You’re not looking for another list of “best stock pickers.” You’ve seen those. They all rank the same services by the same track record numbers and tell you to pick the one with the highest returns.

That approach misses something fundamental: investment subscriptions aren’t interchangeable products. A stock-picking newsletter and a research platform solve completely different problems. Comparing them by “which beats the market” is like comparing a personal trainer to a gym membership by asking “which one makes you stronger.”

The right question isn’t “which service has the best returns?” It’s “which subscription model fits how I actually want to invest?”

Our Top Pick: Motley Fool Stock Advisor — 23+ years, +1051.7% returns vs S&P’s +185.5%. The most complete investment system with portfolio framework and proven methodology. Try Stock Advisor risk-free for 30 days.

Why February 2026 Is the Best Stock-Picker’s Market in Years: Dispersion has surged to an exceptional 66 points—with top 20 stocks averaging +39% while bottom 20 average -27%. The Russell 2000 (+6.75% YTD) is crushing the S&P 500 (+0.63% YTD) by 10:1—the kind of small-cap outperformance that defines rotation environments. Memory/storage is dominating: SNDK +146%, WDC +56%, STX +52%. Transportation breaks out: ODFL +33%, FDX +26%, LUV +27%. Enterprise software collapses: APP -43%, IT -37%, PLTR -22%. The Fed remains on hold at 3.50-3.75% with 2 cuts expected in 2026, CAPE sits at ~36, and VIX hovers around 16. In this environment, professional stock selection isn’t just helpful—it’s essential. The gap between owning SNDK (+146%) and APP (-43%) is nearly 200 percentage points. Start with Stock Advisor’s proven 23-year track record.

Time horizon determines your best fit:

- 1-3 year horizons: Alpha Picks (EXCEPTIONAL fit) with 73% win rate—quant model capturing the 10:1 small-cap rotation

- 5+ year horizons: Stock Advisor (EXCEPTIONAL fit) with 67% win rate, 92.8% for 10+ year holds, 46 ten-baggers

Here’s the landscape: Investment subscriptions fall into four distinct categories—stock-picking newsletters that tell you what to buy, research platforms that help you decide for yourself, expert-tracking tools that verify who’s worth listening to, and market intelligence services that give you an information edge. Each serves a different investor. This guide helps you find where you belong.

The Quick Answer: 7 Investment Subscriptions Compared

| Rank | Service | Category | What You Pay For | Price | Best For |

|---|---|---|---|---|---|

| 🥇 | Stock Advisor | Stock Picking | 2 picks/month + portfolio framework | $99/yr | Investors who want a complete system |

| 🥈 | Alpha Picks | Stock Picking | 2 quant-selected picks/month | $449/yr | Data-driven investors who trust algorithms |

| 🥉 | Morningstar Investor | Research Platform | Fair Value estimates + Moat ratings | $199/yr | Self-directed analysts who enjoy research |

| 4 | Seeking Alpha Premium | Research Platform | 18,000+ contributors + Quant ratings | $269/yr | Research synthesizers who want diverse views |

| 5 | TipRanks | Expert Tracking | 96,000+ expert performance tracking | $99/yr | Skeptics who verify before trusting |

| 6 | Zacks Premium | Research Platform | Zacks Rank + earnings estimates | $249/yr | Earnings-focused quantitative investors |

| 7 | Benzinga Pro | Market Intelligence | Real-time news + Audio Squawk | $184/yr+ | Day traders who need speed |

Find Your Category:

- “Just tell me what to buy” → Stock-Picking Newsletters (Stock Advisor, Alpha Picks)

- “Give me tools to decide myself” → Research Platforms (Morningstar, SA Premium, Zacks)

- “Help me verify who’s credible” → Expert Tracking (TipRanks)

- “I need information faster than everyone else” → Market Intelligence (Benzinga Pro)

Why This Ranking Is Different

Most “best investment newsletter” lists rank services by track record. That’s useful—but it assumes everyone wants the same thing: stock picks that beat the market.

In reality, investors have fundamentally different needs:

- Some want to be told what to buy and trust the process

- Some want research tools to make their own decisions

- Some want to verify which experts are actually accurate

- Some need real-time information to trade actively

Our approach: We categorized 7 investment subscriptions by what they actually deliver, then ranked the best within each category. The result is a guide that helps you find the right type of subscription—not just the one with the biggest return number.

How we evaluated:

-

Value proposition clarity. Does the service deliver what it promises? A research platform shouldn’t be judged by stock picks it doesn’t make.

-

Methodology transparency. Services that explain their approach rank higher than black boxes.

-

Subscriber experience. The interface, community, educational content, and ongoing support matter as much as the recommendations.

-

Honest trade-offs. Every service has limitations. We call them out.

This isn’t sponsored content. We use affiliate links, but the rankings are based on what we’d actually recommend to different types of investors.

Understanding Investment Subscription Categories

Before diving into individual services, understand what you’re choosing between:

Category 1: Stock-Picking Newsletters

What they are: Services that provide specific buy recommendations—“buy this stock now”—with varying levels of supporting research.

What you pay for: The picks themselves, plus (in better services) a framework for building a portfolio.

Examples: Stock Advisor, Alpha Picks

Best for: Investors who want actionable recommendations and are willing to follow a system.

The trade-off: You’re outsourcing conviction. If you don’t understand why you own something, you’ll struggle to hold through volatility.

Category 2: Research Platforms

What they are: Tools and data that help you evaluate investments and make your own decisions. They don’t tell you what to buy—they help you figure it out.

What you pay for: Valuation models, ratings, screening tools, analyst reports, and data access.

Examples: Morningstar Investor, Seeking Alpha Premium, Zacks Premium

Best for: Self-directed investors who enjoy the research process and want to build independent capability.

The trade-off: You do the work. No one tells you what to buy.

Category 3: Expert Tracking Tools

What they are: Services that track and rank the performance of financial experts—analysts, bloggers, hedge funds—so you know who’s actually accurate.

What you pay for: Accountability data. Who’s right? Who’s wrong? Who should you listen to?

Examples: TipRanks

Best for: Skeptical investors who want to verify credibility before following anyone’s advice.

The trade-off: Still requires you to synthesize information and make decisions.

Category 4: Market Intelligence Services

What they are: Real-time news and data platforms designed for active traders who need information before it’s priced in.

What you pay for: Speed. Breaking news, unusual activity alerts, and market-moving information faster than mainstream sources.

Examples: Benzinga Pro

Best for: Day traders and swing traders who trade on news and momentum.

The trade-off: Speed-focused services are useless for long-term investors. You’re paying for an edge that only matters if you act on it immediately.

1. Motley Fool Stock Advisor — The Complete Investment System

Patient growth investors who hold through volatility for 5+ years

Most stock-picking newsletters give you tips. Stock Advisor gives you a system.

That distinction matters. A tip is “buy this stock.” A system is a framework for building a portfolio, managing risk, and holding through the inevitable 40% drawdowns that come with growth investing. After 22 years and 500+ recommendations, Stock Advisor has refined both.

Motley Fool Stock Advisor Performance

The Motley Fool · 503 picks · 24 years · Updated 2025-11-24

| SA Return | S&P 500 | Alpha | Win Rate |

|---|---|---|---|

| +1.1K% | +186% | +866% | 65% |

S&P 500 shows what you'd have earned buying the index on each pick date instead. Same timing, fair comparison.

| SA Multi-Baggers | 10x+ | 5x+ | 3x+ | 2x+ |

|---|---|---|---|---|

| Count | 43 | 85 | 125 | 181 |

| SA Asymmetry | Avg Winner | Avg Loser | Ratio |

|---|---|---|---|

| Return | +1.6K% | -44% | ~35:1 |

Best Performers (All-Time)

| SA Pick | Return |

|---|---|

DIS Disney | +5.8K% |

AMZN Amazon | +31K% |

AAPL Apple | +5.5K% |

BKNG Booking Holdings | +20K% |

TSLA Tesla | +20K% |

NFLX Netflix | +43K% |

CTAS CTAS | +4.2K% |

SHOP Shopify | +3.6K% |

NVDA NVIDIA | +110K% |

MME.DL MME.DL | +4.3K% |

43 ten-baggers. These 1,000%+ winners—NVDA, NFLX, AMZN—are what drive the portfolio. You don't need to pick all winners; you need a few massive ones.

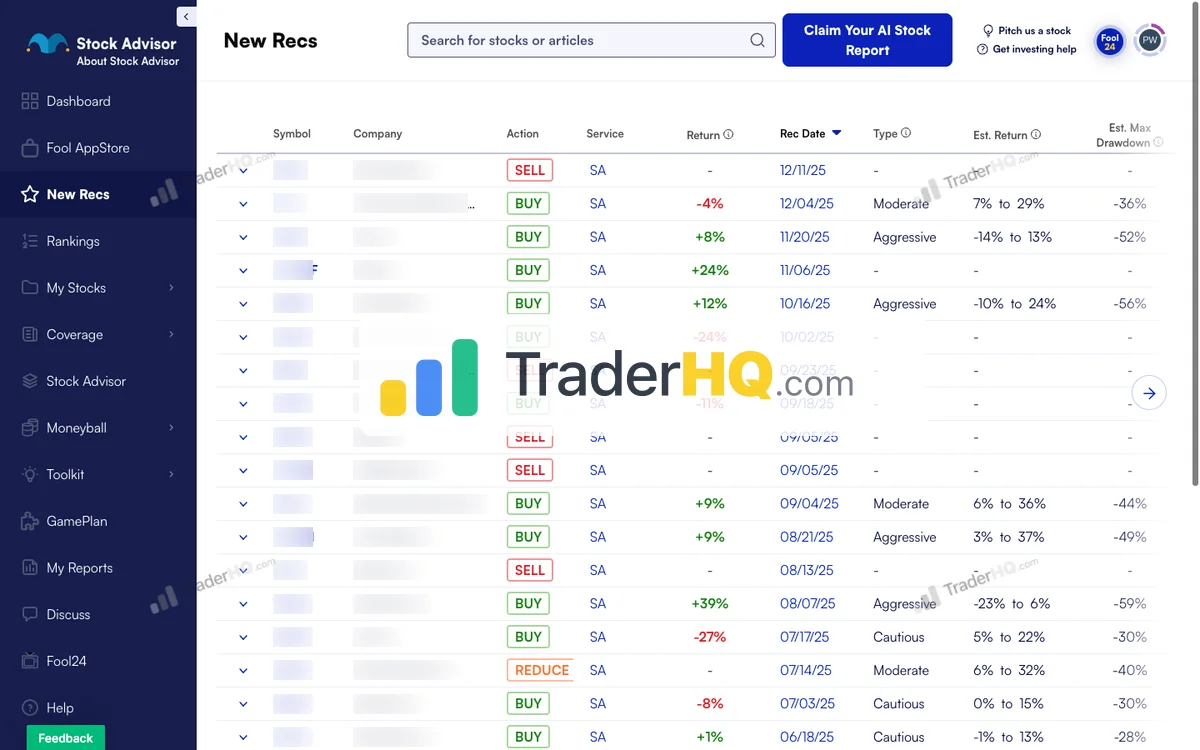

See All Stock Advisor Recommendations →Latest Stock Advisor Picks

Tickers masked to protect subscriber value. Recent picks need 3-5+ years to demonstrate thesis.

| SA Pick | Return |

|---|---|

**** Chip Equipment | +91% |

**** Space Launch | +84% |

**** Mobile App Platform | +70% |

**** Building Products | +42% |

**** Infrastructure Construction | +34% |

**** Growth Company | +26% |

**** Growth Company | +20% |

**** Growth Company | +17% |

**** Growth Company | +9% |

**** Athletic Apparel | +9% |

Lessons from 2005. 16 picks that year averaged +7.0K%. Best performers often come from buying during uncertainty—when conviction feels hardest.

Stock Advisor Win Rate by Holding Period

| Hold Time | SA Win Rate | Avg Return |

|---|---|---|

| < 1 Year | 54.3% | +12% |

| 1-3 Years | 61.2% | +14% |

| 3-5 Years | 38.4% | -1% |

| 5-10 Years | 62.8% | +187% |

| 10+ Years | 92.8% | +3.8K% |

503 data points over 24 years. The pattern repeats: early volatility, mid-term clarity, long-term outperformance. The data is the strategy.

Stock Advisor Performance by Year

| Year | SA Picks | Avg Return | Win Rate | |

|---|---|---|---|---|

| 2026 | 1 | +1% | 100% | CASY+1% |

| 2025 | 25 | +6% | 48% | ASML+91% |

| 2024 | 25 | +10% | 67% | SHOP+94% |

| 2023 | 25 | +48% | 79% | CRWD+241% |

| 2022 | 23 | +25% | 48% | NET+238% |

| 2021 | 23 | -31% | 17% | LRCX+350% |

| 2020 | 24 | +86% | 33% | TSLA+1.4K% |

| 2019 | 24 | +41% | 67% | SNPS+240% |

| 2018 | 22 | +160% | 64% | SHOP+841% |

| 2017 | 23 | +551% | 83% | NVDA+6.9K% |

| 2016 | 21 | +377% | 81% | SHOP+3.6K% |

| 2015 | 24 | +192% | 71% | META+772% |

| 2014 | 21 | +212% | 81% | IBKR+1.0K% |

| 2013 | 19 | +333% | 68% | NFLX+2.5K% |

| 2012 | 23 | +1.3K% | 74% | TSLA+20K% |

| 2011 | 19 | +475% | 63% | AAPL+2.7K% |

| 2010 | 18 | +444% | 83% | AMZN+2.6K% |

| 2009 | 20 | +2.7K% | 90% | NVDA+47K% |

| 2008 | 18 | +1.1K% | 94% | AAPL+5.5K% |

| 2007 | 19 | +1.5K% | 37% | NFLX+28K% |

| 2006 | 20 | +2.4K% | 65% | NFLX+25K% |

| 2005 | 16 | +7.0K% | 63% | NVDA+110K% |

| 2004 | 17 | +5.7K% | 59% | NFLX+43K% |

| 2003 | 17 | +205% | 65% | HAS+1.1K% |

| 2002 | 16 | +2.9K% | 81% | AMZN+31K% |

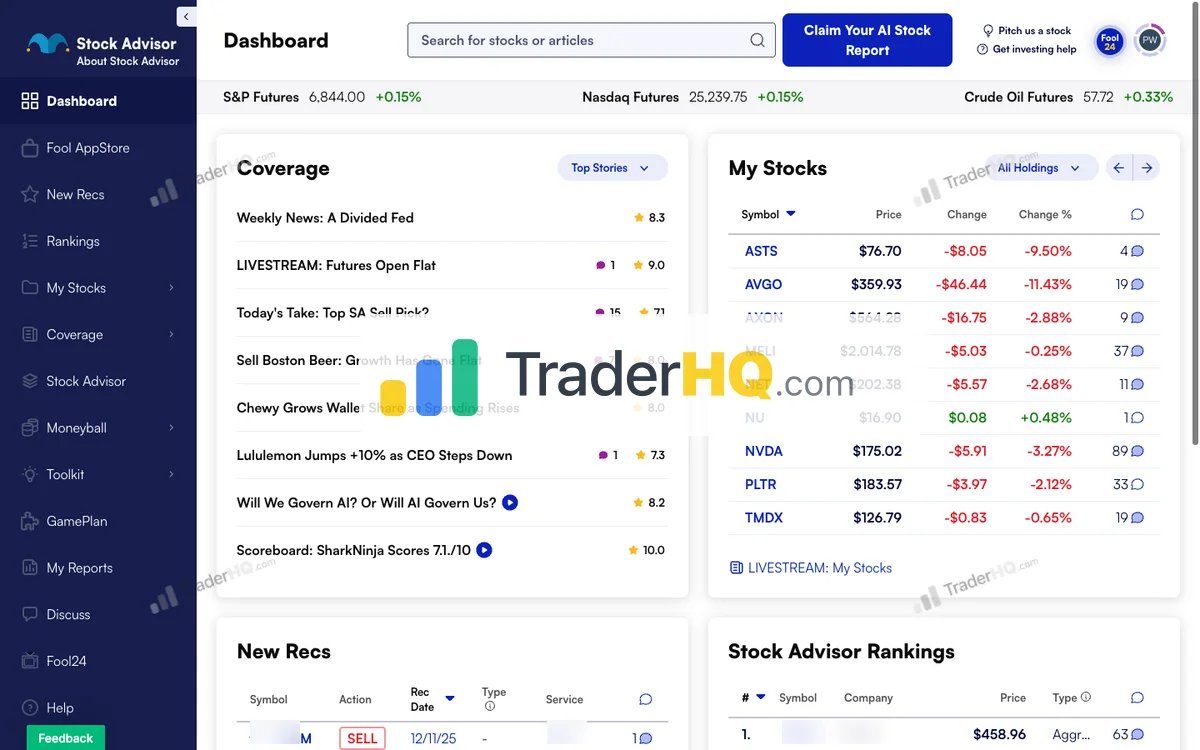

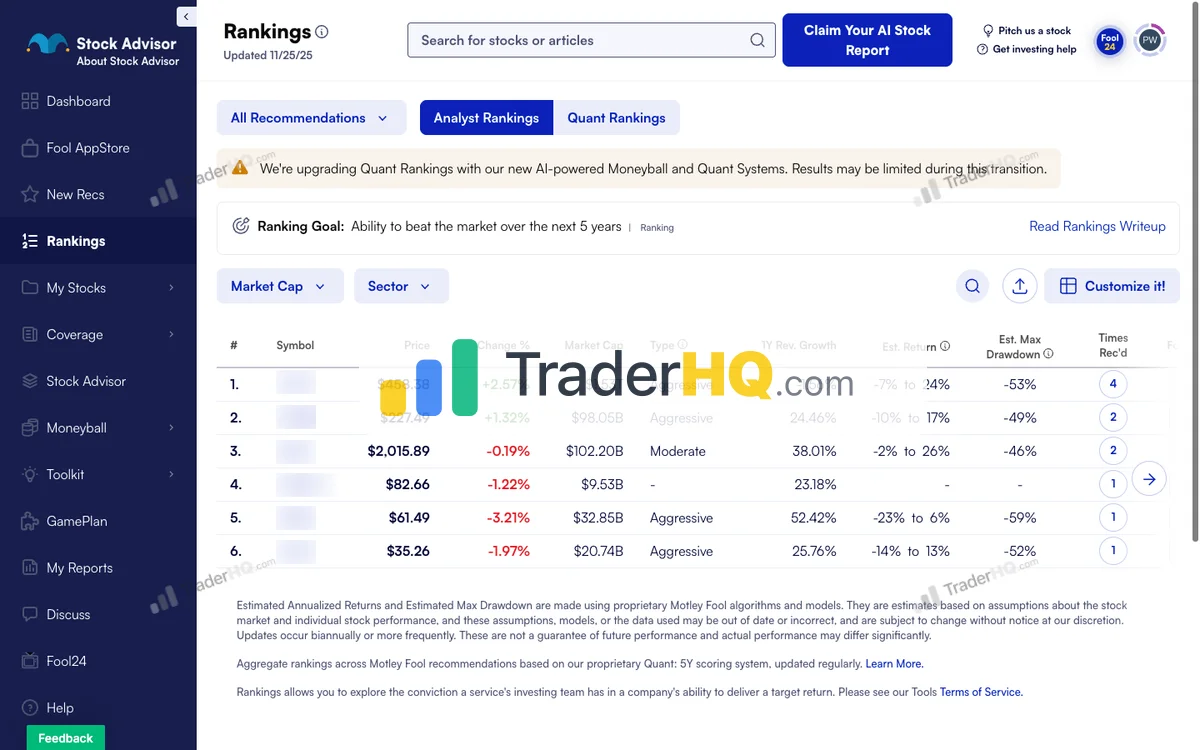

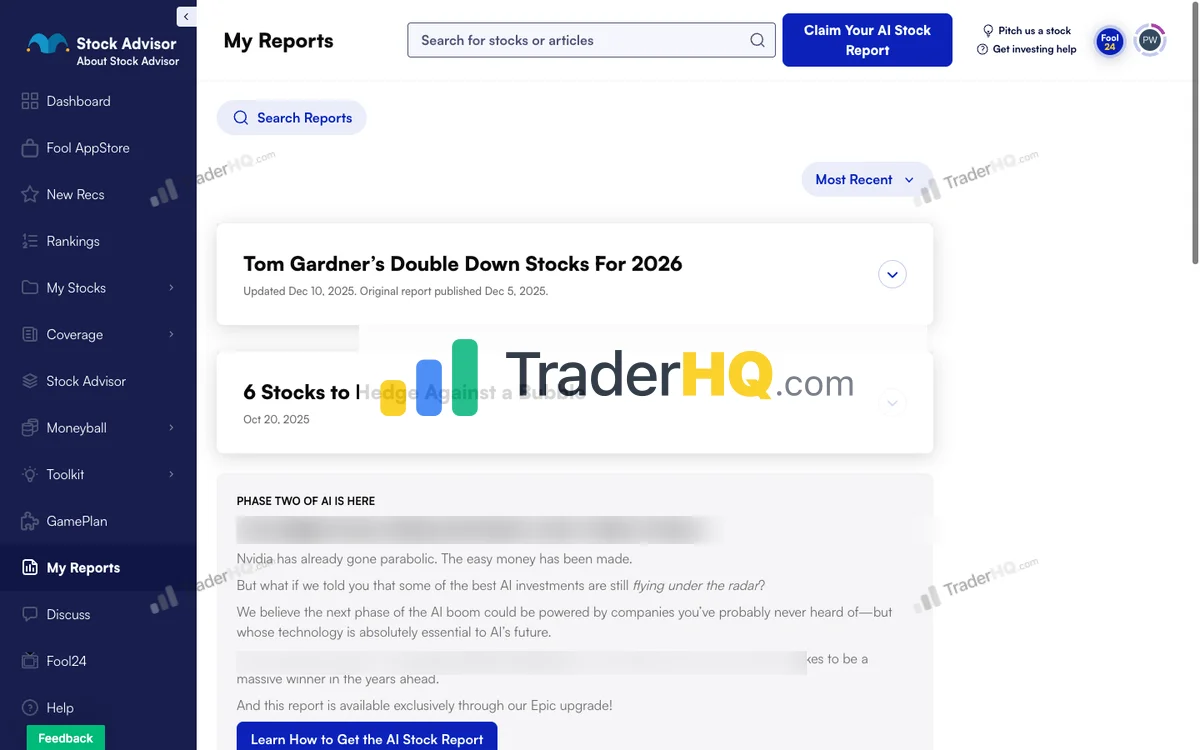

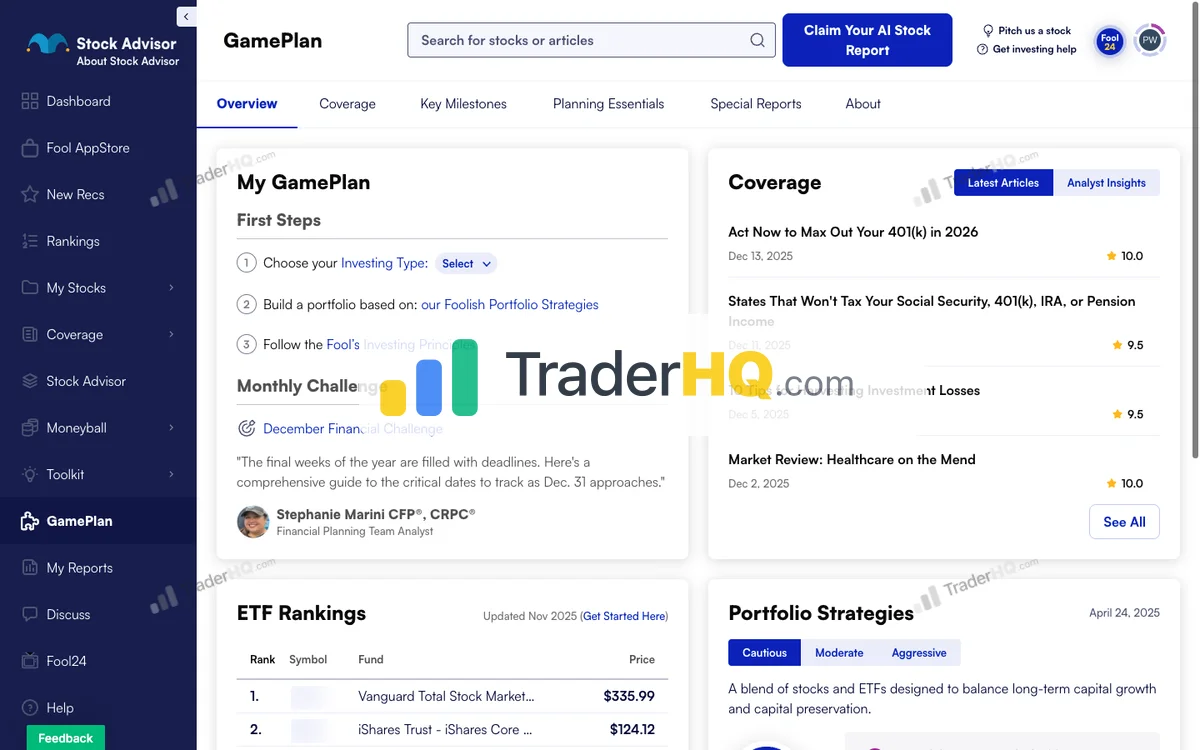

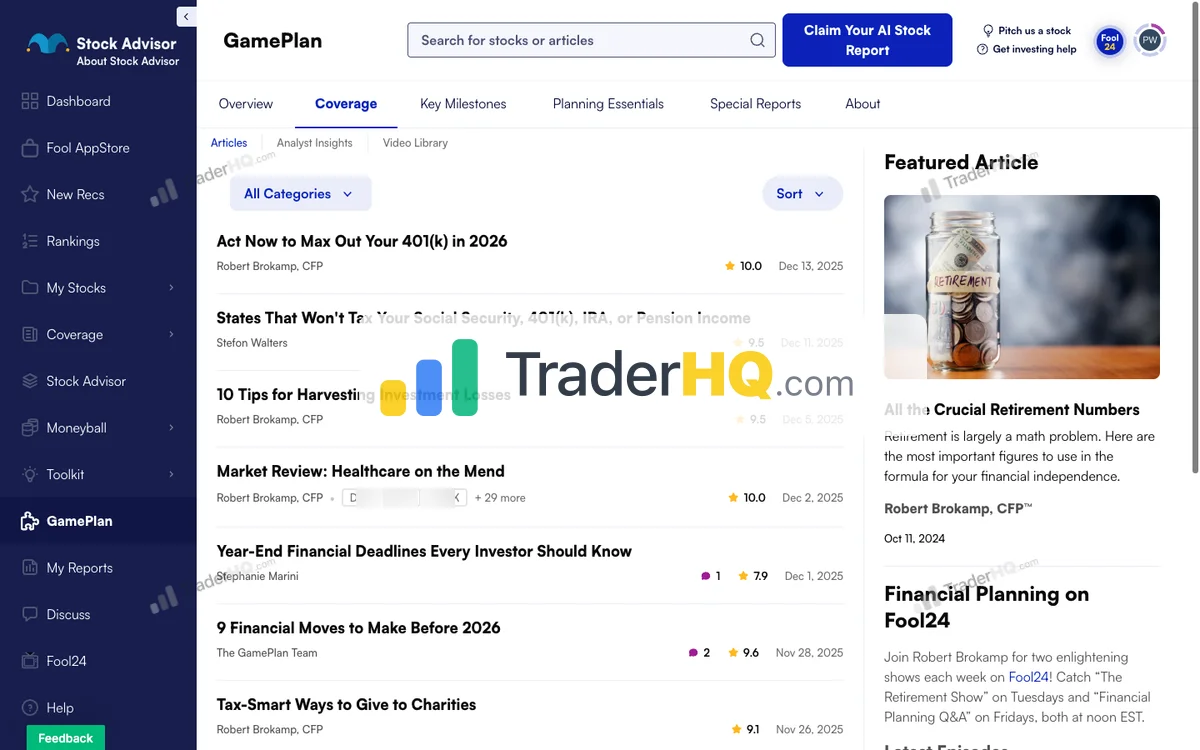

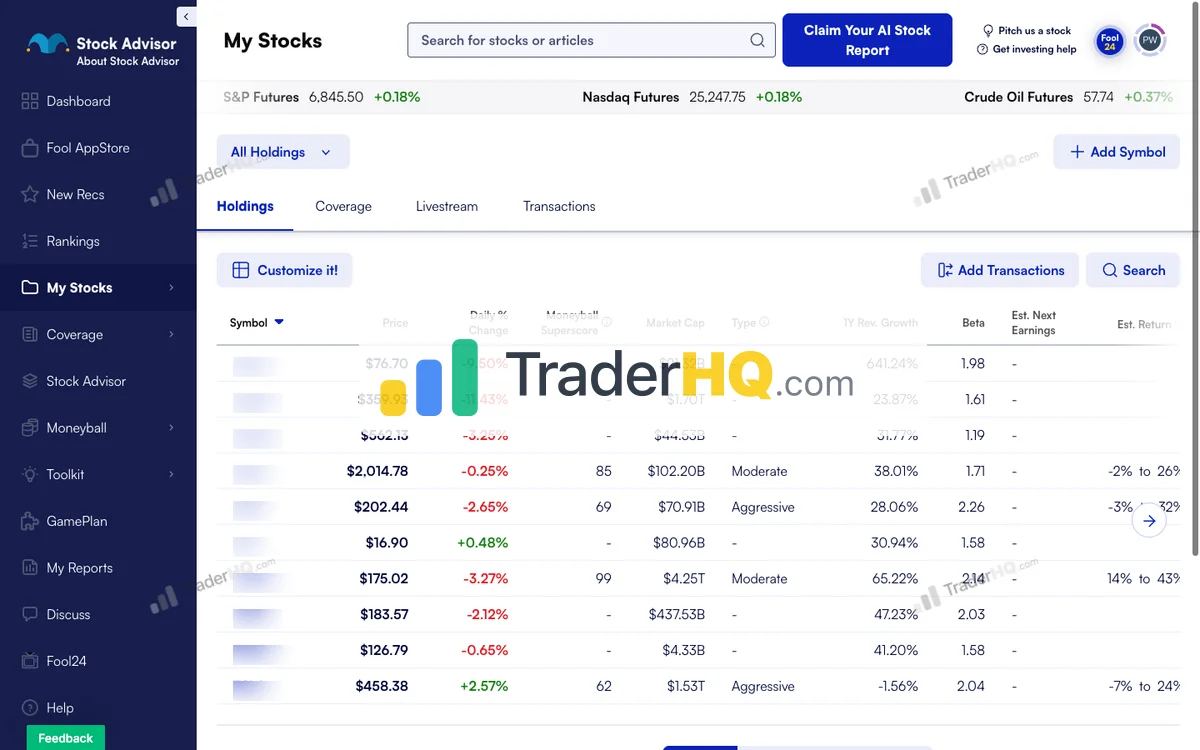

Inside Stock Advisor

9 screenshots · Click to expand

What You’re Actually Paying For

The headline is 2 new stock picks per month. But the real value is everything around those picks:

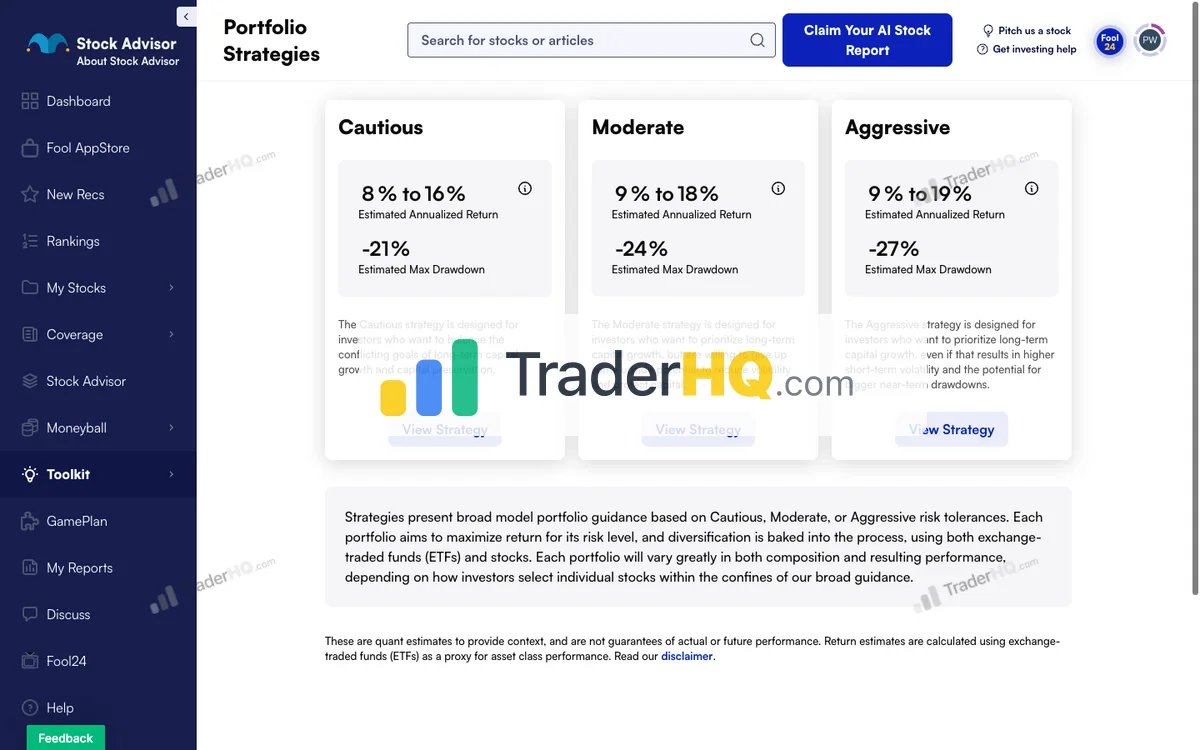

Portfolio Strategies: Three frameworks—Cautious, Moderate, and Aggressive—calibrated to different risk tolerances. This addresses the psychological reality that even the best picks are worthless if you panic-sell during crashes.

Foundational Stocks: 10 highest-conviction core holdings with explicit risk classifications. New subscribers often ask “where do I start?” This is the answer.

Moneyball Database: 344 companies with 12+ scoring dimensions. It’s essentially a research platform that builds investor capability rather than dependency.

Re-Recommendation Signals: When existing picks become even more attractive, you get notified. This helps with position sizing and conviction-building.

The Track Record Reality

+1051.7% cumulative return since February 2002 versus the S&P 500’s +185.5%.

Let me make that visceral: $10,000 invested in Stock Advisor picks in 2002 would be worth approximately $115,170 today. The same money in an S&P 500 index fund? About $28,550.

The time curve tells the real story:

- 67% overall win rate — but it improves dramatically with time

- 92.8% win rate for 10+ year holds — 43 ten-baggers, 184 doublers

- Best for investors with 5+ year horizons who can hold through volatility

But here’s what the marketing won’t tell you:

- 33% of picks lose money. About a third of recommendations end up in the red short-term.

- Returns concentrate in winners. The top 10% of picks generate the majority of returns. Selling winners early destroys the math.

- Vintage matters. Subscribers who joined in 2020-2021 bought at peak growth valuations. Many of those picks are still recovering.

This isn’t criticism—it’s the reality of growth investing. The question is whether you can hold through the pain.

The Time Curve

| Holding Period | Win Rate | Average Return |

|---|---|---|

| Under 1 year | 57% | Modest |

| 5-10 years | 65.2% | +199.5% |

| 10+ years | 92.8% | Multi-bagger potential |

43 ten-baggers, 184 doublers over 23 years. Time horizon isn’t a suggestion—it’s the entire strategy.

Pricing

- Regular Price: $199/year

- New Member Price: $99/year (50% off)

- Refund Policy: 30-day money-back guarantee

At $99/year, you’re paying roughly $4 per stock pick for recommendations backed by 23 years of market-beating performance (+1051.7% vs S&P’s +185.5%).

Who This Is For

Investors who want a complete framework, not just tips. If you’ll follow the portfolio strategies, hold through drawdowns, and think in 5+ year horizons, Stock Advisor works. If you’ll cherry-pick stocks and panic-sell, save your money.

Who Should Skip This

Short-term traders. Income investors. Anyone who can’t stomach 30-50% drawdowns on individual positions. And anyone who gets frustrated by upsell pressure—Motley Fool will try to upgrade you to Epic, Epic Plus, and beyond. Relentlessly.

Try Stock Advisor — 30-Day Guarantee

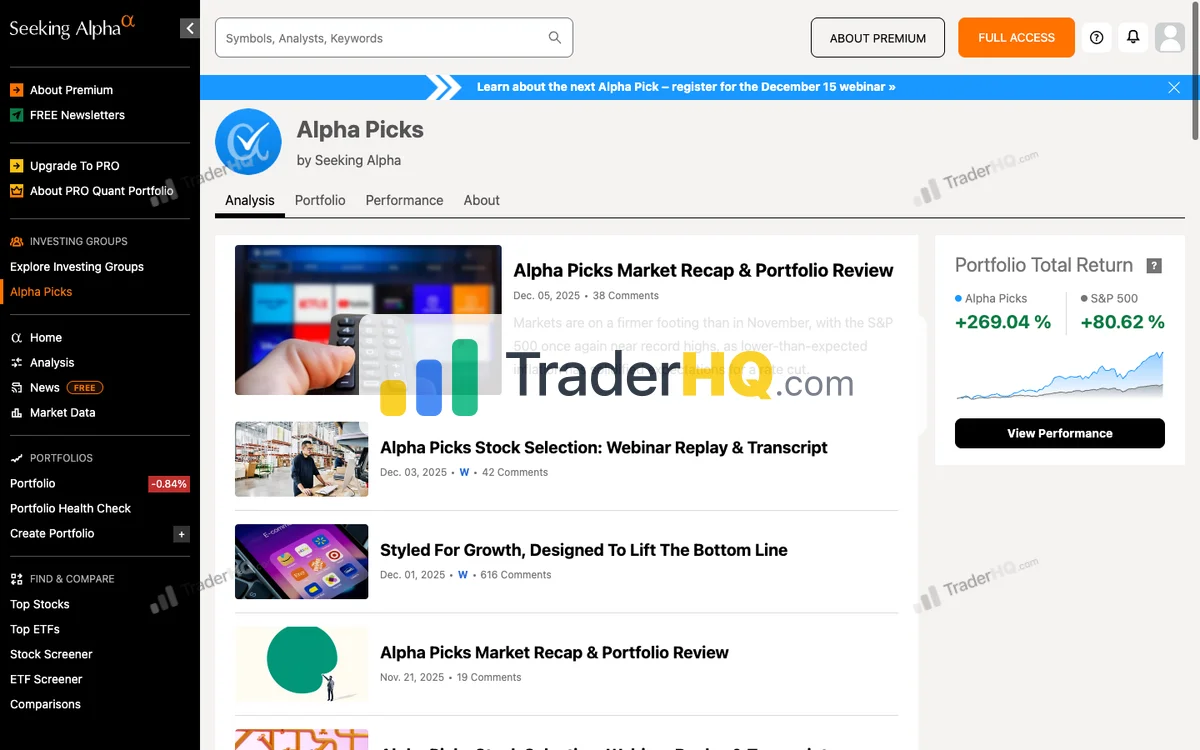

2. Alpha Picks by Seeking Alpha — The Pure Quant Approach

Data-driven investors who trust algorithms over human opinion

If Stock Advisor represents human judgment refined over decades, Alpha Picks represents something fundamentally different: a quantitative model with zero human discretion.

No analyst committee. No narrative-driven investing. No “we believe in this company’s mission.” Just math.

Alpha Picks by Seeking Alpha Performance

Seeking Alpha · 91 picks · 4 years · Updated 2026-02-05

| AP Return | S&P 500 | Alpha | Win Rate |

|---|---|---|---|

| +286% | +83% | +204% | 70% |

S&P 500 shows what you'd have earned buying the index on each pick date instead. Same timing, fair comparison.

| AP Multi-Baggers | 10x+ | 5x+ | 3x+ | 2x+ |

|---|---|---|---|---|

| Count | 1 | 4 | 9 | 14 |

| AP Asymmetry | Avg Winner | Avg Loser | Ratio |

|---|---|---|---|

| Return | +108% | -21% | ~5:1 |

Best Performers (All-Time)

| AP Pick | Return |

|---|---|

**** Homebuilder | +228% |

**** Casual Dining | +216% |

POWL Powell Industries | +865% |

**** Thermal Management | +348% |

**** Power Plant Construction | +224% |

SMCI Super Micro Computer | +969% |

APP AppLovin | +1.6K% |

CLS Celestica | +1.2K% |

STRL Sterling Construction | +477% |

**** Growth Company | +155% |

Latest Alpha Picks Picks

Tickers masked to protect subscriber value. Recent picks need 3-5+ years to demonstrate thesis.

| AP Pick | Return |

|---|---|

**** Memory Chips | +99% |

**** Precious Metals Mining | +87% |

**** Engineering Services | +70% |

**** Circuit Board Manufacturing | +63% |

**** Dermatology Biotech | +58% |

**** Gold Mining | +55% |

**** Pawn & Financial Services | +42% |

**** Infrastructure Construction | +38% |

**** Growth Company | +28% |

**** Growth Company | +26% |

Alpha Picks Win Rate by Holding Period

| Hold Time | AP Win Rate | Avg Return |

|---|---|---|

| < 1 Year | 62.2% | +11% |

| 1-3 Years | 75.9% | +110% |

| 3-5 Years | N/A% | N/A |

| 5-10 Years | N/A% | N/A |

| 10+ Years | N/A% | N/A |

Alpha Picks Performance by Year

| Year | AP Picks | Avg Return | Win Rate | |

|---|---|---|---|---|

| 2026 | 3 | +2% | 67% | B+9% |

| 2025 | 24 | +23% | 75% | MU+99% |

| 2024 | 24 | +46% | 63% | CLS+240% |

| 2023 | 24 | +152% | 71% | CLS+910% |

| 2022 | 16 | +65% | 75% | MOD+348% |

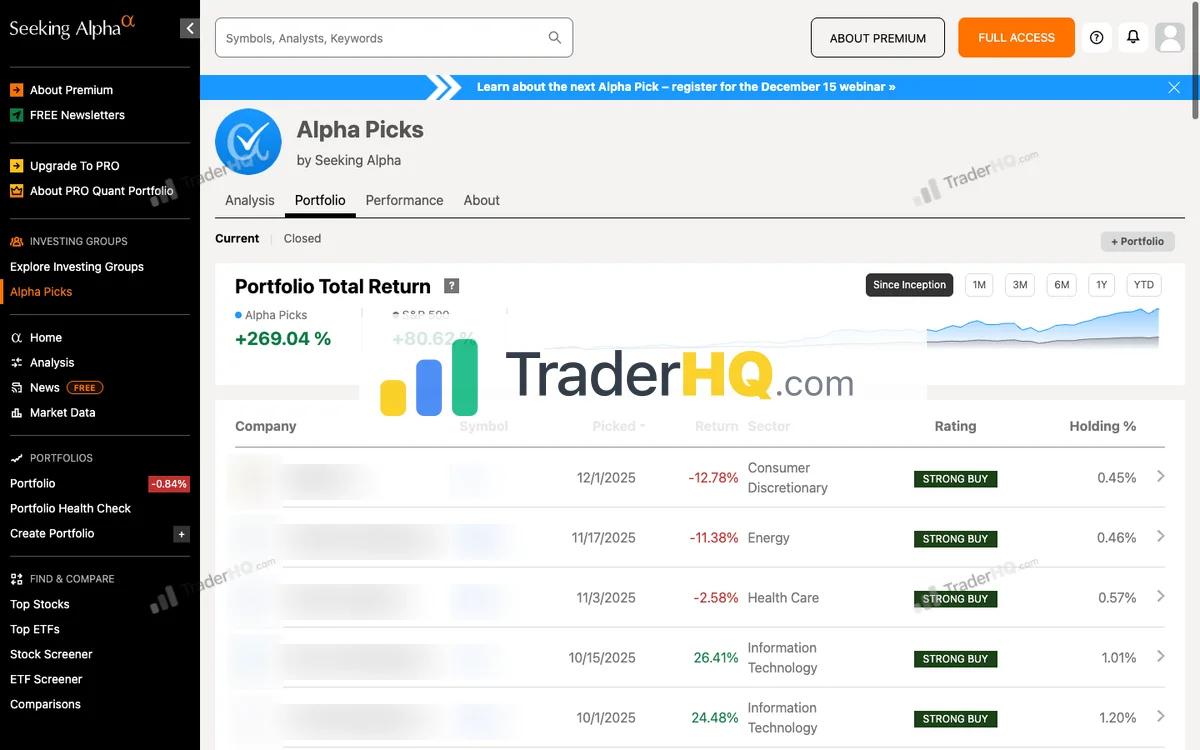

Inside Alpha Picks

6 screenshots · Click to expand

What You’re Actually Paying For

Two stock picks per month, selected entirely by algorithm. The Seeking Alpha Quant system scores every US equity on five factors:

- Value

- Growth

- Profitability

- Momentum

- EPS Revisions

The two highest-scoring stocks become that month’s picks. Exit triggers are equally systematic: quant rating drops below “Hold,” 12-month maximum holding period, or position hits 15% of portfolio.

No human override. Pure system.

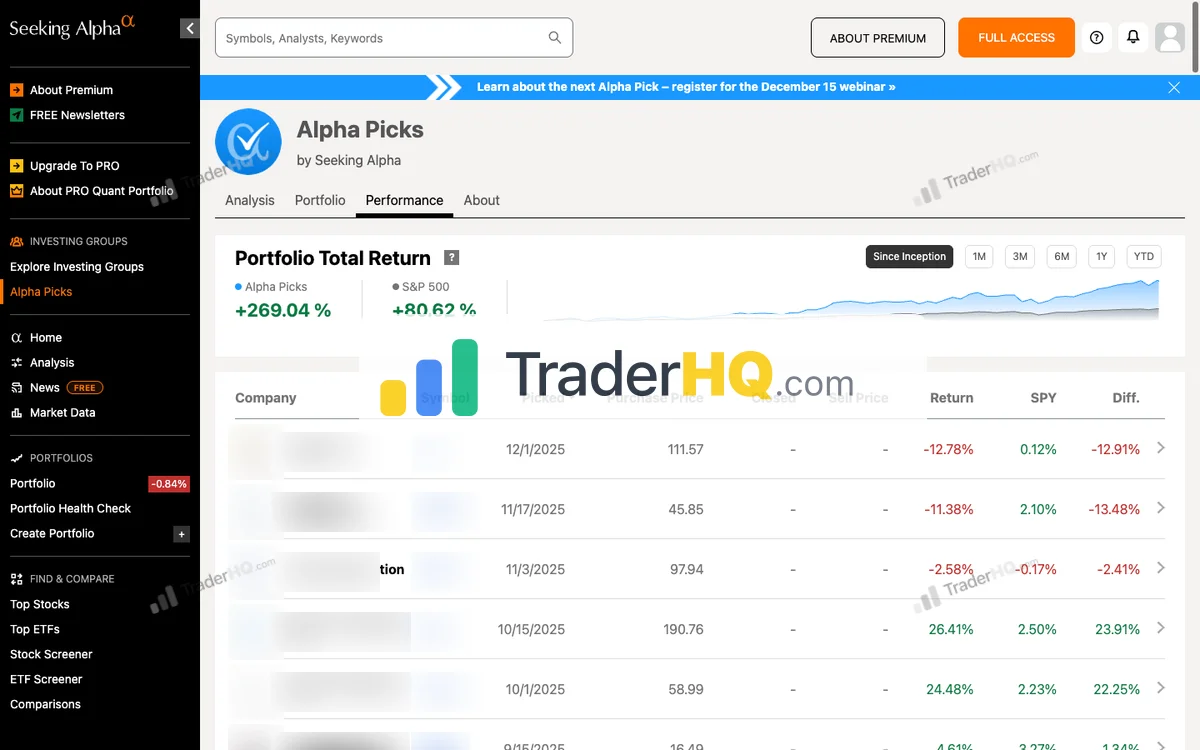

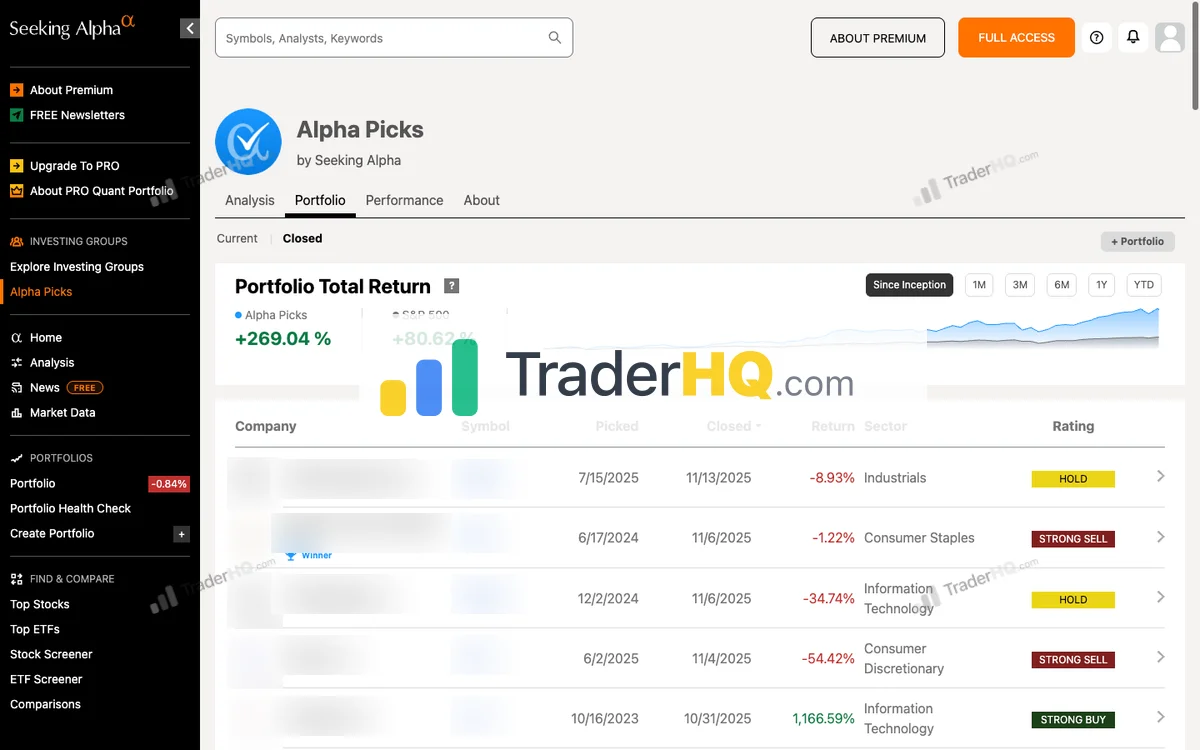

The Track Record Reality

+286.8% return since July 2022 versus +81.6% for the S&P 500.

| Metric | Alpha Picks | S&P 500 |

|---|---|---|

| Total Return | +286.8% | +81.6% |

| Win Rate | 73% | — |

| 1-3 Year Win Rate | 79.2% | — |

| CAGR | ~44% | — |

The shorter track record (3.6 years vs Stock Advisor’s 23) is a legitimate caveat. But the returns during that period are exceptional, and every position is documented with entry dates, exit dates, and returns visible. Best for 1-3 year horizons where the 79.2% win rate shines.

The Time Curve

| Holding Period | Win Rate | Average Return |

|---|---|---|

| Under 1 year | 54% | +5% |

| 1-3 years | 79.2% | +119% |

That’s a 23x difference in returns based purely on holding period. Selling early would have cost 62% of total returns. This is why we recommend Alpha Picks for 1-3 year horizons.

Pricing

- Regular Price: $499/year

- New Member Price: $449/year (10% off)

- Refund Policy: None (annual billing only)

At $449/year with no refund policy, Alpha Picks requires more commitment than Stock Advisor. But the +286.8% return and 73% win rate justify the premium for data-driven investors with 1-3 year horizons. Caveat: Only 3.6 years of data—Stock Advisor’s 23-year track record provides more confidence for longer horizons.

Who This Is For

Investors who trust algorithms over human opinion. If you’ve ever sold a winner too early or held a loser too long because of emotion, a systematic approach protects you from yourself.

Who Should Skip This

Investors who want to understand why they own something. The quant model is a black box—you know the factors, but not the specific weightings. If you need narrative conviction to hold through volatility, this isn’t your service.

3. Morningstar Investor — The Research Platform Standard

Morningstar Investor is fundamentally different from the services above. It’s not a stock-picking newsletter—it’s a research platform that gives you the tools to make your own decisions.

If you want someone to tell you what to buy, skip to the next entry. If you want to become a better investor, keep reading.

What You’re Actually Paying For

Fair Value Estimates: Morningstar’s proprietary valuation methodology estimates what each stock is actually worth. When market price is below Fair Value, you’re potentially buying at a discount. When it’s above, you might be overpaying.

Economic Moat Ratings: Morningstar pioneered the concept of “economic moats”—competitive advantages that protect companies from competition. Wide moat companies can maintain pricing power and profitability for decades. Narrow moat companies have advantages that may erode. No moat companies are vulnerable to competition.

Portfolio X-Ray: Upload your holdings and see your true allocation, performance, fees, and overlaps. This alone is worth the subscription for serious investors managing multiple accounts.

200+ Data Points for Screening: Build custom screens based on valuation, growth, profitability, momentum, and hundreds of other factors.

The Track Record Question

Morningstar Investor doesn’t have a “track record” because it doesn’t make stock picks. It’s a tool, not an advisor.

That said, Morningstar’s ratings methodology has been trusted for 40+ years and is recession-tested across multiple market cycles. Their quality/moat focus and fair value methodology is the industry standard for fundamental analysis. Best for DIY researchers and value investors who want to build capability, not dependency.

Pricing

- Regular Price: $249/year

- New Member Price: $199/year (save $50)

- Refund Policy: 7-day free trial

Who This Is For

Self-directed investors who want professional-grade research tools. DIY analysts who enjoy the research process. Investors who want to understand why they’re buying, not just what.

Who Should Skip This

Investors who want someone to tell them what to buy. Beginners who need guidance. Anyone seeking actionable stock picks—Morningstar won’t provide them.

4. Seeking Alpha Premium — The Crowd-Sourced Research Hub

Seeking Alpha Premium takes a different approach to research: instead of a small team of analysts, it aggregates insights from 18,000+ contributing analysts covering stocks that Wall Street ignores.

The result is the largest investor-focused content platform on the internet—5,000+ articles published monthly, covering everything from mega-caps to micro-caps.

What You’re Actually Paying For

Crowd-Sourced Analysis: 18,000+ contributors means perspectives you won’t find anywhere else. While Wall Street analysts cover the same 500 large-caps, Seeking Alpha contributors dig into small-caps, special situations, and contrarian theses.

Quant Ratings: Proprietary ratings for 10,000+ US stocks with factor grades for Value, Growth, Profitability, Momentum, and EPS Revisions. Similar methodology to what powers Alpha Picks, but applied across the entire market.

Unlimited Earnings Transcripts: Every earnings call, fully searchable. Essential for fundamental research.

Broker Linking: Connect your brokerage accounts for automatic daily portfolio updates. See your holdings alongside Seeking Alpha’s ratings and contributor coverage.

The Quality Question

The strength of crowd-sourced content is also its weakness: quality varies dramatically by contributor. Some writers produce institutional-quality research. Others are amateurs with axes to grind.

Seeking Alpha addresses this with author ratings, track records, and the Quant system. But you still need to evaluate sources—you can’t blindly trust every article.

Pricing

- Regular Price: $299/year

- New Member Price: $269/year (10% off)

- Refund Policy: 7-day free trial, then annual billing

Who This Is For

Research junkies who want diverse perspectives. Investors who enjoy synthesizing multiple viewpoints. Anyone who wants to discover stocks before they become consensus picks.

Who Should Skip This

Investors seeking specific stock picks. Those who want curated, quality-controlled recommendations. Anyone who doesn’t have time to evaluate contributor credibility.

5. TipRanks — The Expert Accountability Platform

Here’s a question most investors never ask: How do I know if this analyst is actually good?

Wall Street analysts make thousands of recommendations. Bloggers publish endless “buy this stock” articles. Hedge fund managers appear on CNBC with bold predictions. But who tracks whether they’re right?

TipRanks does.

What You’re Actually Paying For

Expert Performance Tracking: TipRanks monitors 96,000+ financial experts—analysts, bloggers, hedge funds, and corporate insiders—and ranks them by historical accuracy. Before you follow anyone’s advice, you can see their track record.

Smart Score: An AI-powered 1-10 rating that combines 8 key market factors to rate stocks. It’s not a recommendation—it’s a synthesis of multiple signals into a single score.

Institutional Credibility: TipRanks data is integrated into Nasdaq, TD Ameritrade, E*TRADE, and Interactive Brokers. The same data that powers your broker’s research tools is available directly.

The Accountability Insight

This is the hidden value of TipRanks: it changes how you consume financial content.

When you read an analyst recommendation, you can check their success rate. When a blogger makes a bold call, you can see their historical accuracy. When a hedge fund discloses a position, you can evaluate whether their past picks worked.

It’s not about finding “the best analyst.” It’s about knowing who to trust—and who to ignore.

Pricing

- Regular Price: $299/year

- New Member Price: $99/year (67% off, limited time)

- Refund Policy: 30-day money-back guarantee

At $99/year with the current promotion, TipRanks is the most affordable way to add accountability to your research process.

Who This Is For

Skeptical investors who want to verify credibility before following anyone. Data-driven decision makers who appreciate quantified track records. Anyone who consumes financial content and wants to know who’s actually accurate.

Who Should Skip This

Passive index investors who don’t follow individual stocks. Investors seeking specific stock picks—TipRanks helps you evaluate others’ picks, not make your own.

6. Zacks Premium — The Earnings Revisions Specialist

Zacks Premium is built on a single academic insight: earnings estimate revisions predict stock performance.

Founded in 1978 by Len Zacks (MIT PhD), the company pioneered research on the predictive power of earnings revisions. The Zacks Rank system has been in continuous use since 1988—37+ years of real-world application.

What You’re Actually Paying For

The Zacks Rank: A proprietary 1-5 rating based on earnings estimate revisions, updated daily:

- 1 = Strong Buy — Analysts raising estimates aggressively

- 2 = Buy — Estimates trending higher

- 3 = Hold — Mixed signals

- 4 = Sell — Estimates declining

- 5 = Strong Sell — Analysts cutting estimates aggressively

The logic is simple: when analysts raise earnings estimates, it signals positive information about a company’s prospects. Stocks with rising estimates tend to outperform; stocks with falling estimates tend to underperform.

Research Tools: Earnings calendars, estimate data, screening tools, and analyst reports. The platform is comprehensive—almost overwhelmingly so.

The Academic Foundation

The relationship between earnings revisions and stock performance is well-documented in financial research. Zacks didn’t invent the insight—they commercialized it into a usable system.

That said, specific performance claims aren’t prominently displayed. The methodology is sound, but you’re trusting the system rather than verifying a track record.

Pricing

- Price: $249/year

- Refund Policy: 30-day money-back guarantee

Who This Is For

Earnings-focused investors who follow estimate revisions religiously. Quantitative investors who want data-driven signals. Those comfortable with information overload—Zacks gives you a lot.

Who Should Skip This

Investors who want simple stock picks. Those overwhelmed by data-heavy interfaces. People who dislike aggressive marketing—Zacks will upsell you to Ultimate, Black Box, and beyond.

7. Benzinga Pro — The Speed Advantage

Benzinga Pro serves a completely different investor: the active trader who needs information before it’s priced in.

If you’re a long-term investor, skip this section. Benzinga Pro’s value proposition—speed—is irrelevant if you’re not trading on news.

What You’re Actually Paying For

Real-Time News Feed: Benzinga claims to deliver exclusive news “up to 30 minutes” before other sources. For active traders, that window is the entire edge.

Audio Squawk: A unique audio stream of breaking headlines for hands-free monitoring. You can listen while watching charts, executing trades, or doing other work.

Signals and Scanners: Real-time alerts for price spikes, block trades, unusual options activity, and other market-moving events.

Calendars: Earnings, economic events, FDA decisions, and other scheduled catalysts.

The Speed Question

Benzinga’s claim of 30-minute news advantage is difficult to verify independently. What’s clear is that they’re positioned as a news-first platform for active traders, not a research service for long-term investors.

The platform is used by major brokerages and claims to be the “largest news vendor to North American brokerages.” That institutional adoption suggests the speed claims have merit.

Pricing

- Basic: $184/year (promo) / $367/year (regular)

- Essential: $997/year (promo) / $1,997/year (regular)

- Refund Policy: 7-day account credit (not cash refund)

The wide pricing range reflects different feature tiers. Basic includes news and calendars. Essential adds options flow, signals, and advanced features.

Who This Is For

Day traders and swing traders who need breaking news before price moves. Active investors who trade on momentum and catalysts. Anyone whose strategy depends on information speed.

Who Should Skip This

Long-term investors. Buy-and-hold investors. Anyone who doesn’t trade frequently enough to benefit from real-time news. The speed advantage is worthless if you’re not acting on it.

The Allocation Reality: How Subscriptions Fit Your Portfolio

None of these subscriptions should replace your core investment strategy. Here’s how to think about them:

The Core-Explore Framework

| Allocation | Purpose | What Goes Here |

|---|---|---|

| 80-90% | Core | Low-cost index funds (total market, international) |

| 10-20% | Explore | Individual stocks from newsletters or your own research |

If your “explore” bucket is $50,000, that’s enough for 15-20 positions from a service like Stock Advisor. The $199 subscription costs 0.4% of that allocation annually. The math works.

If your explore bucket is $5,000, the $199 fee is 4% of your capital. Consider waiting until you’ve built a larger base, or use the research platforms to learn while primarily investing in index funds.

Combining Subscriptions

Some investors use multiple services strategically:

Stock Advisor + Alpha Picks: Human conviction + quant validation. Different methodologies, complementary signals.

Stock Advisor + Morningstar: Picks + research tools. Use Stock Advisor for ideas, Morningstar to evaluate them independently.

Any Newsletter + TipRanks: Picks + accountability. Verify the experts behind recommendations you’re following.

Avoid subscribing to multiple services that do the same thing. Two stock-picking newsletters means overlapping picks at double the cost.

The Decision Matrix

| If you… | Choose… | Because… |

|---|---|---|

| Want a complete investing system (5+ years) | Stock Advisor | 23-year track record, 92.8% win rate on 10+ year holds |

| Trust algorithms over humans (1-3 years) | Alpha Picks | Pure quant, 79.2% win rate for 1-3 year holds |

| Want to make your own decisions | Morningstar Investor | Industry-standard research tools |

| Love synthesizing diverse views | SA Premium | 18,000+ contributors, crowd-sourced |

| Need to verify expert credibility | TipRanks | Tracks 96,000+ experts |

| Focus on earnings revisions | Zacks Premium | 37+ year methodology |

| Trade actively on news | Benzinga Pro | Speed advantage, real-time alerts |

| Have <$25K to invest | Index funds first | Build your base before paying for subscriptions |

Frequently Asked Questions

What is the best investment newsletter overall?

Motley Fool Stock Advisor is the best investment newsletter for long-term investors (5+ year horizons). With a verified +1051.7% return since 2002 (vs S&P 500’s +185.5%), 67% overall win rate, 92.8% win rate on 10+ year holds, and a complete portfolio-building framework, it offers the strongest combination of track record and methodology. For shorter horizons (1-3 years), Alpha Picks’ 79.2% win rate is compelling.

What’s the best investment subscription for beginners?

Stock Advisor works best for beginners because it provides more than just picks—it includes portfolio strategies (Cautious, Moderate, Aggressive), Foundational Stocks to start with, and clear guidance on position sizing. The framework helps beginners understand not just what to buy, but how to build a portfolio.

Are investment newsletters worth the money?

Yes, if you follow the system and hold long-term. Stock Advisor’s 10+ year picks have a 92.8% win rate with 43 ten-baggers and 184 doublers. Alpha Picks’ 1-3 year holds show 79.2% win rate with +119% average returns. The key is patience—short-term results are closer to coin flips. One avoided mistake on a $5,000 position saves more than years of subscription costs.

What’s the difference between stock-picking newsletters and research platforms?

Stock-picking newsletters tell you what to buy; research platforms help you decide for yourself. Services like Stock Advisor and Alpha Picks provide specific buy recommendations. Platforms like Morningstar Investor and Seeking Alpha Premium provide data, ratings, and analysis tools but don’t make buy/sell recommendations. Choose based on whether you want guidance or independence.

Stock Advisor vs Alpha Picks: Which is better?

It depends on your time horizon:

- 5+ year horizons: Stock Advisor wins with 23 years of data (+1051.7%), 92.8% win rate on 10+ year holds, and 43 ten-baggers.

- 1-3 year horizons: Alpha Picks excels with 79.2% win rate and +286.8% returns since 2022. Stock Advisor uses human analysts with narrative reasoning; Alpha Picks is pure quant with no human discretion. Alpha Picks has only 3.6 years of data—a legitimate caveat for long-term investors.

Can I use multiple investment subscriptions?

Yes, but strategically. Complementary combinations work well: Stock Advisor (human conviction) + Alpha Picks (quant validation), or Stock Advisor (picks) + Morningstar (research tools). Avoid overlapping services that do the same thing—you’ll get similar picks at higher cost.

How much money do I need to use an investment subscription?

$25,000+ in investable assets is ideal. At smaller portfolio sizes, the annual fee ($99-499) represents too large a percentage of your capital. If you have $10,000 to invest, a $199 fee is 2% annually—you need to beat the market by 2% just to break even on the subscription.

What’s the difference between Seeking Alpha Premium and Alpha Picks?

Seeking Alpha Premium is a research platform; Alpha Picks is a stock-picking service. SA Premium ($269/year) gives you access to 18,000+ contributor articles, Quant ratings, and research tools—but no specific buy recommendations. Alpha Picks ($449/year) gives you 2 specific stock picks per month selected by the Quant algorithm. Different products for different needs.

How do I know if an investment newsletter is legitimate?

Look for verified track records, transparent methodology, and honest trade-off disclosure. Services like Stock Advisor and Alpha Picks publish every historical recommendation with returns. Tools like TipRanks help you verify expert credibility. Be skeptical of services that only show winners or make unrealistic return claims.

What’s the best free alternative to paid investment subscriptions?

Index funds. If you’re not willing to pay for stock picking and follow the system, a low-cost S&P 500 index fund will outperform most active investors. Beating the market through stock selection requires either significant time investment (doing your own research) or paying for expertise. There’s no free shortcut that consistently works.

How long should I hold newsletter picks?

It depends on the service:

- Stock Advisor: 5+ years minimum. 10+ year holds have 92.8% win rates with 43 ten-baggers.

- Alpha Picks: 1-3 years optimal. 79.2% win rate in that window. First-year results for both are closer to coin flips. The math only works if you hold to the service’s optimal horizon.

Do investment newsletters work in bear markets?

The best ones do, but expect drawdowns. Stock Advisor’s 23-year track record includes the 2008 financial crisis, the 2020 COVID crash, and the 2022 bear market—and delivered +1051.7% through all of them. Morningstar’s 40+ years of methodology is recession-tested. The key is having conviction to hold—which is why framework and methodology matter as much as picks.

How do investment newsletters perform when the economy is bifurcated?

The current 66-point dispersion represents the best stock-picker’s market in years—active management’s time to shine. The Russell 2000 (+6.75% YTD) is crushing the S&P 500 (+0.63% YTD) by 10:1. Memory/storage leads (SNDK +146%, WDC +56%), transportation breaks out (ODFL +33%, FDX +26%), while enterprise software collapses (APP -43%, IT -37%). Services that identify sector rotations early thrive:

- Stock Advisor (EXCEPTIONAL fit) emphasizes competitive moats and recurring revenue—46 ten-baggers and 67% win rate prove the methodology works across conditions

- Alpha Picks (EXCEPTIONAL fit) quant factors capture the small-cap rotation driving 10:1 outperformance

- Morningstar’s (GOOD fit) quality/moat focus and fair value discipline helps navigate elevated valuations at CAPE ~36 The key insight: with 66-point dispersion and VIX around 16, alpha from stock selection becomes the primary driver of portfolio performance. The gap between owning winners and losers spans nearly 200 percentage points. This is definitively a stock-picker’s market.

Should I pause my investment newsletter subscription if I run out of capital to invest?

Consider keeping research access but reducing expectations. Most investment newsletters provide value beyond just new picks—research tools, portfolio tracking, market commentary, and educational content. If you’re temporarily out of capital, you can still use the service to: (1) Research and rank existing picks for when capital becomes available, (2) Learn from the methodology to improve your independent analysis, (3) Monitor positions you already own. That said, if the $99-449/year feels burdensome, it’s better to cancel and re-subscribe later than to let the subscription add financial stress.

The Bottom Line

You came here trying to figure out which investment subscription is “best.” The real answer is that different subscriptions serve different investors.

If you want someone to tell you what to buy and provide a framework for doing it well, Stock Advisor is the proven choice for 5+ year horizons. Twenty-three years, +1051.7% returns, 92.8% win rate on 10+ year holds, and 43 ten-baggers speak for themselves.

If you trust algorithms over human judgment and have 1-3 year horizons, Alpha Picks offers a pure quant approach with 79.2% win rate and +286.8% returns since 2022.

If you want to make your own decisions with professional-grade tools, Morningstar Investor is the industry standard.

If you need to verify who’s worth listening to, TipRanks tracks 96,000+ experts so you don’t have to trust blindly.

The bigger risk isn’t picking the “wrong” subscription. It’s spending another year consuming free content that leads nowhere while your money sits in cash earning less than inflation.

Pick the category that fits your investing style. Start with one subscription. Use it consistently for a year. That’s how you find out what actually works for you.