7 Best Investment Advice Websites & Service Subscriptions in 2025

Empower your journey to financial clarity with best stock advisor websites and stock research sites.

Navigating today’s unpredictable financial world, shaped by shifting trade policies and rapid tech advancements, can feel overwhelming, but you’re driven by a deep desire to build a portfolio that secures a future you can believe in—whether it’s funding your children’s dreams of college or creating a retirement filled with peace.

With the right guidance, you can turn uncertainty into possibility, and that’s why uncovering the best stock picking services 2025 has to offer is so vital—tools and subscriptions that show you the way, tailored to fit your life and the goals that keep you up at night.

Find out how these seven top resources can offer clarity and confidence, helping you make decisions that turn your heartfelt aspirations into reality.

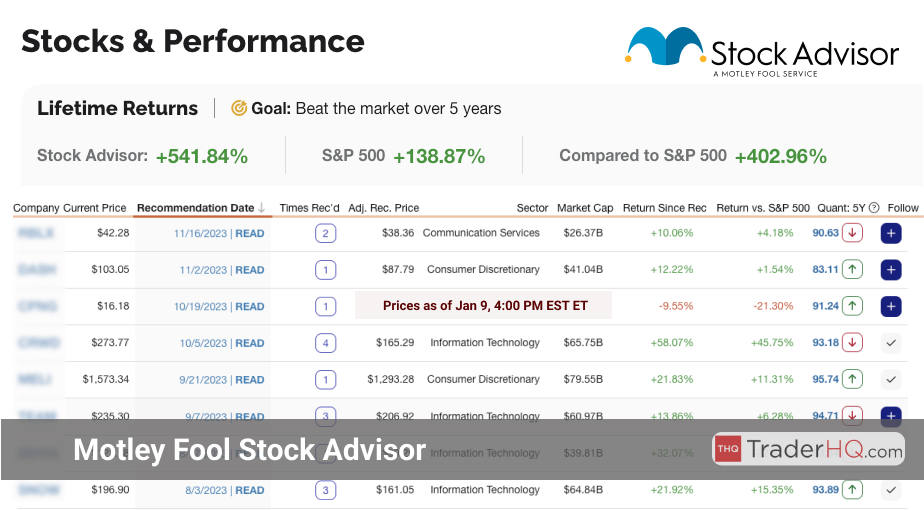

1. Motley Fool Stock Advisor

-

Best for: Long-term investors seeking market-beating returns, new stock pickers craving expert guidance, and busy professionals needing actionable, simplified recommendations.

-

Cost: $99/year for new members (50% OFF $199/year)

Aggregate Overall Performance:

- Total Return: +975.44%

- S&P 500 Return: +171.82%

- Outperformance vs. S&P 500: +803.62%

Motley Fool Stock Advisor, launched in 2002, stands as a trusted leader among the best stock advisor services for 2025. With a proven focus on long-term, buy-and-hold strategies, it’s designed to help you outpace the market, especially in today’s challenging landscape marked by trade policy uncertainties and inflation pressures as of May 17, 2025. Whether you’re dodging volatility or aiming for life-changing gains, Stock Advisor offers the clarity and expertise you need.

This service delivers monthly stock picks, a curated list of foundational investments, and transparent performance tracking. Its philosophy hinges on spotting high-quality companies with enduring growth potential—perfect for navigating the current market where AI-driven tech surges and geopolitical risks loom large. Stock Advisor’s approach ensures you’re not just reacting to trends but building wealth over time.

As of May 16, 2025, Stock Advisor (in-depth 2025 review) boasts an average return of +975.44% since inception, crushing the S&P 500’s +171.82% by a staggering +803.62%. This isn’t luck; it’s a testament to a disciplined strategy that thrives even as interest rate dynamics and global tensions shake investor confidence. You can trust these numbers to guide your next move.

Stock Advisor’s success mirrors the wisdom of icons like Warren Buffett, who champions patience over panic. In a market rattled by tariff talks and inflation spikes, their focus on resilient businesses with strong fundamentals helps you stay the course. Think of it as your anchor amid 2025’s economic storms.

Their track record speaks volumes. Consider these standout picks:

- A semiconductor giant, recommended in 2005, delivered +82,888%, turning $1,000 into over $829,880.

- A streaming pioneer, picked in 2004, soared to +64,158%, transforming $1,000 into $642,580.

- An e-commerce titan from 2002 returned +26,757%, growing $1,000 to $268,570.

Beyond numbers, Stock Advisor tackles the emotional rollercoaster of investing. Their research-backed insights keep you grounded, preventing knee-jerk moves when markets wobble due to policy shifts or geopolitical flare-ups. It’s like having a seasoned mentor whispering, “Stick to the plan,” during uncertain times.

The Motley Fool platform equips you with tools like stock screeners, performance dashboards, and a robust learning hub. These resources empower you to sharpen your skills and make informed choices—crucial in a 2025 market where small-cap opportunities and AI trends demand quick, smart decisions. You’re not just buying picks; you’re gaining a financial edge.

Whether you’re starting out or managing a hefty portfolio, Stock Advisor helps you craft a diversified, high-performing portfolio. With inflation eroding purchasing power and trade tensions spiking volatility, their focus on quality and growth offers a path to financial security. Imagine turning today’s uncertainty into tomorrow’s triumph.

Key Features of Motley Fool Stock Advisor (read the 2025 review)

- Monthly Stock Recommendations: Get two deeply researched picks each month, backed by detailed reports and clear reasoning. These target companies poised for growth, helping you stay ahead of inflation and market shifts in 2025.

- Curated Foundational Stocks: Access a list of 10 core stocks with long-term potential, updated regularly to seize the best opportunities. This is your bedrock for stability amid today’s economic headwinds.

- Monthly Rankings: Stay current with top 10 investment ideas from their recommendations, tailored to 2025’s fast-moving market dynamics. Never miss a timely opportunity.

- Detailed Performance Tracking: Enjoy full transparency with returns compared to the S&P 500 for every pick. Know exactly how you’re stacking up in a volatile environment.

- Extensive Educational Resources: Dive into articles, videos, live Q&As, and a supportive community to boost your investing know-how. This is vital for confidently navigating complex 2025 trends like AI investments or gold’s safe-haven surge.

Motley Fool Stock Advisor’s unmatched history of delivering superior returns builds unshakable trust. By prioritizing long-term investments and arming you with ongoing education, it empowers you to achieve lasting wealth, no matter the economic challenges of 2025. You’re not just investing; you’re securing your future.

Investment Philosophy and Methodology

Long-Term, Buy-and-Hold Investing

At its core, Stock Advisor champions long-term investing. You’re encouraged to ignore short-term noise—like 2025’s tariff-induced market jitters—and focus on a company’s lasting potential. This compounding strategy turns patience into profit, shielding you from today’s volatility.

This approach curbs emotional decisions, helping you ride out market cycles. With geopolitical risks and inflation pressures mounting, holding quality stocks for years ensures you capture growth, not just survive dips. It’s a proven way to build wealth.

Focus on High-Quality Companies

Stock Advisor zeroes in on businesses with robust fundamentals—think strong earnings, high margins, and solid returns on equity. These companies can endure economic downturns, a must in 2025 when trade policies threaten corporate profits. You’re investing in resilience, not just returns.

The Role of Team Everlasting

Led by Tom Gardner, Team Everlasting targets companies with:

- Strong Competitive Advantages: Unique strengths like brand power or tech innovation, key to staying dominant in uncertain markets.

- Excellent Management: Leaders who innovate and execute, steering firms through 2025’s policy and rate challenges.

- Consistent Growth: Steady revenue and market share gains, critical for long-term gains in today’s economy.

The Role of Team Rule Breakers

Team Rule Breakers hunts disruptive innovators with:

- Innovation: Game-changing products, aligning with 2025’s AI and tech boom.

- Disruption: Challengers to industry giants, offering early entry into emerging sectors.

- Market Potential: Capacity to dominate growing markets, tapping into trends like data infrastructure.

Rigorous Analysis and Strict Criteria

Every pick undergoes intense scrutiny, focusing on:

- Fundamental Research: Deep dives into financials and business models to gauge true value, essential in volatile 2025 markets.

- Management Assessment: Evaluating leadership’s vision and track record, crucial during economic shifts.

- Competitive Advantage Analysis: Spotting unique edges that sustain growth, even as global tensions rise.

- Growth Potential: Assessing future revenue and market expansion, aligning with 2025’s small-cap and M&A trends.

- Valuation Metrics: Using P/E ratios and cash flow analysis to ensure fair pricing, helping you buy smart in turbulent times.

This meticulous process delivers picks with high growth potential while balancing quality and value. In 2025, where inflation and policy risks loom, Stock Advisor’s method builds portfolios that endure and excel. You’re equipped to beat the market, no matter the odds.

Stock Picking Performance and Examples of Successful Picks

Motley Fool Stock Advisor’s reputation for market-beating picks is rock-solid. Since 2002, its average return has consistently trounced the S&P 500, proving its knack for spotting winners across market cycles, including 2025’s complex environment.

Recent performance shines. A 2024 e-commerce pick from June returned +80%, outpacing the S&P 500 by +67%. Another, a ride-hailing and delivery firm picked in April 2024, gained +50%, beating the index by +29%, even as trade tensions rattled markets.

Over five years, results impress further. A 2020 tech pick soared +1,120%, outstripping the S&P 500 by +1,021%. A 2023 cybersecurity recommendation returned +255%, ahead of the market by +201%. These aren’t flukes—they’re proof of a winning system.

Imagine turning $1,000 into these gains with the best stock advisor services for 2025. Picture a nurse who followed a 2024 pick and grew her savings by 80% in months. With Stock Advisor, you’re not just picking stocks; you’re crafting your financial future with expert guidance.

2. Alpha Picks by Seeking Alpha

-

Best for: Value investors chasing high returns, growth-focused individuals hunting market outperformers, and strategic planners aiming to diversify with confidence.

-

Cost: $449/year for new members (10% OFF $499/year)

Aggregate Overall Performance:

- Total Return: +163.81%

- S&P 500 Return: +57.41%

- Outperformance vs. S&P 500: +106.40%

Alpha Picks by Seeking Alpha shines as a trusted guide for investors tackling the unpredictable stock market of 2025. With trade policy uncertainties and inflation pressures looming as of May 17, 2025, this service delivers a systematic, data-driven approach to uncover top-tier investment opportunities. If you’re looking to beat the market and secure your financial future, Alpha Picks offers the clarity and precision you need right now.

Methodology and Approach

Alpha Picks (read the 2025 review) uses a rigorous, numbers-driven strategy to select stocks, a must-have in today’s volatile landscape. Here’s how they stand out:

- Quantitative Edge: Advanced algorithms analyze massive datasets to spotlight stocks with the highest potential to outperform, cutting through market noise.

- Deep Fundamentals: Every pick is backed by thorough research, ensuring you’re investing in companies with real staying power, not just trends.

- Risk-Aware Focus: With geopolitical tensions and interest rate swings shaping 2025 markets, their risk-adjusted approach helps you invest with confidence, minimizing exposure to sudden downturns.

Key Features and Benefits

Alpha Picks arms you with tools and insights tailored for success in today’s challenging environment:

- Expert Quantitative Team: Tap into the expertise of pros like Steve Cress, Head of Quantitative Strategies, who decode complex market trends for actionable picks.

- In-Depth Analysis: Each recommendation includes detailed breakdowns, so you understand the reasoning behind every move—vital for navigating 2025’s uncertainties.

- Bi-Monthly Stock Picks: Fresh recommendations every two weeks keep your portfolio aligned with shifting conditions, from tariff impacts to tech sector volatility.

- Continuous Portfolio Guidance: As inflation risks and market swings persist, Alpha Picks offers ongoing advice to adapt your strategy and safeguard your gains.

Performance in 2025

As of May 16, 2025, Alpha Picks proves its ability to deliver market-beating results:

- Overall Performance: Since inception, Alpha Picks has achieved a staggering total return of +163.81%, dwarfing the S&P 500’s +57.41% over the same period. That’s an outperformance of +106.40%, showcasing their knack for thriving amid economic shifts.

- Standout Picks:

- A Mobile App Monetization Platform picked in November 2023 soared +753.77%, turning a $1,000 investment into $8,537. This highlights their ability to spot explosive growth early.

- A Server & Storage Solutions Provider from November 2022 delivered +968.59%, transforming $1,000 into over $10,685 by March 2024—a testament to their long-term vision.

- A Casual Dining Chain picked in April 2024 returned +195.82%, growing $1,000 to nearly $2,958 in just over a year, proving their strength in diverse sectors.

Tools and Resources

Alpha Picks equips you with cutting-edge resources to sharpen your investment game:

- Proprietary Ratings System: Their unique quantitative ratings reveal stock potential, helping you gauge performance amid 2025’s trade tensions and rate volatility.

- Portfolio Management Suite: Real-time tools let you adjust your holdings on the fly, critical for reacting to sudden market or policy shifts.

- Timely Alerts & Analysis: Stay ahead with email updates and deep insights, ensuring you’re never caught off guard by inflation spikes or geopolitical events.

The Team Behind Alpha Picks

The strength of Alpha Picks lies in its expert team, dedicated to your success:

- Steve Cress, Head of Quantitative Strategies: Spearheads the analytical framework, grounding every pick in hard data and market realities.

- Zachary Marx, CFA, Senior Quantitative Strategist: Leverages deep market knowledge to pinpoint high-potential opportunities, even in turbulent times.

- Joel Hancock, Senior Director of Product: Ensures subscribers get intuitive tools and resources to make smart, informed decisions effortlessly.

Why Alpha Picks in 2025?

With trade tariffs threatening corporate earnings, AI-driven tech concentration risks, and inflation hovering above targets as of May 17, 2025, Alpha Picks is your strategic ally. Their data-first methodology, paired with expert insight, helps you turn today’s challenges into tomorrow’s wins. Whether you’re a beginner or a seasoned investor, this service positions you to outpace the market, dodge volatility, and build lasting wealth.

Imagine turning a modest $1,000 into thousands by capitalizing on undervalued gems others overlook. With Alpha Picks, you’re not just reacting to the market—you’re ahead of it, ready to seize opportunities in a year of uncertainty.

By joining Alpha Picks, you’re stepping into a community of savvy investors armed with the strategies, data, and support to excel in 2025 and beyond. Don’t let market noise hold you back—take control of your financial future today.

Best Financial & Stock Advisor Websites

Here are the best financial advisor websites and best stock advisor websites we’ve reviewed in 2025.

| Best Advisor Websites | Focus Area |

|---|---|

| 📈 Motley Fool Stock Advisor | Long-term growth |

| 🎯 Alpha Picks by Seeking Alpha | Market insights |

| 📊 Seeking Alpha Premium | Data analysis |

| 📉 Zacks Premium | Stock research |

| 💡 Trade Ideas | Trade signals |

| 🔍 Morningstar Investor | Fundamental analysis |

| 📈 TipRanks Premium | Expert forecasts |

3. Seeking Alpha Premium

-

Best for: Value investors seeking in-depth analysis, growth investors looking for stock recommendations, and income investors wanting dividend insights.

-

Cost: $189/year (regular price $239/year)

Seeking Alpha Premium is a comprehensive investment platform that has carved out a unique niche in the market. By harnessing the power of crowd-sourced insights alongside professional analysis, Seeking Alpha Premium (see our review) provides in-depth, diverse perspectives on a wide array of stocks as of January 2025.

At the heart of Seeking Alpha Premium’s offerings is a powerful fusion of quantitative ratings, authored analysis, and Wall Street insights. This multi-pronged approach to stock evaluation sets Seeking Alpha (read the 2025 review) Premium apart, allowing users to assess investment opportunities through various lenses and develop a holistic understanding of a stock’s potential.

Beyond stock analysis, Seeking Alpha Premium offers a suite of tools and resources designed to cater to the needs of different investor types:

-

Dividend investors will appreciate the platform’s Dividend Grades and dividend-oriented stock screening capabilities, helping them construct portfolios that prioritize stable, growing income streams.

-

Value and growth investors can leverage Seeking Alpha Premium’s proprietary Quant Ratings and Factor Grades to identify stocks that align with their investment philosophy and goals.

-

Portfolio managers can utilize the platform’s portfolio analysis tools to assess their holdings, benchmark performance, and make strategic adjustments as needed.

One of the standout features of Seeking Alpha Premium is its emphasis on accessibility and user-friendliness. The platform presents complex financial data and analysis in intuitive, easy-to-digest formats, empowering users to quickly grasp key insights and take action.

Whether you’re a novice investor just starting to navigate the world of stocks or a seasoned pro looking to refine your strategies, Seeking Alpha Premium’s extensive educational resources and vibrant contributor community provide a wealth of knowledge and support to help you grow as an investor.

For those seeking to elevate their investment game in 2025, Seeking Alpha Premium is an invaluable resource. With its commitment to delivering high-quality, actionable insights and its track record of empowering investors, Seeking Alpha Premium is well-positioned to be your trusted partner on your journey to building a resilient, prosperous investment portfolio.

4. Zacks Premium

-

Best for: Value investors seeking reliable stock rankings, growth investors looking for top picks, and income investors focused on dividend-paying stocks.

-

Cost: $249 per year

Zacks Premium stands as a cornerstone in the investment research industry. Founded in 1978, Zacks Investment Research has evolved to become a trusted name for data-driven stock analysis.

The service’s core offerings revolve around the Zacks Rank system, a proprietary stock-rating model. This system analyzes earnings estimate revisions to identify stocks with the highest potential for outperformance. The #1 Rank List, representing the top 5% of stocks, has historically doubled the S&P 500’s returns.

What sets Zacks Premium (read our review) apart is its focus on earnings estimate revisions as a key indicator of future stock performance. This approach provides investors with a unique edge in predicting market movements.

Zacks Premium offers a suite of powerful tools:

- Style Scores (Value, Growth, Momentum)

- Focus List Portfolio

- Industry Rank

- Earnings ESP Filter

- Premium Screener

The Style Scores help investors align their strategies with specific investment styles. The VGM Score combines these metrics, offering a comprehensive view of a stock’s potential.

Zacks’ Focus List Portfolio curates 50 stocks for long-term growth potential. This list has consistently outperformed the market since its inception.

The Industry Rank tool aggregates individual stock ranks to identify top-performing sectors. This allows investors to capitalize on broader market trends and sector rotations.

For those seeking an edge during earnings season, the Earnings ESP Filter predicts earnings surprises with remarkable accuracy. A ten-year study supports its effectiveness in identifying stocks likely to beat earnings expectations.

Zacks Premium also provides in-depth Equity Research Reports on over 1,000 widely-followed companies. These reports offer valuable insights into growth drivers, industry placement, and valuation metrics.

The Premium Screener allows investors to discover stocks matching specific criteria. This customizable tool caters to various investment strategies, from value to growth to income-focused approaches.

Zacks Premium empowers investors with data-driven insights and powerful analytical tools. Whether you’re a seasoned investor or just starting out, these resources can help enhance your investment strategy and potentially improve your portfolio performance.

5. Trade Ideas

-

Best for: Active traders seeking real-time data, swing traders looking for actionable picks, and day traders who need advanced scanning tools.

-

Cost: $999/year for the Standard Plan (55% OFF $1999/year)

Trade Ideas is a cutting-edge stock market analysis platform that harnesses the power of artificial intelligence to provide individual traders with institutional-grade tools and insights. Founded in 2003, the company has established itself as a leader in the fintech space, revolutionizing the way traders approach the markets.

At the core of Trade Ideas (read our review)’ offerings is its advanced AI technology, which continuously scans the markets, analyzes vast amounts of data, and generates actionable trade ideas in real-time. This powerful AI engine, named Holly, has been trained on decades of market data and adapts to changing market conditions, ensuring that users always have access to the most relevant and timely insights.

What sets Trade Ideas apart from other stock analysis platforms is its comprehensive suite of tools and resources designed to cater to the needs of traders at all levels. From customizable scanning algorithms and real-time alerts to backtesting capabilities and risk management features, Trade Ideas provides users with everything they need to make informed trading decisions and execute their strategies with precision.

In addition to its core AI-powered tools, Trade Ideas offers a range of value-added resources, including:

-

Educational materials and webinars to help users enhance their trading knowledge and skills

-

A vibrant Trading Room Community where users can interact with and learn from experienced traders

-

Seamless integration with popular brokerage platforms for efficient trade execution

-

Customizable dashboards and workspaces to suit individual trading styles and preferences

By leveraging Trade Ideas’ powerful tools and insights, traders can gain a significant edge in the markets, identifying opportunities and managing risk more effectively. Whether you’re a seasoned professional or just starting your trading journey, Trade Ideas can help you navigate the complexities of the markets with greater confidence and clarity.

Trade Ideas offers two main subscription plans to cater to different user needs and budgets:

-

The Standard Plan, priced at $84/month (billed annually at $999), provides access to the platform’s core features and tools, making it an excellent choice for traders looking to enhance their market analysis capabilities without breaking the bank.

-

For traders who demand the ultimate in performance and functionality, the Premium Plan offers an expanded set of features and resources, including advanced backtesting capabilities, additional data feeds, and priority support. While the Premium Plan comes at a higher cost, it delivers unparalleled value for serious traders seeking to maximize their edge in the markets.

In today’s fast-paced and ever-changing market environment, having access to the right tools and insights can make all the difference in your trading success. Trade Ideas’ innovative AI technology, combined with its user-friendly interface and comprehensive resources, makes it an invaluable asset for traders of all skill levels. By harnessing the power of Trade Ideas, you can take your trading to the next level and unlock your full potential in the markets.

6. Morningstar Investor

- Best for: Long-term planners needing detailed analysis, value investors craving in-depth research, and retirement savers seeking trusted guidance.

- Cost: $199/year (55% OFF $249/year)

Founded in 1984, Morningstar is a cornerstone of independent investment research. With Morningstar Investor, you gain access to a treasure trove of data, tools, and expert insights designed to help you make smarter decisions and build a resilient portfolio. In today’s complex market—marked by trade policy uncertainties and interest rate shifts as of May 17, 2025—this service equips you to navigate challenges with confidence.

What makes Morningstar Investor (read our review) stand out is its dedication to unbiased, thorough research. Backed by over 150 specialized analysts, it delivers detailed coverage across sectors, ensuring you have the expert perspective needed to refine your investment strategy. Whether you’re dodging inflation pressures or eyeing small-cap opportunities, this service offers clarity amidst 2025’s volatility.

Morningstar Investor’s core features include:

- Comprehensive Ratings System: A transparent methodology that evaluates securities, fund managers, and ESG factors, helping you align investments with your values and goals.

- Investment Screening Tools: Powerful, data-driven filters and curated lists to pinpoint opportunities that match your risk tolerance and objectives.

- Portfolio X-Ray: A deep dive into your portfolio’s makeup, exposing hidden risks, overlaps, and concentrations so you can adjust before market swings hit.

Beyond these essentials, Morningstar (see our review) Investor empowers you with advanced resources tailored to your needs:

- Account Aggregation: Simplify tracking by consolidating all your investment data into one clear, strategic view—perfect for busy professionals managing multiple accounts.

- Personalized Insights: Get actionable analysis on your specific holdings, making every recommendation relevant to your unique financial picture.

Imagine a retirement saver uncovering a low-risk fund that’s outperformed its peers by 10% over the past year, thanks to Morningstar’s screening tools. Or a long-term planner using Portfolio X-Ray to spot a risky sector concentration just as geopolitical tensions flare in 2025. These tools don’t just inform—they protect and grow your wealth.

Morningstar Investor’s pricing is structured for value, with the annual subscription at $199/year (a 55% discount off the regular $249/year) saving you more than monthly plans. Plus, a 7-day free trial lets you test the platform without commitment. In a market where inflation risks and AI-driven tech volatility dominate headlines, having this level of research at your fingertips is a game-changer.

Whether you’re managing risk, scouting new opportunities, or building financial know-how, Morningstar Investor is your partner. Its user-focused design and relentless commitment to independent analysis make it indispensable for self-directed investors ready to own their financial future. Don’t let 2025’s uncertainties hold you back—take control now.

For those worried about missing out on market shifts or struggling to balance risk, Morningstar Investor offers the depth you need to stay ahead. From personalized insights to robust screening, it’s built to help beginners simplify choices and seasoned investors fine-tune strategies.

Ready to elevate your investing game? With Morningstar Investor, you’re not just reacting to markets—you’re mastering them. Join thousands of savvy investors who trust this platform to guide their decisions.

7. TipRanks Premium

-

Best for: Active traders, fundamental analysts, and data-driven investors seeking comprehensive market insights.

-

Cost: $30/month, billed annually

TipRanks Premium aggregates analyst ratings, insider transactions, and blogger opinions to provide a comprehensive stock analysis platform. It compiles and simplifies complex market data and opinions into actionable insights, catering to both novice and experienced investors.

The service offers a user-friendly interface, ensuring ease of navigation for all skill levels. It provides a wide array of analytical tools, including:

-

Advanced filters for customized searches

-

Risk assessments to gauge investment suitability

-

Insider trading insights for informed decision-making

TipRanks employs an expert aggregation algorithm that curates opinions from a diverse analyst community, providing a democratically sourced perspective on stock forecasts. This approach reduces biases and offers a well-rounded investment outlook.

The platform offers several key features:

-

Data export options in PDF and CSV formats cater to users who prefer offline analysis using various external tools and software.

-

Tiered support structure recognizes the different needs of users, from casual inquiries to urgent professional demands.

-

High-level encryption and compliance with PCI DSS standards ensure the security of sensitive financial data and payment transactions.

TipRanks offers a money-back guarantee, demonstrating its commitment to customer satisfaction and nullifying risk for new users. This policy solidifies brand reliability and underscores confidence in the platform’s effectiveness.

By providing a sophisticated yet intuitive ecosystem, TipRanks democratizes access to high-end investment research tools. It empowers users to make informed decisions by merging cutting-edge technology with human insight.

Whether you’re managing a personal portfolio or navigating complex institutional investing workflows, TipRanks offers the tools and insights needed to elevate your investment strategies. Experience the power of data-driven decision-making with TipRanks Premium (see our review).

What is a Financial Advisor Website?

A financial advisor website is an online platform designed to provide you with expert guidance and recommendations for making informed investment decisions. These websites are created by experienced financial professionals who have a deep understanding of the stock market and investing strategies. By using a financial advisor website, you can access a wealth of knowledge and resources to help you navigate the complex world of investing with confidence.

Financial advisor websites offer a range of services, from providing stock picks and analysis to offering educational resources and tools. These websites aim to empower you to take control of your financial future by providing you with the information and support you need to make smart investment choices. Whether you’re a beginner or an experienced investor, a financial advisor website can be an invaluable resource for growing your wealth over time.

One of the key benefits of using a financial advisor website is that you can access professional advice and guidance without having to pay the high fees typically associated with hiring a personal financial advisor. By leveraging the expertise of these websites, you can make informed decisions about where to invest your money and how to build a diversified portfolio that aligns with your financial goals and risk tolerance.

What is the Best Financial Advisor Website?

The best financial advisor website is one that provides you with accurate, timely, and actionable advice to help you achieve your investment goals. It should have a proven track record of delivering market-beating returns and a transparent methodology for selecting stocks. The best financial advisor website will also offer a range of educational resources and tools to help you understand the rationale behind their recommendations and develop your own investing skills.

When evaluating financial advisor websites, it’s important to look for one that aligns with your individual needs and preferences. Some websites may focus on a particular investing style or strategy, such as growth investing or value investing, while others may offer a more diversified approach. The best financial advisor website for you will depend on factors such as your risk tolerance, investment timeline, and financial goals.

Ultimately, the best financial advisor website is one that you can trust to provide you with the guidance and support you need to make informed investment decisions. It should have a strong reputation in the industry, a commitment to transparency and integrity, and a track record of helping investors like you achieve their financial aspirations. By choosing the best financial advisor website for your needs, you can take a significant step towards building the wealth and financial security you desire.

How We Evaluated the Best Financial Advisor Websites?

To determine the best financial advisor websites, we conducted a rigorous evaluation process that considered a range of key factors. Our goal was to identify the websites that offer the most value to investors like you, based on criteria such as:

-

Track record of performance: We looked for websites with a proven history of delivering market-beating returns over the long term.

-

Quality of stock recommendations: We evaluated the accuracy and timeliness of each website’s stock picks, as well as the depth of research and analysis behind them.

-

Transparency and accountability: We prioritized websites that are transparent about their methodology and have a clear track record of accountability for their recommendations.

-

Educational resources and tools: We looked for websites that offer valuable educational content and tools to help investors understand the markets and make informed decisions.

-

User experience and accessibility: We considered factors such as ease of use, site navigation, and mobile compatibility to ensure that the best financial advisor websites are accessible and user-friendly.

In addition to these factors, we also considered the unique needs and preferences of different types of investors. We recognized that what makes the best financial advisor website for one person may not be the same for another, depending on their individual goals, risk tolerance, and investing style.

By taking a comprehensive and nuanced approach to evaluating the best financial advisor websites, we aim to provide you with a clear and reliable guide to choosing the right resource for your needs. Whether you’re just starting out on your investing journey or looking to take your portfolio to the next level, our recommendations can help you find the best financial advisor website to support you along the way.

🧠 Thinking Deeper

- ☑️ Always seek a margin of safety in your investments. Buy at a discount to intrinsic value when possible.

- ☑️ Develop a clear investment strategy. It will help you stay consistent through market turbulence.

- ☑️ Be emotionally and financially prepared for losses. They're an inevitable part of the investing journey.

- ☑️ Don't expect constant excitement from your portfolio. Sustainable growth is often slow and steady.

📚 Wealthy Wisdom

- ✨ Buy not on optimism, but on arithmetic. - Benjamin Graham

- ✔️ I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful. - Warren Buffett

- 🌟 Successful investing is about managing risk, not avoiding it. - Benjamin Graham

- 🚀 In investing, what is comfortable is rarely profitable. - Robert Arnott

📘 Table of Contents

- • Motley Fool Stock Advisor

- • Alpha Picks by Seeking Alpha

- • Methodology and Approach

- • Key Features and Benefits

- • Performance in 2025

- • Tools and Resources

- • The Team Behind Alpha Picks

- • Why Alpha Picks in 2025?

- • Best Financial & Stock Advisor Websites

- • Seeking Alpha Premium

- • Zacks Premium

- • Trade Ideas

- • Morningstar Investor

- • TipRanks Premium

- • What is a Financial Advisor Website?

- • What is the Best Financial Advisor Website?

- • How We Evaluated the Best Financial Advisor Websites?