The Best Stock Advisor Service Overall: Motley Fool Stock Advisor — 23.9 years, +883.8% total return (42 ten-baggers, 182 doublers) vs S&P’s +195.8%. The longest-running, most transparent stock advisor available. Read our full Stock Advisor review.

Dispersion just hit 83 points — a new 2026 high — and forward return compression makes every point of alpha worth more than ever. The S&P 500 rallied to ~6,883, within 1.4% of its all-time high, up +0.68% YTD. CPI confirmed at 2.4% (lowest since May 2025), core CPI hit 2.5% (lowest since April 2021), and the disinflation thesis is validated. The VIX dropped 4.3% to 20.29 as AI panic subsided and tech rebounded on Feb 18. Consumer confidence remains at a 12-year low. AAII bears (38.1%) nearly match bulls (38.5%). Gold holds above $5,000/oz. The 2-year Treasury yield sits at 3.47% — still below the fed funds rate of 3.50-3.75% — meaning the bond market continues pricing in rate cuts the Fed hasn’t announced yet.

This is the “Disinflation Validated, Rotation Deepens” market: inflation is fading, the VIX is declining, and money is flowing — but only to the right stocks. The 83-point dispersion separating winners from losers tells you everything — the top 20 stocks average +51.8% while the bottom 20 average -30.7%. The S&P 500 is up barely 0.68% YTD at ~6,883. Index investors captured almost nothing. Stock pickers captured +51.8%.

Run the numbers on what compressed forward returns actually cost you:

- $100K at 7% for 10 years = ~$197K (passive indexing at CAPE ~40)

- $100K at 11% for 10 years = ~$289K (with quality stock advisor alpha)

- The gap: $92,000 from a single portfolio

That $92K difference is the price of settling for index returns when valuations are at their second-highest level in 155 years. It’s also the opportunity that stock advisors exist to capture.

The environment reinforces the thesis: The Fed holds at 3.50-3.75% with a March hold expected, but the bond market has already moved — the 10-year sits at 4.09% and the 2-year at 3.47%, still below the fed funds rate. That’s the bond market voting for cuts before the Fed acts. Gold holds above $5,000/oz. Intra-sector dispersion is extreme — memory/storage stocks surged (SNDK +155%, WDC +75%, MU +48%) while enterprise software remains deeply negative (CRM -29%, NOW -29%, WDAY -34%, INTU -41%). Energy leads at +22.5%, Materials +16.9%, Consumer Staples +13.3%, Industrials +12.8% while Tech sits at -2.1% and Financials at -4.0%. Energy names like BKR (+36%) and SLB (+35%) are entering the top 20. Manufacturing PMI at 52.6 marks the highest reading since August 2022. Credit spreads at 2.94% show no systemic stress — this is a rotation, not a crisis.

When index returns are muted but individual stock dispersion is at extremes, alpha from quality stock advisors becomes the primary wealth-building lever. Click to See the Latest Picks.

Time horizon matters more than ever. Our analysis of service track records reveals a critical insight:

- 1-3 year horizons: Alpha Picks leads with 77.8% win rate, +123% average returns, and 299.6% total return in 3.6 years

- 3-5 year horizons: Either Alpha Picks or Stock Advisor works well

- 5-10 year horizons: Stock Advisor dominates with 62.8% win rate and 187% average returns

- 10+ year horizons: Stock Advisor is unmatched with 92.8% win rate, 42 ten-baggers, and 182 doublers

When index returns are expected to compress to 6-9% annually at CAPE ~40, finding the stocks that return 20%+ becomes dramatically more valuable. With 83 points of dispersion — a new 2026 high — separating winners from losers, this is the environment where proven stock advisors earn their keep.

Why Stock Picking Matters More in 2026

The Forward Return Problem

After three consecutive years of strong S&P 500 returns (+26% in 2023, +25% in 2024, +18% in 2025), the math has changed. CAPE at ~40 sits at its second-highest reading in 155 years. Only the dot-com peak was higher. The S&P 500 rallied to ~6,883 — within 1.4% of the January 27 all-time high of 6,978.60 — but it’s up only +0.68% YTD despite confirmed disinflation and declining volatility.

What does that mean for your portfolio? Forward return estimates tell the story:

- Expected 1-year S&P 500 return: 2-12% (wide range, high uncertainty amid the data gauntlet)

- Expected 3-year CAGR: 5-8%

- Expected 5-year CAGR: 6-9%

- Historical average: 10.2%

When the index is expected to deliver 6-9% instead of 10%+, every extra percentage point of alpha carries outsized weight.

The Compounding Gap Is Real

Here’s what compressed index returns actually cost over a decade:

| Growth Rate | $100K After 10 Years | Difference vs. 11% |

|---|---|---|

| 7% (index estimate) | $197K | -$92K |

| 9% (optimistic index) | $237K | -$52K |

| 11% (with alpha) | $289K | Baseline |

| 14% (strong alpha) | $379K | +$90K |

A stock advisor that adds 2-4% annual alpha to a compressed-return index doesn’t just beat the market. It fundamentally changes your retirement math.

The Dispersion Multiplier

Alpha only matters if it’s available to capture. Right now, it is — in abundance.

Dispersion hit 83 points — a new 2026 high — with the top 20 stocks averaging +51.8% and the bottom 20 averaging -30.7%. The sectors tell the story:

- Winners: Energy +22.5%, Materials +16.9%, Consumer Staples +13.3%, Industrials +12.8%

- Losers: Financials -4.0%, Tech -2.1% (bifurcated)

The INTRA-SECTOR dispersion is now the dominant theme. Memory/storage stocks surged (SNDK +155%, WDC +75%, MU +48%) — averaging ~83% across the cluster. Energy names are entering the top 20 (BKR +36%, SLB +35%). Meanwhile, enterprise software remains deeply negative (CRM -29%, NOW -29%, WDAY -34%, INTU -41%). Within technology alone, the gap between the best winner (SNDK +155%) and the worst loser (INTU -41%) is a staggering 196 points — proving this isn’t about sector rotation but company-level stock selection.

The “Disinflation Validated, Rotation Deepens” narrative defines this market. CPI confirmed at 2.4% YoY (lowest since May 2025) with core CPI at 2.5% (lowest since April 2021) — unambiguously good inflation news. The VIX dropped 4.3% to 20.29 as AI panic subsided and tech rebounded. But consumer confidence remains at a 12-year low. AAII bears (38.1%) nearly match bulls (38.5%). Gold holds above $5,000/oz. The bond market continues pricing in rate cuts — the 2-year Treasury at 3.47% sits below the fed funds rate of 3.50-3.75%, while the 10-year sits at 4.09%. The yield curve (2s10s) at +62 bps maintains a healthy positive slope. Credit spreads at 2.94% confirm no systemic stress. This is a market that’s rotating, not breaking — and rotation rewards stock pickers who can identify where the money is flowing.

This isn’t a simple bull market. It’s a bifurcated market with structural fault lines and a sentiment washout — and it rewards precision.

Why Stock Advisors Earn Their Keep Now

When index returns compress and dispersion widens, stock advisors shift from “nice to have” to essential:

- Stock Advisor’s quality GARP focus identifies companies that compound through rotations — 883.8% total return, 42 ten-baggers, and a 92.8% win rate on 10+ year holds prove the methodology works in exactly this kind of market. When AAII bearish hits 38.1% and retail hesitates, 24 years of through-cycle compounding provides the conviction to stay invested.

- Alpha Picks’ quant model captures factor-driven sector rotation — 299.6% total return and 73% win rate surface opportunities the crowd misses while the rotation deepens beneath a calm surface

- Morningstar’s fair value discipline prevents overpaying at CAPE ~40 — with the 10-year yield at 4.09% and CPI confirmed at 2.4%, knowing what’s actually cheap while the market sits near all-time highs is worth its weight in gold (still above $5,000/oz)

- Rule Breakers’ innovation thesis remains valid long-term (60 ten-baggers over 21 years, 71% win rate) but faces bifurcated headwinds — memory/AI stocks surge while enterprise software stays deeply negative and intra-sector selection matters more than ever

Bottom line: When the S&P is up barely 0.68% YTD at ~6,883 and individual stocks range from +51.8% to -30.7%, the advisor who helps you land on the right side of that 83-point spread is worth multiples of their subscription cost. The VIX declining to 20.29, consumer confidence at a 12-year low, and AAII bears nearly matching bulls — all while disinflation is validated and the bond market prices in cuts — make this one of the most favorable environments of the decade for quality stock selection.

The Quick Answer: Best Stock Advisors Compared

| Rank | Service | Best For | Track Record | Price | 2026 Fit |

|---|---|---|---|---|---|

| 🥇 | Stock Advisor | Long-term growth (5+ years) | +883.8% since 2002 (42 ten-baggers) | $99/yr | Exceptional — quality GARP thrives in rotation |

| 🥈 | Alpha Picks | Data-driven investors (1-3 years) | +299.6% since 2022 (73% win rate) | $449/yr | Good — quant factors capture rotation |

| 🥉 | Rule Breakers | Aggressive growth | +313.8% since 2004 (60 ten-baggers) | $299/yr | Situational — tech lagging, but multi-bagger potential |

| 4 | Morningstar Investor | DIY researchers | N/A (40+ year research platform) | $199/yr | Exceptional — fair value essential at CAPE ~40 |

| 5 | 7investing | Innovation enthusiasts | Not disclosed | $199/yr | Situational — deep research, unproven track |

| 6 | Zacks Premium | Earnings-focused | 37+ year methodology | $249/yr | Good — manufacturing expansion supports earnings |

| 7 | Danelfin | AI/quant enthusiasts | +263% since 2017 | $39/mo | Situational — AI scoring in high-dispersion market |

The Scenario Cheat Sheet:

- Just starting out (<$25K)? Stock Advisor — proven track record, complete framework, 30-day guarantee

- Building serious wealth ($50K+)? Stock Advisor + Alpha Picks — combine human conviction with quant validation

- Want to pick your own stocks? Morningstar Investor — research tools, not recommendations (40+ years of methodology)

- High risk tolerance? Rule Breakers — more volatility, more upside

- Trust algorithms over humans? Alpha Picks — pure quant, zero human discretion, 73% win rate

- Want deep research on fewer picks? 7investing — 1 pick/month with extensive thesis

- Prefer AI-driven analysis? Danelfin — explainable AI, 10,000+ features per stock

Time Horizon Matching:

- 1-3 years: Alpha Picks — 77.8% win rate, 299.6% total return

- 5-10 years: Stock Advisor — 62.8% win rate, 187% average return

- 10+ years: Stock Advisor — 92.8% win rate, 42 ten-baggers, 182 doublers

1. Motley Fool Stock Advisor

Patient growth investors who hold through volatility for 5+ years

Every “best stock advisor” list starts with Motley Fool Stock Advisor, and there’s a reason: 23.9 years of beating the market isn’t a fluke. When I’m asked “what’s the one service I should try?” this is still my answer — even though it’s not the cheapest or the newest.

In the current environment — with CAPE at ~40 compressing forward index returns to 6-9%, 83-point dispersion (a new 2026 high) rewarding stock selection, and the S&P up barely 0.68% YTD at ~6,883 — Stock Advisor’s quality-focused GARP approach becomes even more valuable. The VIX declining to 20.29 as fear subsides while the bond market prices in cuts (2-year yield at 3.47%, below fed funds) creates the kind of environment where quality compounders reassert themselves. The methodology that produced 883.8% total returns specifically thrives when the market rewards quality over speculation. Most reviews stop at the headline numbers. Let me show you what actually makes Stock Advisor work — and why most subscribers still fail.

Motley Fool Stock Advisor Performance

The Motley Fool · 504 picks · 24 years · Updated Feb 18, 2026

| SA Return | S&P 500 | Alpha | Win Rate |

|---|---|---|---|

| +888% | +193% | +695% | 65% |

S&P 500 shows what you'd have earned buying the index on each pick date instead. Same timing, fair comparison.

| SA Multi-Baggers | 10x+ | 5x+ | 3x+ | 2x+ |

|---|---|---|---|---|

| Count | 42 | 86 | 126 | 181 |

| SA Asymmetry | Avg Winner | Avg Loser | Ratio |

|---|---|---|---|

| Return | +1.5K% | -45% | ~34:1 |

Best Performers (All-Time)

| SA Pick | Return |

|---|---|

NVDA NVIDIA | +113K% |

AAPL Apple | +5.4K% |

MME.DL MME.DL | +4.3K% |

CTAS CTAS | +4.4K% |

BKNG Booking Holdings | +18K% |

DIS Disney | +5.9K% |

TSLA Tesla | +19K% |

COST Costco | +3.5K% |

AMZN Amazon | +26K% |

NFLX Netflix | +41K% |

34:1 asymmetry. Winners average +1.5K%, losers average -45%. One winner offsets 34 complete losses—this is why selling winners early is costly.

See All Stock Advisor Recommendations →Latest Stock Advisor Picks

Tickers masked to protect subscriber value. Recent picks need 3-5+ years to demonstrate thesis.

| SA Pick | Return |

|---|---|

**** Chip Equipment | +95% |

**** Mobile App Platform | +70% |

**** Space Launch | +58% |

**** Infrastructure Construction | +46% |

**** Growth Company | +35% |

**** Growth Company | +33% |

**** Growth Company | +24% |

**** Athletic Apparel | +16% |

**** Growth Company | +12% |

**** Athletic Footwear | +5% |

Lessons from 2005. 16 picks that year averaged +7.2K%. Best performers often come from buying during uncertainty—when conviction feels hardest.

Stock Advisor Win Rate by Holding Period

| Hold Time | SA Win Rate | Avg Return |

|---|---|---|

| < 1 Year | 54.3% | +10% |

| 1-3 Years | 58.2% | +13% |

| 3-5 Years | 37.2% | -2% |

| 5-10 Years | 62.8% | +181% |

| 10+ Years | 92.9% | +3.7K% |

Time is the strategy. 10+ year picks show 92.9% win rate with +3.7K% average returns. Same methodology, same picks—time transforms the results.

Stock Advisor Performance by Year

| Year | SA Picks | Avg Return | Win Rate | |

|---|---|---|---|---|

| 2026 | 2 | 0% | 50% | CASY+4% |

| 2025 | 25 | +6% | 52% | HWM+106% |

| 2024 | 25 | +6% | 58% | SHOP+85% |

| 2023 | 25 | +44% | 75% | CRWD+235% |

| 2022 | 23 | +22% | 43% | NET+285% |

| 2021 | 23 | -33% | 17% | LRCX+360% |

| 2020 | 24 | +82% | 29% | TSLA+1.3K% |

| 2019 | 24 | +36% | 67% | SNPS+243% |

| 2018 | 22 | +155% | 64% | SHOP+795% |

| 2017 | 23 | +568% | 87% | NVDA+7.1K% |

| 2016 | 21 | +367% | 81% | SHOP+3.4K% |

| 2015 | 24 | +195% | 71% | CASY+721% |

| 2014 | 21 | +215% | 81% | IBKR+995% |

| 2013 | 19 | +324% | 68% | NFLX+2.4K% |

| 2012 | 23 | +1.3K% | 74% | TSLA+19K% |

| 2011 | 19 | +492% | 63% | AAPL+2.6K% |

| 2010 | 18 | +418% | 83% | AMZN+2.2K% |

| 2009 | 20 | +2.8K% | 90% | NVDA+48K% |

| 2008 | 18 | +1.0K% | 94% | AAPL+5.4K% |

| 2007 | 19 | +1.5K% | 37% | NFLX+27K% |

| 2006 | 20 | +2.3K% | 65% | NFLX+24K% |

| 2005 | 16 | +7.2K% | 63% | NVDA+113K% |

| 2004 | 17 | +5.4K% | 59% | NFLX+41K% |

| 2003 | 17 | +230% | 65% | BWA+1.4K% |

| 2002 | 16 | +2.6K% | 81% | AMZN+26K% |

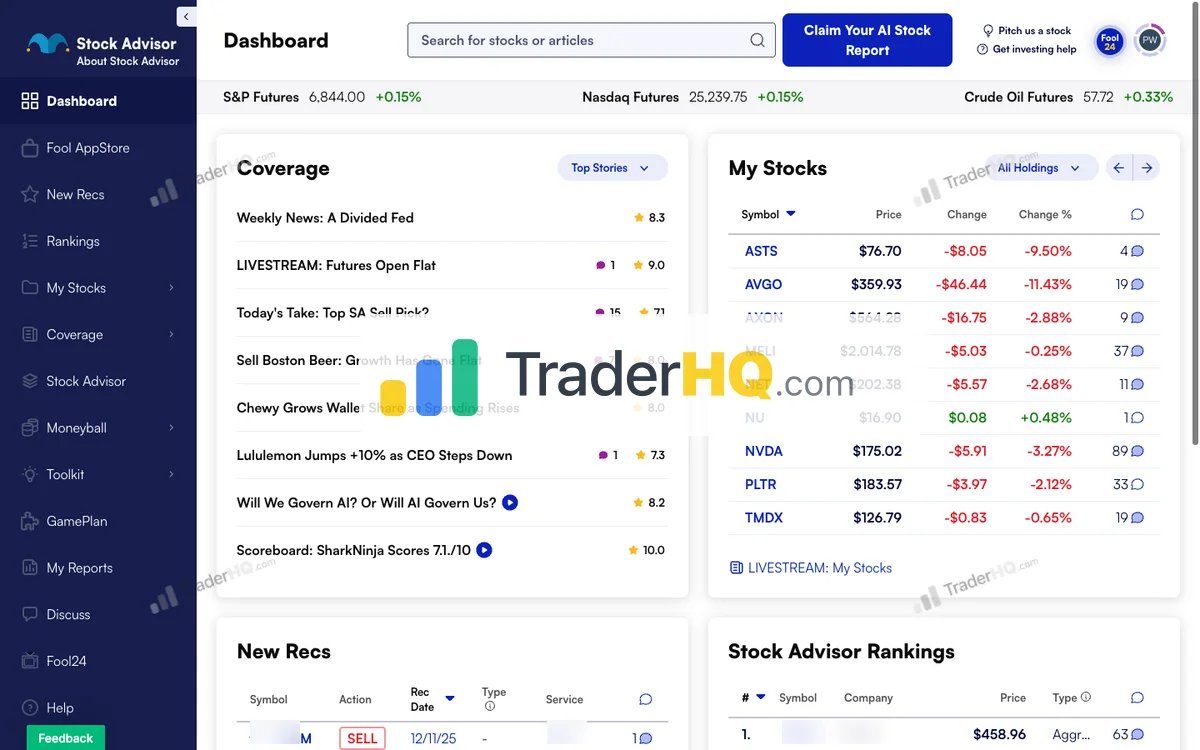

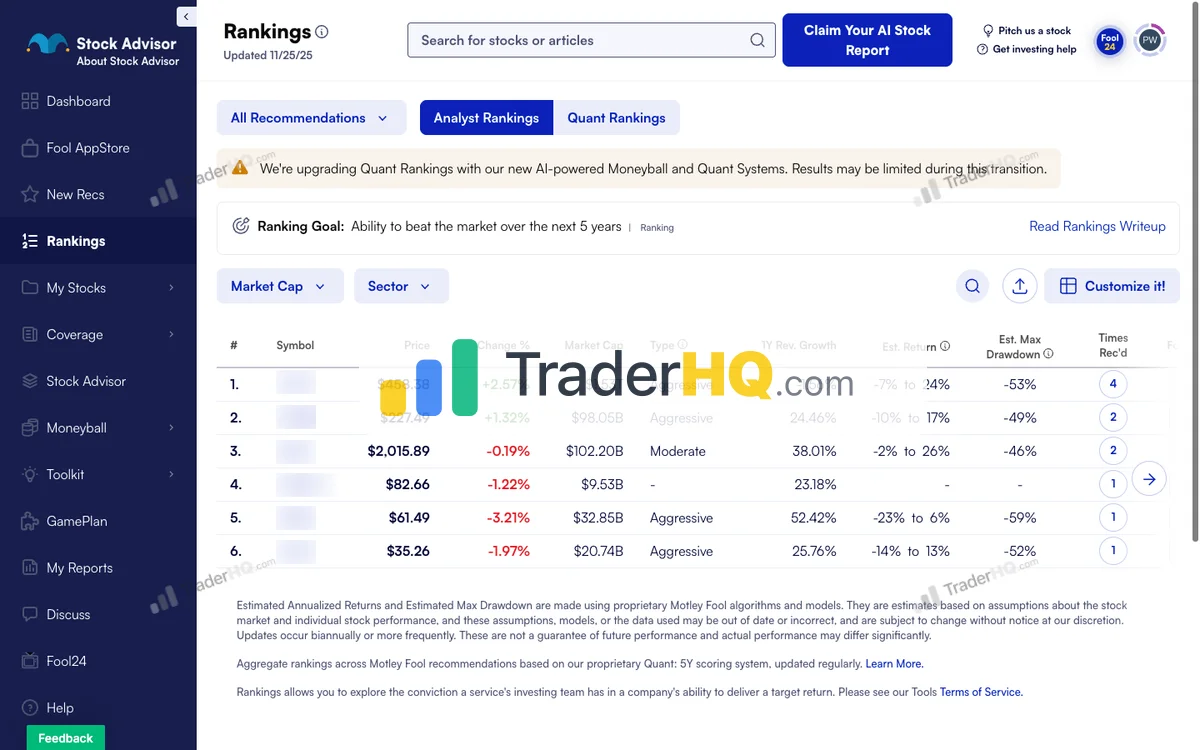

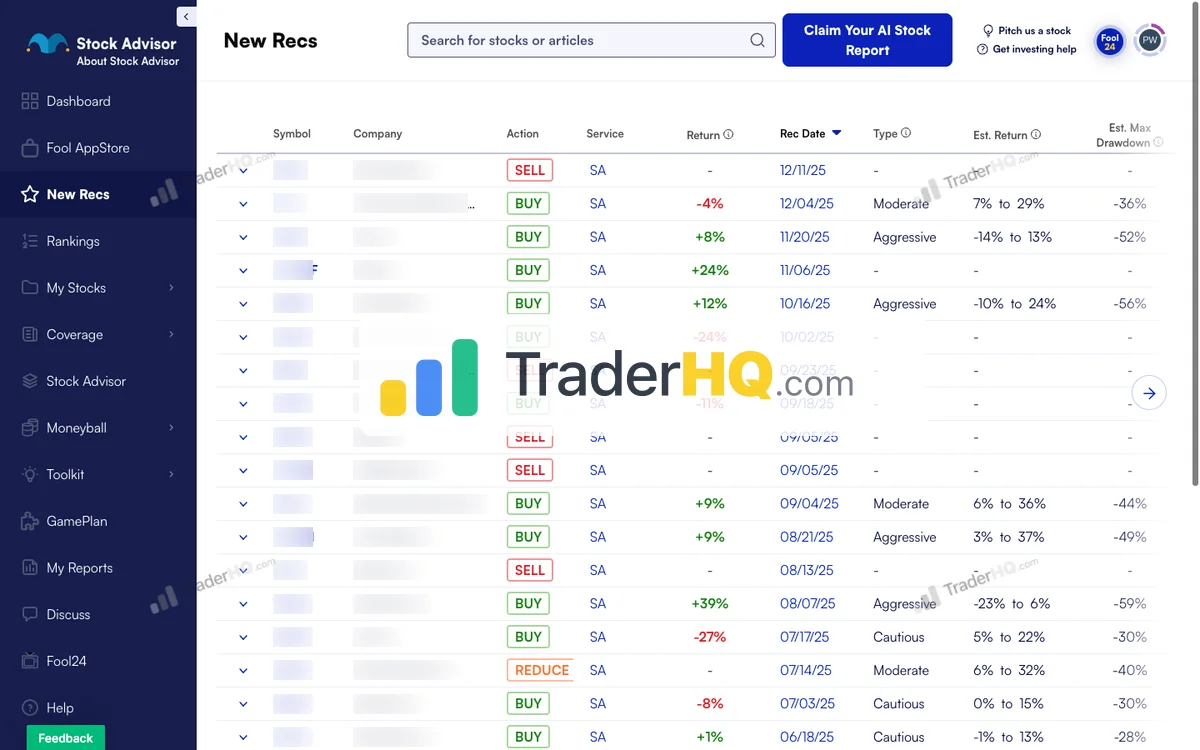

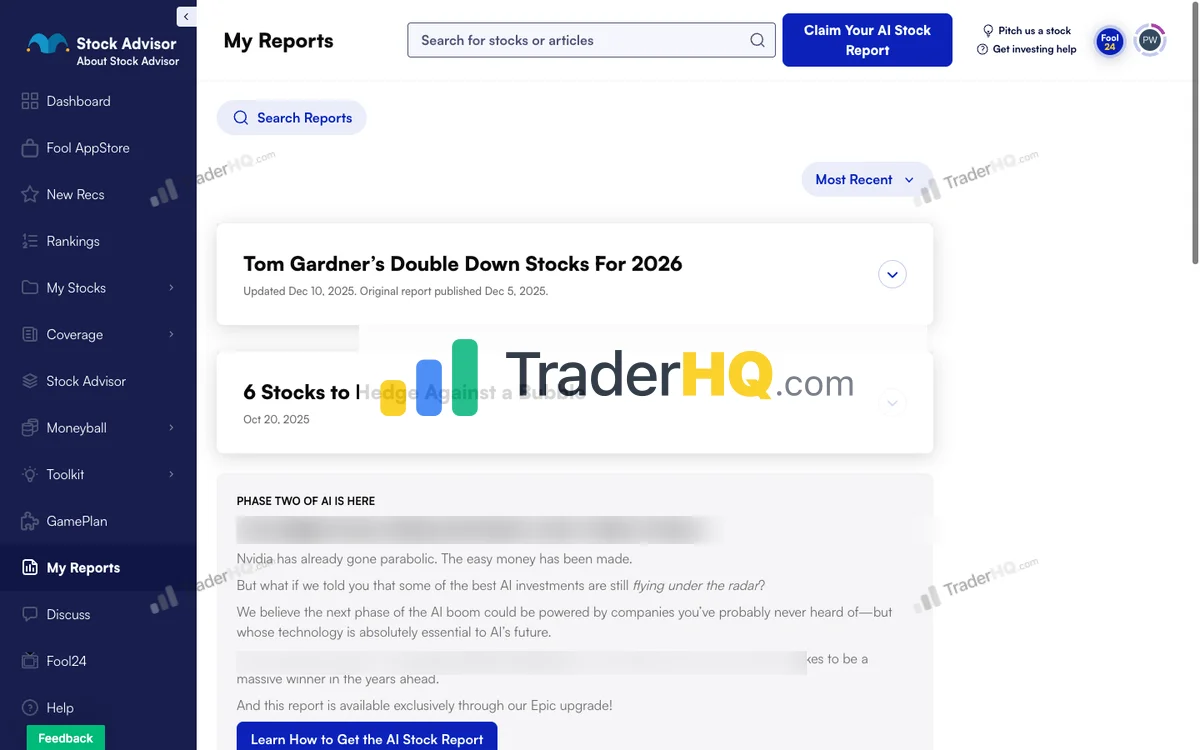

Inside Stock Advisor

9 screenshots · Click to expand

The Track Record: What the Numbers Actually Mean

+883.8% total return since February 2002 versus the S&P 500’s +195.8%. That’s across 504 positions over 23.9 years.

Let me make that visceral: $10,000 invested in Stock Advisor picks in 2002 would be worth approximately $98,380 today. The same money in an S&P 500 index fund? About $29,580. That’s a $68,800 gap from the same starting capital.

The time curve tells the real story:

- 65% overall win rate across all picks

- 92.8% win rate for 10+ year holds — 42 ten-baggers, 182 doublers

- Best for investors with 5+ year horizons who can hold through volatility

That’s not marketing spin. I’ve verified it against the actual historical recommendations—including the losers. Every pick since 2002 is visible in their scorecard. The transparency is exceptional.

But here’s what the marketing doesn’t tell you:

- 33% of Stock Advisor picks lose money. About a third of recommendations end up in the red.

- The returns are concentrated in the winners. The top 10% of picks generate the majority of returns. Selling winners early—or panic-selling during drawdowns—destroys the math.

- The 2021 vintage is still recovering. If you subscribed during the growth stock mania, your portfolio probably doesn’t look like +1051%.

This isn’t a criticism—it’s the reality of growth investing. The question is whether you can hold through the pain.

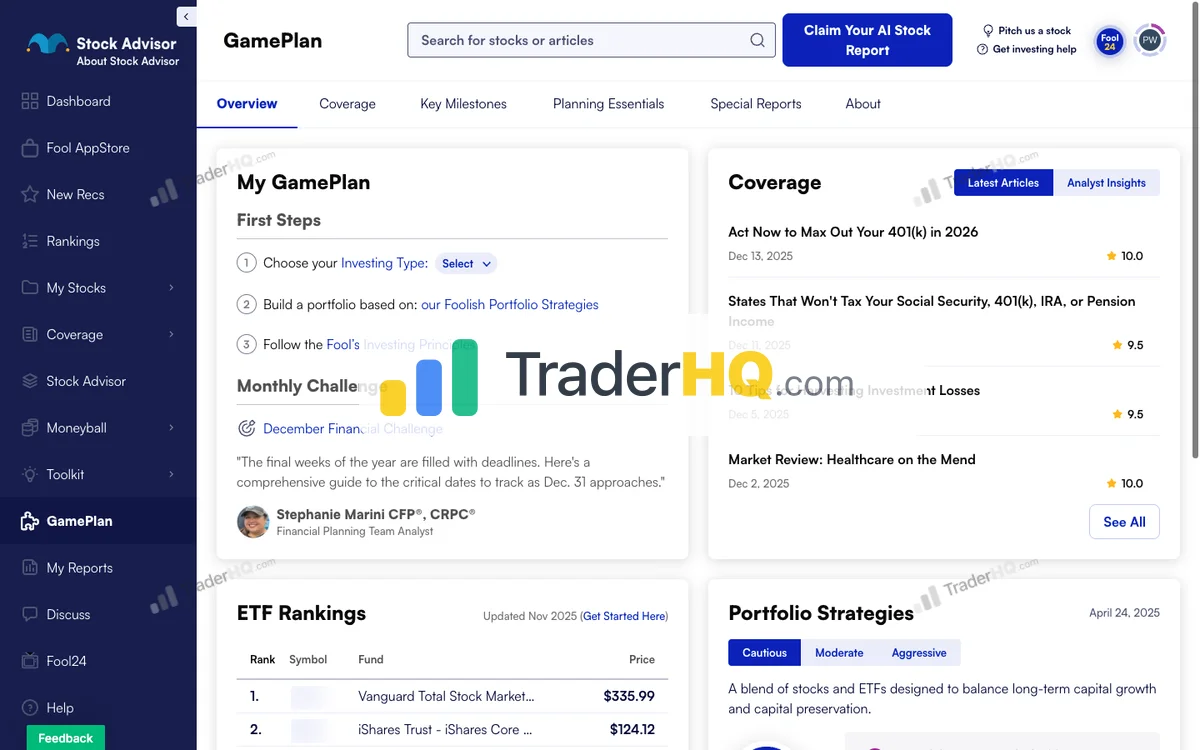

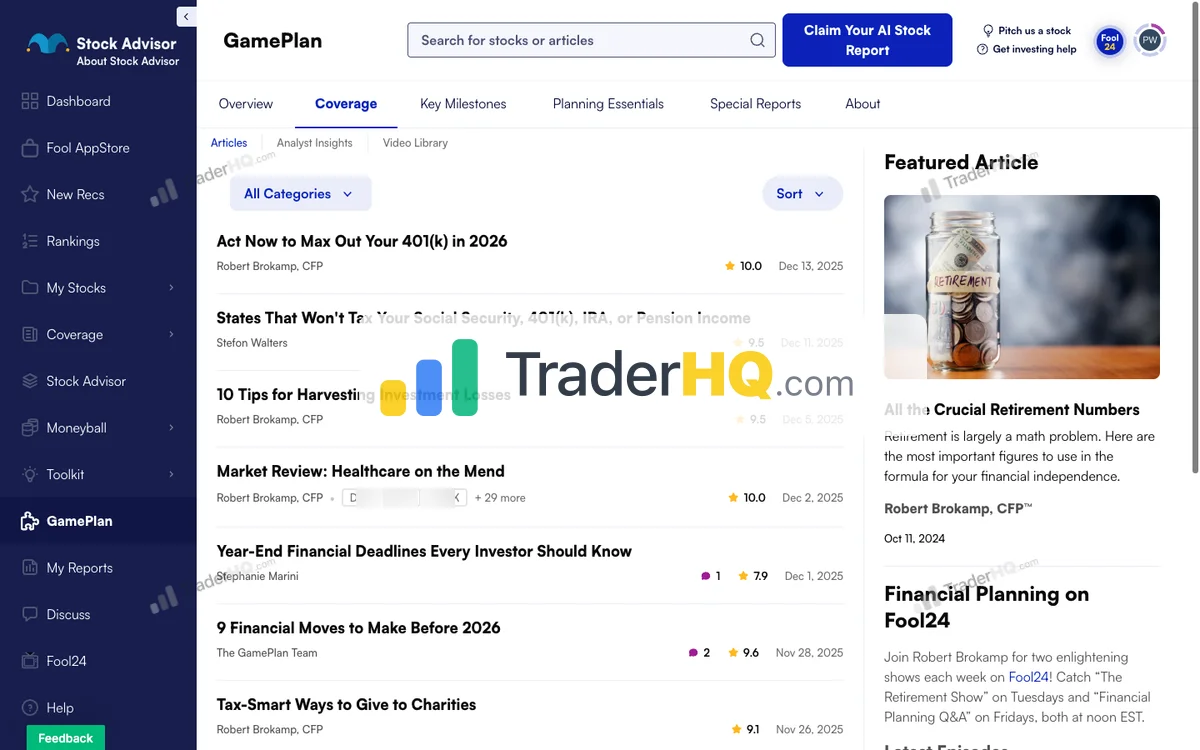

How Stock Advisor Actually Works

Stock Advisor delivers 2 new stock recommendations per month from Motley Fool’s analyst team. Each comes with:

- A deep-dive thesis explaining why this company can compound for decades

- Quantitative projections with estimated return ranges and maximum drawdown estimates

- Risk classifications so you know what you’re signing up for

- Re-recommendation signals when existing picks become even more attractive

But here’s what separates Stock Advisor from basic stock-picking newsletters: the portfolio framework.

The Real Product: Portfolio Construction, Not Just Picks

Most subscribers think they’re paying for stock tips. They’re actually paying for a complete portfolio-building system:

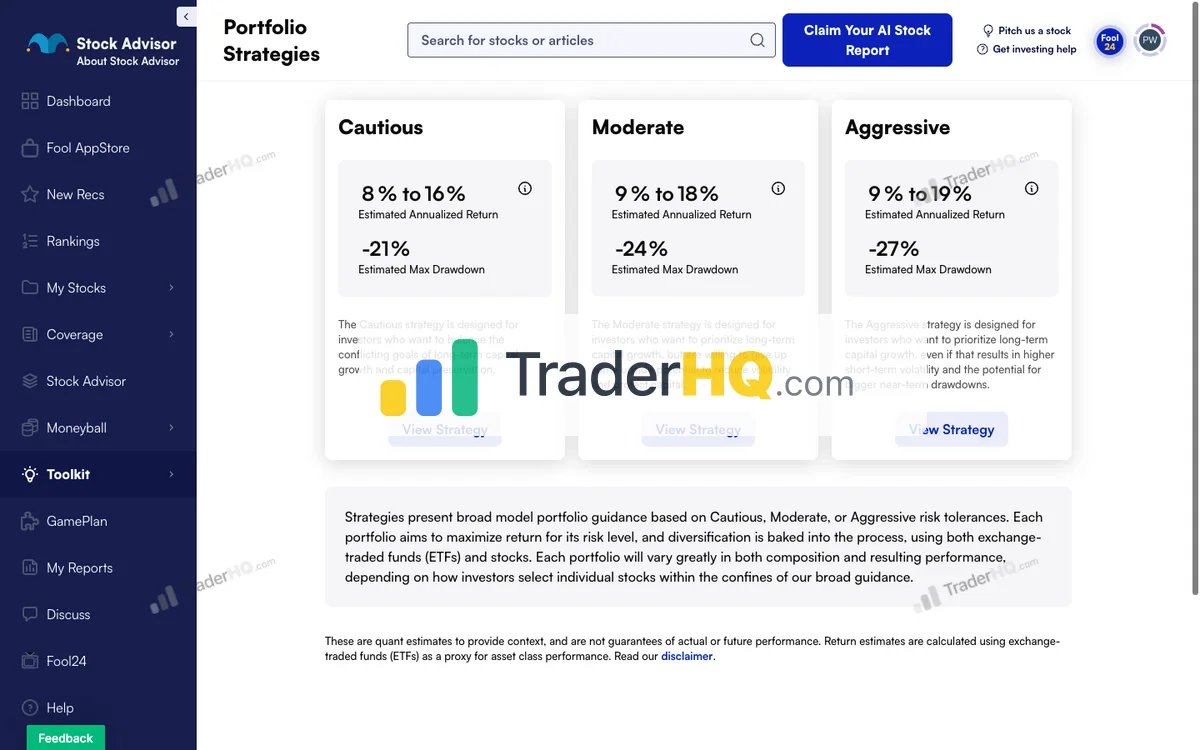

Three Portfolio Strategies:

- Cautious Portfolio — Lower volatility, more established companies, for investors who can’t stomach 50% drawdowns

- Moderate Portfolio — Balanced approach, mix of growth and stability

- Aggressive Portfolio — High-conviction growth picks, expect significant volatility

This matters because even the best picks are worthless if you can’t hold them. The portfolio strategies address the psychological reality that most investors sell at exactly the wrong time.

Foundational Stocks:

Stock Advisor maintains a list of 10 highest-conviction core holdings with explicit risk classifications. New subscribers often ask “where do I start?” This is the answer. These aren’t the picks with the highest potential returns—they’re the ones the team would stake their reputation on.

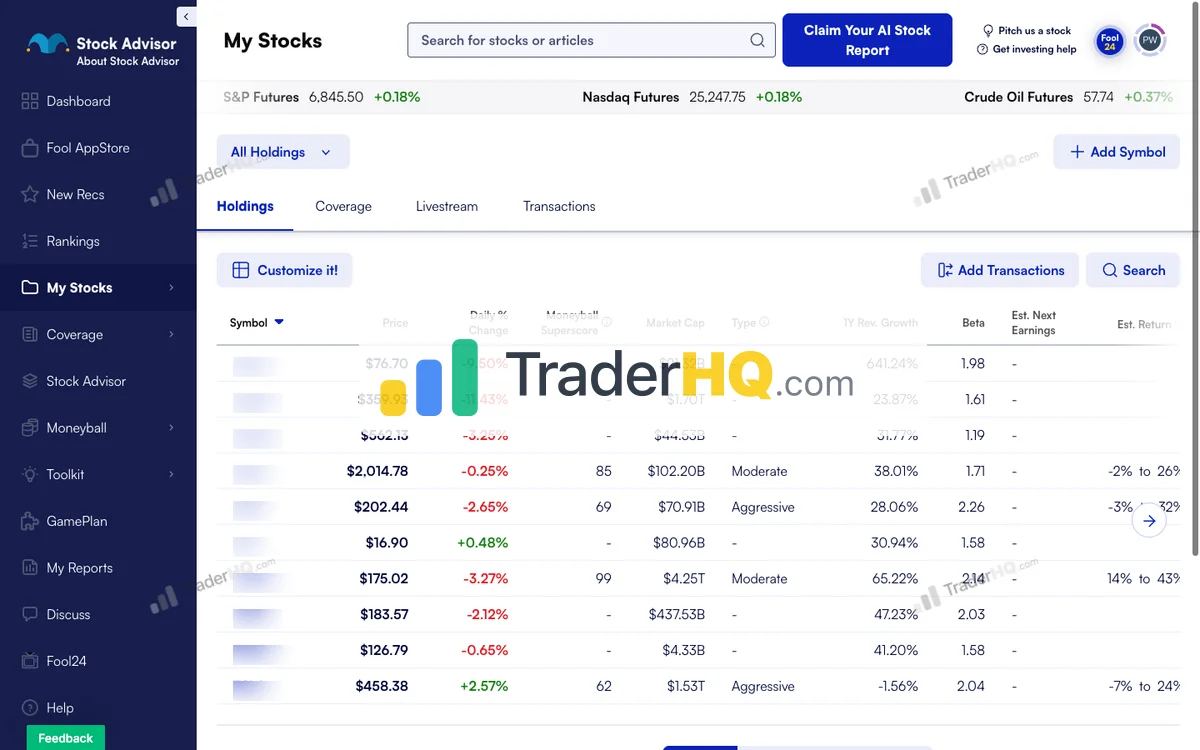

The Moneyball Database:

This is the hidden gem most subscribers never discover. The Moneyball database covers 344 companies with 12+ scoring dimensions. It’s essentially a research platform that helps you evaluate stocks on your own—building investor capability rather than dependency.

The Uncomfortable Reality: Why Most Subscribers Fail

Stock Advisor’s track record is real. But most subscribers don’t capture it. Here’s why:

1. They can’t hold through drawdowns.

Stock Advisor picks are growth stocks. Growth stocks are volatile. The service’s best performers—Netflix, Amazon, Nvidia—have all crashed 50-80% at some point. If you sold during those crashes, you missed the recovery.

2. They sell winners too early.

When a position doubles, the instinct is to take profits. But Stock Advisor’s math depends on letting winners run. Selling Netflix at +100% would have forfeited thousands of percent in future gains.

3. They joined at the wrong time.

Subscribers who joined in 2020-2021 bought at peak growth stock valuations. Many of those picks are still down 50-70%. The 23-year track record is real, but your personal track record depends on when you started.

4. They ignore the framework.

Stock Advisor isn’t “buy these 2 stocks every month.” It’s a system with portfolio strategies, position sizing guidance, and re-recommendation signals. Subscribers who cherry-pick stocks without following the framework consistently underperform.

Who Stock Advisor Is For

- Patient investors with 5+ year horizons. This is non-negotiable. If you need the money in 2-3 years, index funds are safer.

- Portfolios of $25,000+. At smaller sizes, the $199/year fee (or $99 promo) represents too large a percentage of your capital.

- Investors who can stomach 30-50% drawdowns. Not theoretically—actually. When your portfolio drops 40%, will you hold or sell?

- People who want a framework, not just tips. If you’ll follow the portfolio strategies and position sizing guidance, Stock Advisor works. If you’ll cherry-pick stocks and panic-sell, save your money.

Who Stock Advisor Is NOT For

- Short-term traders. The average holding period is 5+ years. If you’re looking for swing trades, look elsewhere.

- Income investors. Stock Advisor focuses on growth, not dividends. If you need current income, this isn’t your service.

- Investors who hate upsells. The Motley Fool will try to upgrade you to Epic, Epic Plus, and beyond. Relentlessly. If this frustrates you, be warned.

- People who subscribed in 2020-2021 and are frustrated. Your experience is valid. But the solution isn’t to quit—it’s to hold. The 23-year track record includes multiple periods that looked just as bad.

Pricing and Value

- Regular Price: $199/year

- New Member Price: $99/year (50% off)

- Refund Policy: 30-day money-back guarantee

At $99/year, you’re paying roughly $4 per stock pick for recommendations backed by 23 years of market-beating performance. Compare that to:

- A single hour with a financial advisor: $200-400

- An actively managed mutual fund with 1% expense ratio on $100K: $1,000/year

- The cost of one bad stock pick: Potentially thousands

The math works. The question is whether you’ll follow the system.

The Bottom Line on Stock Advisor

Motley Fool Stock Advisor isn’t perfect. The upsell pressure is annoying. The 2021 vintage picks are still recovering. And 35% of recommendations lose money.

But the 23.9-year track record is real, verified, and transparent — +883.8% vs the S&P’s +195.8%, with 42 ten-baggers and 182 doublers across 504 positions. The quality GARP methodology is specifically suited to the current environment: disinflation validated at 2.4% CPI, the VIX declining to 20.29, and the S&P rallying to ~6,883 — but still barely positive YTD (+0.68%). When the index crawls but dispersion hits a new 2026 high of 83 points, quality compounders are the primary alpha source. The portfolio framework addresses the psychological challenges that cause most investors to fail. And at $99/year with a 30-day guarantee, the risk/reward is asymmetric in your favor.

Bottom line for Stock Advisor: Best for investors with 5+ year horizons in an 83-point dispersion market. The 92.8% win rate on 10+ year holds and 42 ten-baggers prove the methodology works for patient investors — especially when forward index returns are compressed to 6-9%.

If you’re going to try one stock advisory service, this is it.

For a deeper analysis, read our complete Stock Advisor review. Wondering how it compares to the competition? See our Stock Advisor vs Alpha Picks comparison.

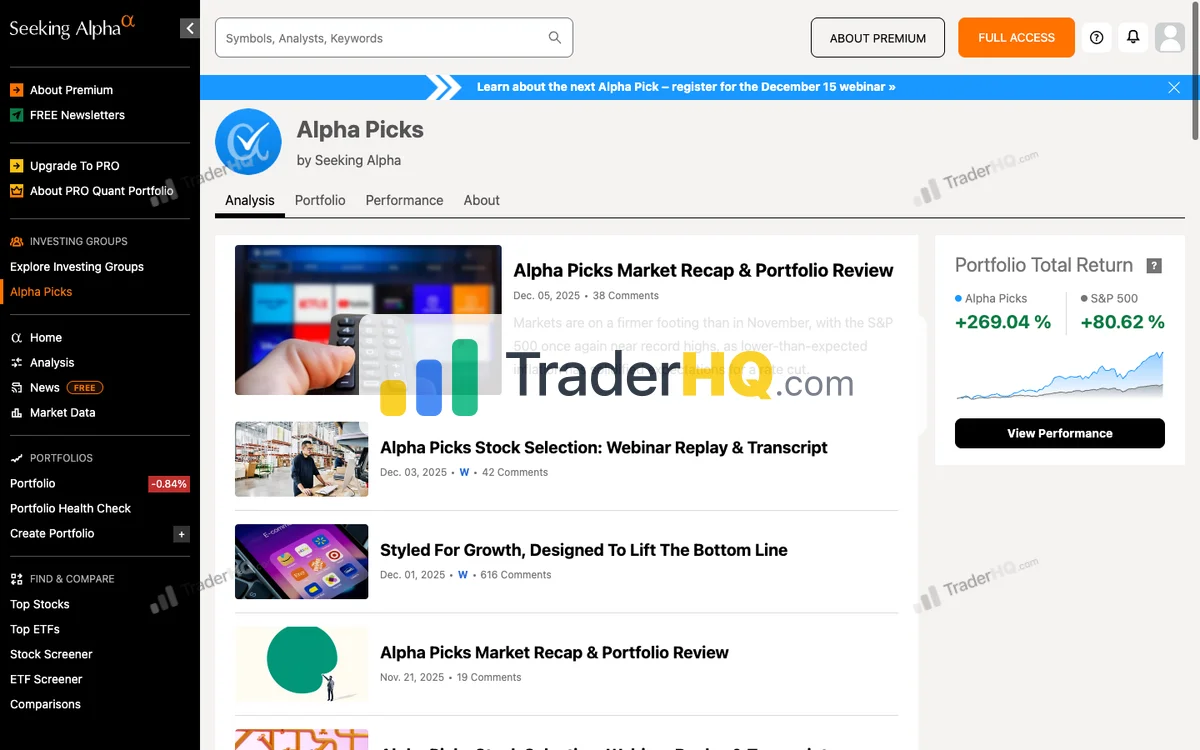

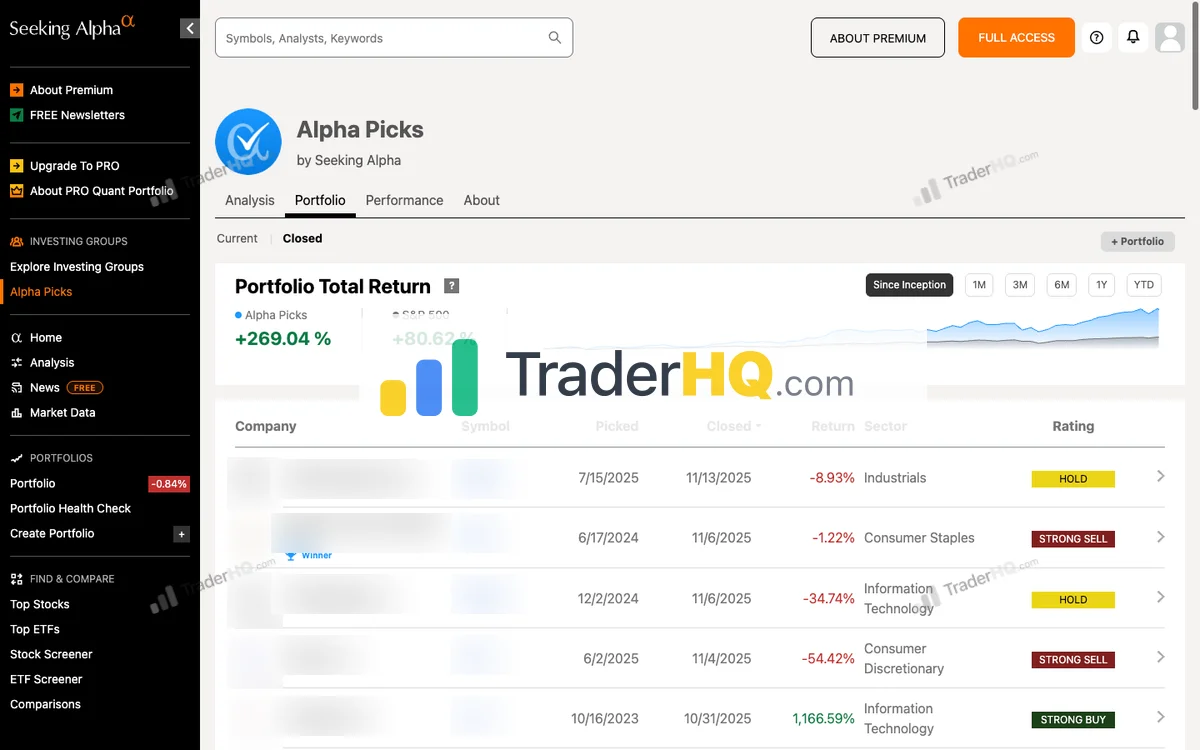

2. Alpha Picks by Seeking Alpha — The Quant Challenger

Data-driven investors who trust algorithms over human opinion

Alpha Picks represents something genuinely different in the stock-picking landscape: a pure quant system with no human discretion, complete transparency on every position, and a track record that’s impossible to dismiss.

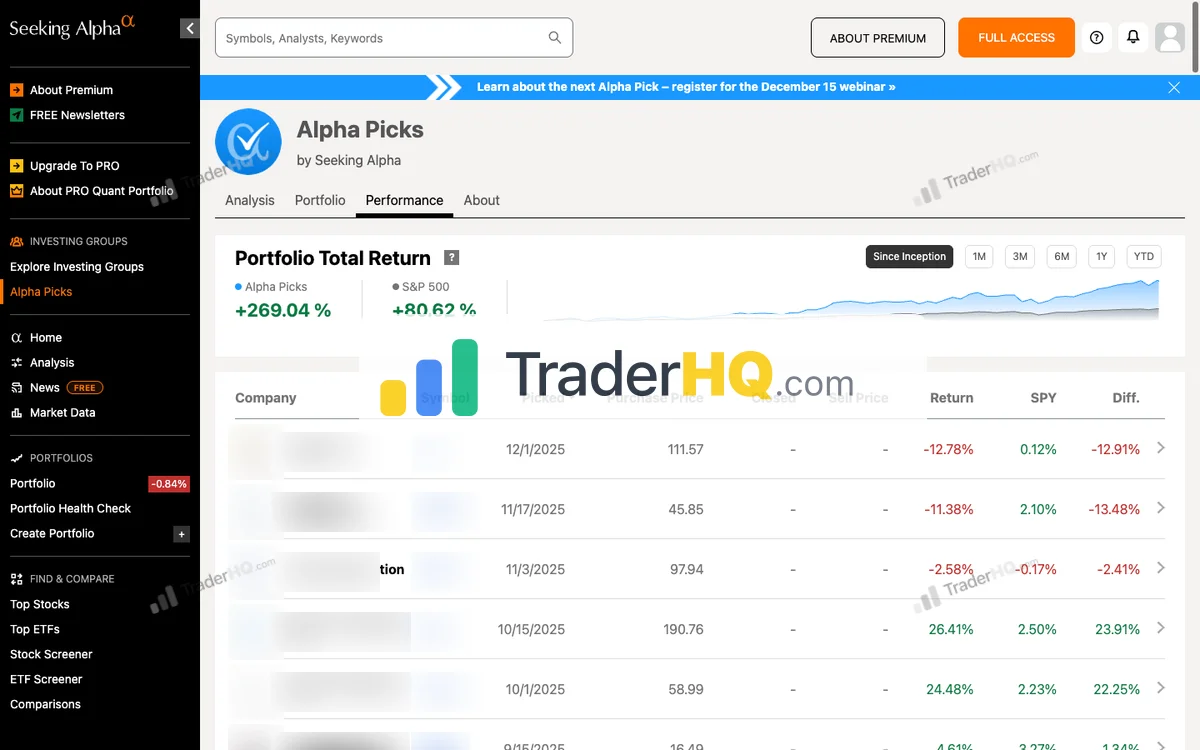

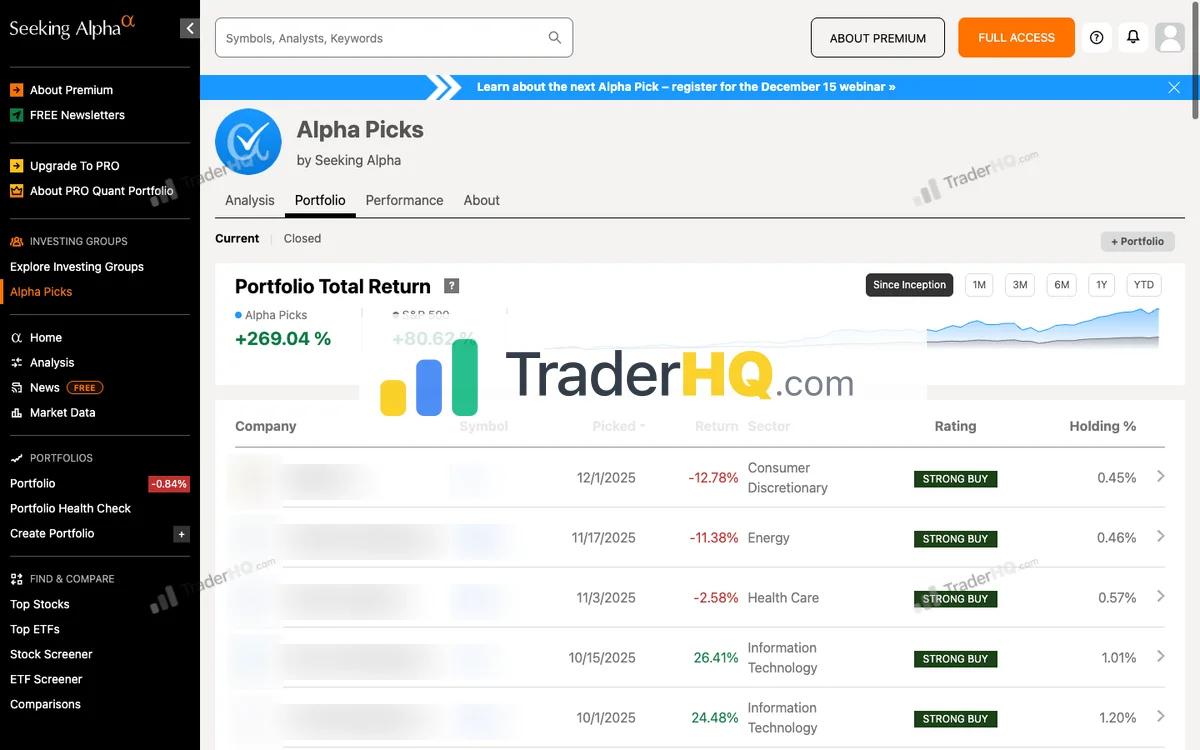

Among stock advisors, the +299.6% total return versus +83% for the S&P 500 since July 2022 isn’t marketing spin — it’s documented across every position with entry date, exit date, and return visible. In an 83-point dispersion market where AAII bearish sentiment sits at 38.1% and the rotation beneath the surface keeps deepening, Alpha Picks’ emotion-free quant methodology is capturing alpha that hesitant human analysts miss.

Alpha Picks by Seeking Alpha Performance

Seeking Alpha · 92 picks · 4 years · Updated 2026-02-19

| AP Return | S&P 500 | Alpha | Win Rate |

|---|---|---|---|

| +297% | +81% | +216% | 73% |

S&P 500 shows what you'd have earned buying the index on each pick date instead. Same timing, fair comparison.

| AP Multi-Baggers | 10x+ | 5x+ | 3x+ | 2x+ |

|---|---|---|---|---|

| Count | 1 | 4 | 10 | 14 |

| AP Asymmetry | Avg Winner | Avg Loser | Ratio |

|---|---|---|---|

| Return | +110% | -22% | ~5:1 |

Best Performers (All-Time)

| AP Pick | Return |

|---|---|

**** Homebuilder | +228% |

POWL Powell Industries | +894% |

**** Growth Company | +153% |

**** Casual Dining | +209% |

**** Power Plant Construction | +249% |

STRL Sterling Construction | +558% |

APP AppLovin | +1.6K% |

CLS Celestica | +1.2K% |

**** Thermal Management | +348% |

SMCI Super Micro Computer | +969% |

Latest Alpha Picks Picks

Tickers masked to protect subscriber value. Recent picks need 3-5+ years to demonstrate thesis.

| AP Pick | Return |

|---|---|

**** Memory Chips | +121% |

**** Precious Metals Mining | +106% |

**** Engineering Services | +77% |

**** Pawn & Financial Services | +63% |

**** Gold Mining | +62% |

**** Dermatology Biotech | +62% |

**** Circuit Board Manufacturing | +59% |

**** Infrastructure Construction | +58% |

**** Growth Company | +37% |

**** Growth Company | +30% |

Alpha Picks Win Rate by Holding Period

| Hold Time | AP Win Rate | Avg Return |

|---|---|---|

| < 1 Year | 65.8% | +14% |

| 1-3 Years | 77.8% | +117% |

| 3-5 Years | N/A% | N/A |

| 5-10 Years | N/A% | N/A |

| 10+ Years | N/A% | N/A |

Alpha Picks Performance by Year

| Year | AP Picks | Avg Return | Win Rate | |

|---|---|---|---|---|

| 2026 | 4 | +8% | 100% | B+11% |

| 2025 | 24 | +30% | 75% | MU+121% |

| 2024 | 24 | +49% | 67% | CLS+259% |

| 2023 | 24 | +161% | 71% | CLS+967% |

| 2022 | 16 | +65% | 75% | MOD+348% |

Inside Alpha Picks

6 screenshots · Click to expand

The Track Record: Shorter But Impressive

- +299.6% total return since July 2022 (vs S&P 500 +83%) — across 92 positions

- 73% overall win rate — significantly higher than industry average

- 93% active win rate — among current open positions

- 77.8% win rate for 1-3 year holds — the sweet spot for this service

- 3 ten-baggers, 16 doublers already in just 3.6 years

- Performance calculated by S&P Global (third-party verification)

The shorter track record (3.6 years vs Stock Advisor’s 23.9) is a legitimate caveat. But the returns during that period are exceptional, and the methodology is designed to work across market cycles. The quant factors that drive Alpha Picks naturally surface rotation opportunities — exactly what an 83-point dispersion market demands.

Key insight: Alpha Picks is optimized for 1-3 year holding periods. If your horizon is shorter or much longer, consider other options.

How Alpha Picks Works

Alpha Picks uses Seeking Alpha’s proprietary Quant Rating system to identify stocks with statistical edge. The algorithm analyzes:

- Valuation metrics

- Growth factors

- Profitability measures

- Momentum indicators

- Earnings revisions

Two new picks per month. No human discretion in selection—the algorithm identifies the highest-rated stocks, period.

The Time Curve: Why Patience Pays

This is the most important insight about Alpha Picks:

| Holding Period | Win Rate | Average Return |

|---|---|---|

| Under 1 year | 64.9% | +14.6% |

| 1-3 years | 77.8% | +123% |

That’s a 23x difference in returns based purely on holding period. Selling early would have cost 62% of total returns.

This is why we recommend Alpha Picks for 1-3 year horizons. The 77.8% win rate in that window is exceptional. For longer horizons (5+ years), Stock Advisor’s methodology becomes more compelling.

Who Alpha Picks Is For

- Data-driven investors who trust algorithms over human opinion

- Patient holders who can commit to 1-3+ year holding periods

- Investors who want transparency — every position visible, winners AND losers

- Those seeking systematic, emotion-free investing

Who Alpha Picks Is NOT For

- Investors who want to understand why — the algorithm is a black box

- Those who need portfolio guidance — no construction framework, just picks

- Investors who think in decades — 3-year track record limits confidence

- Anyone who needs a money-back guarantee — Alpha Picks doesn’t offer one

Pricing

- Regular Price: $499/year

- New Member Price: $449/year (10% off)

- Refund Policy: None (annual billing only)

At $449/year with no refund policy, this stock advisor requires more commitment than Stock Advisor. But the +299.6% total return, 73% win rate, and 3 ten-baggers in 3.6 years justify the premium for data-driven investors with 1-3 year horizons who want a quant-driven stock advisor.

Caveat: Only 3.6 years of data — untested in a consumer-led slowdown or full recession. The VIX has eased to 20.29 and the S&P rallied to ~6,883, but consumer confidence remains at a 12-year low. Financials are still negative at -4.0% YTD, and the 83-point dispersion (new 2026 high) shows the rotation is intensifying, not settling. The regime-change risk persists. Stock Advisor’s 23.9-year track record through 2008, 2020, and 2022 provides more confidence for long-term (5+ year) investors.

For our complete analysis, see our Alpha Picks review. Curious how it stacks up against other stock advisors? Check our Alpha Picks vs Mindful Trader comparison.

3. Motley Fool Rule Breakers — The Aggressive Growth Play

Rule Breakers is Stock Advisor’s aggressive sibling — same Motley Fool DNA, but hunting for disruptive innovators before they become obvious.

Among stock advisors, the +313.8% total return versus +169% for the S&P 500 since 2004 over 21 years is real and verifiable. In the current environment, tech is bifurcated (-2.1% YTD) — memory/storage stocks surged (SNDK +155%, WDC +75%, MU +48%) while enterprise software stays deeply negative (CRM -29%, NOW -29%, WDAY -34%, INTU -41%). Rule Breakers’ 60 ten-baggers and 71% win rate prove that innovation investing works on long enough time horizons, but the 196-point intra-tech gap between SNDK and INTU means picking the RIGHT innovation stocks matters more than ever.

Motley Fool Rule Breakers Performance

The Motley Fool · 369 picks · 21 years · Updated 2026-02-19

| RB Return | S&P 500 | Alpha | Win Rate |

|---|---|---|---|

| +313% | +167% | +146% | 72% |

S&P 500 shows what you'd have earned buying the index on each pick date instead. Same timing, fair comparison.

| RB Multi-Baggers | 10x+ | 5x+ | 3x+ | 2x+ |

|---|---|---|---|---|

| Count | 60 | 104 | 139 | 187 |

| RB Asymmetry | Avg Winner | Avg Loser | Ratio |

|---|---|---|---|

| Return | +2.0K% | -41% | ~48:1 |

Best Performers (All-Time)

| RB Pick | Return |

|---|---|

DIS Disney | +5.9K% |

AMZN Amazon | +26K% |

NVDA NVIDIA | +113K% |

BKNG Booking Holdings | +18K% |

TSLA Tesla | +19K% |

ISRG Intuitive Surgical | +10.0K% |

SHOP Shopify | +5.3K% |

MELI MercadoLibre | +14K% |

NFLX Netflix | +41K% |

AAPL Apple | +5.4K% |

The multi-bagger pipeline. 187 doublers → 104 5-baggers → 60 10-baggers. About 32% of doublers become 10-baggers with enough time.

See All Rule Breakers Recommendations →Latest Rule Breakers Picks

Tickers masked to protect subscriber value. Recent picks need 3-5+ years to demonstrate thesis.

| RB Pick | Return |

|---|---|

**** Chip Equipment | +95% |

**** Genetic Medicine | +89% |

**** Growth Company | +45% |

**** RNA Therapeutics | +14% |

**** Growth Company | +12% |

**** Convenience Stores | +4% |

**** LatAm E-commerce | -7% |

**** Growth Company | -19% |

**** Growth Company | -21% |

**** Travel & Lodging Platform | -23% |

Lessons from 2004. 3 picks that year averaged +31K%. Best performers often come from buying during uncertainty—when conviction feels hardest.

Rule Breakers Win Rate by Holding Period

| Hold Time | RB Win Rate | Avg Return |

|---|---|---|

| < 1 Year | 35.3% | -6% |

| 1-3 Years | 59.6% | +21% |

| 3-5 Years | 45% | +22% |

| 5-10 Years | 70.6% | +304% |

| 10+ Years | 98.3% | +4.1K% |

369 data points over 21 years. The pattern repeats: early volatility, mid-term clarity, long-term outperformance. The data is the strategy.

Rule Breakers Performance by Year

| Year | RB Picks | Avg Return | Win Rate | |

|---|---|---|---|---|

| 2026 | 3 | -18% | 50% | CASY+4% |

| 2025 | 17 | -6% | 29% | ASML+95% |

| 2024 | 23 | +30% | 65% | GH+251% |

| 2023 | 31 | +26% | 61% | CRWD+262% |

| 2022 | 32 | +38% | 50% | ANET+450% |

| 2021 | 28 | -8% | 36% | LRCX+360% |

| 2020 | 26 | -7% | 27% | ASML+285% |

| 2019 | 25 | +66% | 80% | DDOG+277% |

| 2018 | 22 | +224% | 82% | MDB+1.0K% |

| 2017 | 22 | +596% | 86% | NVDA+7.1K% |

| 2016 | 23 | +783% | 91% | SHOP+5.3K% |

| 2015 | 12 | +383% | 92% | AXON+1.7K% |

| 2014 | 16 | +713% | 100% | ANET+3.0K% |

| 2013 | 13 | +611% | 100% | NFLX+2.4K% |

| 2012 | 12 | +1.2K% | 100% | META+2.7K% |

| 2011 | 11 | +2.6K% | 91% | TSLA+19K% |

| 2010 | 5 | +1.3K% | 100% | AMZN+2.2K% |

| 2009 | 12 | +6.4K% | 100% | NVDA+48K% |

| 2008 | 8 | +2.3K% | 100% | AAPL+5.4K% |

| 2007 | 7 | +1.1K% | 100% | CMG+3.0K% |

| 2006 | 7 | +7.1K% | 100% | NFLX+24K% |

| 2005 | 7 | +20K% | 100% | NVDA+113K% |

| 2004 | 3 | +31K% | 100% | NFLX+41K% |

| 2003 | 2 | +968% | 100% | HAS+1.2K% |

| 2002 | 2 | +16K% | 100% | AMZN+26K% |

The Track Record: Asymmetric Math

- +313.8% cumulative return since 2004 (vs S&P 500 +169%) over 21 years

- 71% historical win rate

- 187 picks doubled (49%)

- 60 ten-baggers with innovation thesis

- 382 total positions over 21 years of disruption-focused picking

Here’s the asymmetric math that makes Rule Breakers work:

- Winners average +2,039%

- Losers average -36.8%

The asymmetry is massive. Selling winners at +100% would forfeit the bulk of total returns.

The Time Curve: Patience Is the Strategy

| Holding Period | Win Rate | Average Return |

|---|---|---|

| First year | 33.3% | -8.4% |

| 10+ years | 98.3% | +4,185% |

Time horizon isn’t a suggestion—it’s the entire strategy. First-year picks mostly start underwater. Hold for a decade, and you’re looking at near-certain gains with 4,185% average returns.

How Rule Breakers Works

Rule Breakers focuses on disruptive innovation: companies breaking the rules of their industries. Think early Amazon, Netflix, Tesla.

2 new picks per month with:

- Estimated return ranges

- Maximum drawdown estimates

- Risk classifications

- Deep-dive thesis on the disruption thesis

Important: Rule Breakers is no longer available as a standalone subscription. It’s bundled in Motley Fool Epic ($299/year), which includes Stock Advisor, Rule Breakers, and two additional scorecards.

Who Rule Breakers Is For

- Aggressive growth investors with genuine 5+ year horizons

- High risk tolerance — expect 50%+ drawdowns on individual positions

- Believers in disruptive innovation as an investment thesis

- Investors who already have Stock Advisor and want more aggressive exposure

Who Rule Breakers Is NOT For

- Income investors — these are growth stocks, not dividend payers

- Short-term traders — the math requires years to work

- Those who subscribed 2020-2021 and are frustrated — many picks are still down 70%+

- Investors who can’t handle positions down 80-90% — it happens

Pricing

- Price: $299/year (via Epic bundle)

- Includes: Stock Advisor + Rule Breakers + 2 additional scorecards

- Refund Policy: 30-day money-back guarantee

The Epic bundle is actually excellent value if you want both Stock Advisor and Rule Breakers. You’re essentially getting Rule Breakers for $100/year incremental.

For the complete breakdown, see our Rule Breakers review. Still deciding between the two Motley Fool stock advisors? Read Stock Advisor vs Rule Breakers.

4. Morningstar Investor — The DIY Research Platform

Morningstar Investor is fundamentally different from other stock advisors on this list. It’s not a stock-picking service — it’s a research platform that gives you the tools to make your own decisions.

With CAPE at ~40 — the second-highest reading in 155 years — and the S&P barely positive at +0.68% YTD despite validated disinflation (CPI 2.4%, lowest since May 2025), fair value discipline has never been more relevant. Morningstar’s 40+ year methodology is specifically built for this environment: the VIX has eased to 20.29, the 10-year Treasury sits at 4.09%, the 2-year yield at 3.47% remains below the fed funds rate — and 83-point dispersion means some stocks are overpriced while others are deeply undervalued. When the index barely moves but individual stocks diverge by 83 points, you need to know what a stock is actually worth, not just what the market is willing to pay.

If you want someone to tell you what to buy, skip to the next entry. If you want to become a better investor, keep reading.

What You Get

Fair Value Estimates:

Morningstar’s proprietary valuation methodology estimates what each stock is actually worth. When market price is below Fair Value, you’re potentially buying at a discount.

Economic Moat Ratings:

Morningstar pioneered the concept of “economic moats”—competitive advantages that protect companies from competition. Wide moat companies can maintain pricing power and profitability for decades.

Portfolio X-Ray:

Upload your holdings and see your true allocation, performance, fees, and overlaps. This alone is worth the subscription for serious investors.

200+ Data Points for Screening:

Build custom screens based on valuation, growth, profitability, momentum, and hundreds of other factors.

The Track Record Question

Morningstar Investor doesn’t have a “track record” because it doesn’t make stock picks. It’s a research tool, not an advisor.

That said, Morningstar’s ratings methodology has been trusted for 40+ years and is recession-tested across multiple market cycles. Their quality/moat focus and fair value methodology is the industry standard for fundamental analysis. At CAPE ~40 with forward index returns compressed to 6-9%, knowing the fair value of what you’re buying isn’t just useful — it’s the difference between compounding and overpaying. Sector leaders (Energy +22.5%, Materials +16.9%, Industrials +12.8%) are proving the quality thesis right, while the S&P is up barely 0.68% at ~6,883 despite validated disinflation. For DIY researchers and value investors, this is the gold standard.

Who Morningstar Is For

- Self-directed investors who want professional-grade research tools

- DIY analysts who enjoy the research process

- Investors who want to understand why they’re buying, not just what

- Those building independent capability rather than following picks

Who Morningstar Is NOT For

- Investors who want someone to tell them what to buy — Morningstar won’t do that

- Beginners who need guidance — the learning curve is real

- Those seeking actionable stock picks — look at Stock Advisor or Alpha Picks instead

Pricing

- Regular Price: $249/year

- New Member Price: $199/year (save $50)

- Refund Policy: 7-day free trial

Morningstar is different from typical stock advisors—it’s a research platform. Read our Morningstar Investor review for the complete analysis.

Try It Free — See the Latest Research

5. 7investing — The Boutique Innovation Service

7investing is a solo analyst operation run by Simon Erickson, former Motley Fool Explorer Lead Advisor who managed over $1 million in real-money investments.

The value proposition for this stock advisor is simple: 1 high-conviction stock recommendation per month with deep research, direct analyst access, and zero upsells.

How 7investing Works

- 1 pick per month (vs 2 at most competitors)

- Deep-dive video thesis with peer scrutiny

- Discord community for direct interaction with Simon

- Focus on disruptive innovation: AI, quantum computing, biotech, fintech

- 5+ year investment horizon

The Founder Credibility

Simon Erickson’s background is legitimate:

- Led team of 22 at Motley Fool

- Managed >$1 million in real-money investments

- Former Motley Fool Explorer Lead Advisor

- 15+ years of investment experience

The Trade-Offs

- Performance not publicly disclosed — scorecard available to members only

- Only 1 pick per month — half the volume of Stock Advisor or Alpha Picks

- Solo analyst model — all eggs in one basket

- 7-day trial only — no money-back guarantee

- Shorter track record — founded 2020

Who 7investing Is For

- Innovation enthusiasts with 5+ year horizons

- Investors who value direct analyst access and community engagement

- Those frustrated by upsells — 7investing has none

- People who want deep research on fewer picks

Who 7investing Is NOT For

- Bargain hunters — $199/year for 12 picks vs Stock Advisor’s 24

- Those needing immediate performance validation — no public track record

- Passive investors — requires engagement to get full value

Pricing

- Price: $199/year

- Refund Policy: 7-day free trial (no money-back guarantee)

6. Zacks Premium — The Earnings-Focused Quant

Zacks Premium is built on a single insight: earnings estimate revisions predict stock performance.

Founded in 1978 by Len Zacks (MIT PhD), this stock advisor service pioneered research on the predictive power of earnings revisions. The Zacks Rank system has been in continuous use since 1988—37+ years of real-world application as a stock advisor methodology.

How the Zacks Rank Works

Stocks are rated 1-5 based on earnings estimate revisions:

- 1 = Strong Buy — Analysts raising estimates aggressively

- 2 = Buy — Estimates trending higher

- 3 = Hold — Mixed signals

- 4 = Sell — Estimates declining

- 5 = Strong Sell — Analysts cutting estimates aggressively

The system updates daily based on new earnings estimate data. It’s purely quantitative—no human discretion in the ratings.

The Track Record

Zacks claims strong backtested performance, though specific numbers aren’t prominently displayed. The methodology is academically sound—the relationship between earnings revisions and stock performance is well-documented in financial research.

The Trade-Offs

- Overwhelming amount of content — Zacks throws everything at you

- Aggressive upselling to higher tiers (Ultimate, Black Box, etc.)

- Pricing not always transparent — promotional offers change frequently

- Research platform, not specific stock picks — you still have to do the work

Who Zacks Is For

- Earnings-focused investors who follow estimate revisions religiously

- Quantitative investors who want data-driven signals

- Those comfortable with information overload — Zacks gives you a lot

Who Zacks Is NOT For

- Investors who want simple stock picks — Zacks is a research platform

- Those overwhelmed by data — the interface is dense

- People who dislike aggressive marketing — Zacks will upsell you constantly

Pricing

- Price: $249/year

- Refund Policy: 30-day money-back guarantee

7. Danelfin — The AI-Powered Scorer

Danelfin uses machine learning to generate daily predictive scores for over 10,000 US and European stocks. It’s the most AI-forward stock advisor service on this list.

How Danelfin Works

The platform analyzes 900+ daily indicators per stock, transforming them into 10,000+ features to predict the probability of a stock beating the market over the next 3 months.

Each stock gets an AI Score from 1-10:

- 10/10: Highest probability of outperformance

- 1/10: Lowest probability

The key differentiator: Explainable AI. Unlike black-box algorithms, Danelfin shows you exactly which features are driving each score.

The Track Record

- Best-Score Stocks (10/10): +21.05% average outperformance over 3 months (since 2017)

- “Danelfin Best Stocks” Strategy: +263% total return (Jan 2017 - Aug 2024) vs +189% for S&P 500

- Trade Ideas Win Rate: ≥60% for Buy/Strong-Buy signals

Note: These are company-stated figures. Independent verification recommended.

The Trade-Offs

- 3-month focus — not for long-term holders or day traders

- Monthly pricing ($39/mo) adds up to ~$468/year — more expensive than it looks

- Scoring tool, not stock picks — you still decide what to buy

- Learning curve to understand AI scores and features

Who Danelfin Is For

- AI/quant enthusiasts who want cutting-edge methodology

- Active investors comfortable with 3-month holding periods

- Those who want transparency into algorithmic recommendations

- Investors covering US and European markets

Who Danelfin Is NOT For

- Long-term holders — the 3-month focus doesn’t match 5+ year horizons

- Passive investors — requires active engagement

- Those seeking fundamental research — Danelfin is pure quant

- Budget-conscious investors — monthly pricing adds up

Pricing

- Price: $39/month (~$468/year)

- Free tier available to try before committing

Try It Free — See AI Stock Scores

The Allocation Reality: How Stock Advisors Fit Your Portfolio

None of these stock advisor services should be your entire portfolio. Here’s how I think about stock advisors:

The Core-Explore Framework

- 90% Core: Low-cost index funds (total market, international, bonds)

- 10% Explore: Stock advisor services for potential alpha

If your “explore” bucket is $50,000, that’s enough for 10-15 positions from a stock advisor like Stock Advisor. The stock advisor service costs $199/year—0.4% of that allocation. The math works.

If your explore bucket is $5,000, the $199 fee is 4% of your capital annually. Consider the $99 promo or just index everything until you’ve built a larger base.

Position Sizing

Most stock advisors recommend equal-weight positions. For a 15-stock portfolio built from stock advisor picks:

- Each position: ~6.7% of your explore allocation

- New picks: Start at half-size, add on conviction

- Winners: Let them run (don’t rebalance down)

- Losers: Hold unless thesis breaks (don’t panic-sell)

Multiple Stock Advisors?

Can you use more than one stock advisor? Yes, but with intention:

- Stock Advisor + Alpha Picks: Human conviction + quant validation (complementary)

- Stock Advisor + Rule Breakers: Core + aggressive growth (different risk profiles)

- Stock Advisor + Morningstar: Picks + research tools (different purposes)

Avoid overlapping stock advisors that do the same thing (e.g., two human analyst-led stock advisor services).

The Decision Matrix

Still stuck deciding between stock advisors? Use this:

| If you… | Choose… | Because… |

|---|---|---|

| Have 5+ years and $50K+ | Stock Advisor | 23.9-year track record, 883.8% return, quality GARP thrives in 83-pt dispersion |

| Are just starting out | Stock Advisor | Best value at $99/yr, complete framework, 30-day guarantee |

| Trust algorithms over humans | Alpha Picks | 299.6% return, 73% win rate, quant captures intra-sector rotation |

| Want aggressive growth | Rule Breakers | 60 ten-baggers, but tech bifurcated in 2026 — long-term thesis |

| Want to pick your own stocks | Morningstar Investor | Fair value essential at CAPE ~40, 40+ year methodology |

| Value direct analyst access | 7investing | Solo analyst, community-driven, deep research |

| Follow earnings religiously | Zacks Premium | 37+ years of earnings revision research, PMI expansion helps |

| Want AI-driven analysis | Danelfin | Explainable AI, 10,000+ features, high-dispersion market |

| Want income, not growth | None of these | Look at dividend-focused services instead |

| Are worried about recession | Morningstar + Stock Advisor | Both quality-focused, both through-cycle tested |

Frequently Asked Questions

What is a stock advisor?

A stock advisor is a service that recommends which stocks to buy and sell. Unlike robo-advisors that manage your money automatically, stock advisors provide specific stock picks that you execute in your own brokerage account. The best stock advisor services include research explanations, portfolio guidance, and track record transparency. You maintain full control of your investments—they just tell you what they’d buy.

What’s the best stock picking service in 2026?

Motley Fool Stock Advisor is the best stock picking service in 2026. With 23.9 years of verified returns (+883.8% vs S&P 500’s +195.8%), 42 ten-baggers, 182 doublers, complete portfolio guidance, and transparent track records for every pick, it remains the gold standard. Its quality GARP methodology is specifically suited to the current 83-point dispersion market where quality stocks outperform and forward index returns are compressed to 6-9%. For data-driven investors with 1-3 year horizons, Alpha Picks offers compelling quant-based returns (+299.6% since 2022 with a 73% win rate).

Is it worth paying for a stock advisor in 2026?

Yes — and the math actually makes stock advisors more valuable now than in recent years. With CAPE at ~40, forward 5-year index returns have compressed to an estimated 6-9% CAGR. That means every point of alpha carries outsized weight: $100K at 7% for 10 years = $197K, while $100K at 11% = $289K — a $92,000 gap. Stock Advisor’s $99/year subscription has generated +883.8% total returns over 23.9 years. Alpha Picks’ $449/year has returned +299.6% in 3.6 years with a 73% win rate. The 83-point dispersion between 2026’s winners (+51.8%) and losers (-30.7%) proves alpha is available to capture. The catch: most subscribers underperform because they sell during drawdowns or take profits too early. The stock advisor provides the picks; you must provide the discipline.

How do I choose a stock advisor?

When choosing a stock advisor, prioritize verified track records over marketing claims. Look for: (1) Transparent performance data including losers, (2) Clear methodology you understand, (3) Holding period that matches your timeline, (4) Price you can justify with your portfolio size, and (5) Refund policy to test risk-free. Compare options in our stock advisor comparison guide.

Which stock picking service has the best track record?

Motley Fool Stock Advisor has the longest and most verified track record among all stock picking services: +883.8% total return over 23.9 years across 504 positions, with 42 ten-baggers, 182 doublers, and a 92.8% win rate on 10+ year holds. It’s recession-tested through 2008, 2020, and 2022. The 65% overall win rate, complete portfolio-building framework, and $99/year new member price make it the lowest-regret choice. For shorter horizons (1-3 years), Alpha Picks’ +299.6% return and 77.8% win rate for 1-3 year holds makes it compelling.

What is the best stock advisor for beginners?

Stock Advisor is best for beginners because it provides more than just stock picks—it includes portfolio strategies (Cautious, Moderate, Aggressive), Foundational Stocks to start with, and clear guidance on position sizing. The 30-day guarantee also reduces risk for first-time subscribers.

Is Motley Fool Stock Advisor worth it?

Yes, for long-term investors who can hold 5+ years. At $199/year (or $99 for new members), Stock Advisor has returned +883.8% since 2002 versus the S&P 500’s +195.8% across 504 positions over 23.9 years. The math works if you follow the strategy — the 92.8% win rate on 10+ year holds with 42 ten-baggers and 182 doublers proves the methodology. In 2026’s 83-point dispersion market (a new 2026 high), the quality GARP approach is particularly well-suited as Energy (+22.5%) and Industrials (+12.8%) lead while enterprise software stays deeply negative (INTU -41%, WDAY -34%). About 35% of picks lose money short-term, so patience and discipline are mandatory.

Stock Advisor vs Alpha Picks: Which is better?

It depends on your time horizon:

- 5+ year horizons: Stock Advisor wins with 23.9 years of data (+883.8%), 92.8% win rate on 10+ year holds, and 42 ten-baggers.

- 1-3 year horizons: Alpha Picks excels with 77.8% win rate and +299.6% returns since 2022 across 91 positions. Stock Advisor uses human analysts with narrative reasoning; Alpha Picks is pure quant with no human discretion. Stock Advisor costs $99-199/year; Alpha Picks costs $449-499/year. Alpha Picks has only 3.6 years of data and is untested in a full recession — a legitimate caveat as AAII bearish sits at 38.1% and 83-point dispersion reaches a new 2026 high. Disinflation is validated (CPI 2.4%) and the VIX has eased to 20.29, but the rotation beneath the surface keeps intensifying.

Are stock picking services worth the money?

Yes, if you follow the system and hold long-term. The best services (Stock Advisor, Alpha Picks, Rule Breakers) have verifiable track records beating the market. But most subscribers underperform because they sell during drawdowns, take profits too early, or cherry-pick stocks without following the framework. The service is worth it; the question is whether you’ll use it correctly.

Can I use multiple stock advisory services?

Yes, but with intention. Complementary combinations work well: Stock Advisor (human conviction) + Alpha Picks (quant validation), or Stock Advisor (core) + Rule Breakers (aggressive growth). Avoid overlapping services that do the same thing. Two stock advisors means twice the picks—make sure you have enough capital to build positions in both stock advisor portfolios.

What’s the difference between stock advisors and research tools?

Stock advisors tell you what to buy; research tools help you decide for yourself. Services like Stock Advisor and Alpha Picks provide specific stock recommendations. Platforms like Morningstar Investor provide data, ratings, and analysis tools but don’t make buy/sell recommendations. Choose based on whether you want guidance or independence.

How much money do I need to use a stock advisory service?

$25,000+ in investable assets is ideal. At smaller portfolio sizes, the annual fee ($99-499) represents too large a percentage of your capital. If you have $10,000 to invest, a $199 fee is 2% annually—you need to beat the market by 2% just to break even on the subscription.

Do stock advisory services actually beat the market?

The best ones do, with verified track records. Stock Advisor: +883.8% since 2002 (vs S&P +195.8%) with 42 ten-baggers and 182 doublers. Alpha Picks: +299.6% since 2022 (vs S&P +83%) with 73% win rate. Rule Breakers: +313.8% since 2004 (vs S&P +169%) with 60 ten-baggers. These returns are documented and verifiable across every position. However, past performance doesn’t guarantee future results, and most subscribers underperform the service’s track record due to behavioral mistakes — selling during drawdowns or taking profits too early.

What’s the best free alternative to paid stock advisors?

Index funds. If you’re not willing to pay for stock picking and follow the system, a low-cost S&P 500 index fund will outperform most active investors. Beating the market through stock selection requires either significant time investment (doing your own research) or paying for expertise (stock advisory services). There’s no free shortcut that consistently works.

How long should I hold stock advisor picks?

5+ years minimum, ideally longer. Stock Advisor’s data shows that first-year picks have modest win rates (~60%), but 10+ year holds have 98% win rates with 4,185% average returns. Alpha Picks shows similar patterns: under 1 year = 64.9% win rate, 1-3 years = 77.8% win rate. The math only works if you hold.

What happens if a stock advisor pick loses money?

Hold unless the thesis breaks. About 35% of Stock Advisor picks lose money. But the winners (+2,039% average) more than compensate for the losers (-36.8% average). Selling losers locks in losses and prevents recovery. The exception: if the fundamental thesis changes (company strategy shifts, competitive position deteriorates), selling may be appropriate.

Do stock advisors recommend AI stocks?

Yes, but AI is creating winners AND losers — and the spread is massive. Memory/storage stocks powered by AI demand averaged ~83% (SNDK +155%, WDC +75%, MU +48%), while enterprise software remains deeply negative (CRM -29%, NOW -29%, WDAY -34%, INTU -41%) and Financials sit at -4.0% YTD. Stock Advisor and Rule Breakers have recommended AI beneficiaries like Nvidia early in their growth cycles. Alpha Picks’ quant factors naturally surface AI winners through momentum and earnings revision signals. The 7,624 AI-cited layoffs in January show the dual nature of AI investment: you need services that identify which companies benefit from AI vs. which get disrupted. Motley Fool Epic Plus includes Tom Gardner’s dedicated AI Playbook portfolio.

Are stock advisor returns realistic for new subscribers?

Track records are real, but your experience depends on timing and behavior. Stock Advisor’s +883.8% return includes subscribers who joined in 2002 and held through multiple 40%+ drawdowns. If you joined in late 2021 at peak growth valuations, many picks are still underwater. The methodology works over 5+ year periods, but your entry point and holding discipline determine your personal results. The current entry point is actually favorable: CAPE at ~40 means valuations are elevated, but 83-point dispersion (a new 2026 high) and intra-sector bifurcation (memory/storage ~83% vs enterprise software -34%) create exceptional opportunities for quality stock picking. The VIX declining to 20.29 and disinflation validated at 2.4% CPI suggest the fear premium is fading, but the rotation beneath the surface continues deepening. The 30-day guarantee lets you test whether you can follow the system.

How do stock advisors perform during recessions?

The best ones outperform during downturns. Stock Advisor beat the market during 2008, 2020, and 2022 corrections—not by avoiding losses, but by recovering faster. Morningstar’s quality/moat focus provides natural downside protection. The key is that through-cycle track records matter more than peak-market performance. Services with only 3-5 years of data (like Alpha Picks or 7investing) haven’t been tested through a full recession.

Should I follow stock advisor picks exactly or modify them?

Follow the system first, then adapt based on experience. Most underperformance comes from subscribers who cherry-pick “exciting” stocks while ignoring “boring” ones, or who sell winners too early. Start by following the framework exactly—portfolio allocations, position sizing, holding periods. After 1-2 years of experience, you’ll understand which aspects to personalize. The biggest mistake is thinking you know better than a 23-year track record.

What’s the difference between stock advisors and robo-advisors?

Stock advisors tell you what to buy; robo-advisors invest for you. Robo-advisors (Betterment, Wealthfront) automatically manage diversified ETF portfolios—hands-off but limited to index-like returns. Stock advisors (Stock Advisor, Alpha Picks) recommend individual stocks you buy yourself—more work but potential for outperformance. Choose robo-advisors if you want zero involvement; choose stock advisors if you want to beat the market and are willing to follow a system.

How do tariffs and policy changes affect stock advisor picks?

Through-cycle services adapt; newer services are unproven. Policy uncertainty (tariffs, Fed moves, government layoffs) creates sector winners and losers. Stock Advisor’s methodology has navigated multiple policy regimes over 23 years. Morningstar’s moat analysis identifies companies with pricing power that can pass through tariff costs. The key is choosing services proven through different policy environments, not just the most recent bull market.

Can I use a stock advisor with a small portfolio ($5,000-$10,000)?

Yes, but consider the math carefully. At $10,000, Stock Advisor’s $99 fee is 1% of your capital—you need to beat the index by 1% just to break even. With fewer positions (5-7 stocks vs recommended 15-25), you’re also less diversified. The 30-day guarantee lets you test whether the picks are worth it at your portfolio size. Many investors start with index funds until they reach $25,000+, then add stock advisors.

How do I know if a stock advisor service is legitimate?

Look for transparent, verified track records that include losers. Legitimate services like Stock Advisor publish every historical pick with dates and returns—winners and losers. Red flags include: cherry-picked results, no historical data, guaranteed returns, pressure tactics, or testimonials without verifiable performance. The best stock advisors welcome scrutiny because their numbers hold up. Services with 30-day money-back guarantees (Stock Advisor, Epic) also signal confidence in their product.

What’s the best stock advisor for dividend investors?

Motley Fool Dividend Investor (included in Epic) or Morningstar Investor. Most services on this list focus on growth stocks, not income. Dividend Investor specifically targets reliable dividend payers with growth potential. Morningstar’s Fair Value estimates help identify undervalued dividend stocks. For pure dividend focus, consider dedicated dividend newsletters outside this list. If you want both growth and income, Epic ($299/year, discount auto-applied) includes Dividend Investor alongside growth-focused services.

Which stock advisor is best for the current 2026 market?

CAPE at ~40 has compressed expected 5-year index returns to 6-9% CAGR — making alpha from stock advisors more valuable than it’s been in years. The gap between $100K compounding at 7% vs 11% over a decade is $92,000. Meanwhile, 83-point dispersion (a new 2026 high) means individual stock selection can add dramatically more value than usual. The sentiment picture (AAII bearish at 38.1%, bull-bear spread at +0.4%) combined with a declining VIX (20.29) creates a contrarian entry point. When bearish exceeds 35% and VIX stays under 20-21, forward 12-month returns historically average 12-15%. Disinflation is validated (CPI 2.4%, lowest since May 2025) and the market has rallied to ~6,883:

- Stock Advisor (EXCEPTIONAL fit): Quality GARP methodology thrives when fear subsides and rotation deepens. 883.8% total return, 42 ten-baggers, and 92.8% win rate on 10+ year holds prove it captures compounding alpha across cycles. With the VIX declining and dispersion hitting new highs, 24 years of through-cycle proof provides conviction to stay invested.

- Alpha Picks (GOOD fit): Quant factors naturally surface intra-sector rotation winners. 299.6% total return and 73% win rate capture the shift from enterprise software (

-34%) to memory/storage (+83%). Caveat: untested in consumer-led slowdown. - Morningstar (EXCEPTIONAL fit): Fair value discipline is critical at CAPE ~40. With the 10-year yield at 4.09% and CPI confirmed at 2.4%, knowing what’s cheap vs. expensive as the bond market prices in rate cuts prevents overpaying. Perfect 4/4 environment alignment.

- Rule Breakers (SITUATIONAL fit): Tech is bifurcated — memory/AI surging (+83% avg) but enterprise software deeply negative (-34% avg). 60 ten-baggers over 21 years prove multi-bagger potential remains for decade-long horizons, but the 196-point intra-tech gap (SNDK +155% vs INTU -41%) means picking the right innovation stocks matters more than ever.

The key insight: when index returns compress, every point of alpha matters more. Stock advisors that identify sector rotations early and avoid overvalued sectors directly address the forward return challenge.

How does stock picking compare to index investing in 2026?

In 2026, stock picking has a clear mathematical advantage over indexing — if you use proven services. The S&P 500 sits at ~6,883 — up just +0.68% YTD. Index investors captured almost nothing. Meanwhile, the 83-point dispersion (a new 2026 high) between winners (+51.8% average for top 20) and losers (-30.7% average for bottom 20) means stock pickers who identified the right companies captured outsized returns. Memory/storage stocks averaged ~83%, Energy +22.5%, Industrials +12.8%, while enterprise software sits at -34% and Financials at -4.0%.

With CAPE at ~40, forward 5-year index returns are expected at 6-9% CAGR — below the historical 10.2% average. That compression makes alpha from stock selection the primary wealth-building lever. Consider: $100K at 7% (passive) reaches $197K in a decade. $100K at 11% (with stock advisor alpha) reaches $289K — a $92,000 difference. Stock Advisor’s 883.8% total return over 23.9 years and Alpha Picks’ 299.6% in 3.6 years demonstrate that quality stock picking services consistently beat compressed index returns. The 196-point gap within technology alone (SNDK +155% vs INTU -41%) proves this isn’t about sector rotation — it’s about stock selection. The caveat: you must follow the system, hold through volatility, and diversify across 15-25 positions.

Are stock advisors worth it after the market has already gone up so much?

Yes — and the math actually makes them more valuable now, not less. With CAPE at ~40, expected 5-year index returns have compressed to 6-9% CAGR versus the historical 10.2%. That compression means alpha from stock selection carries outsized weight. Consider: $100K compounding at 7% (passive) reaches $197K in a decade, while $100K at 11% (with advisor alpha) reaches $289K — a $92K difference.

The opportunity is real because dispersion hit 83 points — a new 2026 high. Top 20 stocks average +51.8% while bottom 20 average -30.7%. Within tech alone, memory/storage averaged ~83% while enterprise software averaged -34%. The Fed holds at 3.50-3.75% but the bond market has moved decisively — the 2-year yield sits at 3.47% (below fed funds), the 10-year at 4.09%. The yield curve (2s10s) at +62 bps maintains a healthy positive slope. CPI confirmed at 2.4% (lowest since May 2025) and disinflation is validated. AAII bears at 38.1% nearly match bulls at 38.5%. When the index delivers muted returns (+0.68% YTD) but individual stocks diverge by 83 points, stock advisors become the primary lever for building wealth above the compressed baseline.

What happens to stock advisor picks if we enter a recession in 2026?

Expect 30-50% portfolio drawdowns, but through-cycle services recover. Stock Advisor and Rule Breakers have survived 2008, 2020, and 2022 — each time falling harder than the index but recovering faster. The signals are mixed but worth watching: the VIX has eased to 20.29 and tech rebounded, but consumer confidence remains at a 12-year low, AAII bearish sits at 38.1%, and the rotation keeps intensifying (83-point dispersion, a new 2026 high). The downside scenario (consumer-led slowdown) still carries meaningful probability. If a recession concerns you: (1) Use services with multi-decade track records (Stock Advisor’s 23.9 years over Alpha Picks’ 3.6 years), (2) Consider Morningstar for quality/moat-focused research, (3) Maintain proper diversification (25+ positions), and (4) Keep cash reserves so you don’t sell at the bottom. The worst outcome is panic-selling during a downturn.

How do I build a portfolio using stock advisor picks?

Start with 10-15 positions across different sectors, then add monthly. Most stock advisors recommend building to 25+ positions over 12-18 months. Follow this framework: (1) Begin with “Foundational Stocks” or “Top 10” lists—these are highest-conviction picks, (2) Allocate equal amounts to each position (avoid overweighting “favorites”), (3) Add new picks monthly rather than deploying all capital at once, (4) Reinvest dividends and add fresh capital to new recommendations. The key is diversification across sectors and position sizes—no single pick should exceed 5% of your portfolio initially.

What’s the best strategy when stock advisor picks conflict with each other?

Diversification is the strategy—own both positions if you have the capital. Different stock advisors using different methodologies will naturally disagree. Stock Advisor might recommend a quality growth company while Alpha Picks flags a value play in the same sector. This isn’t a problem—it’s portfolio construction. The services aren’t trying to time the same opportunities; they’re finding different paths to outperformance. If capital is limited, prioritize picks from your primary service and use secondary services for validation or sector exposure you’re missing.

The Bottom Line

You came here with dozens of browser tabs and analysis paralysis. You should leave with one decision.

The 2026 market makes that decision clearer than ever. With CAPE at ~40, forward index returns compressed to 6-9%, and 83-point dispersion (a new 2026 high) separating winners (+51.8%) from losers (-30.7%), the premium on quality stock selection has never been higher. AAII bearish sentiment at 38.1% nearly matches bulls at 38.5%. The VIX has eased to 20.29. CPI confirmed at 2.4% (lowest since May 2025) and the S&P rallied to ~6,883 — but it’s up only +0.68% YTD. Passive indexing in this environment means accepting compressed returns. Quality stock picking means capturing the 83-point spread.

If you’re going to try one stock advisory service, start with Motley Fool Stock Advisor. Not because it’s perfect — nothing is — but because the 23.9-year track record with 883.8% total returns, 42 ten-baggers, and 182 doublers makes it the lowest-regret choice. The quality GARP methodology is specifically suited to bifurcated markets where intra-sector dispersion (memory ~83% vs software -34%) rewards company-level selection. If it doesn’t work for you, you’ll know in 30 days (money-back guarantee) and you can try something else.

For data-driven investors with 1-3 year horizons, pair it with Alpha Picks — the 299.6% total return and 73% win rate from pure quant methodology complement Stock Advisor’s human conviction.

The bigger risk isn’t picking the “wrong” service. It’s spending another year “researching” while your money sits in cash earning less than inflation — or worse, indexing passively while 83 points of dispersion reward those who pick the right stocks.

Imperfect action beats perfect paralysis. Every time.

Related Stock Advisor Resources

Looking for more in-depth analysis? Explore our stock advisor research:

- How to Use Stock Picking Services Effectively — Maximize your returns

- Best Stock Research Tools — For DIY investors

- Best Investment Newsletters — Alternative stock advisors

- Portfolio Construction Guide — Build around stock advisor picks