Best Stock Advisor Websites & Stock Picking Services in 2024

Published

Published

Here are the best stock advisor websites and stock picking services we've reviewed in 2024.

| Best Stock Advisor Picks | Best For | Investing Focus |

|---|---|---|

| 📈 Motley Fool Stock Advisor | Long-term growth & portfolio building. | Stock Picking |

| 🎯 Motley Fool Rule Breakers | Innovators & market disruptors. | Growth Investing |

| 📊 Alpha Picks by Seeking Alpha | Community insights & analyst wisdom. | Analyst-Powered |

| 📈 Seeking Alpha Premium | Data-reliant stock evaluations. | Detailed Analysis |

| 📚 7 Investing | Education-based, long-term investing. | Investment Education |

| 📊 TipRanks Premium | Predictive analytics & expert consensus. | Forecasting Tools |

| 📈 Morningstar Investor | Fundamental, disciplined investors. | Fundamentals Research |

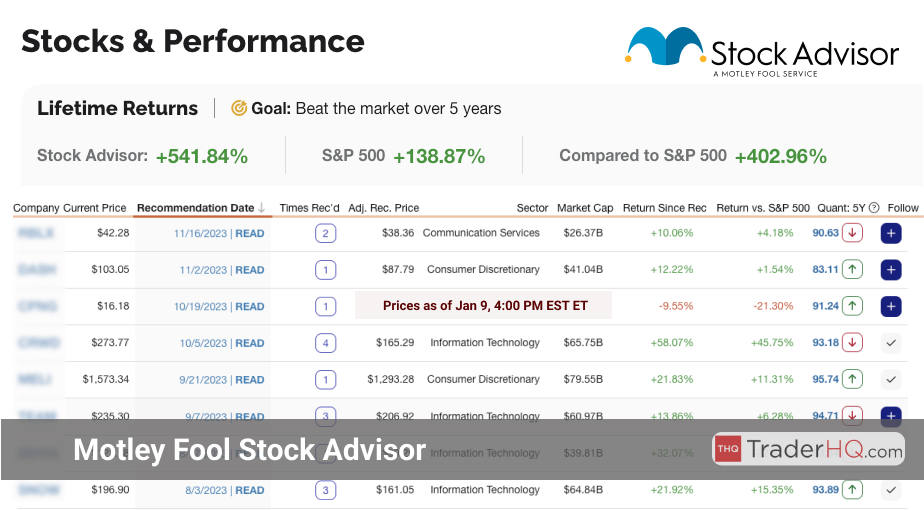

Motley Fool Stock Advisor is a premier investment advisory service. It offers expert stock picks with a proven track record. The service is designed for long-term investors seeking market-beating returns.

Each month, you'll receive two new stock recommendations carefully selected for their growth potential. With a focus on quality businesses, Stock Advisor aims to help you build wealth over time.

Whether you're a beginner or an experienced investor, Stock Advisor provides valuable insights. Let's dive deeper into what makes this service stand out.

Stock Advisor Performance

The Motley Fool's Stock Advisor service has a history of delivering market-beating returns. By focusing on companies with strong growth potential, the service aims to help subscribers build wealth over the long term.

Let's take a closer look at the performance of some of Stock Advisor's top picks:

| Best Stock Advisor Picks (2002 to 2024) | Return* | Annualized Return |

|---|---|---|

| Computer Graphics Company | 46,588% | 60% |

| Streaming Company | 29,833% | 37% |

| Online Retail Company | 22,713% | 53% |

| Travel Company | 14,339% | 28% |

| Electric Car Company | 6,828% | 46% |

These Stock Advisor stock picks have produced an average return of 24,060% or 45% annualized.. (As of Apr 19, 2024)

While these are the best performers the average Stock Advisor pick has returned 605.87% compared to 144.40% for the S&P 500.

Click here to See the Latest Stock Advisor Picks (Apr 20th, 2024)

Stock Advisor's ability to identify winning stocks spans across various time frames. The service's recommendations have not only outperformed over the long term but have also delivered impressive returns in more recent years.

| Best Stock Picks (2017 to 2024) | Return | Annualized Return |

|---|---|---|

| Advertising Tech Company | 1,115% | 47% |

| Cybersecurity Company | 702% | 169% |

| Freight Forwarding Company | 659% | 34% |

| Credit scoring Company | 579% | 36% |

| Fast Casual Company | 492% | 29% |

Q4-2019 Stock Advisor Stock Picks

The Q4-2019 Stock Advisor picks have produced an average return of 158%. (As of Apr 19, 2024)

| Stock Picks from Q4-2019 | Return | Annualized Return |

|---|---|---|

| Cloud Software Company | 311% | 38% |

| Advertising Tech Company | 301% | 37% |

| Streaming Company | 78% | 14% |

| Consulting Firm Company | 62% | 12% |

| Biotech Company | 36% | 7% |

This closer look at the individual year of 2019 demonstrates that even within a shorter to medium-term timeframe, selected stocks can yield impressive results..

Click here to See the Latest Stock Advisor Picks (Apr 20th, 2024)

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Motley Fool Stock Advisor is a top-tier investment advisory service. It offers a compelling value proposition for growth-oriented investors.

With a focus on quality stocks and a long-term perspective, Stock Advisor can help you navigate the market with confidence. If you're ready to invest in your financial future, it's a service worth considering.

Insider Tip: Enhance your stock picking prowess by combining Motley Fool's recommendations with your own due diligence and portfolio management strategies.

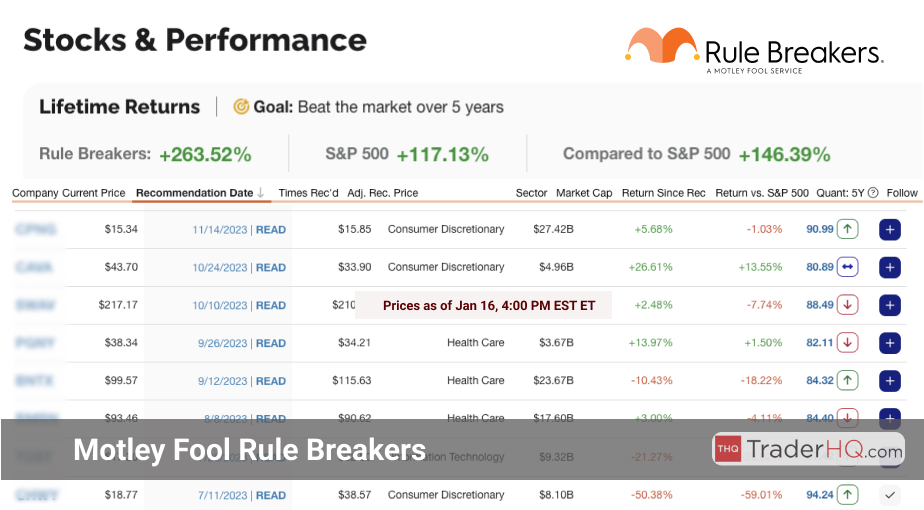

Motley Fool Rule Breakers is a high-growth stock picking service. It challenges conventional wisdom to identify disruptive companies poised for outsized returns. The service provides monthly stock picks, in-depth analysis, and a supportive investor community.

Rule Breakers is tailored for investors with a long-term horizon. It's designed for those willing to embrace volatility in pursuit of transformative gains. The service equips subscribers with the tools and insights to navigate growth investing.

By focusing on innovative businesses not yet recognized by the broader market, Rule Breakers offers a pathway to potentially significant returns. It's an invaluable resource for growth-oriented investors seeking to align their portfolios with future industry leaders.

Rule Breakers Performance

An effective investment strategy is supported by clear performance data, reflecting both past achievements and future potential.

Reviewing the Motley Fool Rule Breakers performance data, we highlight the service's track record for investors targeting long-term growth.

The performance figures of these selected stocks demonstrate the potential for significant returns.

| Best Rule Breakers Picks (2012 to 2024) | Return* | Annualized Return |

|---|---|---|

| Electric Car Company | 6,828% | 46% |

| Gaming Company | 5,927% | 55% |

| Computer Graphics Company | 2,873% | 60% |

| E-commerce Company | 2,056% | 48% |

| Streaming Company | 1,691% | 31% |

The average return of these stocks is 3,875%, with an annualized return of 48%. (As of Apr 19, 2024).

Average performance across all picks from Stock Advisor has resulted in 605.87%, outperforming 144.40% of the S&P 500.

Click here to See the Latest Stock Advisor Picks (Apr 20th, 2024)

Below, we showcase the top-performing picks from 2014 to 2024, reflecting their growth potential and the effectiveness of their investment approach.

| Best Rule Breakers Picks (2014 to 2024) | Return | Annualized Return |

|---|---|---|

| E-commerce Company | 3,214% | 54% |

| Advertising Tech Company | 2,154% | 54% |

| Networking Company | 1,235% | 57% |

| Neurotech Company | 1,150% | 38% |

| Cloud Database Company | 917% | 46% |

Q4-2019 Rule Breakers Stock Picks

The Q4-2019 Rule Breakers picks have produced an average return of 64%. (As of Apr 19, 2024)

| Stock Picks from Q4-2019 | Return | Annualized Return |

|---|---|---|

| Cloud Monitoring Company | 270% | 34% |

| Fitness Equipment Company. | 81% | 15% |

| Online Marketplace Company | 60% | 11% |

| Medical Device Company | -10% | -2% |

| Fitness Company | -81% | -32% |

The data from 2019 shows that careful selection of stocks can lead to significant returns over short to medium terms.

This underscores the value of rigorous analysis behind each selection, highlighting the expertise Stock Advisor offers to investors.

Click Here to See the Latest Rule Breakers Picks (Apr 20th, 2024)

The next Rule Breakers pick will be released on Apr 18, 2024.

Access upcoming picks and all historical selections with a 30-day money-back guarantee on membership.

| Rule Breakers Release Schedule | Release Date |

|---|---|

| New Stock Pick | Apr 11, 2024 |

| 5 Best Buys Now | Apr 18, 2024 |

| New Stock Pick | Apr 25, 2024 |

| 5 Best Buys Now | May 2, 2024 |

Rule Breakers recommendations are based on continuous investment research and identifying growth opportunities. This is essential for a portfolio growth.

Investors should not only consider past performance but also focus on new picks.

Data is significant, but practical experience and insight are also necessary for investing.

Rule Breakers provides detailed research aimed at uncovering future market leaders, supporting a proactive, growth-oriented investment strategy.

Click Here to See the Latest Rule Breakers Picks (Apr 20th, 2024)

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Motley Fool Rule Breakers is a powerful resource for growth-oriented investors. It offers a principled approach to identifying and investing in high-potential, innovative companies.

While not suitable for every investor, those aligned with its philosophy and willing to embrace volatility may find significant value in its recommendations and educational resources.

Insider Tip: When utilizing a stock picking service like Rule Breakers, maintain a diversified portfolio to manage risk while still capturing growth potential.

Alpha Picks by Seeking Alpha delivers high-probability investment recommendations for long-term capital appreciation. It employs a unique "quantamental" approach, blending quantitative analysis with fundamental investment principles. By leveraging proprietary data and sophisticated algorithms, Alpha Picks aims to simplify the investment process while outperforming market averages.

The service targets investors who believe in data-backed decision-making but may lack the resources or expertise to perform such analysis independently. It offers not just recommendations but education and transparency behind each pick, promoting an educated investor base poised for long-term growth through disciplined investment practices.

Whether you're looking to gradually integrate Alpha Picks into your existing portfolio or use it as an idea generation tool, the service provides direct stock picks every two weeks, along with detailed analysis for each recommendation.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Alpha Picks by Seeking Alpha is a compelling choice for data-driven, long-term investors seeking to outperform the market. By combining quantitative analysis with fundamental investing insights, the service offers a unique and effective approach to stock selection.

While the subscription cost may be higher than some other services, Alpha Picks' proven performance, transparency, and educational resources make it a worthwhile investment for those serious about growing their wealth in the stock market.

Insider Tip:Utilize Alpha Picks' stock analysis to identify potential winners in your existing portfolio and optimize your holdings for better returns.

Seeking Alpha Premium empowers investors to make well-informed decisions through comprehensive tools and insights. It caters to those seeking in-depth stock analysis and income-generating strategies.

With a focus on individual investors, dividend enthusiasts, and financial analysts, the service offers a wealth of resources to navigate the complex investment landscape.

From multi-faceted stock ratings to dividend insights, Seeking Alpha Premium provides the tools needed to refine your investment approach. Let's dive into the key features.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Seeking Alpha Premium is a comprehensive toolkit for investors seeking to elevate their research and decision-making process. With a wealth of data, insights, and portfolio management tools, it caters to a wide range of investing styles and goals.

Whether you're focused on income generation, long-term growth, or tactical strategies, Seeking Alpha Premium provides the resources needed to navigate the market with confidence. Its user-friendly interface and real-time updates make it a valuable asset for both novice and experienced investors alike.

Insider Tip: Leverage Seeking Alpha Premium's stock analysis tools to identify high-quality companies with consistent revenue growth and strong market positions. These insights can help you build a resilient portfolio positioned for long-term success.

7 Investing delivers a comprehensive subscription service tailored to empower long-term, growth-oriented investors.

Through in-depth analysis and educational resources, 7 Investing fosters confident, well-informed investment decisions.

Let's explore what makes 7 Investing a standout choice for savvy investors.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

7 Investing offers a holistic approach to stock picking that extends beyond mere recommendations.

By fostering education, community engagement, and a long-term perspective, it empowers investors to navigate the market with confidence.

Insider Tip:Leverage 7 Investing's stock analysis to identify high-conviction, long-term holdings for your portfolio's core.

TipRanks Premium empowers investors with institutional-grade data and analytical tools. It transforms complex financial information into actionable insights, enabling informed decision-making. The service caters to diverse needs, from individual portfolios to professional advisory.

With a user-friendly interface and mobile accessibility, TipRanks Premium ensures seamless navigation and real-time updates. Its comprehensive toolkit includes advanced filters, risk assessments, and insider trading insights.

By aggregating expert opinions and incorporating risk analysis, the platform offers a multifaceted perspective on investments. TipRanks Premium is committed to data security and compliance, providing a reliable ecosystem for financial research.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

TipRanks Premium is a powerful ally for data-driven investors. It aggregates expert opinions, insider activity, and fundamental data into an accessible format.

While not a stock-picking service per se, it provides the tools and insights to make informed investment decisions. For those willing to conduct their own analysis, TipRanks Premium is a valuable resource.

Insider Tip:Use TipRanks' stock analysis tools to validate your investment strategies and enhance your portfolio management skills.

Morningstar Investor empowers you with trusted, independent research to make informed investment decisions. As an experienced investor, I appreciate how Morningstar Investor provides comprehensive tools and insights to navigate the market with confidence. Let's explore what makes this service stand out and how it can elevate your investment strategy.

With a team of over 150 specialized analysts, Morningstar Investor offers unbiased, in-depth analysis across various sectors. This expertise, combined with a commitment to subscriber interests, ensures you receive objective research to support your investment goals.

Whether you're seeking to build a diversified portfolio, manage risk, or discover new opportunities, Morningstar Investor has the features to help you succeed. In the following sections, we'll dive into the key aspects that make this service an invaluable resource for investors like you.

What I like Most

Best Suited for:

What You Get:

Best Uses:

Bottom-line

Morningstar Investor is a comprehensive tool for investors seeking to make informed, data-driven decisions. By providing unbiased research, personalized insights, and powerful portfolio management features, this service empowers you to take control of your investments with confidence.

Whether you're a seasoned investor or just starting to build your portfolio, Morningstar Investor offers the resources and expertise to help you navigate the market effectively. With its commitment to objective analysis and subscriber-centric approach, this service is a valuable asset for any investor's toolkit.

Insider Tip: Leverage Morningstar's stock analysis to identify companies with strong economic moats—a key indicator of sustainable competitive advantage and potential long-term value creation.

These top stock picking and stock advisor services offer a range of valuable features, from expert recommendations to comprehensive research and analysis tools, catering to both novice and experienced investors looking to enhance their investment strategies.

For a comprehensive look at two of the most popular services, check out our Motley Fool Epic Bundle review and our comparison of Stock Advisor, Rule Breakers, and Everlasting Stocks.

A stock picking and stock advisor service is a platform that provides expert recommendations and analysis to help investors make informed decisions about which stocks to buy, sell, or hold. These services are designed to save time and effort for investors who may not have the expertise or resources to conduct in-depth research on their own.

Typically, these services employ experienced analysts and investors who use various methods, such as fundamental analysis, technical analysis, and market trends, to identify stocks with the potential for growth or undervaluation. They then provide their subscribers with regular updates, reports, and recommendations based on their findings.

Stock picking and stock advisor services cater to a wide range of investors, from beginners to seasoned professionals. Some services focus on specific sectors or investment strategies, while others offer a more general approach. Many of these platforms also provide educational resources and tools to help investors improve their knowledge and skills.

Investing in the stock market always involves some level of risk, but stock picking and stock advisor services aim to minimize that risk by providing well-researched and data-driven recommendations. By leveraging the expertise of these services, investors can potentially enhance their portfolio performance and achieve their financial goals more effectively.

While there are numerous stock picking and stock advisor services available, two of the most highly regarded and popular options are Motley Fool Stock Advisor and Motley Fool Rule Breakers. Both services are offered by The Motley Fool, a well-established and trusted name in the investment community.

Motley Fool Stock Advisor, led by co-founders Tom and David Gardner, focuses on identifying stocks with strong long-term growth potential. Each month, subscribers receive two new stock recommendations, along with in-depth analysis and ongoing updates. The service has a proven track record of outperforming the market, making it an excellent choice for investors seeking to build a solid, long-term portfolio.

On the other hand, Motley Fool Rule Breakers, also led by David Gardner, targets high-growth, innovative companies that are poised to disrupt their industries. This service is geared towards investors with a higher risk tolerance who are looking to invest in the "next big thing." Rule Breakers provides monthly stock picks, as well as a wealth of research and analysis to help subscribers make informed decisions.

For investors seeking the best value, the Motley Fool Epic Bundle combines both Stock Advisor and Rule Breakers at a discounted price. This bundle offers a diverse range of investment opportunities, catering to both conservative and growth-oriented investors. With a focus on long-term success and a commitment to transparency, the Motley Fool services are an excellent choice for those looking to elevate their investment game.

What makes The Motley Fool's Stock Advisor service stand out among other advisory services?

The Motley Fool's Stock Advisor service distinguishes itself with a proven track record of providing high-quality stock picks that have historically outperformed the market. Its success is attributed to its consistent, long-term investment philosophy and the deep-dive research carried out by Motley Fool co-founders Tom and David Gardner. Stock Advisor simplifies complex investment decisions by delivering straightforward, actionable advice twice a month, making it particularly appealing to investors seeking clarity and ease of use.

How does Stock Advisor help individual investors?

Stock Advisor is built around the needs of individual investors, regardless of their experience level. By offering comprehensive stock analysis, educational content, and clear recommendations, the service aims to demystify the investing process. It empowers subscribers to build diversified portfolios poised for long-term growth, fostering an investment approach that leverages patience and market resilience.

Can beginners benefit from the Motley Fool's Stock Advisor?

Absolutely. Beginners can greatly benefit from the Stock Advisor service because it provides them with expertly chosen stock picks along with explanations of the reasoning behind each selection. This knowledge sharing not only aids in making informed investment choices but also serves as a practical financial education that enriches a beginner's understanding of stock market dynamics.

What kind of support and resources does Stock Advisor offer?

Subscribers to Stock Advisor gain access to a wealth of resources, including in-depth research reports, stock recommendations, portfolio management tools, and a supportive community forum. The service also comes with access to Motley Fool's wealth of published articles on investment strategies, market news, and financial discipline, facilitating ongoing education and support.

Is there flexibility in how I can use Stock Advisor recommendations?

Yes, while Stock Advisor provides specific stock picks, as an investor, you have complete autonomy over how you use these recommendations. You can choose to follow them closely or use them as starting points for your own research and analysis. This flexibility ensures that you can adapt the advice given to suit your unique investment style and risk tolerance.

Remember, while The Motley Fool's Stock Advisor service can be a powerful asset in reaching your financial goals, it's important for you to remain engaged with your investments and make decisions that align with your individual objectives and circumstances.

Related Resources:

More Stock Market Resources:

*Disclaimer: Unless noted otherwise all returns are as of Apr 19, 2024. Past performance is no guarantee of future results. Individual investment results may vary. All investing involves risk of loss.

We provide general information, not investment advice. Some of the links on this page are affiliate links in which we receive a commission when a purchase is made.

$89 promotional price for new members only. $110 discount based on current list price of Stock Advisor of $199/year. Membership will renew annually at the then current list price.

$99 promotional price for new Rule Breakers members. $200 discount based on current list price for Rule Breakers of $299. Membership will renew annually at the then current list price.