7 Best Stock Advisor Websites & Stock Picking Services in 2025

You can discover reliable stock picks to grow your portfolio with confidence using Motley Fool Stock Advisor Review and Seeking Alpha review insights.

We aim for insightful coverage of products and services, including some from compensating partners, which may influence our topics and presentation. Our opinions and conclusions remain unbiased. See our Advertiser Disclosure.

As of April 2025, investors face a perfect storm of challenges—persistent inflation eroding savings, tech sector volatility shaking confidence, and geopolitical risks impacting markets. Just consider this: inflation rates are still outpacing many traditional returns, leaving even savvy portfolios vulnerable. That’s where the best stock advisor services for 2025 come in, offering expert guidance to navigate these turbulent waters and seize opportunities in trending sectors like AI and healthcare.

Whether you’re a beginner craving simplicity, a long-term investor seeking stability, or a professional needing efficiency, the right stock advisor 2025 can transform your approach. These platforms deliver top stock picks 2025 tailored to your goals, simplifying complex decisions and boosting your investment strategy 2025 for optimal market performance 2025. Imagine dodging losses in volatile markets while building wealth with data-driven insights— that’s the power of the 7 Best Stock Advisor (see our 2025 review) Websites & Stock Picking Services in 2025.

Don’t let uncertainty hold you back; act now to stay ahead in 2025’s unpredictable landscape. This article is your roadmap, packed with actionable insights on the best stock advisor services to match your ambitions. Dive in and discover your path to financial growth with the 7 Best Stock Advisor Websites & Stock Picking Services in 2025!

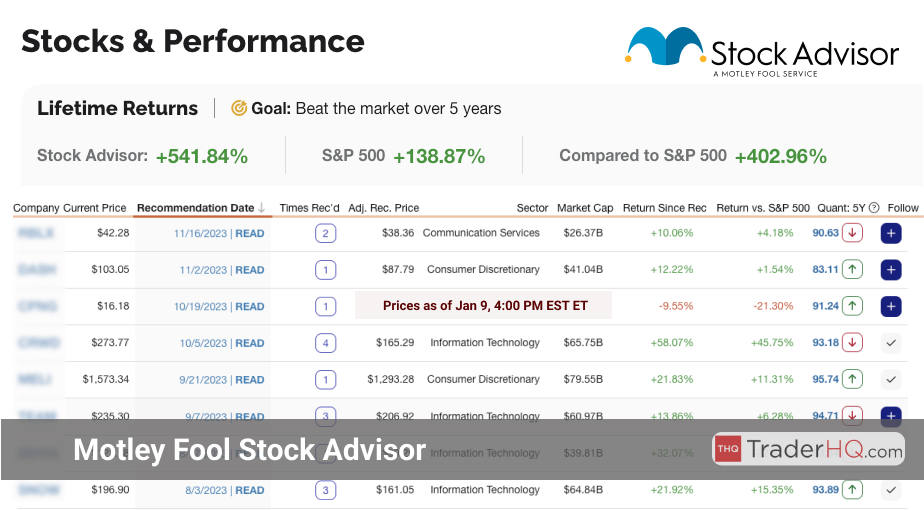

1. Motley Fool Stock Advisor

- Best for: Long-term investors chasing market-beating returns, beginners needing expert guidance, and busy professionals seeking streamlined stock picks.

- Cost: $99/year for new members (50% OFF $199/year)

Aggregate Overall Performance (as of April 15, 2025):

- Total Return: +817.63%

- S&P 500 Return: +156.11%

- Outperformance vs. S&P 500: +661.52%

Motley Fool Stock Advisor, launched in 2002, stands as a trusted leader among the best stock advisor services for 2025. It’s built for investors who want to outperform the market over the long haul, especially in today’s turbulent environment marked by inflation, geopolitical risks, and tech sector volatility as of April 16, 2025. With a proven track record, this service cuts through the noise, delivering actionable stock picks to help you build wealth.

The focus is on long-term, buy-and-hold strategies—perfect for navigating 2025’s challenges like Federal Reserve policy shifts and energy price swings. Stock Advisor equips you with monthly recommendations and tools to stay ahead, whether you’re a beginner or a seasoned investor. Its philosophy of identifying high-growth, quality companies ensures your portfolio can weather market storms and capitalize on opportunities.

Imagine turning $1,000 into over $8,176 with their average pick’s performance. With a total return of +817.63% versus the S&P 500’s +156.11%, Stock Advisor has crushed the market by +661.52% since inception. This isn’t just numbers—it’s proof of a strategy that works, even amidst 2025’s economic headwinds.

Motley Fool Stock Advisor (in-depth 2025 review) Performance Report Data accurate as of April 15, 2025

Executive Summary

Motley Fool Stock Advisor has delivered exceptional performance since March 2002, significantly outperforming the broader market:

- Total Return: +817.63%

- S&P 500 Return: +156.11%

- Outperformance vs. S&P 500: +661.52%

This track record showcases Stock Advisor’s ability to pinpoint market-beating stocks across sectors and conditions over two decades.

All-Time Best Performing Recommendations

The service has produced life-changing returns with picks like:

- A semiconductor giant (2005): +68,668%—turning $1,000 into $687,680.

- A streaming pioneer (2004): +52,550%—$1,000 grew to $526,500.

- An e-commerce titan (2002): +23,360%—$1,000 became $234,600.

Best Performing Picks (Last 5 Years)

Recent winners include:

- An electric vehicle leader (2020): +786%—$1,000 soared to $8,860.

- A cybersecurity innovator (2020): +309%—$1,000 hit $4,090.

- A music streaming platform (2022): +174%—$1,000 reached $2,740.

Best Performing Picks (Last 12 Months)

Strong performers in the past year:

- An e-commerce solutions provider (June 2024): +37%—outpacing the market.

- An insurance leader (August 2024): +31%—steady gains in volatility.

- A logistics platform (October 2024): +28%—matching market trends.

Recent Recommendations (2024-2025)

Fresh picks for 2025 focus on trending sectors like AI and healthcare:

- A digital advertising tech leader (April 2025).

- A healthcare tech innovator (January 2025).

- A global e-commerce marketplace (November 2024).

Summary

Stock Advisor’s consistent outperformance—spanning long-term compounders and recent winners—proves its value. From tech to consumer services, it identifies growth potential across industries, making it a top choice for investors seeking the best stock advisor services in 2025.

Whether you’re dodging market volatility or aiming for financial freedom, Stock Advisor offers clarity. It counters emotional investing traps with research-backed picks, helping you stay focused on long-term goals despite 2025’s uncertainties. This is your chance to align with a service that’s transformed portfolios for over 20 years.

The Motley Fool platform bolsters your journey with robust tools like stock screeners and a learning hub. These resources empower beginners to grasp basics and professionals to refine strategies—crucial in a year where inflation and policy shifts demand smarter decisions. It’s not just about picks; it’s about mastering your financial future.

Key Features of Motley Fool Stock Advisor

- Monthly Stock Picks: Two deeply researched stocks monthly, with detailed reports targeting high-growth opportunities—vital for beating inflation in 2025.

- Foundational Stock List: A curated set of 10 core stocks for long-term growth, updated to reflect market shifts like tech volatility.

- Top 10 Rankings: Monthly updates on the best current opportunities, keeping you aligned with top stock picks for 2025.

- Performance Transparency: Detailed tracking of each pick versus the S&P 500, building trust during uncertain market performance in 2025.

- Educational Wealth: Articles, videos, and community access to boost your skills—perfect for navigating complex investment strategies in 2025.

Stock Advisor isn’t just a service; it’s a partner for long-term investors. With a focus on quality and growth, it helps you sidestep 2025’s risks—think geopolitical tensions or energy swings—and seize opportunities in trending sectors like AI, noted on web platforms as a 2025 hotspot.

Investment Philosophy and Methodology

Long-Term, Buy-and-Hold Focus Stock Advisor champions patience over panic. By holding quality stocks through market cycles, you harness compounding returns—key in 2025 when short-term noise from policy changes can derail gains. This approach shields you from volatility and builds lasting wealth.

High-Quality Companies First The service zeroes in on firms with robust fundamentals: strong earnings, high margins, and resilience. In today’s economy, where inflation bites, picking companies that endure downturns is non-negotiable. Stock Advisor’s lens ensures your investments stand firm.

Team Everlasting’s Edge Led by Tom Gardner, this team targets companies with:

- Competitive Moats: Unique strengths like brand power or tech innovation.

- Top Management: Leaders who excel in strategy and execution.

- Steady Growth: Consistent revenue and market share gains—crucial for 2025 stability.

Team Rule Breakers’ Innovation This squad hunts disruptive players with:

- Game-Changing Ideas: Firms redefining industries with bold solutions.

- Market Disruption: Potential to upend established norms.

- Growth Horizons: Massive opportunities in emerging 2025 sectors like healthcare tech.

Rigorous Selection Process Every pick undergoes strict vetting:

- Deep Research: Financials, models, and industry trends dissected.

- Leadership Checks: Management’s vision and track record evaluated.

- Value Analysis: Metrics like P/E ratios ensure fair pricing—key for 2025’s overvalued pockets.

This disciplined method delivers stocks with outsized potential, helping you craft a portfolio that beats market performance in 2025. It’s not guesswork; it’s a science tailored to your ambitions.

Stock Picking Performance and Real Impact Stock Advisor’s knack for spotting winners is unmatched among the best stock advisor websites in 2025. Beyond the staggering +817.63% total return, recent picks show ongoing strength. A 2024 e-commerce platform pick gained +55%, trouncing the S&P 500’s +49%, while a food delivery play from late 2024 hit +29% despite choppy markets.

Over five years, a 2020 semiconductor bet soared +78% against the S&P 500’s -9%—proof of resilience. Imagine $1,000 ballooning to $1,780 while others faltered. These aren’t flukes; they’re the result of a methodology that nails top stock picks for 2025, empowering you to conquer market fears.

Motley Fool Stock Advisor isn’t just about numbers—it’s about transforming your financial outlook. By blending expert guidance with actionable tools, it positions you to outpace the market and build wealth, no matter the economic curveballs of 2025. Ready to join a community of winners? Take the leap today.

2. Alpha Picks by Seeking Alpha

-

Best for: Value investors chasing high returns, growth-focused individuals hunting market outperformers, and strategic planners aiming to diversify portfolios with precision.

-

Cost: $449/year for new members (10% OFF $499/year)

Aggregate Overall Performance:

- Total Return: +122.15%

- S&P 500 Return: +42.43%

- Outperformance vs. S&P 500: +79.72%

Alpha Picks by Seeking Alpha shines as a trusted guide for investors tackling the unpredictable stock market in 2025. As of April 16, 2025, with inflation lingering, geopolitical tensions simmering, and tech sector volatility spiking, this service delivers a data-driven edge through its rigorous quantitative analysis. If you’re aiming to beat the market and secure your financial future, Alpha Picks offers the tools and insights to navigate these challenges with confidence.

Methodology and Approach

Alpha Picks (read our review) stands out with a disciplined, numbers-driven strategy—perfect for today’s erratic markets. Its methodology cuts through noise to deliver actionable stock picks, addressing 2025’s unique risks like Federal Reserve policy shifts and energy price swings. Here’s how it works:

- Quantitative Precision: Advanced algorithms analyze mountains of data to spotlight stocks with the highest potential to outperform, ensuring you’re ahead of trends.

- Fundamental Depth: Every pick is rooted in thorough research, so you’re investing in companies with real staying power, not just hype.

- Risk Mitigation: With a focus on risk-adjusted returns, Alpha Picks helps you weather uncertainty—crucial when global events can shift markets overnight.

Key Features and Benefits

Alpha Picks equips investors with features tailored to thrive amid 2025’s economic headwinds. Whether you’re a beginner seeking simplicity or a professional needing efficiency, these benefits deliver value:

- Expert Quantitative Strategists: Tap into the expertise of pros like Steve Cress, who decode complex market signals—think of them as your personal market navigators.

- In-Depth Research Reports: Each stock pick includes detailed analysis, explaining the “why” behind recommendations, so you can invest with clarity during volatile times.

- Bi-Monthly Stock Updates: Stay agile with fresh picks every two weeks, ensuring your portfolio adapts to fast-changing conditions like inflation spikes or tech disruptions.

- Portfolio Guidance: Continuous advice helps you tweak your strategy, protecting gains and minimizing losses when markets swing due to policy or energy shocks.

Performance in 2025

As of April 15, 2025, Alpha Picks proves its mettle in uncovering market-beating opportunities. Its track record speaks volumes for investors craving results:

-

Overall Performance: Since inception, Alpha Picks has achieved a staggering total return of +122.15%, crushing the S&P 500’s +42.43% over the same span. That’s an outperformance of +79.72%, showcasing its knack for navigating economic turbulence and delivering outsized gains.

-

Standout Picks:

-

A Technology Hardware Company picked in November 2022 soared +968.59%, turning a $1,000 investment into over $10,685. This exemplifies Alpha Picks’ ability to spot explosive growth in trending sectors like AI hardware.

-

A Digital Advertising Platform from November 2023 surged +441.49%, growing $1,000 to $5,414. This highlights their foresight in capitalizing on digital economy shifts.

-

A Manufacturing Solutions Provider picked in December 2022 returned +348.42%, transforming $1,000 into $4,484, proving their skill in identifying industrial innovators amid supply chain challenges.

Tools and Resources

Alpha Picks arms you with cutting-edge resources to sharpen your investment strategy, especially in 2025’s uncertain climate:

- Proprietary Quantitative Ratings: Get clear insights into a stock’s potential, helping you gauge performance against inflation or sector volatility.

- Real-Time Portfolio Tools: Adjust your holdings on the fly with intuitive dashboards—vital when markets react to geopolitical news or Fed decisions.

- Timely Alerts & Analytics: Stay informed with email updates and deep analysis, ensuring you never miss a critical move in fast-evolving sectors like healthcare or energy.

The Team Behind Alpha Picks

Alpha Picks’ success rests on a powerhouse team of market experts, bringing decades of insight to your portfolio:

- Steve Cress, Head of Quantitative Strategies: Crafts the analytical backbone, turning raw data into winning picks with pinpoint accuracy.

- Zachary Marx, CFA, Senior Quantitative Strategist: Leverages deep market knowledge to uncover hidden gems, even in choppy 2025 conditions.

- Joel Hancock, Senior Director of Product: Ensures subscribers get user-friendly tools and resources, making complex investing accessible to all.

Why Alpha Picks in 2025?

With 2025 bringing economic uncertainty, geopolitical risks, and inflation pressures, Alpha Picks by Seeking Alpha (read our review) (in-depth 2025 review) emerges as a must-have for investors. Its data-driven precision, paired with expert insights, positions you to turn challenges into opportunities—whether it’s capitalizing on AI trends or dodging volatility in energy markets. Imagine transforming a modest $1,000 into five figures by following their proven picks; Alpha Picks isn’t just a service, it’s your roadmap to financial growth.

By joining Alpha Picks, you’re not just getting stock tips—you’re stepping into a community of savvy investors armed with the best stock advisor services for 2025. With top stock picks for 2025 and strategies to outpace market performance, you’re set to build wealth and conquer your financial fears in today’s turbulent landscape.

Best Stock Advisor Services for 2025 – Top Picks to Grow Your Wealth with Confidence

| 🎯 Best Stock Advisor Picks | Best For | Investing Focus |

|---|---|---|

| Motley Fool Stock Advisor | Long-term growth | Stock Picking |

| Alpha Picks by Seeking Alpha | Quant analysis | Analyst-Powered |

| Morningstar Investor | Independent research | Investment Screening |

| Zacks Premium | Research focused | Earnings Analysis |

| Seeking Alpha Premium | Detailed research | Comprehensive Analysis |

| Trade Ideas | Real-time traders | AI Insights |

| TipRanks Premium | Data-driven investing | Expert Consensus |

3. Morningstar Investor

- Best for: Value seekers, data-driven planners, and research enthusiasts who crave in-depth analysis and robust tools to navigate complex markets.

- Cost: $199/year for new members (20% OFF $249/year)

Morningstar Investor equips self-directed investors with the insights and tools to make confident decisions in volatile 2025 markets. As of April 16, 2025, with over 150 expert analysts, this service delivers unbiased, independent research spanning diverse sectors—perfect for beginners needing clarity, long-term investors seeking stability, and professionals demanding efficiency. If you’re looking to build wealth with the best stock advisor services, Morningstar’s data-driven approach helps you uncover top stock picks for 2025 while managing risks like inflation and tech sector swings.

Why Morningstar Investor Stands Out in 2025

Morningstar’s strength lies in its comprehensive research and cutting-edge tools, designed to help you outpace market performance in 2025. Whether you’re dodging geopolitical risks or capitalizing on trending sectors like AI and healthcare (noted on X as key 2024–2025 growth areas), this service offers a clear path. Its transparent methodology and powerful features address your burning question: “How do I find the right investments amid uncertainty?”

- Robust Ratings System: Covers securities, fund managers, and ESG factors, offering a clear framework to evaluate opportunities. As of April 2025, new AI-driven filters spotlight emerging trends, ensuring you don’t miss out on market-beating picks.

- Portfolio X-Ray Tool: Provides a deep dive into your holdings, revealing hidden risks, redundancies, and fee impacts. Recent updates (April 2025) include predictive analytics to simulate performance under scenarios like Federal Reserve policy shifts or energy price volatility.

- Screening Powerhouse: Combines data analytics with expert insights to filter investments fast. Imagine screening 50 stocks in minutes to find gems aligned with your investment strategy for 2025.

- Account Aggregation: Simplifies tracking by consolidating all holdings into one view, updated for real-time accuracy as of April 2025.

- Personalized Insights: Tailors recommendations to your assets, with granular updates in 2025 ensuring relevance for your unique goals.

- Watchlists & Customization: Keeps critical data at your fingertips, with new real-time market tracking features added in April 2025 to stay ahead of volatility.

How It Helps You Navigate 2025 Challenges

With economic headwinds like inflation and policy uncertainty looming as of April 16, 2025, Morningstar Investor (read our review) is your anchor. Its tools streamline risk management—think of spotting a portfolio concentration that could tank during a tech downturn before it happens. For instance, a 2024 update helped users rebalance away from overexposure in volatile sectors, saving potential losses, while educational modules on sustainable investing (new in 2025) keep you ahead of market shifts.

Pricing & Value

Morningstar Investor’s pricing rewards commitment with a discounted annual rate of $199/year (20% off $249/year) for new members. A 7-day free trial lets you test the waters risk-free, while quarterly and semi-annual discounts (updated April 2025) cater to varied timelines. For the depth of research and time saved, it’s a steal for anyone serious about market performance in 2025.

Who Benefits Most?

Whether you’re a beginner overwhelmed by choices, a long-term investor guarding against losses, or a professional needing quick insights, Morningstar (see our review) delivers. It’s about trust—unbiased research democratizes investing, empowering you to craft a winning investment strategy for 2025. Subscribers gain not just data, but a roadmap to financial confidence through tools that simplify complex decisions.

Why Act Now?

Markets in 2025 are unpredictable—don’t let fear of missing out or volatility derail your goals. Morningstar Investor offers consistent, actionable insights to help you seize opportunities in trending sectors like healthcare or AI, as buzzed about on web platforms in early 2025. From portfolio analysis to opportunity discovery, it’s your partner in building wealth with the best stock advisor services.

4. Zacks Premium

-

Best for: Experienced traders seeking detailed analytics, value investors looking for underpriced stocks, and active investors needing daily updates.

-

Cost: $249/year after free 30-day trial

Zacks Premium stands as a cornerstone in the investment research industry. Founded in 1978, Zacks Investment Research has evolved to become a trusted name for data-driven stock analysis, and as we enter 2025, its relevance remains strong amidst the evolving market dynamics.

The service’s core offerings revolve around the Zacks Rank system, a proprietary stock-rating model. This system analyzes earnings estimate revisions to identify stocks with the highest potential for outperformance. The #1 Rank List, representing the top 5% of stocks, has historically doubled the S&P 500’s returns.

What sets Zacks Premium (see our review) apart is its focus on earnings estimate revisions as a key indicator of future stock performance. This approach provides investors with a unique edge in predicting market movements, a strategy that continues to be effective in the volatile markets of early 2025.

Zacks Premium offers a suite of powerful tools:

-

Style Scores (Value, Growth, Momentum): These scores help investors align their strategies with specific investment styles, which is particularly useful in the current economic climate where different sectors are responding variably to global economic recovery trends.

-

Focus List Portfolio: Curates 50 stocks for long-term growth potential. This list has consistently outperformed the market since its inception, and with the latest updates in January 2025, it continues to show robust performance.

-

Industry Rank: Aggregates individual stock ranks to identify top-performing sectors. This tool is vital for investors looking to capitalize on the ongoing sector rotations influenced by technological advancements and sustainability initiatives.

-

Earnings ESP Filter: Predicts earnings surprises with remarkable accuracy. Given the recent volatility in corporate earnings due to global supply chain challenges, the ESP Filter’s insights have proven even more critical for investors in early 2025.

-

Premium Screener: Allows investors to discover stocks matching specific criteria. This customizable tool caters to various investment strategies, from value to growth to income-focused approaches, making it adaptable to the diverse investment needs in the current market.

Zacks Premium also provides in-depth Equity Research Reports on over 1,000 widely-followed companies. These reports offer valuable insights into growth drivers, industry placement, and valuation metrics, crucial for understanding the impact of recent global economic policies and shifts in consumer behavior.

The Style Scores help investors align their strategies with specific investment styles. The VGM Score combines these metrics, offering a comprehensive view of a stock’s potential, which is more relevant than ever with the rapid shifts in market conditions at the start of 2025.

Zacks’ Focus List Portfolio curates 50 stocks for long-term growth potential. This list has consistently outperformed the market since its inception, and its latest iteration in January 2025 reflects adjustments to the new economic landscape.

The Industry Rank tool aggregates individual stock ranks to identify top-performing sectors. This allows investors to capitalize on broader market trends and sector rotations, which have been influenced by recent technological breakthroughs and sustainability trends.

Zacks Premium empowers investors with data-driven insights and powerful analytical tools. Whether you’re a seasoned investor or just starting out, these resources can help enhance your investment strategy and potentially improve your portfolio performance in the dynamic market conditions of January 2025.

5. Seeking Alpha Premium

-

Best for: Data-driven analysts, long-term planners, value seekers. Comprehensive insights for strategic planning and identifying undervalued stocks.

-

Cost: $189/year (Regularly $239/year) + 7-day free trial

Seeking Alpha Premium is a comprehensive stock analysis platform that harnesses the collective wisdom of a global community of investors and industry experts. With a focus on providing diverse, data-driven insights, Seeking Alpha Premium (read our review) empowers users to make informed investment decisions in early 2025.

The platform offers an extensive array of tools and resources, including:

-

In-depth articles from seasoned investors and analysts, covering a wide range of stocks, sectors, and market trends. As of January 2025, Seeking Alpha Premium continues to deliver high-quality content, with a recent focus on emerging sectors such as AI, renewable energy, and biotechnology.

-

Proprietary ratings and quantitative metrics to help users quickly assess the strength of individual stocks. These tools have been updated to reflect the latest market conditions and include new metrics for assessing ESG (Environmental, Social, and Governance) factors, which are increasingly important for investors in 2025.

-

Powerful screening tools to help users discover new investment opportunities aligned with their portfolio and risk tolerance. In the first week of January 2025, Seeking Alpha Premium introduced enhanced screening features that allow users to filter stocks based on real-time market data and the latest economic indicators.

What sets Seeking Alpha Premium apart is the sheer breadth and depth of its crowd-sourced content. Users can access a spectrum of opinions and analysis, from detailed fundamental research to technical assessments and contrarian views. As of early 2025, the platform has seen an increase in user-generated content, reflecting the growing interest in alternative investment strategies and niche sectors.

If you’re ready to elevate your investing game and join a vibrant community of market participants, Seeking Alpha Premium is the platform to help you achieve your financial goals with confidence in early 2025.

6. Trade Ideas

-

Best for: Day traders seeking real-time data, swing traders looking for actionable alerts, and algorithmic traders interested in AI-driven insights.

-

Cost: $84/month for Standard Plan (billed annually at $999)

Trade Ideas is a pioneering stock market analytics platform that has been empowering individual traders and investors since 2002. With its cutting-edge technology and innovative tools, Trade Ideas (see our 2025 review) has carved a unique niche in the market. As of January 2025, Trade Ideas continues to evolve, adapting to the ever-changing dynamics of the financial markets and leveraging the latest advancements in AI and machine learning to enhance user experience.

At the core of Trade Ideas’ offerings is a powerful combination of real-time market data, advanced analytics, and artificial intelligence. This unique blend of features sets Trade Ideas apart from other stock advisory services, providing users with actionable insights that can be immediately applied to their trading strategies. In the current market environment, where volatility and rapid changes are the norm, the ability to access real-time data and AI-driven insights has become more crucial than ever.

One of the standout features of Trade Ideas is its AI-powered assistant, named Holly. Holly is designed to scan the market in real-time, identify potential trading opportunities, and provide users with clear, easy-to-follow trade ideas. By leveraging machine learning algorithms, Holly continuously adapts to changing market conditions, ensuring that the trade ideas generated are always relevant and up-to-date. In 2025, Holly has been further refined to incorporate the latest AI technologies, enhancing its ability to predict market movements and identify high-probability trading opportunities.

In addition to Holly, Trade Ideas offers a wealth of other tools and resources, including:

-

Customizable stock scanners

-

Real-time alerts

-

Backtesting capabilities

-

Risk management tools

-

Educational resources

These features are designed to cater to the diverse needs of Trade Ideas’ user base, whether they are day traders looking for quick profit opportunities or long-term investors seeking to build a robust portfolio. In the current market, where the ability to quickly adapt to new information is key, these tools provide a significant edge to users.

Another key aspect of Trade Ideas is its commitment to user education and community building. The platform offers a range of educational resources, including webinars, tutorials, and a comprehensive knowledge base, to help users enhance their trading skills and knowledge. In 2025, Trade Ideas has expanded its educational offerings, with new courses focused on the latest trading strategies and market trends.

Additionally, Trade Ideas fosters a vibrant community of traders through its trading room and forum, where users can interact, share ideas, and learn from one another. This community aspect has become even more valuable in the current year, as traders seek to navigate the complexities of the market together.

If you’re looking for a stock advisory service that can provide you with the tools, insights, and support you need to succeed in the markets, Trade Ideas is definitely worth considering. With its advanced technology, user-friendly interface, and commitment to user education, Trade Ideas has the potential to revolutionize your trading experience and help you achieve your financial goals in the dynamic market environment of 2025.

7. TipRanks Premium

-

Best for: Growth seekers looking for analyst insights, trend spotters benefiting from data visualization, and value hunters using stock scores.

-

Cost: $360/year for new members

TipRanks Premium is a cutting-edge stock advisor service that harnesses the power of aggregated expert opinions and predictive tools to provide investors with actionable market insights. By compiling data and forecasts from top-performing analysts, TipRanks offers a comprehensive overview of market sentiment and consensus, empowering users to make more informed investment decisions in the dynamic market environment of January 2025.

What sets TipRanks apart is its unique approach to transparency and user empowerment. The platform provides a wealth of features designed to give investors a clear, unbiased view of the market, including:

-

Analyst Rating Consensus: See the overall “buy, hold, or sell” recommendations from top analysts for any given stock. This can be particularly useful as we enter 2025, with various sectors expected to rebound or continue their growth trajectory.

-

Price Targets: Access the average, high, and low price targets from analysts to gauge a stock’s potential upside or downside. With the economic forecasts for 2025 suggesting a potential shift in interest rates, these targets can offer critical insights.

-

Insider Trading Signals: Monitor the trading activity of company insiders, which can often provide clues about a stock’s future performance. Given the increased regulatory scrutiny in 2025, insider trading patterns could be more telling than ever.

In addition to these powerful tools, TipRanks Premium (see our 2025 review) offers a host of resources to help investors stay informed and ahead of the curve. From daily stock ideas to in-depth research reports, the platform provides a constant stream of valuable insights. As we move into 2025, TipRanks has enhanced its data analytics capabilities to better predict market trends in the post-AI boom era.

Whether you’re a seasoned investor or just starting to build your portfolio, TipRanks Premium can be an invaluable ally in your investment journey. With its commitment to transparency, data-driven insights, and user empowerment, TipRanks is uniquely positioned to help you navigate the complex world of stock investing with confidence and clarity, especially in the volatile market conditions anticipated for 2025.

If you’re ready to take your investment strategy to the next level, TipRanks Premium could be the solution you’ve been seeking. By leveraging the collective wisdom of top market experts and cutting-edge predictive tools, you’ll be well on your way to building a robust, resilient portfolio designed to weather any market conditions in 2025.

What is a Stock Advisor Website?

A stock advisor website is an online platform designed to provide investors with expert guidance, recommendations, and tools to make informed investment decisions. These websites aim to demystify the process of selecting stocks by offering curated lists of promising investment opportunities. Leveraging the expertise of professional analysts and comprehensive research, stock advisor websites empower investors to build profitable portfolios with confidence.

Whether you’re a novice investor or a seasoned market participant, a stock advisor website can serve as an invaluable resource throughout your investing journey. These platforms typically feature a range of offerings, including stock picks, in-depth market analysis, and educational content tailored to help you navigate the complexities of the stock market. By subscribing to a reputable stock advisor website, you can gain access to the insights and strategies necessary to make smart investment choices and grow your wealth over time.

One of the primary advantages of using a stock advisor website is the potential to outperform the broader market. Many of these services boast a proven track record of delivering market-beating returns due to the rigorous research and analytical expertise of their teams. By following the guidance of a trusted stock advisor, you can position yourself to capitalize on profitable opportunities while mitigating risks.

However, not all stock advisor websites are created equal. It’s crucial to select a service that aligns with your investment goals, risk tolerance, and learning preferences. Look for a platform with a transparent methodology, a strong history of performance, and a user-friendly interface that facilitates easy implementation of their recommendations. With the right stock advisor website, you can approach the stock market with enhanced knowledge, skill, and confidence.

What is the Best Stock Advisor?

Identifying the best stock advisor involves evaluating several key factors. First and foremost, you want a service with a proven track record of delivering market-beating returns over the long term. Look for a stock advisor that has consistently outperformed benchmark indexes like the S&P 500, demonstrating their ability to identify winning stocks in various market conditions.

Transparency is another critical component of top-tier stock advisor services. You want a platform that openly shares its methodology, performance metrics, and track record, ensuring you can trust the validity of their recommendations. The best stock advisors provide clear, detailed analysis and rationale behind each stock pick, enabling you to understand the factors driving their investment decisions.

Affordability and value are also essential considerations. While investing in quality research and guidance is crucial, you don’t want to overpay for services you don’t need. Look for a stock advisor that offers various subscription options and pricing tiers to fit your budget and investing goals.

Ultimately, the best stock advisor for you will depend on your unique needs and preferences as an investor. Some platforms may be better suited for long-term, buy-and-hold investors, while others cater to more active traders. Consider your investment style, risk tolerance, and learning objectives when evaluating potential stock advisor services.

How We Evaluated the Best Stock Advisor Websites?

To determine the best stock advisor websites, we conducted a comprehensive evaluation process that considered a range of critical factors. Our goal was to identify platforms that offer the most value, performance, and user experience for investors like you.

Key criteria we assessed include:

-

Track Record: We analyzed each stock advisor’s historical performance, focusing on services that have consistently beaten the market over the long term.

-

Transparency: We prioritized platforms that openly share their methodology, performance metrics, and investment rationale, ensuring trust in their recommendations.

-

Expertise: We evaluated the qualifications, experience, and track record of each service’s analysts and research team.

In addition to these core factors, we also considered:

-

Educational Resources: The best stock advisors don’t just tell you what to buy—they also help you understand why. We looked for platforms with robust educational content to help you grow your investing knowledge.

-

User Experience: A stock advisor website should be easy to navigate and use. We assessed each platform’s interface, mobile accessibility, and overall user experience.

-

Community and Support: Many of the best stock advisor services offer vibrant investor communities and responsive customer support. We factored these elements into our evaluation as well.

By weighing each of these criteria and more, we identified the stock advisor websites that truly stand out. While no single service may be perfect for every investor, the platforms that scored highest in our evaluation offer a compelling combination of performance, value, and user experience. Whether you’re just starting to invest or looking to take your portfolio to the next level, these top-rated stock advisor websites can provide the guidance and insight you need to succeed in the market.

Benefits of Using a Stock Advisor Website

Using a stock advisor website offers several benefits that can significantly enhance your investing experience and outcomes:

-

Access to Expert Analysis: Stock advisor websites employ seasoned analysts who conduct thorough research, saving you time and effort while providing access to high-quality insights.

-

Diversified Recommendations: These platforms often offer a diversified list of stock picks, helping you spread risk across different sectors and industries.

-

Educational Support: Many stock advisor websites offer educational materials, webinars, and tutorials that can help you build your investing knowledge and skills.

-

Timely Updates: Subscribers receive timely updates and alerts about market changes, new stock picks, and portfolio adjustments, ensuring you stay informed and can act swiftly.

-

Community Engagement: Some platforms feature forums or groups where you can discuss strategies, share experiences, and gain insights from other investors.

Conclusion

Stock advisor websites can be a powerful tool for investors looking to make informed decisions and achieve their financial goals. By providing expert analysis, diversified recommendations, and educational resources, these platforms can help you navigate the complexities of the stock market with greater confidence. However, it’s essential to choose a service that aligns with your investment strategy, risk tolerance, and budget. By carefully evaluating your options and using stock advisor websites as a complement to your own research, you can enhance your investing journey and work towards building a successful portfolio.

FAQ: Motley Fool Stock Advisor

Choosing the right stock advisor service can be a critical decision in your investing journey. To help you determine if Motley Fool Stock Advisor is the best fit for your needs, here are answers to some of the most commonly asked questions about the service:

What is the track record of Motley Fool Stock Advisor?

Stock Advisor has a proven history of delivering market-beating returns. Since its inception in 2002, the service’s recommendations have yielded an average return of , significantly outperforming the S&P 500’s return of over the same period. That means Stock Advisor has beaten the market by times, demonstrating the effectiveness of its investment philosophy and methodology.

How many stock picks does Stock Advisor provide?

Each month, Stock Advisor delivers two new stock recommendations, complete with in-depth research reports and clear investment rationales. Additionally, the service maintains a list of 10 Foundational Stocks, representing core holdings with strong long-term growth potential. This combination of monthly picks and foundational stocks provides a steady stream of high-quality investment ideas.

What is the investment philosophy behind Stock Advisor’s picks?

Stock Advisor follows a long-term, buy-and-hold investment philosophy. The service focuses on identifying high-quality companies with strong competitive advantages, excellent management, and consistent growth prospects. By holding these stocks for the long term, investors can benefit from compounding returns and weather short-term market fluctuations.

How does Stock Advisor help me build a diversified portfolio?

Diversification is a core tenet of Stock Advisor’s approach. The service recommends stocks across various sectors and market capitalizations, helping you build a well-rounded portfolio that can mitigate risk. Additionally, Stock Advisor provides ongoing guidance for managing and rebalancing your portfolio to ensure it stays aligned with your goals and risk tolerance.

What resources does Stock Advisor offer beyond stock picks?

Stock Advisor offers a wealth of educational resources and tools to support your investing journey. These include in-depth articles, videos, and live Q&A sessions with the service’s expert analysts. The Stock Advisor platform also features a stock screener, performance tracking, and a vibrant member community where you can learn from and share ideas with fellow investors.

Can Stock Advisor adapt to my unique investing needs and goals?

Absolutely. Stock Advisor recognizes that every investor’s situation is unique. The service offers a diverse range of investment ideas and strategies, from Starter Stocks for beginners to aggressive growth picks for those with higher risk tolerances. With its ongoing guidance and personalized support, Stock Advisor can help you tailor your portfolio to your individual needs and goals.

Ultimately, Motley Fool Stock Advisor’s combination of a proven track record, long-term investment philosophy, and comprehensive support makes it a compelling choice for investors seeking to grow their wealth in the stock market. If you’re ready to take control of your financial future, we encourage you to try Stock Advisor today and start building a portfolio of high-quality, market-beating stocks.

Related Motley Fool Resources:

- •Review our detailed Motley Fool Stock Advisor Review.

- •Read our in-depth Motley Fool review.

- •Take advantage of our Motley Fool discounts.

- •Check out the latest Motley Fool stock picks.

🧠 Thinking Deeper

- ☑️ Seek to buy assets for less than they're worth. That's the essence of value investing.

- ☑️ Be willing to go against popular opinion. The crowd is often wrong at crucial junctures.

- ☑️ Remember that the market is not always rational in the short term. Prices can diverge from value.

- ☑️ Develop a clear, written investment philosophy. It will guide you through difficult decisions.

📚 Wealthy Wisdom

- ✨ If you have trouble imagining a 20% loss in the stock market, you shouldn't be in stocks. - John Bogle

- ✔️ It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong. - George Soros

- 🌟 Successful investing is about managing risk, not avoiding it. - Benjamin Graham

- 🚀 The best investment you can make is in yourself. - Warren Buffett

📘 Table of Contents

- • Motley Fool Stock Advisor

- • Executive Summary

- • All-Time Best Performing Recommendations

- • Best Performing Picks (Last 5 Years)

- • Best Performing Picks (Last 12 Months)

- • Recent Recommendations (2024-2025)

- • Summary

- • Alpha Picks by Seeking Alpha

- • Methodology and Approach

- • Key Features and Benefits

- • Performance in 2025

- • Tools and Resources

- • The Team Behind Alpha Picks

- • Why Alpha Picks in 2025?

- • Best Stock Advisor Services for 2025 – Top Picks to Grow Your Wealth with Confidence

- • Morningstar Investor

- • Why Morningstar Investor Stands Out in 2025

- • How It Helps You Navigate 2025 Challenges

- • Pricing & Value

- • Who Benefits Most?

- • Why Act Now?

- • Zacks Premium

- • Seeking Alpha Premium

- • Trade Ideas

- • TipRanks Premium

- • What is a Stock Advisor Website?

- • What is the Best Stock Advisor?

- • How We Evaluated the Best Stock Advisor Websites?

- • Benefits of Using a Stock Advisor Website

- • Conclusion

- • FAQ: Motley Fool Stock Advisor

- • What is the track record of Motley Fool Stock Advisor?

- • How many stock picks does Stock Advisor provide?

- • What is the investment philosophy behind Stock Advisor’s picks?

- • How does Stock Advisor help me build a diversified portfolio?

- • What resources does Stock Advisor offer beyond stock picks?

- • Can Stock Advisor adapt to my unique investing needs and goals?