Stock Market Futures: Looking at All of the Options

Published

Published

Related: Best Stock Advisors, Motley Fool Stock Advisor, Investment Advice Sites, How to Spot and Interpret the Three-Drive Chart Pattern

Equity index futures are cash-settled futures contracts that traders use to either hedge their portfolios or speculate on future price movements. Since there are no physical commodities being traded, equity index futures are valued using the risk-free interest rate minus the index’s estimated dividend yield. In this article, we’ll take a look at the most popular equity index futures in the United States.

Dow Jones Industrial Average

The Dow Jones Industrial Average (“DJIA”) is one of the most popular U.S. stock market indexes, consisting of 30 of the largest and most influential publicly traded U.S. company's. According to the CME Group, the index trades in $10.00 index point values during regular futures trading hours with quarterly contract months ending in March, June, September, and December on the third Friday of the month.

In addition to the standard DJIA futures contracts, traders can also buy and sell Big Dow futures that are issued in $25.00 point values or Dow E-Minis that are issued in $5.00 point values. Big Dow futures might make more sense for larger institutions, while smaller individual traders primarily use Dow E-Minis. There may also be differences in liquidity in these groups based on the size of the contracts [see also Ten Commandments of Futures Trading].

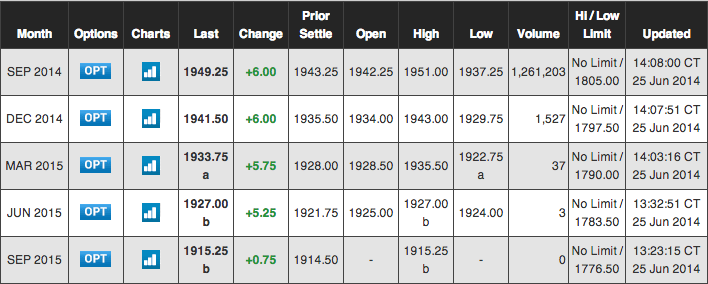

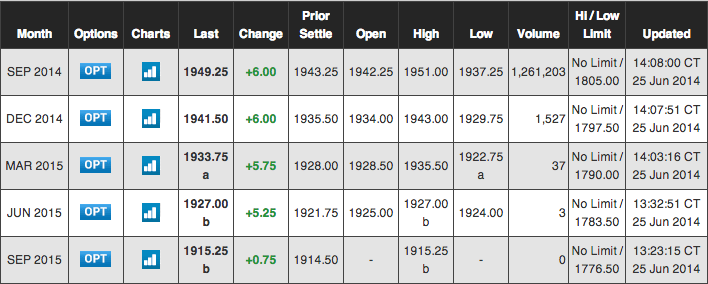

S&P 500

The Standard & Poor’s 500 (“S&P 500”) is another popular U.S. stock market index given its greater breadth, consisting of the 500 largest publicly traded U.S. company's. According to the CME Group, the index trades in $25.00 index point values during regular futures trading hours with quarterly contract months ending in March, June, September, and December on the third Friday of the month.

In addition to the standard S&P 500 futures contracts, traders can also buy and sell S&P 500 E-Mini contracts with $12.50 point values. Larger institutional traders might prefer the traditional futures, while smaller individual traders might appreciate the smaller contract sizes offered by the e-minis. But again, there may be liquidity differences between the two different contract sizes.

NASDAQ 100

The NASDAQ 100 is a popular U.S. stock market index tracking technology stocks, consisting of the largest 100 U.S. publicly traded company's trading on the NASDAQ stock exchange. According to the CME Group, the index trades in $100.00 index point values during regular futures trading hours with quarterly contract months ending in March, June, September, and December on the third Friday of the month.

In addition to the standard NASDAQ 100 futures contracts, traders can also buy and sell NASDAQ 100 E-Mini contracts with $20.00 point values. NASDAQ Composite and NASDAQ Biotechnology futures contracts are also available in order to achieve either greater diversification beyond the 100 largest public company's or specific exposure to biotechnology stocks listed on the exchange, respectively.

Traders looking for specific exposure to certain market capitalizations or industries have a number of different choices, although these futures contracts tend to be less liquid than the aforementioned major equity index futures. In particular, traders should be careful before entering into long-term futures contracts in these niche areas given the lack of liquidity until they come to term.

Some popular alternative index futures include:

Traders can use these specific contracts in order to gain exposure to specific industries or asset classes. For example, a trader may decide to sell S&P Technology e-mini futures if Google or Yahoo were to put out a bearish earnings report. The trader could subsequently profit if these trends were indicative of the technology sector as a whole and future technology earnings reports ended up being bearish.

Equity index futures are cash-settled contracts that enable traders to bet on the future direction of major stock market indexes. For example, the S&P 500 E-Minis are among the most widely traded futures contracts and enable traders to bet on the future direction of the S&P 500 index without having to buy or short-sell the index or exchange-traded fund (“ETF”) associated with the index.

There are many different equity index futures available through exchanges like the CME Group (as mentioned in this article), but traders should be aware that some of the more niche contracts have limited liquidity compared to their mainstream counterparts. Traders should carefully consider these risks before buying and selling futures contracts, especially when they are dated into the distant future.

If you’ve enjoyed this article, sign up for the free TraderHQ newsletter; we’ll send you similar content weekly.

Did you know that...

Quotes of the Day:

More Stock Market Resources: