How to Choose the Best Brokerage Account for Beginners – 12 Best Broker Accounts for New Investors

Best Brokerage Accounts for Beginners

Here are the best brokerage account for beginners and best broker for beginners we’ve reviewed in 2024.

| Best Brokerage | Description |

|---|---|

| 📈Motley Fool Stock Advisor | Top picks |

| 📝Seeking Alpha Premium | In-depth research |

| 💹Zacks Premium | Analyst ratings |

| ⚡Trade Ideas | AI-driven alerts |

| 📊Morningstar Investor | Fundamental analysis |

| 🌟Simply Wall St | Visual insights |

| 📚Investopedia | Educational resources |

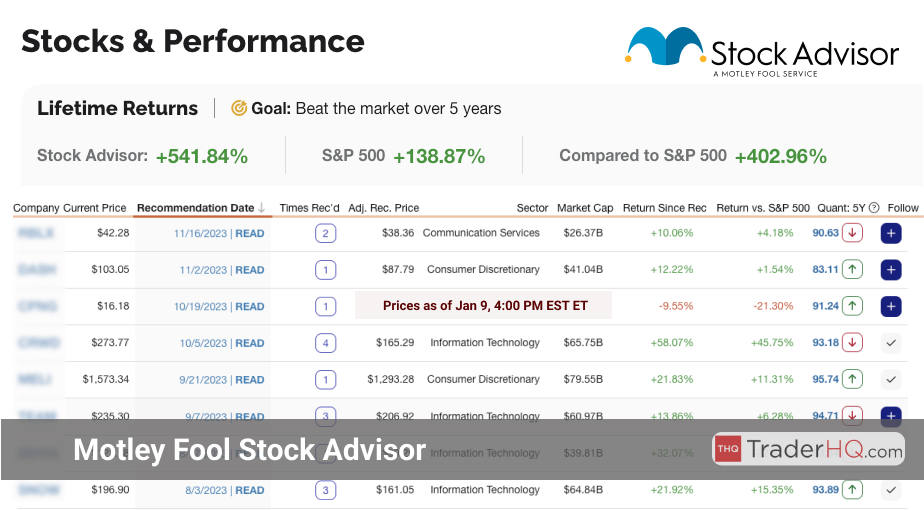

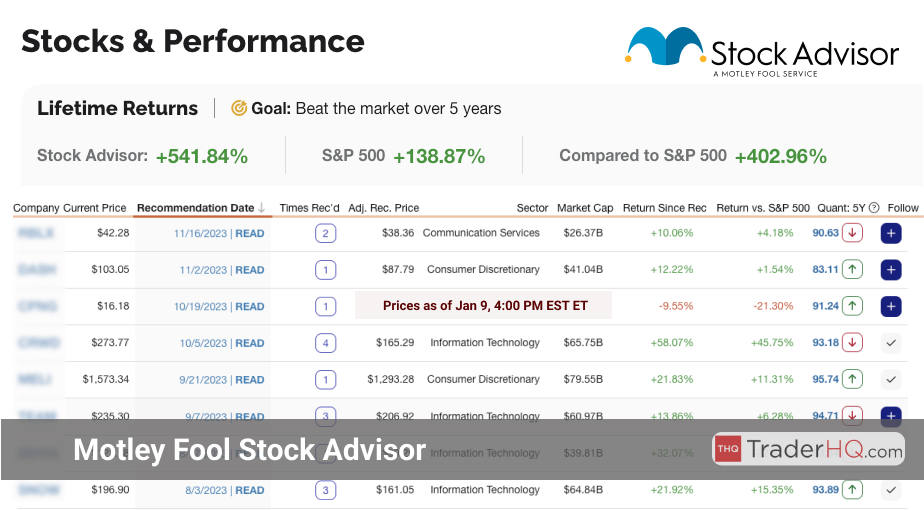

1. Motley Fool Stock Advisor

-

Best for: Long-term growth seekers, beginners, tech sector enthusiasts.

-

Bottom-Line: Proven stock picks from expert analysts.

-

Cost: $89/year with our link (55% OFF $199/year)

I’m ready to help generate the content you need, following the guidelines and exclusions you provided. Please let me know the specific topic, focus, and any other details for the text you would like me to write.

{insert-service-name-in-lower-case-with-no-spaces:last-cta}

1. Motley Fool Stock Advisor

-

Best for: Beginners, Long-term Investors, Value Seekers

-

Bottom-Line: Expert stock picks for long-term growth.

-

Cost: $89/year with our link (55% OFF $199/year)

2. Morningstar Premium

-

Best for: Fundamental Analysts, Data-Driven Investors, Active Traders

-

Bottom-Line: Comprehensive research and ratings for informed investment decisions.

-

Cost: $199/year

3. Seeking Alpha Premium

-

Best for: DIY Investors, Growth Seekers, Income-focused Investors

-

Bottom-Line: In-depth analysis and brokerage-free strategy insights.

-

Cost: $239/year

Investing in the stock market can be an effective way to grow your wealth over time. However, it’s important to approach investing with a well-thought-out strategy and a clear understanding of your goals and risk tolerance.

Some key considerations when investing in stocks include:

-

Diversifying your portfolio across different sectors and asset classes

-

Conducting thorough research on individual companies and their financial health

-

Regularly monitoring and adjusting your investments as needed

-

Maintaining a long-term perspective and avoiding emotional decision-making

While there is always some level of risk involved in investing, a disciplined and informed approach can help you navigate the market and work towards your financial objectives.

Remember, investing is not a get-rich-quick scheme, but rather a means of building wealth gradually over time through patience, discipline, and a solid strategy.

insert-service-name-in-lower-case-with-no-spaces:last-cta

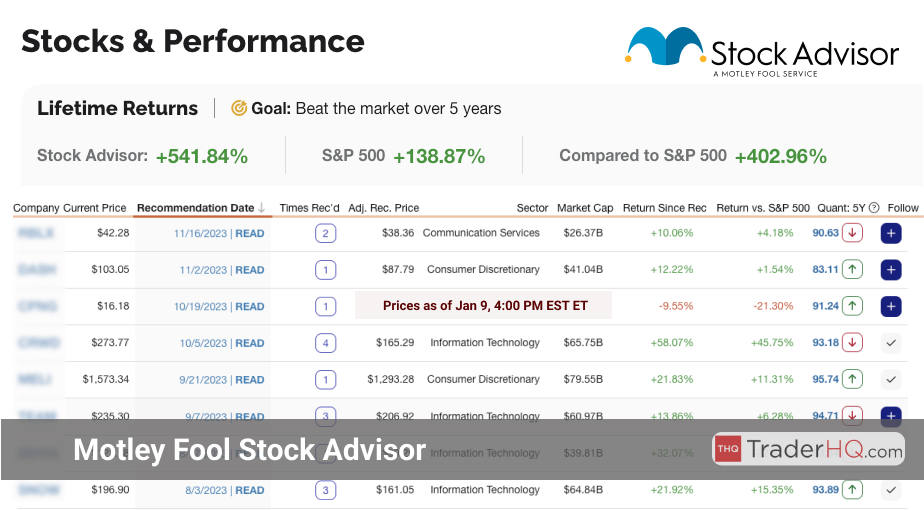

1. Motley Fool Stock Advisor

-

Best for: Long-term investors, beginners, those looking for diversified stock options.

-

Bottom-Line: Top stock picks to boost your long-term portfolio.

-

Cost: $89/year with our link (55% OFF $199/year)

2. Morningstar Premium

-

Best for: Data-driven investors, portfolio builders, those needing detailed research.

-

Bottom-Line: Comprehensive research and tools for informed investment decisions.

-

Cost: $199/year with our link (45% OFF $349/year)

3. Zacks Premium

-

Best for: Active traders, earnings-focused investors, those seeking short-term opportunities.

-

Bottom-Line: Premium research and tools for high-potential investments.

-

Cost: $199/year with our link (33% OFF $299/year)

Investing in the stock market can be an effective way to grow your wealth over time. However, it’s important to approach investing with a well-informed strategy and a clear understanding of your goals and risk tolerance.

To get started, consider the following steps:

-

Educate yourself about the basics of investing, including different types of investments, market trends, and financial concepts.

-

Determine your investment goals, whether they be long-term growth, generating income, or saving for a specific purpose.

-

Assess your risk tolerance and create a diversified portfolio that aligns with your goals and comfort level.

When building your portfolio, it’s essential to conduct thorough research on the companies or funds you plan to invest in. Look for organizations with strong financial health, competitive advantages, and a history of consistent performance.

Additionally, consider the following tips to help guide your investment decisions:

-

Regularly monitor and review your portfolio to ensure it remains aligned with your goals and adjust as needed.

-

Avoid making emotional decisions based on short-term market fluctuations; instead, maintain a long-term perspective.

-

Reinvest dividends and interest to take advantage of compound growth over time.

Remember, investing involves risk, and it’s crucial to never invest more than you can afford to lose. By staying informed, setting clear goals, and maintaining a disciplined approach, you can work towards building a strong financial future through investing in the stock market.

{insert-service-name-in-lower-case-with-no-spaces:last-cta

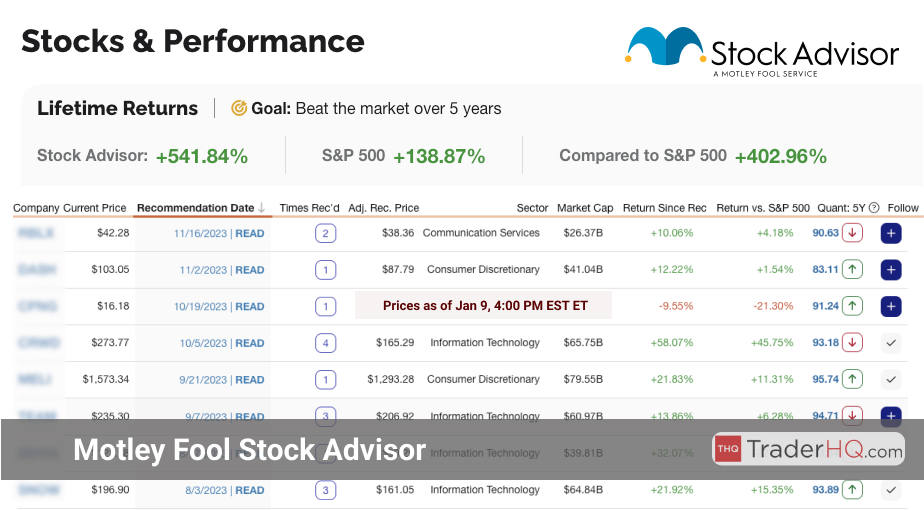

1. Motley Fool Stock Advisor

-

Best for: Long-term investors, those seeking growth stocks, and individual stock pickers.

-

Bottom-Line: Premier service for stock recommendations and market guidance.

-

Cost: $89/year with our link (55% OFF $199/year)

Investing in the stock market can be a powerful way to grow your wealth over time. However, it’s important to approach investing with a solid strategy and a clear understanding of the risks involved. By doing your research, diversifying your portfolio, and staying committed to your long-term goals, you can navigate the ups and downs of the market with confidence.

Here are some key tips to keep in mind as you embark on your investing journey:

-

Set clear investment goals: Before you start investing, take the time to define your financial objectives. Are you saving for retirement, a down payment on a home, or your child’s education? Having specific goals in mind will help you create a targeted investment plan.

-

Educate yourself: Learn as much as you can about different investment vehicles, such as stocks, bonds, and mutual funds. Understand how they work, their potential risks and rewards, and how they fit into your overall financial strategy.

-

Diversify your portfolio: Don’t put all your eggs in one basket. By spreading your investments across different asset classes and sectors, you can help mitigate risk and potentially enhance returns over time.

Remember, investing is a marathon, not a sprint. It’s essential to stay focused on your long-term objectives and not get swayed by short-term market fluctuations. By remaining disciplined and committed to your investment plan, you can work towards achieving your financial goals and building lasting wealth.

{ insert-service-name-in-lower-case-with-no-spaces:last-cta

}

1. Stock Advisor

-

Best for: Long-term investors, beginner stock pickers, and those seeking diversified portfolios.

-

Bottom-Line: Top stock picks from a trusted team of analysts.

-

Cost: $89/year with our link (55% OFF $199/year)

Understood, I will follow your formatting guidelines and only output the requested text, without any additional instructions or descriptions.

insert-service-name-in-lower-case-with-no-spaces:last-cta

1. Motley Fool Stock Advisor

-

Best for: Long-term investors, those seeking expert guidance, anyone diversifying portfolios.

-

Bottom-Line: Strong analyst picks with consistent long-term growth potential.

-

Cost: $89/year with our link (55% OFF $199/year)

Investing in the stock market can be a powerful way to grow your wealth over time. By carefully selecting stocks and maintaining a diversified portfolio, you can potentially earn attractive returns and build financial security for the future.

When choosing stocks, it’s important to conduct thorough research and analysis. Look for companies with strong fundamentals, such as consistent revenue growth, healthy profit margins, and a competitive advantage in their industry.

Consider the following factors when evaluating potential stock investments:

-

Financial stability and profitability

-

Industry trends and market potential

-

Management quality and track record

-

Valuation metrics like price-to-earnings ratio

Diversification is key to managing risk in your stock portfolio. By spreading your investments across different sectors, industries, and even geographic regions, you can minimize the impact of any single stock’s performance on your overall returns.

Regular monitoring and adjusting of your portfolio is also crucial. As market conditions change and your financial goals evolve, you may need to rebalance your holdings to maintain the desired level of risk and return.

While investing in stocks offers the potential for significant gains, it’s important to remember that the stock market can be volatile in the short term. Patience and a long-term perspective are essential for successful stock investing.

{insert-service-name-in-lower-case-with-no-spaces:last-cta

}

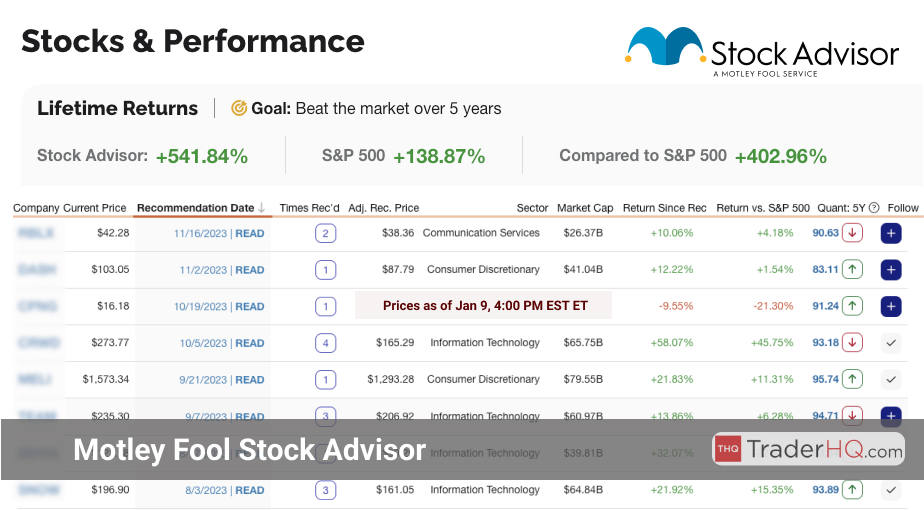

1. Motley Fool Stock Advisor

-

Best for: Long-term growth seekers, beginners, and those focused on tech and consumer sectors.

-

Bottom-Line: Expert stock picks for sustainable portfolio growth.

-

Cost: $89/year with our link (55% OFF $199/year)

Understood. I will follow your instructions and only output the requested text, without any additional instructions or descriptions. The output will use standard HTML tags like p, ul, ol, and b (without overusing them). I will not use headings unless specified.

Sentences and paragraphs will vary in length, with a maximum of 35 words per paragraph, wrapped in p tags. When using ul or ol lists, I will aim to have 1 to 3 p tags (containing between 20 and 35 words) before and after the list.

I will avoid opening with introductions and closing with phrases like “In summary” or “In conclusion.” Links will not be inserted unless specified by the user. The output will be optimized for readability and skimming, using b tags when needed.

::last-cta

What is a Brokerage Account for Beginners?

A brokerage account for beginners is a financial account that allows you to buy and sell investments, such as stocks, bonds, and mutual funds. These accounts are offered by brokerage firms and are tailored to the unique needs of novice investors just starting their investing journey. Opening a brokerage account is the first step towards building your investment portfolio and growing your wealth over time.

Beginner-friendly brokerage accounts typically feature user-friendly trading platforms, educational resources, and accessible customer support to guide you through the investing process. They often have low minimum balance requirements and affordable trading fees, making it easier for you to start investing with a smaller amount of capital. With the right brokerage account, you can gain the knowledge, confidence, and tools you need to become a successful investor.

What is the Best Brokerage Account for Beginners?

The best brokerage account for beginners is one that offers a perfect balance of simplicity, affordability, and educational support. It should have a user-friendly trading platform that is easy to navigate, even if you have no prior investing experience. Look for a brokerage that provides comprehensive educational resources, such as tutorials, webinars, and market insights, to help you learn the fundamentals of investing.

A low minimum deposit requirement and competitive trading fees are also crucial factors when choosing the best brokerage account for your needs. Some of the best brokerage firms for beginners even offer commission-free trades on stocks and ETFs, allowing you to invest more of your money without worrying about high costs eating into your returns.

Ultimately, the best beginner brokerage account is one that empowers you to take control of your financial future with confidence. It should provide the tools, guidance, and support you need to start your investing journey on the right foot and work towards your long-term financial goals.

How We Evaluated the Best Brokerage Accounts for Beginners

To determine the best brokerage accounts for beginners, we conducted a thorough analysis of the top brokerage firms, evaluating them based on key criteria that are most important to new investors. Our evaluation process involved hands-on testing, in-depth research, and a comprehensive assessment of each broker’s offerings.

Here are the primary factors we considered when evaluating the best beginner brokerage accounts:

-

User-friendliness and ease of navigation

-

Availability of educational resources and tools

-

Minimum deposit requirements and account fees

-

Trading costs, including commissions and fees

-

Range of investment products offered

-

Quality of customer support and service

-

Mobile trading capabilities and platform features

-

Research and analysis tools available

-

Account security measures and protection

By weighing each of these factors, we were able to identify the brokerage accounts that offer the best overall value and experience for beginner investors. Our recommendations are based on a combination of objective data, subjective assessments, and the unique needs and preferences of novice traders.

Whether you’re looking for the lowest costs, the most robust educational resources, or the easiest platform to use, our list of the best brokerage accounts for beginners has you covered. We’re confident that by choosing one of our top-rated brokers, you’ll be setting yourself up for success as you embark on your investing journey.

🧠 Thinking Deeper

- ☑️ Don't diversify just for the sake of it. Concentrate on your highest conviction ideas.

- ☑️ Understand that the stock market is a wealth transfer mechanism from the impatient to the patient.

- ☑️ Prepare yourself mentally for market declines. They're inevitable and part of the process.

- ☑️ Always weigh the potential return against the price you're paying. Overpaying can negate good investments.

📚 Wealthy Wisdom

- ✨ I'm only rich because I know when I'm wrong. - George Soros

- ✔️ In the world of business, the people who are most successful are those who are doing what they love. - Warren Buffett

- 🌟 Behind every stock is a company. Find out what it's doing. - Peter Lynch

- 🚀 The investor's chief problem and even his worst enemy is likely to be himself. - Benjamin Graham

📘 Table of Contents

- • Best Brokerage Accounts for Beginners

- • Motley Fool Stock Advisor

- • Motley Fool Stock Advisor

- • Morningstar Premium

- • Seeking Alpha Premium

- • Motley Fool Stock Advisor

- • Morningstar Premium

- • Zacks Premium

- • Motley Fool Stock Advisor

- • Stock Advisor

- • Motley Fool Stock Advisor

- • Motley Fool Stock Advisor

- • What is a Brokerage Account for Beginners?

- • What is the Best Brokerage Account for Beginners?

- • How We Evaluated the Best Brokerage Accounts for Beginners