An Energy Solutions Company recommended on 2023-05-15, delivering a 176% return, turning $1,000 into $2,757.

Alpha Picks offers a range of benefits and features to subscribers, including:

-

Expertise and Resources: Access to a team of seasoned quantitative strategists.

-

In-depth Analysis: Detailed research and analysis for each stock pick.

-

Systematic Approach: A disciplined and data-driven stock selection process.

-

Regular Updates: Bi-monthly stock recommendations and ongoing portfolio management advice.

The service also provides a variety of tools and resources to support informed investment decisions, such as quantitative ratings, portfolio management tools, email alerts, and analytical tools. Subscribers can expect to receive two new stock recommendations each month, along with comprehensive reports and ongoing support from the Alpha Picks team.

For long-term investors seeking to enhance their portfolios with data-driven stock recommendations and expert analysis, Alpha Picks by Seeking Alpha (read our review) offers a compelling solution. With its impressive track record and systematic approach, the service can help investors navigate the market and identify high-potential investment opportunities.

}

3. Trade Ideas

-

Best for: Active traders seeking real-time data, swing traders looking for stock picks, algorithmic traders benefiting from advanced scanning tools.

-

Cost: $84/month (billed annually at $999)

Trade Ideas is a leading market research and stock scanning platform that has been empowering self-directed traders and investors since 2003. With its advanced algorithms and AI-powered analysis, Trade Ideas (see our review) stands apart in providing actionable, real-time insights for navigating the complex world of stock trading.

At the core of Trade Ideas’ offerings is its robust stock scanner, which continuously analyzes market data to uncover promising trade opportunities. This powerful tool is complemented by a range of features designed to help users stay informed and seize potential profits, including:

-

Customizable alerts that notify users of key price movements, volume spikes, and other critical events

-

In-depth charts and technical indicators for evaluating the strength and potential of each trading opportunity

-

Backtesting capabilities to assess the viability of trading strategies based on historical market data

Beyond its core scanning and analysis tools, Trade Ideas also offers a wealth of educational resources to help users sharpen their trading skills and stay ahead of the curve. From expert-led webinars and tutorials to a vibrant user community, Trade Ideas empowers its members with the knowledge and confidence to succeed in the fast-paced world of stock trading.

Whether you’re a seasoned trader looking to refine your strategies or a newcomer eager to start your journey, Trade Ideas provides the tools, insights, and support to help you navigate the market with greater precision and success. With its proven track record and commitment to innovation, Trade Ideas is a powerful ally in your quest to unlock the full potential of your trading.

4. Seeking Alpha Premium

-

Best for: Value investors seeking in-depth analysis, income-focused investors looking for dividend insights, and growth investors interested in emerging opportunities.

-

Cost: $189/year for new members (Regular price $239/year)

Seeking Alpha Premium has established itself as a comprehensive and insightful platform for investors seeking in-depth stock analysis and reliable investment advice. With a history of delivering high-quality research and a strong reputation in the market, Seeking Alpha Premium (in-depth review) offers a range of powerful tools and resources designed to help users make informed decisions and optimize their investment strategies.

One of the key features that sets Seeking Alpha Premium apart is its extensive coverage of stocks, providing detailed analysis from multiple perspectives.

Users can access a wealth of information, including:

-

Quant Ratings: Algorithmic evaluations of stocks based on quantitative models

-

SA Author Ratings: Insights from a diverse group of experienced Seeking Alpha contributors

-

Wall Street Ratings: Opinions and analysis from professional analysts at leading financial institutions

In addition to these comprehensive stock ratings, Seeking Alpha Premium offers a range of tools and resources that cater to the needs of both investors and professionals. The platform’s Dividend Grades provide in-depth analysis of dividend-paying stocks, assessing factors such as dividend safety, growth, and consistency. This feature is particularly valuable for income-focused investors seeking reliable and sustainable dividend streams.

Seeking Alpha Premium also empowers users with powerful screening tools, allowing them to quickly identify stocks that meet specific criteria. This feature saves valuable time and enables investors to focus on opportunities that align with their investment goals and preferences.

Moreover, the platform’s Quick Lists provide instant access to top-rated stocks across various categories, further streamlining the investment research process.

Another standout feature of Seeking Alpha Premium is its robust portfolio management tools. Users can leverage the platform’s Portfolio Grading system to assess the health and balance of their investment portfolio based on factors such as value, growth, and dividends. This holistic evaluation helps investors make informed decisions and adjust their holdings as needed to optimize performance and mitigate risk.

Staying informed about market movements is crucial for successful investing, and Seeking Alpha Premium keeps users ahead of the curve with its real-time alerts and customizable news dashboard. By providing timely updates on stock ratings, earnings reports, and market-moving news, the platform enables users to react quickly to emerging opportunities and potential risks.

For investors seeking to enhance their knowledge and skills, Seeking Alpha Premium offers unlimited access to a vast library of educational content, including articles, earnings call transcripts, and in-depth analysis. This wealth of information empowers users to continually expand their understanding of the market and refine their investment strategies over time.

Whether you’re a seasoned investor or just starting out, Seeking Alpha Premium provides the tools, insights, and expertise you need to navigate the complex world of stock investing with confidence. With its commitment to delivering high-quality research, actionable recommendations, and a user-friendly platform, Seeking Alpha Premium is an invaluable resource for anyone looking to take their investment performance to the next level in 2024 and beyond.

5. Morningstar Investor

-

Best for: Long-term planners, diversified portfolio enthusiasts, and data-driven analysts seeking comprehensive research.

-

Cost: $199/year for new members (20% OFF $249/year)

Founded in 1984, Morningstar has established itself as a leading provider of independent investment research. Morningstar Investor is a comprehensive service designed to empower self-directed investors with the tools and insights needed to make informed decisions.

What sets Morningstar Investor (read our review) apart is its commitment to objective, unbiased analysis. With a team of over 150 specialized analysts, the service delivers in-depth research across various sectors, ensuring subscribers have access to expert insights without the influence of external stakeholders.

Morningstar Investor offers a range of powerful features to support your investment journey:

-

Comprehensive Ratings System: Understand the methodology behind investment evaluations and access ratings for securities, fund managers, and ESG considerations.

-

Investment Screening Tools: Utilize data analytics and expert insights to filter investment options effectively and explore curated lists of vetted investments.

-

Portfolio X-Ray: Gain a granular view into your portfolio composition, identifying concentrations, redundancies, and hidden exposure risks, while evaluating the impact of fees on returns.

The service also prioritizes personalization and efficiency. With account aggregation, you can consolidate and monitor your investments in real-time, ensuring a cohesive strategy across all holdings. Personalized insights, watchlists, and customization features deliver tailored analysis and keep pertinent information at your fingertips.

Morningstar Investor’s pricing strategy demonstrates confidence in its value. The yearly subscription offers significant savings compared to monthly plans, and a 7-day free trial allows you to evaluate the service risk-free.

Whether you’re focused on risk management, performance tracking, discovering new opportunities, or enhancing your financial literacy, Morningstar Investor provides the tools and insights to support your goals. By streamlining portfolio analysis and automating monitoring tasks, the service helps you save time and make informed decisions with ease.

Experience the power of independent research and take control of your investment future with Morningstar Investor. With its commitment to objectivity, comprehensive tools, and personalized insights, you’ll be equipped to navigate the market with confidence and achieve your financial aspirations.

6. TipRanks Premium

-

Best for: Growth investors looking for stock insights, value investors seeking analyst ratings, and data enthusiasts interested in comprehensive financial data.

-

Cost: $30 per month, billed annually (total $360/year)

TipRanks Premium has established itself as a go-to service for investors seeking comprehensive stock analysis and reliable investment advice. With a proven track record and a team of experienced analysts, TipRanks provides valuable insights to help users navigate the complex world of investing.

What sets TipRanks apart is its unique aggregation of analyst ratings, insider transactions, and financial blogger opinions. This holistic approach gives users a well-rounded view of each stock, enabling them to make informed decisions based on a diverse range of expert insights.

In addition to its core stock analysis, TipRanks offers a suite of powerful tools and resources designed to enhance the user’s investing experience. These include:

-

Smart Portfolio: Track and analyze your investments, benchmark performance, and receive personalized portfolio alerts.

-

Stock Screener: Filter stocks based on multiple criteria to identify investment opportunities that align with your strategy.

-

Economic Calendar: Stay informed about upcoming market-moving events and economic releases.

-

Daily Analyst Ratings: Access a daily feed of the latest analyst ratings and target price changes.

TipRanks also provides educational resources, including webinars and tutorials, to help users expand their investing knowledge and skills. Whether you’re a beginner or an experienced investor, TipRanks offers valuable insights and tools to support your investment journey.

For investors seeking reliable stock advice and a comprehensive set of tools to guide their investment decisions, TipRanks Premium (see our review) is an excellent choice. With its commitment to transparency, data-driven insights, and user empowerment, TipRanks can help you navigate the market with confidence and work towards achieving your financial goals.

7. Zacks Premium

-

Best for: Value investors seeking strong stock recommendations, growth investors looking for high potential picks, and technical traders aiming for detailed analysis.

-

Cost: $249/year after free 30-day trial

For the discerning investor seeking a trusted partner to navigate the complexities of the stock market, Zacks Premium stands out as a comprehensive solution. With a proven track record of outperforming the S&P 500, Zacks has built a reputation for delivering high-quality stock picks and investment advice designed to help subscribers achieve long-term capital growth.

What sets Zacks Premium (read our review) apart is its data-driven approach, harnessing the power of advanced algorithms and proprietary ranking systems to identify stocks with the greatest potential. The service’s cornerstone, the Zacks Rank, has consistently demonstrated its predictive accuracy, giving subscribers an edge in anticipating future stock performance.

But Zacks Premium offers far more than just a list of stock picks. Subscribers gain access to a wealth of tools and resources designed to empower informed decision-making, including:

-

Style Scores - Align your investments with your preferred strategy, whether you favor value, growth, or momentum investing.

-

Focus List - Tap into a curated portfolio of 50 stocks selected for their strong potential to outperform the market over the long term.

-

Industry Rank - Identify the top-performing sectors poised to beat the market, increasing your chances of picking winning stocks.

-

Comprehensive Equity Research - Dive deep into the fundamentals with detailed reports on over 1,000 companies, gaining insights to guide your trading decisions.

For those who prefer a more hands-on approach, the Zacks Premium Screener allows you to filter stocks based on your unique criteria, empowering you to build a portfolio tailored to your individual goals and risk tolerance.

With Zacks Premium, you’re never investing alone. You’ll benefit from the expertise of a team of over 80 professional analysts, dedicated to uncovering the best opportunities in the market.

Plus, with a 30-day free trial and a money-back guarantee, you can invest with confidence, knowing you have a trusted partner at your side.

If you’re ready to take your investing to the next level and unlock the power of data-driven stock picks, join the countless satisfied subscribers who trust Zacks Premium to guide them toward their financial goals. With the tools, insights, and support you need to succeed, Zacks Premium is the key to mastering the market in 2024 and beyond.

What is a Stock Advice Service?

A stock advice service provides expert guidance and recommendations to help you make informed decisions when investing in the stock market. These services are designed to cut through the noise and confusion, offering clear, actionable insights backed by thorough research and analysis. By leveraging the knowledge and experience of professional stock analysts, you can gain a valuable edge in identifying the most promising investment opportunities.

Stock advice services can be an invaluable resource for investors of all levels, from beginners just starting to build their portfolios to seasoned pros looking to fine-tune their strategies. With a wide range of options available, from basic stock picking newsletters to comprehensive, personalized investment management, there’s a service to fit every investor’s needs and goals.

Whether you’re aiming to grow your wealth over the long term, generate income in retirement, or anything in between, the right stock advice service can provide the guidance and support you need to navigate the market with confidence and achieve your financial objectives.

What is the Best Stock Advice Service?

The best stock advice service is one that has a proven track record of delivering consistent, market-beating returns over time. Look for a service with a transparent, rigorous methodology for selecting stocks, backed by deep fundamental research and analysis. The best services will provide clear, detailed rationales for each recommendation, helping you understand the key drivers behind a stock’s potential.

Credibility and trustworthiness are also essential factors to consider. The best stock advice services will have a strong reputation in the industry, with endorsements from respected third parties and a loyal, satisfied subscriber base. They should be transparent about their performance, regularly publishing audited track records of their recommendations.

Ultimately, the best stock advice service for you will be one that aligns with your individual investing goals, risk tolerance, and learning style. Some investors prefer a more hands-off approach, with a concise list of top stock picks, while others value detailed analysis, education, and the ability to interact with advisors. Consider your own needs and preferences when evaluating services to find the best fit.

How We Evaluated the Best Stock Advice Services

To identify the best stock advice services, we conducted a rigorous, multi-faceted evaluation process. Our team of experienced analysts and investors reviewed a wide range of services, assessing each one based on a comprehensive set of criteria.

Some of the key factors we considered include:

-

Performance: We looked for services with a proven track record of generating strong, market-beating returns over time, based on audited results.

-

Quality of Research and Analysis: The best services provide in-depth, fundamental analysis to support their stock picks, with clear, compelling rationales.

-

Credibility and Reputation: We prioritized services with a strong reputation in the industry, backed by endorsements from respected third parties and glowing customer reviews.

-

Transparency: Services that openly and regularly publish their performance data and track record earned higher marks in our evaluation.

In addition to these core criteria, we also considered factors like the range and depth of educational resources provided, the user-friendliness and accessibility of the service’s platform and materials, and the overall value proposition relative to cost.

By weighing each of these elements, we were able to narrow down the field to a select list of the very best stock advice services on the market today. While every investor’s needs and preferences are unique, we’re confident that these top-rated services offer exceptional value and have the potential to significantly improve your investing outcomes.

Upfront Bottom Line — Best Stock Picking Services for investors

✅ Top 2 Picks: Motley Fool Stock Advisor and Alpha Picks by Seeking Alpha

Finding reliable and profitable stock advice can transform your investment journey. Whether you’re aiming for consistent growth, high returns, or comprehensive analysis, these top services offer expert guidance to help you navigate the complexities of the market with confidence.

Our Bottom Line Summary:

1. 🥇 Motley Fool Stock Advisor

Motley Fool Stock Advisor is ideal for long-term investors seeking consistent growth and value-minded investors interested in strong fundamentals. Its impressive average return since inception significantly outperforms the S&P 500. Price: $99/year for new members (50% OFF $199/year)

Try it Now Read More ↓

2. 🥈 Alpha Picks by Seeking Alpha

Alpha Picks by Seeking Alpha is perfect for growth seekers, dividend enthusiasts, and value hunters. It combines quantitative analysis and fundamental insights to consistently outperform the S&P 500. Price: $449/year for new members (10% off the first year)

Try it Now Read More ↓

3. Trade Ideas

Trade Ideas is best for active traders seeking real-time data and algorithmic traders benefiting from advanced scanning tools. It provides actionable, real-time insights for navigating the stock market. Price: $84/month (billed annually at $999)

Try it Now Read More ↓

4. Seeking Alpha Premium

Seeking Alpha Premium is essential for value investors seeking in-depth analysis and income-focused investors looking for dividend insights. It offers comprehensive stock ratings and powerful screening tools. Price: $189/year for new members (Regular price $239/year)

Try it Now Read More ↓

5. Morningstar Investor

Morningstar Investor is perfect for long-term planners and diversified portfolio enthusiasts. It provides comprehensive research and powerful tools like Investment Screening and Portfolio X-Ray. Price: $199/year for new members (20% OFF $249/year)

Try it Now Read More ↓

TipRanks Premium is ideal for growth investors and data enthusiasts. It aggregates analyst ratings, insider transactions, and financial blogger opinions to provide a well-rounded view of each stock. Price: $30 per month, billed annually (total $360/year)

Try it Now Read More ↓

7. Zacks Premium

Zacks Premium is designed for value investors seeking strong stock recommendations and growth investors looking for high potential picks. It offers comprehensive equity research and powerful screening tools. Price: $249/year after free 30-day trial

Try it Now Read More ↓

🧠 Thinking Deeper

- ☑️ Work on mastering your emotions. They can lead you astray in both bull and bear markets.

- ☑️ Consider passive investing strategies if active management doesn't suit your style or time constraints.

- ☑️ Get comfortable being uncomfortable. The best investments often feel risky at first.

- ☑️ Look for the value behind the price. They're not always the same thing.

📚 Wealthy Wisdom

- ✨ The individual investor should act consistently as an investor and not as a speculator. - Benjamin Graham

- ✔️ If you have trouble imagining a 20% loss in the stock market, you shouldn't be in stocks. - John Bogle

- 🌟 The best investment you can make is in yourself. - Warren Buffett

- 🚀 Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it. - Peter Lynch

📘 Table of Contents

- • Best Stock Advice and Picks

- • Motley Fool Stock Advisor

- • Alpha Picks by Seeking Alpha

- • Trade Ideas

- • Seeking Alpha Premium

- • Morningstar Investor

- • TipRanks Premium

- • Zacks Premium

- • What is a Stock Advice Service?

- • What is the Best Stock Advice Service?

- • How We Evaluated the Best Stock Advice Services

- • Upfront Bottom Line — Best Stock Picking Services for investors

- • Our Bottom Line Summary: