Motley Fool Rule Breakers Review – 2017 Stock Picking Performance Review

Published

Published

It's time to look back at the 2017 performance of the Motley Fool Rule Breakers service and analyze all the stock picks measuring short and long-term performance 4 years later.

For this review we'll analyze the performance of recommendations including the worst performers. We'll break down the performance by the 3 recomendation types to get a complete picture on the Motley Fool Rule Breakers way of investing so you can better decide if the service is right for you.

For those unfamiliar Rule Breakers has three types of recommendations which are...

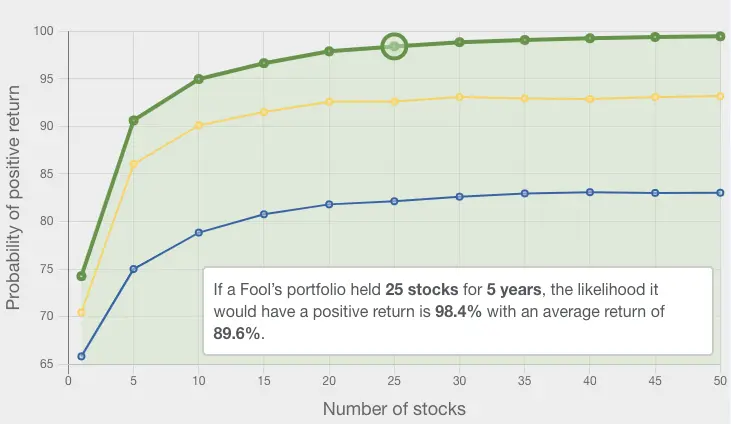

In general the Motley Fool recommends a portfolio construction of at least 25 stocks to have adequate diversity and the foundational stocks are meant to provide a based on which you begin purchasing new recommendations, building up over-time to a portfolio of at least 25 holdings.

The Motley Fool analyzed Stock Advisor performance from March 31, 2002 – November 19, 2021, using an average portfolio from an average month during that time period to help determine the optimal number of holdings and holding period.

They found that the optimal number of stocks to hold is 25 and the optimal minimum holding period is 5 years which produced a 98.4% likelihood of positive returns with an average return of 89.6%.

So without further ado let's dive in and look at the performance of Rule Breakers in 2017.

| Long-term Performance | 1 Year | 2 Years | 3 Years | As of (3/21/22) |

| New Recommendations | 37% | 99% | 161% | 290% |

| Best Buys | 34% | 51% | 90% | 148% |

| Foundational Stocks | 36% | 29% | 102% | 339% |

| Blended Average | 36% | 60% | 117% | 259% |

Here are the 5 best Motley Fool Rule Breakers stock recommendations from 2017.

| Best Picks from 2017 | 1 Year | 2 Years | 3 Years | As of (3/21/22) |

| #1 Best Pick: | 41% | 476% | 726% | 1,852% |

| #2 Best Pick: | 61% | 280% | 481% | 1,200% |

| #3 Best Pick: | 98% | 191% | 310% | 573% |

| #4 Best Pick: | -9% | 259% | 315% | 442% |

| #5 Best Pick: | 51% | 115% | 159% | 406% |

| If $5000 Invested | $2,423 | $13,207 | $19,904 | $44,733 |

The best Rule Breakers pick from 2017 produced a 1,852% return by the 4th year, making a $1000 investment worth $19,522. A $1000 investment in each of these picks would have returned you $44,733 by the fourth year.

Thats the power of compounding returns.

That 19x return on one stock would cancel out 19 other equal weighted investments that go to zero. That is the power of asymmetric risk.

You can only lose 1x the money you invested, while you can gain 5x,10x,100x or more. That's asymmetric returns and the primary draw of stock picking and the value of services like the Motley Fool offers.

Click Here to See the Latest Rule Breakers Picks (Apr 20th, 2024)

While Rule Breakers performance was great, Stock Advisor out-performed in many categories.

Here are the 5 worst performing Motley Fool Rule Breakers recommendations from 2017 to date.

| Worst Picks of 2017 | As of (3/21/22) | |||

| #1 Worst Pick: | -78% | -80% | -91% | -90% |

| #2 Worst Pick: | 2% | -32% | -45% | -80% |

| #3 Worst Pick: | -8% | 28% | 236% | -30% |

| #4 Worst Pick: | -58% | -71% | -23% | -18% |

| #5 Worst Pick: | 63% | 13% | 46% | -13% |

| If $5000 Invested | $4,205 | $3,589 | $6,237 | $2,701 |

The worst Rule Breakers pick from 2017 was down -90% by Mar 21, 2022 making a $1000 investment worth just $105.

A $1000 investment in each of these picks ($5000 total) is worth $2,701 as of Mar 21, 2022.

Based on equal weight investing the 5 best picks returned 17x more money than the losses from the 5 worst picks in 2017.

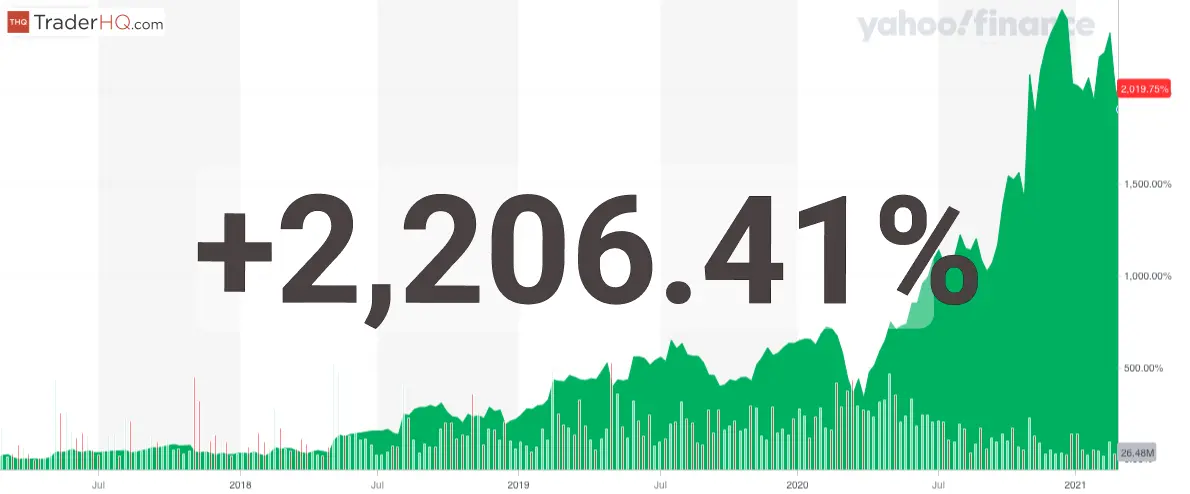

#1 Best Rule Breakers Pick from 2017

#2 Best Rule Breakers Pick from 2017

#3 Best Rule Breakers Pick from 2017

#4 Best Rule Breakers Pick from 2017

#5 Best Rule Breakers Pick from 2017

| Short-term Performance | 3 Months | 6 Months | 9 Months | 1 Year |

| New Recommendations | 19.47% | 21.73% | 37.16% | 37.28% |

| Best Buys | 8.22% | 16.96% | 34.05% | 34.46% |

| Foundational Stocks | 14.40% | 24.02% | 25.07% | 35.78% |

| Blended Average | 14.03% | 20.90% | 32.09% | 35.84% |

Click Here to See the Latest Rule Breakers Picks (Apr 20th, 2024)

Now let's look at win rates and see what percentage of stocks produced a 15%+ and 50%+ return in the first year.

Then let's look at the unicorns and see how many 3x and 10x stock picks so far to date.

| Win Rates | 15%+ Returns at 1 Year | 50%+ Returns at 1 Year | 3x Returns | 10x Returns |

| New Recommendations | 71% | 48% | 29% | 10% |

| Best Buys | 68% | 43% | 20% | |

| Foundational Stocks | 78% | 33% | 5% |

| Sector | |||

| Information Technology | 250% | 24% | 125% |

| Industrials | 130% | 5% | 65% |

| Healthcare | 64% | 33% | 32% |

| Communication Services | 41% | 24% | 20% |

| Consumer Discretionary | 22% | 10% | 11% |

The top performing sectors were information technology, industrials and healthcare with information technology yielding the highest return of 250%

. The average sector weight was 19% with the largest sector accounting for 33% of the picks.

| Annualized Returns | 1 Year | 2 Years | 3 Years |

| New Recommendations | 37% | 49% | 54% |

| Best Buys | 34% | 25% | 30% |

| Foundational Stocks | 36% | 14% | 34% |

| Blended Average | 36% | 30% | 39% |

| S&P 500 | 20% | 6% | 14% |

| New Recommendations | Rule Breakers | S&P 500 | Beat Market by |

| 1 Year | 37% | 20% | 88% |

| 2 Years | 49% | 6% | 767% |

| 3 Years | 54% | 14% | 275% |

| Blended Average | 47% | 13% | 252% |

| Foundational Stocks | Rule Breakers | S&P 500 | Beat Market by |

| 1 Year | 36% | 20% | 80% |

| 2 Years | 14% | 6% | 154% |

| 3 Years | 34% | 14% | 137% |

| Blended Average | 28% | 13% | 111% |

| Best Buys | Rule Breakers | S&P 500 | Beat Market by |

| 1 Year | 34% | 20% | 73% |

| 2 Years | 25% | 6% | 347% |

| 3 Years | 30% | 14% | 109% |

| Blended Average | 30% | 13% | 125% |

Click Here to See the Latest Rule Breakers Picks (Apr 20th, 2024)

The stock picks from Motley Fool Rule Breakers in 2017 strongly outperformed the market in nearly every category. The annualized returns on the new recommendations beat the market by 275% in the 3rd year and the Best Buys beat the market by 109% in the same period.

Rule Breakers continue to prove itself to be an invaluable source for oriented growth investing recommendations. And each year they continue to add exponentially more value through all the additional resources like daily market briefings, webcasts, market research and more frequent updates and coverage on new and past recommendations.

For serious investors just getting started or those with years and decades of experience we believed Rule Breakers is a great investing companion well worth the $99/year (for new members).

Additionally the Motley Fool has a similar service called Stock Advisor which in many categories has out-performed Rule Breakers. You can see our yearly reviews of that service here.

We actually advise people to try both services together as they are very complementary to each other and provide 2x the stock recommendations and they come with a 30 day membership back fee guarantee.

More Stock Market Resources:

Did you know that...

Quotes of the Day:

*Disclaimer: Unless noted otherwise all returns are as of Apr 19, 2024. Past performance is no guarantee of future results. Individual investment results may vary. All investing involves risk of loss.

We provide general information, not investment advice. Some of the links on this page are affiliate links in which we receive a commission when a purchase is made.

$89 promotional price for new members only. $110 discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then current list price.

$99 promotional price for new Rule Breakers members. $200 discount based on current list price for Rule Breakers of $299. Membership will renew annually at the then current list price.