Best Investment Advice Websites & Advisor Subscriptions

Published

Published

Related: What are the Best Stock Advisor Websites?, Stock Picking WebsiteBest stock picking websites

Here are the best stock research, investment advice, and analysis services we've reviewed in 2024.

| Best Advisor & Research Services | Best for |

|---|---|

| 1. Motley Fool Stock Advisor | Comprehensive Stock Recommendations |

| 2. Motley Fool Rule Breakers | Aggressive Growth Strategies |

| 3. Simply Wall St | Infographic Stock Analysis |

| 4. Seeking Alpha Premium | Diverse Investor Opinions |

| 5. Koyfin | Detailed Market Data Analysis |

| 6. Morningstar Investor | Portfolio Construction & Evaluation |

| 7. Zacks Premium | Earnings Momentum Investing |

Discover your ideal investment strategy with our comprehensive guide to the top stock advisory services.

Motley Fool Stock Advisor is a cornerstone service for growth-focused investors. It offers a compelling blend of stock recommendations and educational resources. The service is built on a foundation of rigorous analysis and long-term thinking.

Each month, subscribers receive two new stock picks with detailed insights. These recommendations are designed to outperform the broader market over time. Whether you're just starting or have been investing for years, Stock Advisor adapts to your needs.

What sets this service apart is its emphasis on investor education. Beyond stock picks, it provides the tools to make informed decisions independently. Let's dive deeper into what makes Motley Fool Stock Advisor a standout choice for growth investors.

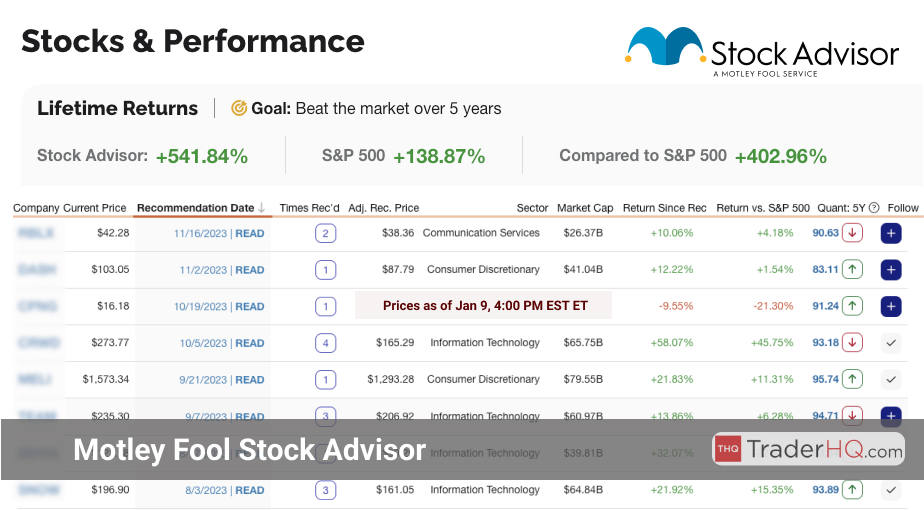

Stock Advisor Performance

The Motley Fool's Stock Advisor service has a history of delivering market-beating returns. By focusing on companies with strong growth potential, the service aims to help subscribers build wealth over the long term.

Let's take a closer look at the performance of some of Stock Advisor's top picks:

| Best Stock Advisor Picks (2002 to 2024) | Return* | Annualized Return |

|---|---|---|

| Computer Graphics Company | 51,389% | 62% |

| Streaming Company | 32,996% | 38% |

| Online Retail Company | 23,581% | 58% |

| Travel Company | 14,462% | 28% |

| Electric Car Company | 7,223% | 48% |

These Stock Advisor stock picks have produced an average return of 25,930% or 47% annualized.. (As of Apr 18, 2024)

While these are the best performers the average Stock Advisor pick has returned 644.36% compared to 146.21% for the S&P 500.

Click here to See the Latest Stock Advisor Picks (Apr 19th, 2024)

Stock Advisor's ability to identify winning stocks spans across various time frames. The service's recommendations have not only outperformed over the long term but have also delivered impressive returns in more recent years.

| Best Stock Picks (2009 to 2024) | Return | Annualized Return |

|---|---|---|

| Computer Graphics Company | 21,685% | 62% |

| Electric Car Company | 7,223% | 48% |

| Gaming Company | 5,927% | 55% |

| E-commerce Company | 2,048% | 48% |

| Online Retail Company | 1,942% | 58% |

Q4-2019 Stock Advisor Stock Picks

The Q4-2019 Stock Advisor picks have produced an average return of 165%. (As of Apr 18, 2024)

| Stock Picks from Q4-2019 | Return | Annualized Return |

|---|---|---|

| Advertising Tech Company | 316% | 38% |

| Cloud Software Company | 313% | 38% |

| Streaming Company | 97% | 17% |

| Consulting Firm Company | 61% | 12% |

| Biotech Company | 38% | 7% |

This closer look at the individual year of 2019 demonstrates that even within a shorter to medium-term timeframe, selected stocks can yield impressive results..

Click here to See the Latest Stock Advisor Picks (Apr 19th, 2024)

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Motley Fool Stock Advisor delivers a compelling proposition for growth investors. It combines top-tier stock selection with deep educational resources and community support.

While no stock picking service is perfect, Stock Advisor has a strong track record. For those seeking long-term investment success, it's a service worth serious consideration.

Insider Tip: Enhance your Stock Advisor experience by actively participating in the vibrant member community. You'll gain valuable insights to complement the formal stock recommendations and strengthen your overall investment strategies.

Click Here to Try Stock Advisor (Apr 19th, 2024)Motley Fool Rule Breakers is a growth-focused investment advisory service. It's designed for investors seeking high-potential, innovative companies. The service provides monthly stock picks, aiming to identify tomorrow's market leaders.

With a philosophy anchored in disruption and long-term growth, Rule Breakers is geared towards investors comfortable with volatility. It's a service for those who understand that significant returns often require patience.

If you're eager to invest in companies driving or redefining industries, Rule Breakers is a compelling choice. Let's dive deeper into what makes this service stand out.

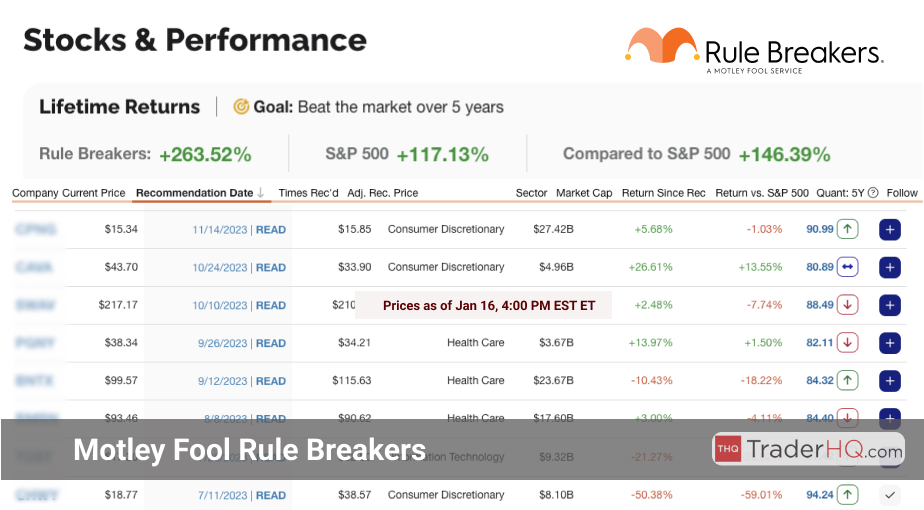

Rule Breakers Performance

An effective investment strategy is supported by clear performance data, reflecting both past achievements and future potential.

Reviewing the Motley Fool Rule Breakers performance data, we highlight the service's track record for investors targeting long-term growth.

The performance figures of these selected stocks demonstrate the potential for significant returns.

| Best Rule Breakers Picks (2013 to 2024) | Return* | Annualized Return |

|---|---|---|

| Gaming Company | 5,927% | 55% |

| Computer Graphics Company | 3,179% | 62% |

| E-commerce Company | 2,048% | 48% |

| Advertising Tech Company | 1,160% | 48% |

| Cybersecurity Company | 718% | 192% |

The average return of these stocks is 2,606%, with an annualized return of 81%. (As of Apr 18, 2024).

Average performance across all picks from Stock Advisor has resulted in 644.36%, outperforming 146.21% of the S&P 500.

Click here to See the Latest Stock Advisor Picks (Apr 19th, 2024)

Below, we showcase the top-performing picks from 2006 to 2024, reflecting their growth potential and the effectiveness of their investment approach.

| Best Rule Breakers Picks (2006 to 2024) | Return | Annualized Return |

|---|---|---|

| E-commerce Company | 9,794% | 54% |

| Electric Car Company | 7,314% | 41% |

| Fast Casual Company | 4,690% | 29% |

| Salesforce Company | 3,914% | 27% |

| Auto Auction Company | 2,764% | 25% |

Q4-2019 Rule Breakers Stock Picks

The Q4-2019 Rule Breakers picks have produced an average return of 66%. (As of Apr 18, 2024)

| Stock Picks from Q4-2019 | Return | Annualized Return |

|---|---|---|

| Cloud Monitoring Company | 280% | 35% |

| Fitness Equipment Company. | 82% | 15% |

| Online Marketplace Company | 61% | 11% |

| Medical Device Company | -10% | -2% |

| Fitness Company | -81% | -32% |

The data from 2019 shows that careful selection of stocks can lead to significant returns over short to medium terms.

This underscores the value of rigorous analysis behind each selection, highlighting the expertise Stock Advisor offers to investors.

Click Here to See the Latest Rule Breakers Picks (Apr 19th, 2024)

The next Rule Breakers pick will be released on Apr 18, 2024.

Access upcoming picks and all historical selections with a 30-day money-back guarantee on membership.

| Rule Breakers Release Schedule | Release Date |

|---|---|

| New Stock Pick | Apr 11, 2024 |

| 5 Best Buys Now | Apr 18, 2024 |

| New Stock Pick | Apr 25, 2024 |

| 5 Best Buys Now | May 2, 2024 |

Rule Breakers recommendations are based on continuous investment research and identifying growth opportunities. This is essential for a portfolio growth.

Investors should not only consider past performance but also focus on new picks.

Data is significant, but practical experience and insight are also necessary for investing.

Rule Breakers provides detailed research aimed at uncovering future market leaders, supporting a proactive, growth-oriented investment strategy.

Click Here to See the Latest Rule Breakers Picks (Apr 19th, 2024)

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Motley Fool Rule Breakers is a powerful tool for growth-oriented investors. It offers a principled strategy for identifying and investing in high-potential innovators.

While not for the risk-averse, Rule Breakers can be a pathway to significant returns for those with patience and fortitude. If that resonates with your investment style, it's a service worth serious consideration.

Insider Tip: Rule Breakers' "Best Buys Now" list is a goldmine for timely stock picking service recommendations. Pay special attention to these monthly insights to optimize your portfolio's growth potential.

Simply Wall St's mission is to make investing accessible and understandable for everyone. By providing clear, unbiased analysis, they empower investors to make informed decisions. Their platform is designed to cut through market noise and focus on fundamentals.

Whether you're just starting out or a seasoned investor, Simply Wall St has tools to help. From beginner-friendly company reports to advanced screening capabilities, they cater to all levels. Their goal is to be your go-to resource for intelligent, long-term investing.

In the following sections, we'll dive into what makes Simply Wall St stand out. We'll explore the features, benefits, and how it can elevate your investing game. Let's discover how Simply Wall St can help you invest with confidence and clarity.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Simply Wall St is an invaluable tool for investors of all levels. It simplifies complex financial information, making it accessible and actionable.

With global data, powerful screening, and in-depth analysis, it's a comprehensive solution for fundamental investors. If you're looking to invest based on a company's true value and long-term potential, Simply Wall St is a top choice.

Insider Tip: Use Simply Wall St's stock screener to find hidden gems - companies with strong fundamentals that are undervalued by the market. These opportunities often have the best potential for long-term returns.

Seeking Alpha Premium empowers investors with comprehensive tools and in-depth stock research. It offers a wealth of expert analysis and data to make well-informed decisions. The service is tailored for those who appreciate diverse investment insights.

With Seeking Alpha Premium, you gain access to a vibrant community of contributors. Their expertise spans various sectors, offering unique perspectives on market trends and opportunities. This crowd-sourced approach provides a balanced view, complementing traditional Wall Street analysis.

Whether you're a long-term investor or an active trader, Seeking Alpha Premium delivers value. Its features are designed to streamline your research process and enhance your investing strategies. In the following sections, I'll dive deeper into what makes this service stand out.

What I Like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Seeking Alpha Premium is a powerful resource for investors who value thorough research. Its diverse insights and robust tools empower users to make informed investment decisions.

While the depth of analysis can be overwhelming, it's indispensable for constructing a resilient portfolio. If you're willing to invest time in leveraging its features, the rewards can be substantial.

Insider Tip: Use Seeking Alpha's Quant Ratings to identify stocks with strong financial health, then layer in insights from expert stock advisors for a comprehensive investment thesis.

Koyfin delivers comprehensive financial data and powerful analytical tools. It's designed for investors who demand precision and depth. The platform combines real-time market insights with customizable research features.

Whether you're analyzing individual stocks or constructing complex portfolio models, Koyfin adapts to your strategy. It's a tool that grows with you as your investing approach evolves.

In the following sections, I'll dive into what makes Koyfin stand out and how it can elevate your investment game.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Koyfin is an advanced investment research platform built for serious market participants. Its extensive data coverage and customizable features make it adaptable to nearly any investing style.

While it may be overkill for casual investors, for those looking to elevate their analysis and seize more opportunities, Koyfin is a powerful ally. The Pro plan in particular offers an impressive array of tools for the price.

Insider Tip: Use Koyfin's advanced charting tools to uncover unique market insights and optimize your stock picking strategy.

Morningstar Investor empowers you to make informed investment decisions independently. It provides unbiased, comprehensive research and tools for effective portfolio management. With Morningstar, you can invest with clarity and confidence.

The service employs 150+ specialized analysts to deliver objective insights. This independent analysis eliminates the biases often found in market-influenced research. Morningstar Investor is designed for self-directed investors seeking control over their financial future.

Whether you're a seasoned investor or just starting, Morningstar has you covered. From stock ratings to portfolio analysis, it's your all-in-one investment toolkit. Let's dive into what makes Morningstar Investor an indispensable resource.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Morningstar Investor is a comprehensive service for self-directed investors. It combines powerful tools, independent research, and educational resources.

If you're committed to taking control of your financial future, Morningstar is your copilot. It's an investment in yourself that can pay dividends for years to come.

Insider Tip: Use Morningstar's Portfolio X-Ray to uncover expensive fees draining your returns, and optimize your portfolio for better performance with this stock picking service.

Zacks Premium empowers investors to outperform the market with data-driven tools and expert insights. It caters to those seeking an edge through intensive research and predictive analytics. The service distills complex financial data into actionable recommendations, enabling smarter investment decisions.

With a proven track record of doubling the S&P 500's returns, Zacks Premium is a compelling choice. It combines the power of the Zacks Rank system with detailed equity research reports. This potent combination helps investors navigate the market with greater confidence and precision.

Whether you're a long-term investor or an active trader, Zacks Premium has you covered. Its diverse features and customizable screeners adapt to your unique investment style and goals. Let's dive deeper into what makes this service truly exceptional.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Zacks Premium is a comprehensive service that caters to serious investors seeking an edge. By leveraging earnings estimate revisions and expert analysis, it consistently outperforms the market.

With its diverse features and customizable tools, Zacks Premium adapts to various investment styles and goals. It's a powerful ally for investors striving to build wealth in the stock market.

Insider Tip:Use the Zacks Rank in combination with the VGM score to discover stocks that blend momentum with growth and value factors for optimal portfolio performance.

In the world of investing, having access to reliable information, expert insights, and powerful tools can make a significant difference in your success. The following seven websites and services stand out for their ability to provide comprehensive investment advice, in-depth stock research, and robust analysis capabilities:

These investment advice services and research platforms offer valuable insights, tools, and resources to help investors of all levels navigate the complexities of the stock market with greater confidence and knowledge.

A stock advisor website or service provides expert guidance and recommendations to help investors make informed decisions in the stock market. These platforms offer a range of features, including in-depth stock analysis, investment newsletters, and personalized portfolio advice.

The primary goal of a stock advisor service is to simplify the complex world of investing by delivering actionable insights and well-researched stock picks. By leveraging the expertise of experienced analysts and proven investment strategies, these services aim to help investors achieve better returns and navigate market volatility with greater confidence.

Whether you're a beginner just starting out or a seasoned investor looking to refine your strategy, a reliable stock advisor can be an invaluable resource. They can help you identify promising investment opportunities, avoid common pitfalls, and stay up-to-date with the latest market trends and analysis.

Investing in the stock market always carries some level of risk, but a trusted stock advisor service can help mitigate that risk by providing well-informed guidance and a long-term perspective on wealth-building. By utilizing these resources, investors can feel more empowered and confident in their ability to make sound investment decisions and achieve their financial goals.

When it comes to the best stock advisor, two services stand out: Motley Fool Stock Advisor and Motley Fool Rule Breakers. Both offerings come from The Motley Fool, a well-respected name in the world of investing known for its high-quality research and impressive track record.

Motley Fool Stock Advisor is an excellent choice for investors seeking reliable, long-term stock recommendations. The service's team of experienced analysts carefully selects two promising stocks each month, focusing on companies with strong growth potential and sustainable competitive advantages. Stock Advisor's straightforward approach and educational resources make it accessible to investors of all skill levels.

For those looking for higher-growth investment opportunities, Motley Fool Rule Breakers is a compelling option. This service targets companies driving innovation and disruption in their respective industries. By identifying these "rule breaker" stocks early on, investors can potentially capitalize on their explosive growth. However, these investments may carry more risk, making Rule Breakers better suited for investors with a higher risk tolerance.

Both Motley Fool services offer a wealth of educational content, regular updates, and a supportive community of investors. They encourage a long-term, buy-and-hold approach, which aligns with the philosophies of many successful investors. While no stock advisor can guarantee success, Motley Fool's proven track record and commitment to quality research make their Stock Advisor and Rule Breakers services stand out as top contenders for the best stock advisor.

More Stock Market Resources:

Did you know that...

Quotes of the Day:

*Disclaimer: Unless noted otherwise all returns are as of Apr 17, 2024. Past performance is no guarantee of future results. Individual investment results may vary. All investing involves risk of loss.

We provide general information, not investment advice. Some of the links on this page are affiliate links in which we receive a commission when a purchase is made.

$89 promotional price for new members only. $110 discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then current list price.

$99 promotional price for new Rule Breakers members. $200 discount based on current list price for Rule Breakers of $299. Membership will renew annually at the then current list price.