7 Best Stock Recommendation Service Subscriptions in 2025

Discover how stock advisor can guide you to confident stock picks and grow your wealth with trusted insights.

We aim for insightful coverage of products and services, including some from compensating partners, which may influence our topics and presentation. Our opinions and conclusions remain unbiased. See our Advertiser Disclosure.

Imagine building a portfolio that doesn’t just grow, but truly secures the dreams you hold dear—whether it’s sending your kids to college or crafting a retirement you can count on, free from worry.

In today’s unpredictable market, shaped by shifting trade policies, evolving tech trends, and global uncertainties, finding the best stock picking services 2025 can be the guide you need to navigate these challenges with confidence and hope.

Picture having tools that fit your life, showing you the way to decisions that feel right for your future—find out how these seven top services can offer clarity and support for every step of your journey.

1. Motley Fool Stock Advisor

-

Best for: Long-term investors seeking market-beating returns, new stock pickers wanting expert guidance, and busy professionals needing simplified stock recommendations.

-

Cost: $99/year for new members (50% OFF $199/year)

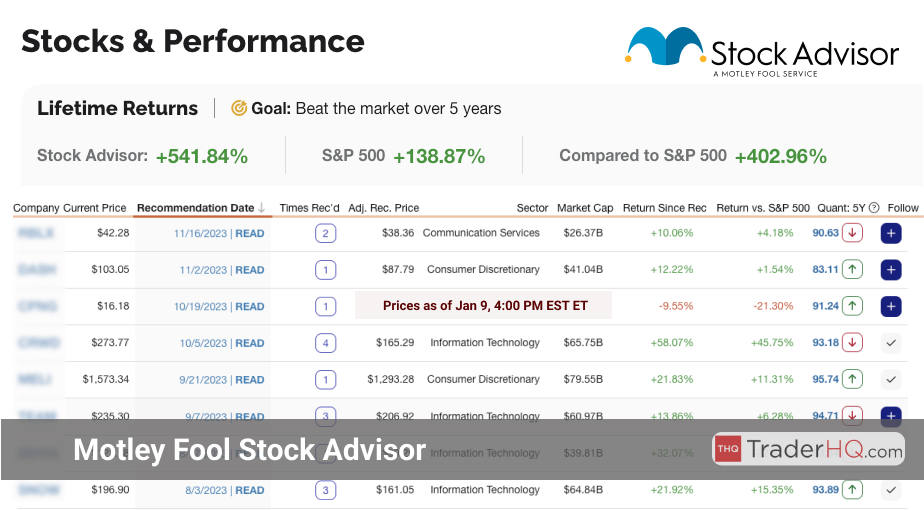

Aggregate Overall Performance:

- Total Return: +1,035.75%

- S&P 500 Return: +181.72%

- Outperformance vs. S&P 500: +854.03%

Motley Fool Stock Advisor, founded in 2002, has established itself as a premier investment guidance service. With a focus on long-term, buy-and-hold investing, Stock Advisor has helped countless investors achieve market-beating returns, especially crucial in navigating the volatile market conditions of 2025, where inflation pressures and geopolitical risks continue to influence investment decisions.

The service provides monthly stock recommendations, a curated list of foundational stocks, and comprehensive performance tracking. Stock Advisor’s investment philosophy is built on identifying high-quality companies with strong fundamentals and holding them to benefit from compounding returns. This approach is particularly relevant in today’s economic environment, as it helps investors outpace inflation and secure long-term growth.

As of August 13, 2025, the average return of a Stock Advisor (read our review) pick since inception is +1,035.75%, compared to the S&P 500’s average return of +181.72% over the same period. Stock Advisor has outperformed the S&P 500 by an impressive +854.03%. This performance underscores the effectiveness of their long-term strategy, especially amidst the current market volatility.

Stock Advisor’s track record is a testament to the power of patient, long-term investing. As legendary investor Peter Lynch once said, “In this business, if you’re good, you’re right six times out of ten.” Stock Advisor’s consistent outperformance demonstrates the effectiveness of their investment approach, even as we face new economic challenges in 2025.

Warren Buffett, another investing icon, has long advocated for the rewards of patience in the stock market. Stock Advisor embodies this philosophy, focusing on companies with strong competitive advantages, excellent management, and consistent growth. This focus is crucial in today’s market, where identifying resilient companies can help you weather economic storms.

Some of Stock Advisor’s most impressive returns include:

- NVIDIA (NVDA), recommended in December 2009, has returned a staggering +46,029%, turning a $1,000 investment into over $461,290.

- Netflix (NFLX), picked in June 2007, has delivered returns of +41,076%.

- Amazon (AMZN), recommended in September 2002, has generated a return of +30,483%, turning $1,000 into over $305,830.

Stock Advisor helps investors navigate the psychological challenges of investing by providing clear, research-backed rationales for each recommendation. By emphasizing the long-term fundamentals of businesses, the service helps you avoid emotional decision-making and stay focused on your goals, even as market sentiment swings due to policy shifts and economic uncertainty.

The Motley Fool platform offers a wealth of tools and resources, including a stock screener, performance tracking, and a comprehensive learning center. This empowers you to make informed decisions and continuously grow your investing knowledge, which is more important than ever in the dynamic market of 2025.

Whether you’re a beginner or an experienced investor, Stock Advisor provides the guidance and support needed to build a diversified, market-beating portfolio. By focusing on quality, growth, and long-term holding, Stock Advisor helps you achieve your financial goals and build lasting wealth, even as inflation and geopolitical tensions threaten your financial stability.

Key Features of Motley Fool Stock Advisor (read our review)

-

Monthly Stock Recommendations: Subscribers receive two meticulously researched stock picks each month, complete with in-depth reports and clear investment theses. These recommendations target high-quality companies with strong growth potential, crucial for outpacing inflation in 2025.

-

Curated List of Foundational Stocks: Stock Advisor provides a list of 10 core stock recommendations, representing companies with long-term growth potential. This list is regularly updated to reflect the most promising opportunities in the market, helping you stay ahead of economic shifts.

-

Monthly Rankings: Stock Advisor offers monthly rankings of the top 10 investment opportunities from its recommendations, ensuring that subscribers have access to the most current and promising ideas, especially important in the rapidly changing market landscape of 2025.

-

Detailed Performance Tracking: Transparency is key, with comprehensive performance tracking for each recommendation, comparing returns against the S&P 500. This allows subscribers to see how their investments measure up to the broader market, providing reassurance in uncertain times.

-

Extensive Educational Resources: Beyond stock picks, Stock Advisor provides a wealth of educational resources, including articles, videos, live Q&A sessions, and a member community to enhance financial knowledge and decision-making. This education is vital for navigating the complex investment environment of 2025.

Motley Fool Stock Advisor’s consistent track record of helping investors achieve superior returns underscores its credibility. By focusing on high-quality, long-term investments and providing continuous education and support, Stock Advisor empowers subscribers to build lasting wealth and achieve their financial goals, even amidst the economic challenges of 2025.

Investment Philosophy and Methodology

Long-Term, Buy-and-Hold Investing

The core principle of Motley Fool Stock Advisor’s philosophy is long-term investing. Investors are encouraged to look beyond short-term market fluctuations and concentrate on the enduring strength and potential of businesses. This strategy capitalizes on the compounding effect of returns, significantly enhancing wealth over time. In today’s market, where volatility is driven by inflation and geopolitical risks, this approach is more critical than ever.

This buy-and-hold strategy aligns with a patient and disciplined approach, helping investors avoid the pitfalls of market timing and emotional decision-making. By holding quality stocks through market cycles, investors can benefit from the growth trajectories of well-managed companies over the long haul, even as policy shifts and economic uncertainty loom.

Focus on High-Quality Companies

Stock Advisor prioritizes companies with strong fundamentals, including solid financial health, consistent earnings growth, high profit margins, and superior return on equity. The goal is to identify companies that can weather economic downturns and thrive over time, which is essential in the face of current economic pressures.

The Role of Team Everlasting

Team Everlasting, led by Tom Gardner, is central to Stock Advisor’s methodology. This team focuses on companies with strong competitive advantages, excellent management, and a track record of consistent growth. These companies often have:

-

Strong Competitive Advantages: Unique attributes such as proprietary technology, brand strength, or network effects, which are crucial for maintaining market leadership in a competitive environment.

-

Excellent Management: Leadership quality is paramount, with a focus on executives who can innovate, execute, and guide the company toward long-term success, especially important in navigating policy changes and economic shifts.

-

Consistent Growth: Reliable growth in revenues, earnings, and market share, often positioning these firms as industry leaders, which is vital for long-term wealth creation in 2025.

The Role of Team Rule Breakers

Team Rule Breakers focuses on innovative, disruptive companies with significant market potential. These companies often operate at the cutting edge of technology and industry trends, poised to redefine markets and create new ones. Key attributes include:

-

Innovation: Companies revolutionizing their industries with groundbreaking products or services, which are essential for capturing new opportunities in the evolving market of 2025.

-

Disruption: Firms challenging the status quo with the potential to disrupt established players, offering investors a chance to tap into emerging sectors.

-

Market Potential: The ability to capture significant market opportunities in emerging or rapidly evolving industries, aligning with the need to stay ahead of economic trends.

Rigorous Analysis and Strict Criteria

Every stock recommendation undergoes rigorous analysis to meet stringent criteria for quality, growth, and value. This process includes:

-

Fundamental Research: In-depth evaluation of financial statements, business models, competitive landscapes, and growth prospects to understand intrinsic value, which is critical for making informed decisions in a volatile market.

-

Management Assessment: Scrutiny of leadership track records, vision, and execution ability, recognizing great management as a key driver of long-term success, especially in times of economic uncertainty.

-

Competitive Advantage Analysis: Identification of unique strengths and competitive advantages that sustain market positions and drive growth, crucial for weathering economic downturns.

-

Growth Potential: Evaluation of revenue, market share, and profitability expansion potential, considering industry dynamics and future trends, which is essential for identifying companies that can thrive in 2025.

-

Valuation Metrics: Use of metrics such as P/E ratios, P/S ratios, and discounted cash flow analysis to determine if stocks are attractively priced relative to intrinsic value, helping investors find value in a turbulent market.

This disciplined approach aims to deliver stock recommendations with substantial growth potential while maintaining a focus on quality and value, helping investors build robust portfolios and achieve market-beating returns, even amidst the economic challenges of 2025.

Stock Picking Performance and Examples of Successful Picks

Motley Fool Stock Advisor has a formidable reputation for stock-picking prowess, consistently delivering market-beating returns. Since its inception, the average return of a Stock Advisor pick has significantly outpaced the S&P 500, showcasing its ability to identify top stock picks that can thrive in various market conditions.

Recent trends show that Stock Advisor’s picks continue to perform well. In the last 1-2 years (2024-2025), standout performers include Shopify (SHOP) recommended in June 2024 with +99% return (+79% vs. S&P 500), Unity Software (U) from September 2024 with +95% (+79% vs. S&P 500), and DoorDash (DASH) from October 2024 with +76% (+64% vs. S&P 500). These examples highlight how the service spots opportunities in dynamic sectors, helping you capitalize on short-term momentum while building toward your long-term aspirations.

Over the past five years (2020-2025), Stock Advisor has also shone brightly with picks like Roblox (RBLX) from November 2023 delivering +259% (+215% vs. S&P 500), DoorDash (DASH) from November 2023 with +185% (+135% vs. S&P 500), and Tesla (TSLA) from January 2020 achieving +975% (+863% vs. S&P 500). Imagine harnessing such insights to grow your portfolio steadily, turning your investment dreams into reality through proven, research-driven selections that align with your goals for financial independence.

These examples illustrate how Motley Fool Stock Advisor’s methodology can help you spot winners tied to the best stock advisor websites and stock picking services in 2025. Imagine turning these insights into your next big win, confidently navigating the market’s ups and downs with the right guidance.

2. Alpha Picks by Seeking Alpha

-

Best for: Value investors seeking high returns, growth-focused individuals looking for outperformers, and strategic planners aiming to diversify their portfolios.

-

Cost: $449/year for new members (10% OFF $499/year)

Aggregate Overall Performance:

- Total Return: +199.56%

- S&P 500 Return: +67.43%

- Outperformance vs. S&P 500: +132.13%

Alpha Picks by Seeking Alpha stands out as a beacon for investors navigating the complexities of the stock market in 2025. This service leverages a systematic stock selection process, harnessing advanced quantitative analysis and unique data to pinpoint top investment opportunities. As of August 13, 2025, with inflation pressures and market volatility at the forefront of investors’ minds, Alpha Picks offers a data-driven sanctuary for those looking to outpace the market and secure their financial future. Imagine building a portfolio that not only withstands economic shifts but thrives, turning your investment aspirations into tangible growth.

Methodology and Approach

Alpha Picks (read the 2025 review) employs a disciplined, data-driven approach to stock selection, which is particularly crucial in today’s volatile market environment. The service’s methodology includes:

- Quantitative Analysis: Utilizing sophisticated algorithms to sift through vast amounts of data, identifying stocks with the highest potential for outperformance.

- Fundamental Research: Each recommendation is backed by detailed research, ensuring that picks are not just numbers on a screen but companies with solid fundamentals.

- Risk Management: In a year where geopolitical risks and policy shifts are influencing markets, Alpha Picks’ approach includes a focus on risk-adjusted returns, helping investors navigate uncertainty with confidence.

Key Features and Benefits

Alpha Picks offers a suite of features designed to empower investors in their quest for financial growth:

- Access to a Team of Seasoned Quantitative Strategists: Benefit from the expertise of professionals like Steve Cress, Head of Quantitative Strategies, who guide you through the intricacies of market trends and investment opportunities.

- Detailed Research and Analysis: Each stock pick comes with comprehensive analysis, helping you understand the ‘why’ behind the recommendation, crucial for making informed decisions in a fluctuating market.

- Bi-Monthly Stock Recommendations: Regular updates ensure your portfolio remains aligned with the latest market conditions, a vital tool as we face ongoing economic challenges.

- Ongoing Portfolio Management Advice: With inflation and market volatility in play, Alpha Picks provides continuous guidance to help you adjust your strategy and protect your investments.

Performance in 2025

As of August 13, 2025, Alpha Picks has demonstrated its prowess in identifying market-beating opportunities:

-

Overall Performance: Since its inception, Alpha Picks has delivered a total return of +199.56%, significantly outperforming the S&P 500’s +67.43% return over the same period. This represents an outperformance of +132.13 percentage points, showcasing the service’s ability to navigate through economic shifts and deliver value to its subscribers.

-

Notable Picks:

-

A technology hardware company recommended in November 2022, has returned +968.59%, turning a $1,000 investment into over $10,685. This pick exemplifies how Alpha Picks can identify companies poised for exponential growth, even amidst sector-specific challenges.

-

A mobile advertising technology company recommended in November 2023, has returned +793.43%, transforming a $1,000 investment into more than $8,934. This demonstrates the service’s ability to spot undervalued companies in industries critical to technological advancement.

-

An electronics manufacturing services provider recommended in October 2023, has returned +613.33%, converting a $1,000 investment into over $7,133. This pick highlights Alpha Picks’ foresight into sectors that are adapting to global energy demands and policy changes.

Tools and Resources

Alpha Picks equips subscribers with an arsenal of tools to enhance their investment strategy:

- Proprietary Quantitative Ratings: Gain insights into stock potential through Alpha Picks’ unique rating system, which is especially valuable in understanding how stocks might perform amidst current economic conditions.

- Portfolio Management Tools: These tools help you manage and adjust your portfolio in real-time, crucial for responding to market shifts and inflation pressures.

- Email Alerts and Analytical Tools: Stay ahead of the curve with timely updates and in-depth analysis, ensuring you’re always informed about market movements and investment opportunities.

The Team Behind Alpha Picks

The success of Alpha Picks is driven by a team of experienced professionals:

- Steve Cress, Head of Quantitative Strategies: Leads the charge in developing the service’s analytical framework, ensuring that recommendations are grounded in robust data analysis.

- Zachary Marx, CFA, Senior Quantitative Strategist: Brings a deep understanding of financial markets, enhancing the service’s ability to identify high-potential stocks.

- Joel Hancock, Senior Director of Product: Oversees the development of tools and resources, ensuring that subscribers have everything they need to make informed decisions.

Why Alpha Picks in 2025?

In a year marked by economic uncertainty, geopolitical tensions, and the ongoing battle against inflation, Alpha Picks by Seeking Alpha (in-depth 2025 review) (see our 2025 review) offers a compelling solution for investors. Its data-driven approach, combined with expert analysis and a focus on long-term growth, makes it an invaluable resource for those looking to not just survive but thrive in the current market environment.

Imagine turning the challenges of 2025 into your next big win. With Alpha Picks, you’re not just investing; you’re strategically positioning yourself to outpace inflation, navigate market volatility, and achieve your financial goals.

By subscribing to Alpha Picks, you’re not just gaining access to stock recommendations; you’re joining a community of forward-thinking investors equipped with the tools, insights, and strategies needed to succeed in 2025 and beyond.

Best Stock Recommendation Services for 2025 – Top Picks for Expert Stock Advice and Investment Growth

Here are the best stock recommendation services and best stock advisor services we’ve reviewed in 2025, focusing on top-rated options for stock picking strategies, stock market recommendations, and stock investment advice. These best stock advising services are selected based on their proven track record, user feedback, and ability to help investors make informed decisions for long-term wealth building.

| 🎯 Best Stock Advisor Picks | Best For | Investing Focus |

|---|---|---|

| 📈 Motley Fool Stock Advisor | Long-term growth | Stock Picking Strategies |

| 🎯 Alpha Picks by Seeking Alpha | Analyst-Powered | Quant Analysis and Expert Insights |

| 🚀 Trade Ideas | Active Traders | Real-Time AI-Driven Recommendations |

| 🔍 Seeking Alpha Premium | Detailed Analysis | Comprehensive Stock Market Advice |

| 📊 Zacks Premium | Equity Research | Earnings-Focused Stock Investment Advice |

| 📉 TipRanks Premium | Predictive Analytics | Data-Driven Expert Consensus |

| 📚 Morningstar Investor | Fundamentals | Independent Research and Screening |

3. Trade Ideas

-

Best for: Active traders seeking advanced tools, swing traders looking for curated picks, and algorithmic traders wanting automated strategies.

-

Cost: $99/year for new members (50% OFF $199/year)

Trade Ideas remains a powerhouse in the stock market analysis arena, offering traders a formidable edge since its inception in 2003. With the re-election of Donald Trump in November 2024, the platform’s relevance has only intensified due to its ability to adapt to the evolving economic landscape. Here’s how Trade Ideas (read the 2025 review) can help you navigate the current market conditions:

Immediate Market Surge: Following Trump’s victory, the market saw an unprecedented surge. Trade Ideas’ real-time market data and advanced analytics can help you identify the new opportunities this surge has created. With its sophisticated AI-powered technology, you can stay ahead, capitalizing on the market’s optimism.

Policy Focus: Expectations of tax cuts and deregulation have driven the market, but with potential tariff threats looming, Trade Ideas’ customizable alerts can notify you of potential trade opportunities influenced by these policy shifts, allowing you to adapt your strategy swiftly.

Interest Rate Adjustments: As the Federal Reserve might reconsider its rate cut strategy due to inflationary pressures, Trade Ideas’ backtesting functionality becomes crucial. You can test your strategies against historical data to refine your approach in anticipation of future rate changes.

Corporate Earnings: With Trade Ideas, you can backtest your strategies to align with the recalibrated earnings expectations, ensuring your investments are well-positioned in this evolving economic climate.

Sector Spotlight: With sectors like banking, energy, and defense poised for growth, Trade Ideas’ stock scanning capabilities can help you pinpoint the most lucrative opportunities within these sectors, leveraging the anticipated regulatory relaxations and increased military spending.

Currency Dynamics: The dollar’s strength post-election can impact international investments. Trade Ideas provides insights and alerts to keep you informed, allowing for strategic adjustments in your international exposure.

Political Landscape: Given the potential for political friction, Trade Ideas’ community can be a valuable resource. Engaging with a network of traders can provide insights into how the political environment might affect the markets, offering a broader perspective.

Global Trade Impact: As Trump’s trade policies reshape global trade, Trade Ideas’ analytical tools can help you navigate the changing landscape, identifying opportunities in sectors that might benefit or face challenges.

Inflation Concerns: With inflation being a key concern, Trade Ideas’ real-time data can help you monitor price levels and adjust your portfolio accordingly.

Volatility Ahead: The platform’s backtesting and strategy testing features are essential in this period of potential volatility, allowing you to refine your strategies as Trump’s policies unfold.

Trade Ideas is not just about providing tools; it’s about empowering traders with the insights and support needed to thrive. Here are some of the features that make Trade Ideas indispensable in the current market environment:

- Customizable alerts notify users of potential trade opportunities in real-time, crucial for reacting to market changes swiftly.

- Backtesting functionality allows traders to test and refine their strategies against historical data, adapting to Trump’s economic policies.

- Educational resources, including webinars and tutorials, help users sharpen their skills, ensuring they’re well-equipped to navigate the evolving market.

Trade Ideas understands that success in the markets requires not only powerful tools but also ongoing support and community. The platform fosters a vibrant user community where traders can connect, share insights, and learn from one another, making it even more valuable in this era of transition.

Whether you’re a seasoned trader looking to refine your edge in light of Trump’s re-election or a beginner seeking to build a solid foundation amidst market shifts, Trade Ideas offers the tools, insights, and support you need to navigate the markets with confidence. With its proven track record and unwavering commitment to empowering traders, Trade Ideas is a platform you can trust to help you seize the opportunities presented by this new economic landscape and achieve your financial goals.

Join Trade Ideas Now to Navigate the Trump Market and Capitalize on Opportunities!

4. Seeking Alpha Premium

-

Best for: Experienced traders seeking deep analysis, value investors looking for underpriced stocks, and growth investors focusing on long-term potential.

-

Cost: $189/year (Regular price $239/year)

Seeking Alpha Premium empowers investors with comprehensive tools for informed decision-making. Launched in 2004, it has evolved into a leading platform for in-depth stock analysis and investment ideas by January 2025.

The service stands out by offering a unique blend of:

- Quantitative ratings from algorithmic models

- Insights from experienced Seeking Alpha contributors

- Wall Street analyst perspectives

This multi-faceted approach provides a holistic view of investment opportunities, catering to diverse investor needs.

Seeking Alpha Premium’s core offerings include:

- Stock Ratings and Scorecards: Comprehensive evaluations based on various factors

- Dividend Insights: Critical analysis of dividend stocks for income-focused investors

- Screening Tools: Efficient filters to identify stocks matching specific criteria

- Real-time Alerts: Timely notifications on rating changes and market shifts

These features enable users to make data-driven decisions and stay ahead of market trends.

The platform’s additional tools and resources further enhance the investment process:

- Stock Symbol Pages: Consolidate ratings and key information for quick analysis

- News Aggregation: Curated news relevant to specific stocks

- Comparative Analysis Tools: Side-by-side stock comparisons for informed decision-making

- Historical Financial Data: Access to a decade of financial information for trend analysis

Seeking Alpha Premium (read our review) also offers portfolio management tools, including:

- Portfolio grading based on various metrics

- Dividend grading system for income-focused strategies

- Customized news dashboard tailored to investor preferences

These features allow users to refine their investment strategies and maintain a balanced portfolio.

The service’s real-time updates and unlimited access to premium content ensure users can react promptly to market developments. Data visualizations and downloadable financial statements further support in-depth analysis and presentation needs.

Seeking Alpha Premium’s comprehensive toolkit empowers investors to navigate complex financial markets with confidence. By leveraging its diverse features, users can develop robust investment strategies aligned with their goals and risk tolerance.

5. Zacks Premium

-

Best for: Experienced investors seeking in-depth research, long-term investors wanting consistent stock picks, value investors looking for fundamental analysis.

-

Cost: $249/year with a 100% Satisfaction Guarantee

Zacks Premium offers a data-driven approach to stock picking, leveraging the power of earnings estimate revisions to identify the most promising investment opportunities. With a proven track record of outperforming the market, Zacks has established itself as a trusted name in the world of stock recommendations.

At the heart of the service is the Zacks Rank system, which uses a proprietary algorithm to rate stocks based on earnings estimate revisions and surprise history. This system has consistently identified the top 5% of stocks most likely to outperform, giving subscribers a significant edge in the market.

But Zacks Premium (see our review) goes beyond just providing a list of top-rated stocks. The service offers a comprehensive suite of tools and resources designed to empower investors to make informed decisions and take control of their financial future.

One of the standout features is the Focus List portfolio, a curated selection of 50 stocks chosen for their strong potential to deliver long-term growth. These picks are backed by in-depth research reports and analysis from Zacks’ team of expert analysts, giving subscribers a deep understanding of the rationale behind each recommendation.

Zacks Premium also offers a range of powerful screening tools, allowing investors to filter stocks based on their preferred investment style, whether it’s value, growth, or momentum. The Style Scores and VGM Score make it easy to align stock picks with individual investing preferences, while the Industry Rank helps identify the sectors most likely to outperform.

For those looking to capitalize on earnings surprises, the Earnings ESP Filter is an invaluable tool. By screening for stocks most likely to beat or miss earnings estimates, investors can strategically enter or exit positions to maximize their returns.

-

Zacks Rank: Harnesses the power of earnings estimate revisions to identify the top 5% of stocks most likely to outperform.

-

Focus List: A portfolio of 50 top-rated stocks selected for their strong potential to deliver long-term growth.

-

Style Scores: Aligns stock picks with individual investing preferences, whether it’s value, growth, or momentum.

-

Industry Rank: Identifies the sectors most likely to outperform, helping investors stay ahead of market trends.

-

Earnings ESP Filter: Screens for stocks most likely to beat or miss earnings estimates, allowing for strategic trading decisions.

With Zacks Premium, investors gain access to an unparalleled wealth of expert analysis and actionable insights. The service’s equity research reports provide an in-depth look at over 1,000 widely followed companies, offering a level of detail and transparency that sets Zacks apart from other stock picking services.

Whether you’re a seasoned investor or just starting to build your portfolio, Zacks Premium offers the tools, resources, and expertise you need to navigate the market with confidence. With a 30-day free trial and a money-back guarantee, there’s no risk in exploring how Zacks can help you achieve your financial goals.

If you’re ready to take control of your investing future and tap into the wealth-building potential of the stock market, Zacks Premium is the partner you’ve been searching for. Don’t let uncertainty hold you back - unlock the power of data-driven stock picking and start building the portfolio of your dreams today.

6. TipRanks Premium

-

Best for: Active traders seeking stock insights, data-driven investors valuing analyst ratings, and growth-focused individuals aiming for comprehensive research.

-

Cost: $360/year for new members (33% OFF $600/year)

TipRanks Premium is a comprehensive stock recommendation service that harnesses the power of data and analytics to deliver actionable insights to investors. With a rich history of empowering investors through technology, TipRanks has carved a unique niche in the market by aggregating expert opinions and providing a consolidated outlook to help users make informed decisions.

What sets TipRanks apart is its advanced algorithms that curate expert insights from top analysts, financial bloggers, and corporate insiders. By democratizing access to institutional-grade research tools, TipRanks levels the playing field for investors, enabling them to invest with confidence and clarity.

The service offers an array of powerful features and resources, including:

-

Expert consensus ratings and price targets for thousands of stocks

-

Detailed analyst track records and ranking systems

-

Insider trading alerts and sentiment analysis

-

Advanced stock screeners and portfolio monitoring tools

-

Daily stock ideas and market news updates

These tools are designed to cater to the diverse needs of investors, from novice traders to seasoned professionals. Whether you’re looking to validate your investment thesis, discover new opportunities, or stay attuned to market-moving insights, TipRanks has you covered.

What’s more, TipRanks is committed to transparency and accountability. Each recommendation comes with a detailed analysis and justification, empowering you to understand the rationale behind the ratings.

Plus, with a money-back guarantee, you can explore the service with confidence, knowing your satisfaction is prioritized.

For investors seeking a reliable partner to navigate the complexities of the stock market, TipRanks Premium (see our 2025 review) is a compelling choice. Its data-driven approach, coupled with a user-friendly interface and mobile accessibility, makes it a valuable resource for investors of all stripes.

While no investment service can guarantee success, TipRanks provides the tools, insights, and expertise to help you make smarter, more informed decisions. If you’re ready to take control of your financial future and invest with greater conviction, TipRanks Premium could be the ally you’ve been seeking.

7. Morningstar Investor

- Best for: Long-term planners, data-focused analysts, and portfolio managers seeking comprehensive research and actionable insights.

- Cost: $199/year for new members (20% OFF $249/year)

For over three decades, Morningstar Investor has been a cornerstone in investment research, delivering independent, unbiased analysis that cuts through market noise. In today’s complex landscape—marked by trade policy uncertainties and interest rate volatility as of May 17, 2025—this trusted platform stands out by equipping you with the tools to make informed decisions, no matter the economic headwinds.

Morningstar Investor (read our review) empowers self-directed investors with a robust arsenal of resources designed to simplify and enhance portfolio management. Here’s what you get:

- In-depth research reports from a team of 150+ expert analysts covering stocks, funds, and ETFs, ensuring you have the data to spot opportunities others miss.

- Robust rating systems that break down investments by performance, risk, and cost, helping you avoid overhyped assets and focus on value.

- Powerful screening tools to filter thousands of options based on your unique goals—imagine narrowing down 50 stocks in minutes to fit your risk tolerance.

- Portfolio X-Ray feature for a granular look at your holdings, revealing hidden overlaps or weaknesses so you can optimize for stability in volatile times like Q1 2025.

Beyond raw data, Morningstar Investor offers practical, personalized solutions to keep your investments on track. Their account aggregation lets you track all your assets in one dashboard—perfect for busy professionals—while custom alerts ensure you’re never caught off-guard by market shifts, such as the recent tariff-induced uncertainties impacting global supply chains.

Morningstar Investor is your go-to partner for building a resilient financial future. Whether you’re a beginner craving clarity or a seasoned investor refining strategy, this platform delivers the independent insights and tools to navigate 2025’s challenges—from inflation pressures to geopolitical risks—with confidence. Imagine turning a $1,000 investment into a diversified, risk-adjusted portfolio with their expert guidance.

Why choose Morningstar (see our 2025 review) now? Their methodology prioritizes long-term value over short-term hype, aligning perfectly with today’s need for stability amid AI-driven tech volatility and small-cap opportunities. For long-term planners, their data-driven approach helps you sidestep costly errors; for analysts, it’s a treasure trove of actionable metrics. Picture a retiree strengthening their nest egg by uncovering undervalued funds with Morningstar’s ratings—real results, grounded in research.

Ready to take control of your investments with a trusted name? Morningstar Investor offers the clarity and precision you need to outsmart the market’s complexities in 2025. Subscribe today and leverage their expertise to build a portfolio that withstands uncertainty and grows over time.

What is a Stock Recommendation Service?

A stock recommendation service provides guidance to investors on which stocks to buy, hold, or sell. These services are designed to help you navigate the complexities of the stock market and make informed investment decisions. By leveraging the expertise of experienced analysts, a stock recommendation service can be a valuable tool for growing your wealth.

While no service can guarantee success, the best stock recommendation services employ rigorous research and analysis to identify high-potential investment opportunities. They consider a wide range of factors, including market trends, company financials, competitive landscape, and more. The goal is to provide you with a curated list of stock picks that align with your investment goals and risk tolerance.

In addition to specific stock recommendations, many services also offer educational resources and ongoing support. This can include detailed reports on each recommended stock, regular portfolio updates, and access to a community of like-minded investors. By providing this holistic approach, a stock recommendation service can empower you to become a more knowledgeable and confident investor.

What is the Best Stock Recommendation Service?

The best stock recommendation service is one that aligns with your unique investment needs and goals. While there are many services to choose from, the top providers share some key qualities. First and foremost, they have a proven track record of delivering market-beating returns over the long term.

The best services are transparent about their methodology and provide clear, actionable recommendations that are easy to follow. They offer a mix of growth and value stock picks across various sectors to help you build a diversified portfolio. Additionally, the best stock recommendation services are committed to ongoing education and support, with resources to help you continually refine your investing skills.

When evaluating stock recommendation services, look for ones with experienced analysts, a strong reputation, and a history of outperforming benchmark indexes. The best services will also have a clear risk management strategy and be upfront about both the potential rewards and risks of each stock pick. Ultimately, the right service for you will instill a sense of confidence and control over your investing journey.

How We Evaluated the Best Stock Recommendation Services?

To identify the best stock recommendation services, we conducted a comprehensive evaluation process. Our analysis considered a wide range of factors, including:

-

Performance: We assessed each service’s track record of returns, looking for consistent market outperformance over various time periods.

-

Quality of Research: The best services employ rigorous analytical methods to identify high-potential stocks. We evaluated the depth and breadth of their research process.

-

Clarity of Recommendations: We favored services that provide clear, specific, and actionable stock picks that investors can easily implement.

-

Educational Resources: The top services offer robust educational materials to help investors expand their knowledge and skills.

In addition to these core factors, we also considered aspects like user experience, customer support, and overall value for the price. We gathered data from both the service providers themselves and aggregated user reviews to develop a comprehensive picture of each offering.

Through this extensive evaluation process, we aimed to identify the stock recommendation services that offer the most trustworthy, impactful, and user-friendly guidance for investors. While no service is perfect, we believe the top performers on our list represent the best options available for individuals seeking expert support in their investing journey.

🧠 Thinking Deeper

- ☑️ Be selective with your investments. Waiting for great opportunities is often better than forcing mediocre ones.

- ☑️ Be willing to admit mistakes and learn from them. Flexibility is a key trait of successful investors.

- ☑️ Learn to recognize extreme market sentiments and act contrary to them.

- ☑️ Create a clear, thoughtful investment policy statement to guide your decisions.

📚 Wealthy Wisdom

- ✨ In investing, what is comfortable is rarely profitable. - Robert Arnott

- ✔️ The only value of stock forecasters is to make fortune tellers look good. - Warren Buffett

- 🌟 The biggest risk of all is not taking one. - Mellody Hobson

- 🚀 The individual investor should act consistently as an investor and not as a speculator. - Benjamin Graham

📘 Table of Contents

- • Motley Fool Stock Advisor

- • Alpha Picks by Seeking Alpha

- • Methodology and Approach

- • Key Features and Benefits

- • Performance in 2025

- • Tools and Resources

- • The Team Behind Alpha Picks

- • Why Alpha Picks in 2025?

- • Best Stock Recommendation Services for 2025 – Top Picks for Expert Stock Advice and Investment Growth

- • Trade Ideas

- • Seeking Alpha Premium

- • Zacks Premium

- • TipRanks Premium

- • Morningstar Investor

- • What is a Stock Recommendation Service?

- • What is the Best Stock Recommendation Service?

- • How We Evaluated the Best Stock Recommendation Services?