Nasdaq Futures: What Every Trader Needs to Know

Published

Published

Related: Best Stock Picking Services, Stock Advisor, Best Investment Advice Sites, How to Spot and Interpret the Three-Drive Chart Pattern

Nasdaq futures provide a way for traders to participate in the movements of a basket of stocks listed on the Nasdaq stock exchange. The Nasdaq exchange is a common listing ground for stocks in the technology and biotechnology fields, although there is a wide array of stocks listed on the Nasdaq.

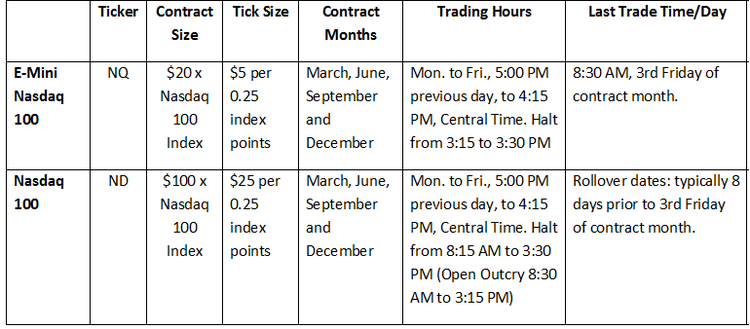

There are two main Nasdaq futures, the E-Mini Nasdaq 100 and the Nasdaq 100, which track a basket of the largest 100 non-financial stocks (Nasdaq 100 Index) listed on the Nasdaq exchange. These futures cater to different types of traders, with the E-Mini Nasdaq 100 being the most popular among Nasdaq futures traders due to its lower cost of trade and high volume.

Be sure to read the Ten Commandments of Futures Trading

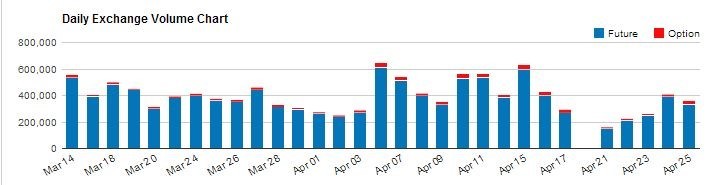

E-mini Nasdaq 100 futures are very liquid, with approximately 200,000 to 600,000 contracts changing hands each day. This provides adequate liquidity for active day traders, hedge funds and longer-term traders.

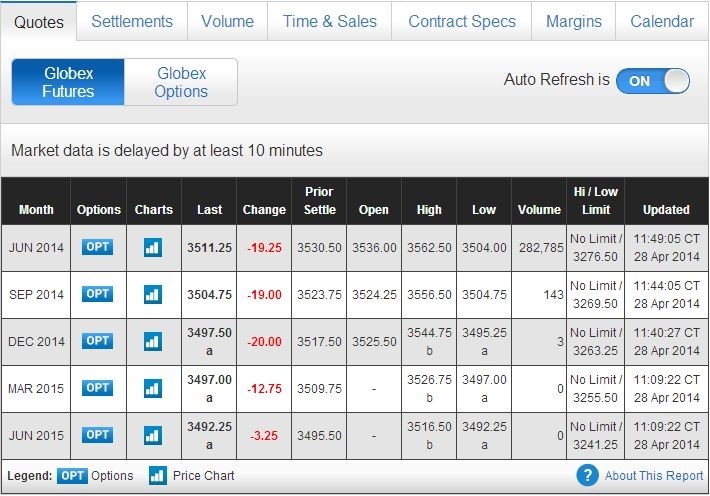

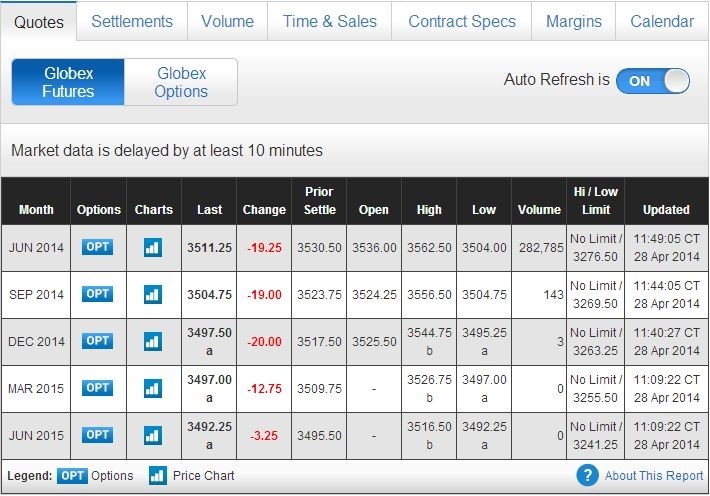

Options contracts can also be traded on E-mini Nasdaq 100 futures, a shown in red on Figure 1.

Nasdaq 100 contracts have different specifications than the E-mini (discussed shortly) so they are less active, with about 100 to several thousand contracts changing hands each day.

Day traders, swing traders, hedgers and hedge funds all trade E-mini Nasdaq 100 futures. The liquid market allows for all these traders to move in and out of positions with ease, and in suitable quantities for each trader class.

Trades are usually taken for speculative reasons, anticipating the future direction of the basket of 100 stocks. Traders can use futures to make money in up or down markets; if you buy a future and it rises you profit, if you short a future and it falls you profit.

Hedgers or hedge funds may also use futures to hedge other positions. For example, if a trader owns a wide assortment of technology stocks the trader may short-sell some E-mini Nasdaq 100 or Nasdaq 100 futures to hedge the stock positions. That way, if the index falls (and likely many of the stocks in the trader’s portfolio as well) the loss will be partially or fully offset by the gain attained by the short futures position.

The Commitment of Traders Report tracks futures position data for commercial traders, speculators, and large traders. The information is publicly available, so all traders can see on which side of the market commercial, large, and speculative positions are being taken. The data does not explain “Why traders are doing what they are doing?” but it shows what major market players are doing.

Each Nasdaq futures contract has an expiry date, on the third Friday of the contract month. Traders typically close out positions before expiry, and re-establish positions in contracts where the expiry date is further out.

Nearly all volume takes place in the futures contract near expiry. For example, in February, nearly all the trading volume will take place in the March contract. In April, nearly all the volume will occur in the June contract. When the June contract is about to expire, volume will shift to the September contract.

All Nasdaq futures are cleared through the Chicago Mercantile Exchange (CME). E-mini Nasdaq 100 futures change hands via electronic transactions only.

Nasdaq 100 futures change hands through electronic transactions as well as open outcry on the trading floor.

Traders who use a broker with access to CME products are able to trade Nasdaq futures electronically.

See also Top 21 Trading Rules for Beginners: A Visual Guide

For current information on Nasdaq futures volume, prices and to see when contracts are expiring, visit www.cmegroup.com. Click on “Products and Trading” and select “Equity Index.”

Choose the Nasdaq futures contract you’d like information on.

The Quotes tab shows daily pricing information. The Settlement tab shows pricing data, estimated volume and prior days open interest. Click the Volume tab for volume and open interest data.

E-mini Nasdaq 100, and Nasdaq 100 futures volume and current prices are also typically available on large financial sites.

Opening a futures position requires that you put up a margin payment. Margins payments vary by the type of Nasdaq future you trade.

Brokers often provide day traders with reduced initial margin rates. Initial margin is the amount needed to initiate a trade for one contract. Maintenance margin is the amount needed in the account to maintain the position.

There are also E-Mini Nasdaq Composite (symbol:QCN) and E-Mini Nasdaq Biotechnology (symbol:BIO) futures, but these futures have no volume on a daily basis. Instead, nearly all traders focus on the E-Mini Nasdaq 100 and Nasdaq 100 futures instead.

Another non-futures alternative is to trade the PowerShares QQQ Trust (Nasdaq:QQQ). It is a unit investment trust (UIT) that mirrors the movements of the Nasdaq 100.

Nasdaq futures are used by all sorts of traders, from day traders to institutional hedgers. All Nasdaq futures are tradable via electronic means during certain hours, and are cleared through the CME. Margin requirements vary by contract, as do tick values. Volume is an issue in E-mini Nasdaq Composite and E-Mini Nasdaq Biotech futures, which will make attaining or liquidating a position difficult. Therefore, retail and institutional traders focus on the E-Mini Nasdaq 100 for its lower margin cost and high volume, with institutional traders or floor traders also trading the Nasdaq 100 futures.

If you’ve enjoyed this article, sign up for the free TraderHQ newsletter; we’ll send you similar content weekly.

Did you know that...

Quotes of the Day:

More Stock Market Resources: