Bull Call Spread Options Strategy Explained

Published

Published

Related: Best Stock Advisor, Stock Advisor Review, Best Investment Advice Websites, How to Spot and Interpret the Three-Drive Chart Pattern

Stock options provide a great way for traders to protect their underlying stock positions or speculate on future price direction. While options strategies are widely used for speculation, they are usually riskier than straight equity strategies given their potential for complete loss. Traders can limit their losses using so-called spreads that establish higher and lower bounds to their trades.

In this article, we’ll take a look at bull call spreads and how they can be used to speculate on an increase in a stock’s price without the risk of a naked call option.

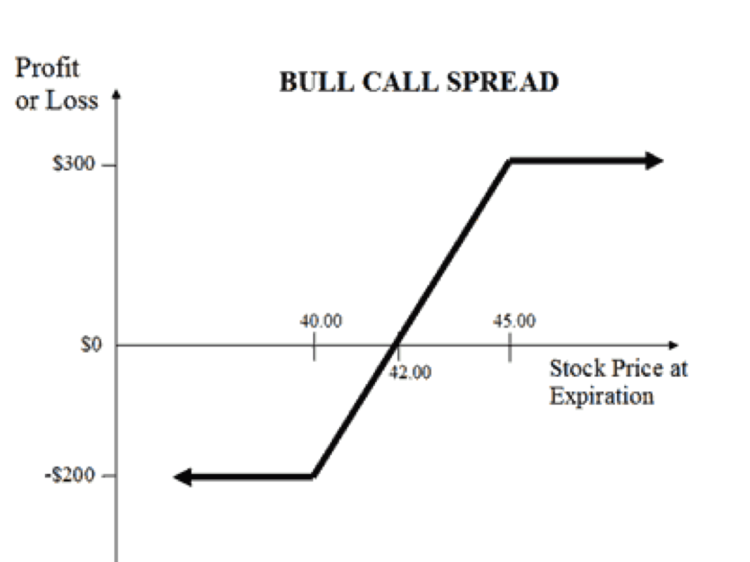

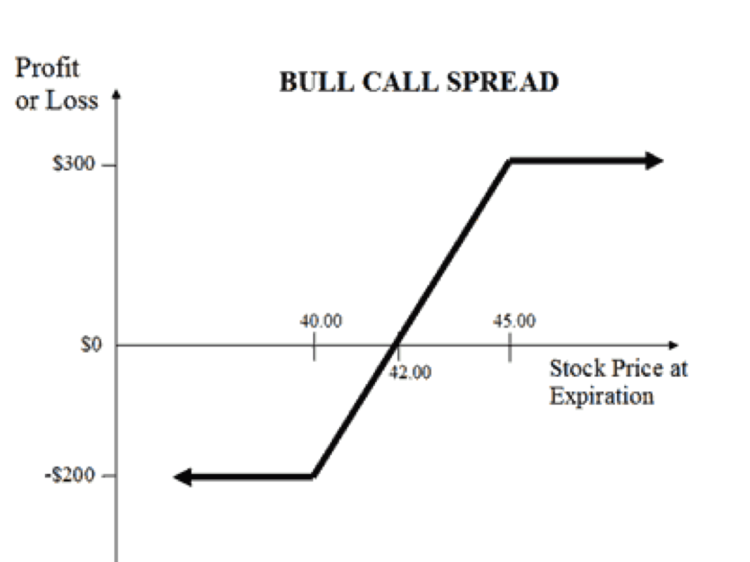

A bull call spread strategy involves two call options with the same expiration date but different strike prices. By writing a short call and receiving a premium, the trader can offset the cost of the long call, although the upside potential is capped. The trade’s dynamics depend on the strike prices of the options, which controls the trade’s profit potential and the upfront cost to establish the position.

Be sure to also see the 7 Options Trading Mistakes Beginners Can Avoid.

The maximum profit is achieved when the stock price meets or exceeds the higher strike price, producing a profit equal to the difference between the two strike prices, less the capital outlay paid to establish the position. Meanwhile, the maximum loss is limited to the cost of both call options expiring worthless, which is equal to the initial outlay paid for the position (net of the premium received).

The long versus short nature of the position means that volatility, time decay, and many other traditional options risks are somewhat mitigated. After all, something that hurts a long call option would presumably help the short call. The only remaining risks to be aware of include early assignment risk (common near ex-dividend dates) and expiration risks associated with assignments.

See also How to Profit in a Sideways Market with Options.

The bull call spread strategy is a bet on a rise in the underlying stock’s price over the duration of the trade. While traders could simply purchase the underlying stock or simple call options, the bull call spread strategy enables traders to limit their upfront capital outlay and minimize their downside risk with a price floor, providing a lot more control over the performance of the trade.

The strategy differs from a bull put spread in that the initial outlay of cash is known rather than guessed in the future. In the case of a bull put spread, the trader receives a known initial cash inflow in exchange for a possible future outlay, whereas the bull call spread requires an initial outlay for an unknown eventual return. The carry adjusted profit or loss payoff profiles for the two trades are exactly the same.

See also the Best Investments of All Time.

In general, the strategy works best when a trader has a bullish short- and mid-term outlook on the underlying stock. While a long-term bullish outlook isn’t always necessary, those with a bearish outlook may want to think twice before utilizing the strategy. Timing the market with short-term options strategies is a very exact art and science that’s difficult to master and usually best to avoid.

Suppose that a trader believeds that a company will report higher earnings next quarter, but purchasing the underlying stock or simple call options is too risky. As an alternative, the trader could use the bull call spread strategy to limit potential losses at the cost of limited upside potential. The benefit is a more defined risk versus reward profile that would limit risk in the event of earnings misses.

Be sure to also read Options 101: American vs. European vs. Exotic.

The underlying stock is trading at $52.00 per share with an SEP 60 call trading at $500 and an SEP 55 call trading at $300. By simultaneously buying the SEP 60 call and selling the SEP 45 call, the trader pays $200 to enter into the position.

The bull call spread strategy provides traders with a great way to place calculated bets on an underlying stock’s move higher. By purchasing one long and one short call option simultaneously, traders can reduce the cost of a long call option with the premium of a short call option, while creating a price ceiling and floor for the trade. However, traders should be aware of the risks associated with early assignment.

If you’ve enjoyed this article, sign up for the free TraderHQ newsletter; we’ll send you similar content weekly.

Did you know that...

Quotes of the Day:

More Stock Market Resources: