7 Best Stock Recommendation Service Subscriptions in 2024

Navigate the stock market confidently with these top 7 stock recommendation services, designed to help you achieve your financial goals. Explore more on best stock advisor websites and investment subscriptions.

We aim for insightful coverage of products and services, including some from compensating partners, which may influence our topics and presentation. Our opinions and conclusions remain unbiased. See our Advertiser Disclosure.

Are you tired of second-guessing your stock picks and watching potential profits slip away?

Your path to confident investing doesn’t have to be a solitary journey.

Let’s explore seven stock recommendation services that can illuminate your investment decisions and help you build a portfolio aligned with your financial goals.

Best Stock Recommendation Services

Here are the best stock advisor and best stock recommendation services we’ve reviewed in 2024.

| Best Stock Advisor Picks | Best For |

|---|---|

| 📈 Motley Fool Stock Advisor | Long-term growth |

| 🎯 Alpha Picks by Seeking Alpha | Analyst-Powered |

| 🚀 Trade Ideas | Active Traders |

| 🔍 Seeking Alpha Premium | Detailed Analysis |

| 📊 Zacks Premium | Equity Research |

| 📉 TipRanks Premium | Predictive Analytics |

| 📚 Morningstar Investor | Fundamentals |

1. Motley Fool Stock Advisor

-

Best for: Growth investors seeking market-beating returns, busy professionals wanting expert stock picks, and beginners looking for a proven investing strategy.

-

Cost: $99/year for new members (50% OFF $199/year)

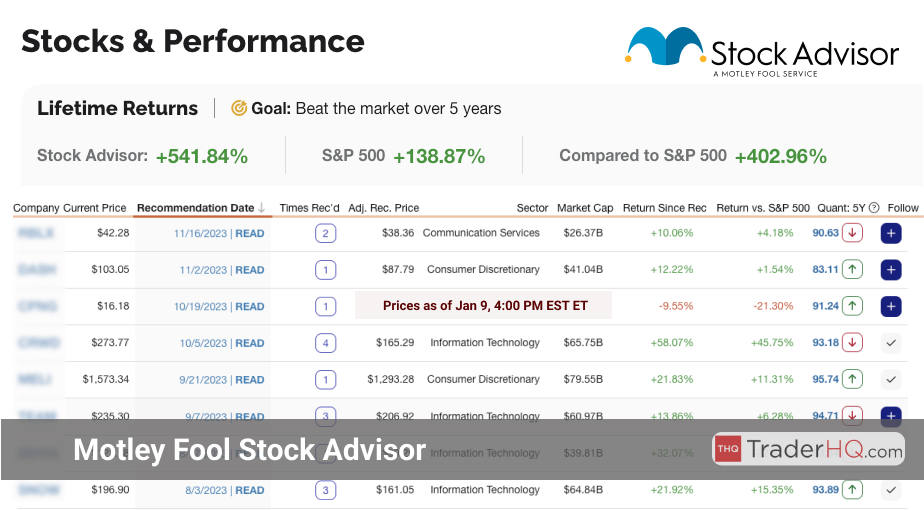

Motley Fool Stock Advisor, established in 2002 by David and Tom Gardner, has cemented its reputation as a leading investment guidance service. It consistently delivers market-beating returns, thanks to its rigorous research and disciplined approach to stock picking. The service offers:

-

Monthly Stock Recommendations: Two new, deeply researched stock picks each month, accompanied by detailed reports.

-

Foundational Stocks: A curated list of 10 core stock recommendations with long-term growth potential, regularly updated.

-

Rankings: Monthly rankings of the top 10 investment opportunities from Stock Advisor’s recommendations.

-

Comprehensive Performance Tracking: Detailed tracking of each recommendation’s performance against the S&P 500.

-

Educational Resources and Community: Access to articles, videos, Q&A sessions, and a vibrant member community.

Notable stock picks include NVDA with a return of 74,099% since 2005, NFLX with 34,579% since 2004, and AMZN with 23,904% since 2002. These illustrate the power of Motley Fool’s methodology.

Asymmetrical risk is a core principle, focusing on stocks with high upside potential and limited downside. Compounding returns emphasize the benefits of reinvesting earnings over time. Peter Lynch famously noted, “You only need to be right six times out of ten.” Warren Buffett’s philosophy that the stock market rewards the patient reinforces this approach.

The fundamental principles of long-term investing are crucial. Motley Fool’s analysts prioritize high-quality companies with strong fundamentals, ensuring each recommendation meets stringent criteria for quality, growth, and value.

The service helps investors overcome psychological challenges by providing:

-

Clear, Research-Backed Rationales: Detailed analyses for each recommendation.

-

Focus on Long-Term Fundamentals: Emphasis on business health over short-term price movements.

-

Personalized Guidance: Support tailored to your unique goals and values.

Motley Fool Stock Advisor (in-depth review) has significantly outperformed the market, with an average return of 737% compared to the S&P 500’s 162%. This has led to the service outperforming the S&P 500 by 4.5x times.

For instance, TSLA recommended in 2012 has yielded a return of 11,641%. DIS since 2002 has grown by 5,299%, underscoring the service’s capacity to identify high-potential stocks early.

Understanding the concepts of asymmetrical risk, compounding returns, and long-term investing through Stock Advisor can transform your investment strategy. With its robust track record and comprehensive resources, Motley Fool Stock Advisor is positioned to help you achieve your financial goals.

2. Alpha Picks by Seeking Alpha

-

Best for: Growth seekers, value hunters, and strategic planners who want curated stock picks to enhance their portfolios.

-

Cost: $449/year for new members (10% OFF $499/year)

Seeking Alpha Premium offers a unique “quantamental” approach to stock picking, combining the precision of quantitative analysis with the depth of fundamental research. Their team of experienced analysts leverages proprietary data and sophisticated algorithms to identify the most promising investment opportunities.

Subscribers gain access to a meticulously curated portfolio of stocks, each selected for its strong potential to outperform the market. The service provides detailed analysis for each recommendation, empowering users to understand the rationale behind every pick.

Beyond the stock picks, Seeking Alpha Premium (see our review) delivers a wealth of resources to enhance subscribers’ investing acumen, including:

-

Exclusive webinars led by the quantitative team, offering deep dives into their methodology and decision-making process

-

Comprehensive research reports on each recommended stock, equipping subscribers with the knowledge to invest with confidence

-

A vibrant community of investors, where users can engage in meaningful discussions and benefit from diverse perspectives

The service’s commitment to transparency is evident in its rigorous performance tracking. Utilizing time-weighted returns, consistent with the Global Investment Performance Standards (GIPS), Seeking Alpha Premium presents an authentic picture of its effectiveness.

For those ready to elevate their investing game, Seeking Alpha Premium is an indispensable ally. Its fusion of cutting-edge quantitative techniques and fundamental wisdom sets it apart in the world of investment advisory services.

Seize this opportunity to align yourself with a proven, trusted partner in your investing journey. Subscribe to Seeking Alpha Premium today and unlock a new level of confidence and control in your pursuit of financial success.

3. Trade Ideas

-

Best for: Active traders seeking advanced tools, swing traders looking for curated picks, and algorithmic traders wanting automated strategies.

-

Cost: $99/year for new members (50% OFF $199/year)

Trade Ideas is a powerful stock market analysis platform that has been empowering self-directed traders and investors since 2003. With its sophisticated AI-powered technology and comprehensive suite of tools, Trade Ideas (read our review) stands out in the market as a leading solution for traders seeking to capitalize on opportunities and maximize their returns.

At the core of Trade Ideas’ offerings is its real-time market data and advanced analytics. The platform employs cutting-edge algorithms to scan the market and identify the most promising trade setups, allowing users to stay ahead of the curve and make informed decisions with confidence.

What sets Trade Ideas apart is its commitment to innovation and its user-centric approach. The platform continuously evolves to meet the changing needs of traders, incorporating new features and enhancements based on user feedback and market trends.

In addition to its robust stock scanning capabilities, Trade Ideas offers a wealth of tools and resources designed to support traders at every level:

-

Customizable alerts notify users of potential trade opportunities in real-time

-

Backtesting functionality allows traders to test and refine their strategies

-

Educational resources, including webinars and tutorials, help users sharpen their skills

Trade Ideas understands that success in the markets requires not only powerful tools, but also ongoing support and community. The platform fosters a vibrant user community where traders can connect, share insights, and learn from one another.

Whether you’re a seasoned trader looking to refine your edge or a beginner seeking to build a solid foundation, Trade Ideas offers the tools, insights, and support you need to navigate the markets with confidence. With its proven track record and unwavering commitment to empowering traders, Trade Ideas is a platform you can trust to help you achieve your financial goals.

4. Seeking Alpha Premium

-

Best for: Experienced traders seeking deep analysis, value investors looking for underpriced stocks, and growth investors focusing on long-term potential.

-

Cost: $189/year (Regular price $239/year)

Seeking Alpha Premium has been a trusted name in the investment community for over a decade. With a unique blend of expert analysis, advanced screening tools, and robust data, it has carved out a distinctive niche in the market.

At its core, Seeking Alpha Premium is designed to empower investors to make better-informed decisions. It does this by providing a comprehensive suite of tools and insights that cater to a wide range of investing styles and goals. The platform’s depth and diversity of investment analysis is a standout feature.

Users can access stock ratings and analysis from three distinct perspectives:

-

Quant Ratings: Advanced algorithms evaluate stocks based on quantitative metrics

-

Seeking Alpha Authors: Qualitative analysis based on expertise and market experience

-

Wall Street Ratings: Aggregated opinions of professional analysts from leading financial institutions

This multi-faceted approach ensures that investors get a well-rounded view of each stock’s potential, helping them to make more nuanced decisions. In addition to stock ratings, Seeking Alpha Premium offers a wealth of tools for researching and analyzing potential investments.

The platform’s screening tools allow users to quickly filter stocks based on specific criteria, while the comparative analysis features enable side-by-side evaluations of different investment options. For dividend investors, Seeking Alpha Premium is a particularly valuable resource, offering detailed dividend insights, including ratings based on dividend safety, growth, and yield.

Seeking Alpha Premium also excels in terms of the accessibility and usability of its research. All the key data and insights for a given stock are consolidated into a single, easy-to-navigate stock symbol page. Moreover, the platform offers a customizable news feed that keeps users up-to-date on the latest developments affecting their portfolio and watchlist.

All of these features are underpinned by Seeking Alpha Premium’s extensive database, which includes over ten years of historical financial data. This allows investors to analyze long-term trends and assess a company’s performance over time. Beyond individual stock research, the platform offers portfolio analysis tools to assess the overall health and balance of your portfolio based on factors like growth, value, and dividend yield.

As a subscriber, you’ll benefit from real-time alerts on important news and analysis, unlimited access to premium content, and an ad-lite browsing experience. This ensures that you can focus on what really matters - finding the best investment opportunities and managing your portfolio effectively.

Whether you’re a new investor looking to learn the ropes or a seasoned pro seeking to refine your strategies, Seeking Alpha Premium has something to offer. With its extensive features, data-driven insights, and user-friendly interface, it’s a powerful ally in your investment journey.

In a market full of noise and uncertainty, Seeking Alpha Premium is a beacon of clarity. It arms you with the tools, knowledge, and confidence to navigate the complexities of investing and work towards your financial goals. If you’re serious about success in the stock market, Seeking Alpha Premium is an investment that can pay dividends for years to come.

5. Zacks Premium

-

Best for: Experienced investors seeking in-depth research, long-term investors wanting consistent stock picks, value investors looking for fundamental analysis.

-

Cost: $249/year with a 100% Satisfaction Guarantee

Zacks Premium offers a data-driven approach to stock picking, leveraging the power of earnings estimate revisions to identify the most promising investment opportunities. With a proven track record of outperforming the market, Zacks has established itself as a trusted name in the world of stock recommendations.

At the heart of the service is the Zacks Rank system, which uses a proprietary algorithm to rate stocks based on earnings estimate revisions and surprise history. This system has consistently identified the top 5% of stocks most likely to outperform, giving subscribers a significant edge in the market.

But Zacks Premium (in-depth review) goes beyond just providing a list of top-rated stocks. The service offers a comprehensive suite of tools and resources designed to empower investors to make informed decisions and take control of their financial future.

One of the standout features is the Focus List portfolio, a curated selection of 50 stocks chosen for their strong potential to deliver long-term growth. These picks are backed by in-depth research reports and analysis from Zacks’ team of expert analysts, giving subscribers a deep understanding of the rationale behind each recommendation.

Zacks Premium also offers a range of powerful screening tools, allowing investors to filter stocks based on their preferred investment style, whether it’s value, growth, or momentum. The Style Scores and VGM Score make it easy to align stock picks with individual investing preferences, while the Industry Rank helps identify the sectors most likely to outperform.

For those looking to capitalize on earnings surprises, the Earnings ESP Filter is an invaluable tool. By screening for stocks most likely to beat or miss earnings estimates, investors can strategically enter or exit positions to maximize their returns.

-

Zacks Rank: Harnesses the power of earnings estimate revisions to identify the top 5% of stocks most likely to outperform.

-

Focus List: A portfolio of 50 top-rated stocks selected for their strong potential to deliver long-term growth.

-

Style Scores: Aligns stock picks with individual investing preferences, whether it’s value, growth, or momentum.

-

Industry Rank: Identifies the sectors most likely to outperform, helping investors stay ahead of market trends.

-

Earnings ESP Filter: Screens for stocks most likely to beat or miss earnings estimates, allowing for strategic trading decisions.

With Zacks Premium, investors gain access to an unparalleled wealth of expert analysis and actionable insights. The service’s equity research reports provide an in-depth look at over 1,000 widely followed companies, offering a level of detail and transparency that sets Zacks apart from other stock picking services.

Whether you’re a seasoned investor or just starting to build your portfolio, Zacks Premium offers the tools, resources, and expertise you need to navigate the market with confidence. With a 30-day free trial and a money-back guarantee, there’s no risk in exploring how Zacks can help you achieve your financial goals.

If you’re ready to take control of your investing future and tap into the wealth-building potential of the stock market, Zacks Premium is the partner you’ve been searching for. Don’t let uncertainty hold you back - unlock the power of data-driven stock picking and start building the portfolio of your dreams today.

6. TipRanks Premium

-

Best for: Active traders seeking stock insights, data-driven investors valuing analyst ratings, and growth-focused individuals aiming for comprehensive research.

-

Cost: $360/year for new members (33% OFF $600/year)

TipRanks Premium is a comprehensive stock recommendation service that harnesses the power of data and analytics to deliver actionable insights to investors. With a rich history of empowering investors through technology, TipRanks has carved a unique niche in the market by aggregating expert opinions and providing a consolidated outlook to help users make informed decisions.

What sets TipRanks apart is its advanced algorithms that curate expert insights from top analysts, financial bloggers, and corporate insiders. By democratizing access to institutional-grade research tools, TipRanks levels the playing field for investors, enabling them to invest with confidence and clarity.

The service offers an array of powerful features and resources, including:

-

Expert consensus ratings and price targets for thousands of stocks

-

Detailed analyst track records and ranking systems

-

Insider trading alerts and sentiment analysis

-

Advanced stock screeners and portfolio monitoring tools

-

Daily stock ideas and market news updates

These tools are designed to cater to the diverse needs of investors, from novice traders to seasoned professionals. Whether you’re looking to validate your investment thesis, discover new opportunities, or stay attuned to market-moving insights, TipRanks has you covered.

What’s more, TipRanks is committed to transparency and accountability. Each recommendation comes with a detailed analysis and justification, empowering you to understand the rationale behind the ratings.

Plus, with a money-back guarantee, you can explore the service with confidence, knowing your satisfaction is prioritized.

For investors seeking a reliable partner to navigate the complexities of the stock market, TipRanks Premium (see our review) is a compelling choice. Its data-driven approach, coupled with a user-friendly interface and mobile accessibility, makes it a valuable resource for investors of all stripes.

While no investment service can guarantee success, TipRanks provides the tools, insights, and expertise to help you make smarter, more informed decisions. If you’re ready to take control of your financial future and invest with greater conviction, TipRanks Premium could be the ally you’ve been seeking.

7. Morningstar Investor

-

Best for: Long-term planners, data-focused analysts, and portfolio managers seeking comprehensive research and analysis.

-

Cost: $199/year for new members (20% OFF $249/year)

For over 35 years, Morningstar Investor has been a trusted name in the investment research industry, known for their independent and unbiased analysis. Their objective approach sets them apart in a market often swayed by external influences.

Morningstar Investor (read our review) empowers self-directed investors with a comprehensive suite of tools and resources, including:

-

In-depth research reports on stocks, funds, and ETFs from a team of 150+ specialized analysts

-

Robust rating systems that evaluate investments based on performance, risk, and costs

-

Powerful screening tools to identify opportunities aligned with investors’ goals and preferences

-

Portfolio X-Ray feature for deep analysis of holdings, uncovering strengths, weaknesses, and potential improvements

Beyond data and analysis, Morningstar Investor offers personalized tools to streamline portfolio management. Account aggregation allows subscribers to monitor all investments in one place, while personalized insights and alerts keep them informed about their most important holdings.

Morningstar Investor is an essential partner for investors aiming to take control of their financial future. The platform’s independent research, robust tools, and personalized features provide the clarity and confidence needed to navigate the markets successfully.

Whether you’re a novice or a seasoned investor, Morningstar Investor helps you cut through the noise, avoid costly mistakes, and stay on track towards your financial goals. Subscribe today and start building a stronger portfolio backed by Morningstar’s expertise.

What is a Stock Recommendation Service?

A stock recommendation service provides guidance to investors on which stocks to buy, hold, or sell. These services are designed to help you navigate the complexities of the stock market and make informed investment decisions. By leveraging the expertise of experienced analysts, a stock recommendation service can be a valuable tool for growing your wealth.

While no service can guarantee success, the best stock recommendation services employ rigorous research and analysis to identify high-potential investment opportunities. They consider a wide range of factors, including market trends, company financials, competitive landscape, and more. The goal is to provide you with a curated list of stock picks that align with your investment goals and risk tolerance.

In addition to specific stock recommendations, many services also offer educational resources and ongoing support. This can include detailed reports on each recommended stock, regular portfolio updates, and access to a community of like-minded investors. By providing this holistic approach, a stock recommendation service can empower you to become a more knowledgeable and confident investor.

What is the Best Stock Recommendation Service?

The best stock recommendation service is one that aligns with your unique investment needs and goals. While there are many services to choose from, the top providers share some key qualities. First and foremost, they have a proven track record of delivering market-beating returns over the long term.

The best services are transparent about their methodology and provide clear, actionable recommendations that are easy to follow. They offer a mix of growth and value stock picks across various sectors to help you build a diversified portfolio. Additionally, the best stock recommendation services are committed to ongoing education and support, with resources to help you continually refine your investing skills.

When evaluating stock recommendation services, look for ones with experienced analysts, a strong reputation, and a history of outperforming benchmark indexes. The best services will also have a clear risk management strategy and be upfront about both the potential rewards and risks of each stock pick. Ultimately, the right service for you will instill a sense of confidence and control over your investing journey.

How We Evaluated the Best Stock Recommendation Services?

To identify the best stock recommendation services, we conducted a comprehensive evaluation process. Our analysis considered a wide range of factors, including:

-

Performance: We assessed each service’s track record of returns, looking for consistent market outperformance over various time periods.

-

Quality of Research: The best services employ rigorous analytical methods to identify high-potential stocks. We evaluated the depth and breadth of their research process.

-

Clarity of Recommendations: We favored services that provide clear, specific, and actionable stock picks that investors can easily implement.

-

Educational Resources: The top services offer robust educational materials to help investors expand their knowledge and skills.

In addition to these core factors, we also considered aspects like user experience, customer support, and overall value for the price. We gathered data from both the service providers themselves and aggregated user reviews to develop a comprehensive picture of each offering.

Through this extensive evaluation process, we aimed to identify the stock recommendation services that offer the most trustworthy, impactful, and user-friendly guidance for investors. While no service is perfect, we believe the top performers on our list represent the best options available for individuals seeking expert support in their investing journey.

Upfront Bottom Line — Best Stock Advisor Services

✅ Top Picks: Motley Fool Stock Advisor and Alpha Picks by Seeking Alpha (in-depth review)

Whether you’re a novice investor or a seasoned pro, finding a reliable stock recommendation service can make all the difference. Here are some of the top services that can help you navigate the complexities of the stock market and achieve your financial goals.

Our Bottom Line Summary:

1. 🥇 Motley Fool Stock Advisor

Motley Fool Stock Advisor is ideal for novice investors, time-strapped professionals, and cautious skeptics. The service offers two new stock picks each month, detailed performance tracking, and a wealth of educational resources, all backed by a proven track record of market-beating returns. Price: $99/year for new members (50% OFF $199/year)

Try it Now Read More ↓

2. 🥈 Alpha Picks by Seeking Alpha (in-depth review)

Alpha Picks by Seeking Alpha is perfect for growth seekers and value hunters. With a unique “quantamental” approach, it combines quantitative analysis with deep fundamental research to offer a curated portfolio of high-potential stocks. Price: $449/year for new members (10% OFF $499/year)

Try it Now Read More ↓

3. Trade Ideas

Trade Ideas stands out for active traders with its AI-powered technology and real-time market data. It offers customizable alerts, backtesting capabilities, and a supportive community, making it a comprehensive tool for maximizing trading returns. Price: $99/year for new members (50% OFF $199/year)

Try it Now Read More ↓

4. Seeking Alpha Premium

Seeking Alpha Premium offers a blend of expert analysis, advanced screening tools, and comprehensive data to empower investors. It provides stock ratings from multiple perspectives, detailed dividend insights, and portfolio analysis tools. Price: $189/year (Regular price $239/year)

Try it Now Read More ↓

5. Zacks Premium

Zacks Premium leverages earnings estimate revisions to identify promising stocks. With a focus on long-term growth, Zacks provides a curated portfolio, powerful screening tools, and in-depth research reports. Price: $249/year with a 100% Satisfaction Guarantee

Try it Now Read More ↓

6. TipRanks Premium

TipRanks Premium aggregates expert insights and provides advanced analytics to help investors make informed decisions. It offers consensus ratings, detailed analyst track records, and insider trading alerts. Price: $360/year for new members (33% OFF $600/year)

Try it Now Read More ↓

7. Morningstar Investor

Morningstar Investor offers independent and unbiased analysis, comprehensive research reports, and powerful screening tools. The service is ideal for long-term planners and data-focused analysts. Price: $199/year for new members (20% OFF $249/year)

Try it Now Read More ↓

🧠 Thinking Deeper

- ☑️ Consider passive investing strategies if active management doesn't suit your style or time constraints.

- ☑️ Recognize that the stock market transfers wealth from the impatient to the patient.

- ☑️ Prepare yourself for the inevitability of economic cycles. They create both challenges and opportunities.

- ☑️ Judge your investing success by your progress toward personal financial goals, not by beating benchmarks.

📚 Wealthy Wisdom

- ✨ The individual investor should act consistently as an investor and not as a speculator. - Benjamin Graham

- ✔️ The stock market is filled with individuals who know the price of everything, but the value of nothing. - Philip Fisher

- 🌟 Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it. - Peter Lynch

- 🚀 In investing, what is comfortable is rarely profitable. - Robert Arnott

📘 Table of Contents

- • Best Stock Recommendation Services

- • Motley Fool Stock Advisor

- • Alpha Picks by Seeking Alpha

- • Trade Ideas

- • Seeking Alpha Premium

- • Zacks Premium

- • TipRanks Premium

- • Morningstar Investor

- • What is a Stock Recommendation Service?

- • What is the Best Stock Recommendation Service?

- • How We Evaluated the Best Stock Recommendation Services?

- • Upfront Bottom Line — Best Stock Advisor Services

- • Our Bottom Line Summary: